Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Experts pick top 10 stocks.

The market scaled a fresh closing high in the week ended February 23 as bulls mustered strength to regain control over the Street from bears. Experts are now hoping to see the rally to reach 22,500 in the coming sessions, with support at the psychological 22,000 mark and a crucial support at the 21,900 level.

The Nifty 50 gained 0.8 percent to 22,214 and formed a bullish candlestick pattern with upper and lower shadows, indicating volatility in the index.

The cooling down in volatility also gave comfort to bulls as India VIX fell 1.6 percent for the week to 14.97 levels.

"Looking ahead, there's a possibility of market stabilisation as the India VIX undergoes a cooling-off period," Jigar S Patel, senior manager of equity research at Anand Rathi, said.

In the upcoming sessions, he feels, the psychological level of 22,000 is expected to serve as a significant support level with any breach below potentially triggering panic selling. "Conversely, a daily close above 22,300 could propel the Nifty towards the 22,500 mark," he said.

Osho Krishan, senior analyst for technical and derivative research at Angel One, also feels the 22000 mark is likely to provide a firm cushion for any intra-week blip, followed by the 20-day exponential moving average (DEMA) of 21,900 - 21,850, while any further blip could disrupt the intermediate trend for the index.

On the higher end, finding resilience is challenging in an uncharted territory, though 22,350-22,500 could be seen as the following potent targets for Nifty in the current week, provided banking participates, he said.

Moneycontrol collated a list of top 10 stocks from experts with 3-4 weeks perspective. The closing price of February 23 is considered for stock price return calculation.

Expert: Nandish Shah, research analyst (technical and derivative) at HDFC Securities

Sasken Technologies: Buy | LTP: Rs 1,741 | Stop-Loss: Rs 1,600 | Target: Rs 1,980/2,000 | Return: 15 percent

The stock price has broken out on the monthly chart by surpassing the resistance of Rs 1,525 levels. Momentum indicators and oscillators like RSI (relative strength index) and MFI (money flow index) are in rising mode and placed above 60 on the monthly chart, indicating strength in the stock.

IT stocks are expected to continue their outperformance in the coming weeks.

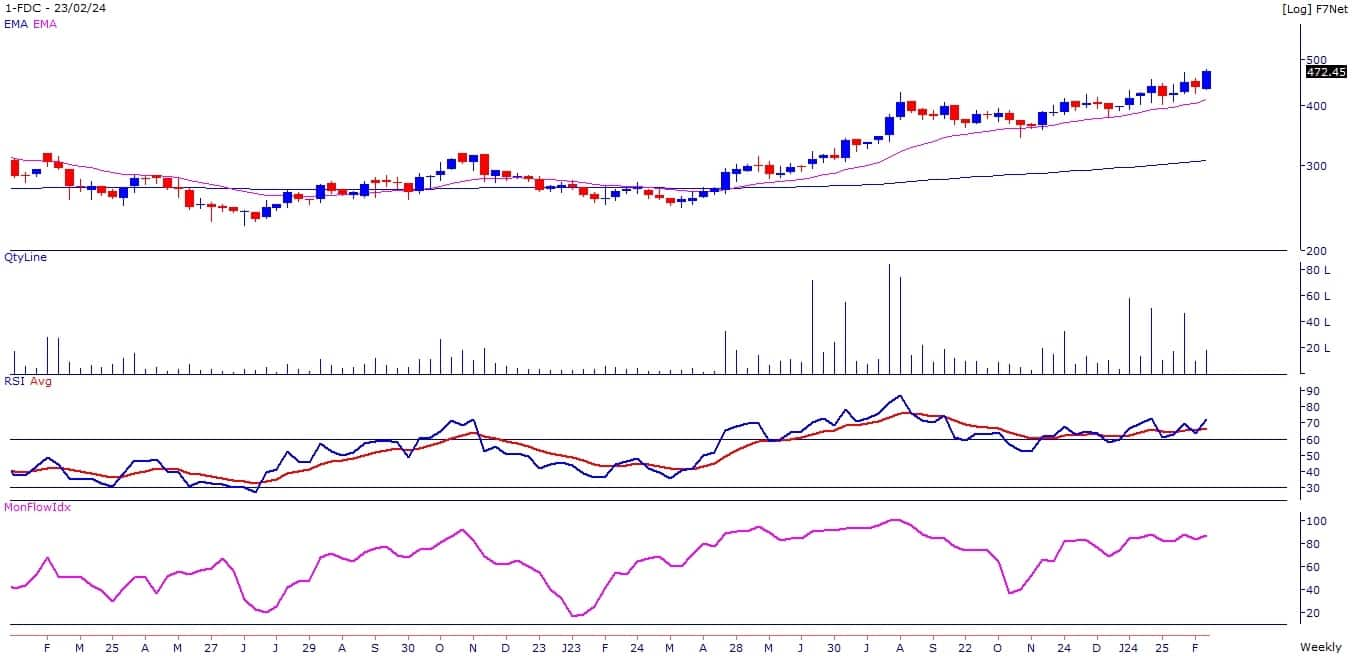

FDC: Buy | LTP: Rs 472 | Stop-Loss: Rs 450 | Target: Rs 500/525 | Return: 11 percent

The stock price has been forming bullish higher top higher bottom formation on the weekly chart. It has broken out on the weekly chart with higher volumes.

Momentum Indicators and oscillators like RSI and MFI are in rising mode and placed above 60 on the weekly chart, indicating strength in the stock.

Aditya Birla Capital: Buy | LTP: Rs 187.35 | Stop-Loss: Rs 178 | Target: Rs 197/206 | Return: 10 percent

The stock price has broken out on the daily chart where it closed at highest level since February 9, 2024 with higher volumes. Stock price is on the verge of breaking out from the downward sloping trendline adjoining the highs of February 8 and 16, 2024.

Momentum indicators and oscillators are showing strength in the stock.

Expert: Shrikant Chouhan, head equity research at Kotak Securities

IRCTC: Buy | LTP: Rs 965 | Stop-Loss: Rs 930 | Target: Rs 1,030 | Return: 7 percent

After the downward trend from the levels of around Rs 1,040, the bearish trend took a pause. The stock was in a rangebound formation for quite some time, which had emerged as a strong base for reversal in the counter.

Recently the breakout from the symmetrical triangle chart formation on daily scale hints at strong upside movement in the coming trading sessions.

SBI Life Insurance Company: Buy | LTP: Rs 1,529 | Stop-Loss: Rs 1,470 | Tartget: Rs 1,630 | Return: 7 percent

On the weekly charts, the counter is into a rising channel chart formation with higher high and higher low series pattern. Additionally, the technical indicators like ADX (average directional index) and RSI is also indicating further up trend from current levels which could boost the bullish momentum in the near future.

Titan: Buy | LTP: Rs 3,692 | Stop-Loss: Rs 3,560 | Target: Rs 3,950 | Return: 7 percent

The counter is into a rising channel chart formation from last few weeks. Moreover, on the daily charts the counter has formed Cup and Handle chart formation.

Therefore, breakout move from the resistance zone for the bullish continuation rally is very likely to occur in the coming trading sessions.

Expert: Om Mehra, technical analyst, SAMCO Securities

Astral: Buy | LTP: Rs 2,076 | Stop-Loss: Rs 1,980 | Target: Rs 2,240 | Return: 8 percent

The stock shifts from an accumulation phase, accentuated by a surge in volume, signalling a robust bullish sentiment. Significantly, the growing delivery volume in the past week bolsters confidence in the positive trend.

The stock actively holds above both the 20 and 50 simple moving averages (SMA), actively confirming its upward trajectory. The RSI standing at a resilient 69 further solidifies the stock's bullish stance.

Hence, based on the above technical structure, one can initiate a long position at Rs 2,076 for a target price of Rs 2,240. The stop-loss can be kept at Rs 1,980.

Info Edge (India): Buy | LTP: Rs 5,337 | Stop-Loss: Rs 5,120 | Target: Rs 5,750 | Return: 8 percent

The stock with a symbol Naukri is currently displaying a robust bullish momentum, praised by consistent higher highs and higher lows. A recent breakout above the critical resistance at Rs 5,300 levels supported by substantial trading volumes. This breakthrough indicates the potential continuation of the upward trend.

Moreover, the stock is trading above key moving averages, including the short-term (20-day) and medium-term (50-day) further solidifying its bullish stance. The RSI is at 55 levels. While minor resistance persists near Rs 5,450 levels, a breach could signal a significant shift in the ongoing bullish rally.

Hence, based on the above technical structure, one can initiate a long position at CMP Rs 5,329 for a target price of Rs 5,750. The stop-loss can be kept at Rs. 5,120

Expert: Riyank Arora, research analyst at Mehta Equities

JSW Infrastructure: Buy | LTP: 262 | Stop-Loss: Rs 240 | Target: Rs 300 | Return: 14 percent

The stock has given a strong breakout above its recent resistance mark of Rs 247.50 and successfully managed to close above the same. With the stock giving a strong closing above its recent resistance mark, the immediate support is placed at Rs 240 mark below which the stock would lose its strength.

On the upside, rally can extend towards Rs 300 and above. The stock is also trading well above its important moving averages which indicate strong signs of momentum and strength.

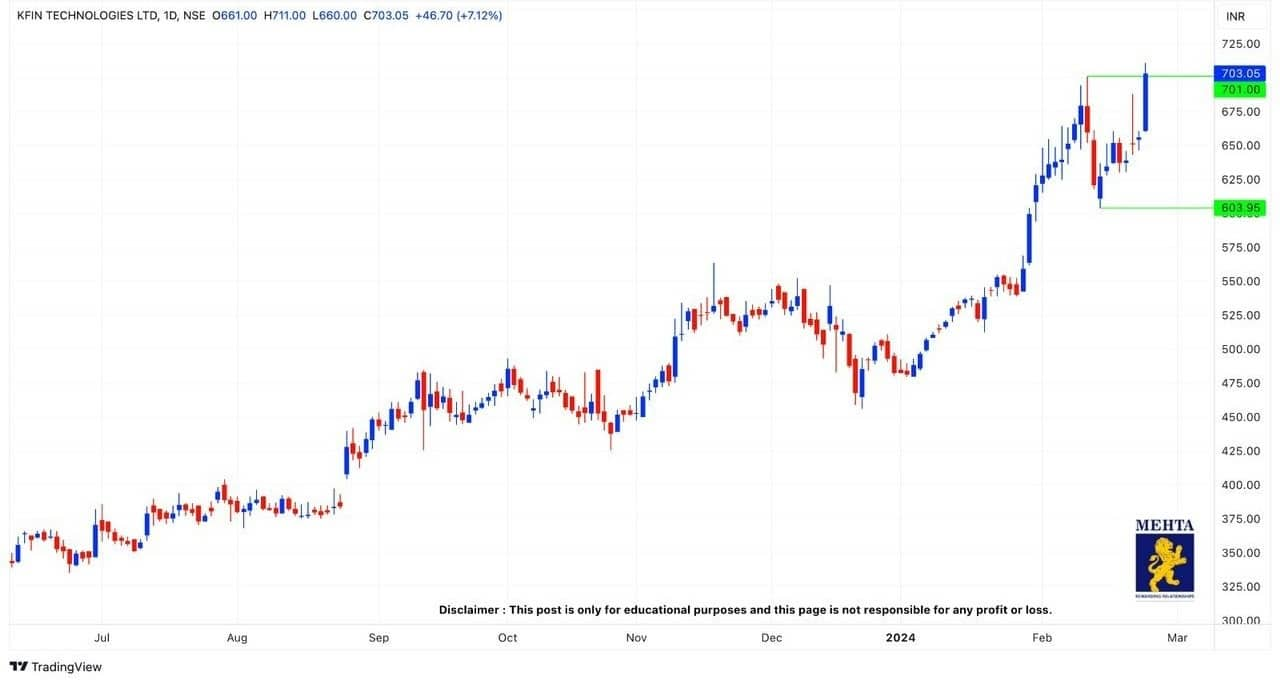

KFin Technologies: Buy | LTP: Rs 703 | Stop-Loss: Rs 660 | Target: Rs 800 | Return: 14 percent

The stock has given a strong breakout above its recent swing high of Rs 701, showing strong signs of momentum. With a strict stop-loss of Rs 650, the stock indicates a good potential upside move towards Rs 800 and beyond.

With the stock continuously making higher highs and higher lows, it seems poised for a strong rally. A strong support at Rs 660 is in place.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.