Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

F&O Cues

Ashish Gupta

Options trading in India has grown multifolds in recent years, thanks to the free time Covid restrictions gave and a vast majority of office-goers taking to trading. Though the craze is with regards to index options trading, especially expiry trading, now that the NSE and the BSE have ensured that there is at least one expiry every day, single stock options trading still finds its own audience.

I have traded single stock options for several years now but one thing that I have observed recently is that the NSE has come up with price circuits on stock options (both upper and lower). The argument is that it is done to safeguard the interest of retail traders and that they should not be trading illiquid options at random pricing. However, the option pricing mechanism adopted by NSE seems to be quite off and these circuit breakers on stock options end up working against the retail traders.

Though I could not find much information on how NSE decides the circuits for these options but here is the snippet from its website:

There are no day minimum/maximum price ranges applicable in the derivatives segment. However, in order to prevent erroneous order entry, operating ranges and day minimum/maximum ranges are kept as below:

•For Index Futures: at 10% of the base price

•For Futures on Individual Securities: at 10% of the base price

•For Index and Stock Options: A contract specific price range based on its delta value is computed and updated on a daily basis.

In view of this, orders placed at prices which are beyond the operating ranges would reach the exchange as a price freeze.

The key thing to look for here is the third point - Contract specific price range is calculated based on its delta value. This is all fine and logical until we actually look at the price range of some of the options.

Let’s consider an example here to better understand.

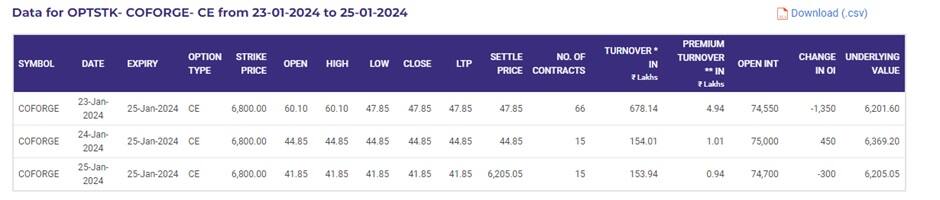

Coforge future closed at Rs 6,369 on January 24 which is one day prior to the expiry. Call option of 6,800 strike which is more than 6 percent away closed at Rs 44 Rs on January 24. If we look at the volumes for this strike on that date, only 15 lots traded and all at the same price of 44.85. The reason is this strike had a lower circuit of 44.85 on that particular day so it’s mostly the case of retail traders booking their sold option because of increased margin requirements. Although this might not be accurate information as I don’t have the exact trade data for that day but it’s a well thought out and logical reason. I have seen broker RMS pitching in the expiry week to cut open trades due to margin requirements.

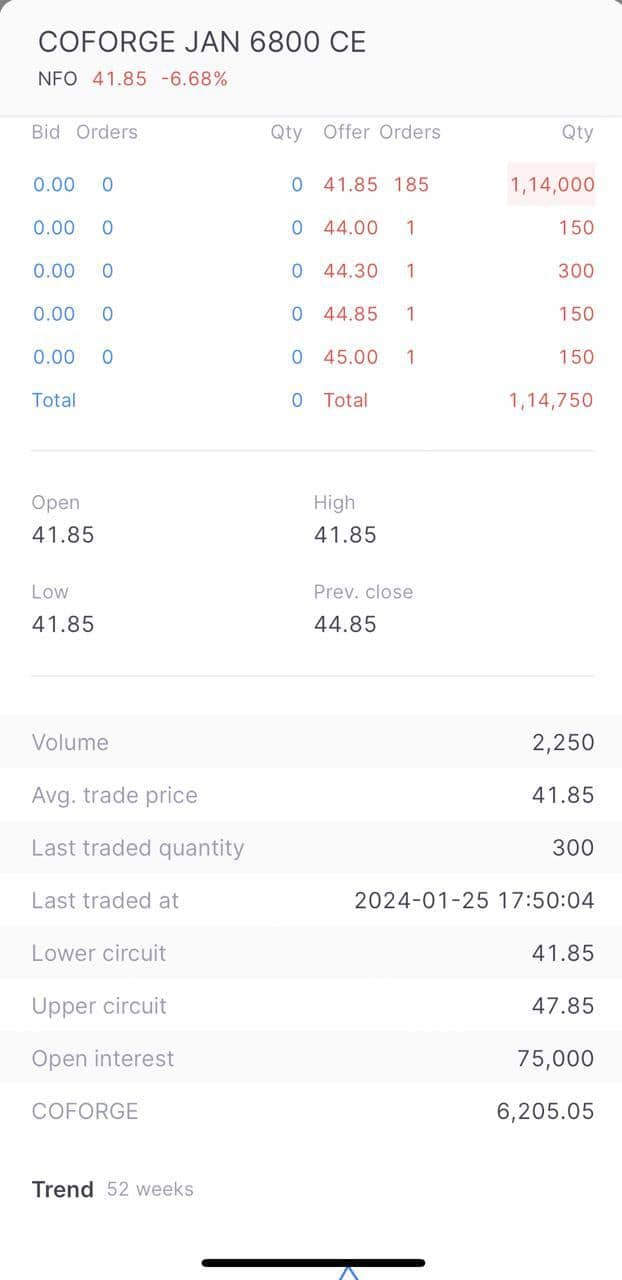

Again, the same option when opened on January 25, which is the expiry day and is still 7-8 percent away from the close price of Rs 6,200 on January 24 still had the lower circuit at 41.85 and upper circuit of 47.85.

See the screenshots for details:

Look at the volume again, a total of 2,250 quantities or 15 lots traded at a price of 41.85 but the fair price for that option is zero. I call this stealing money from poor retailers!

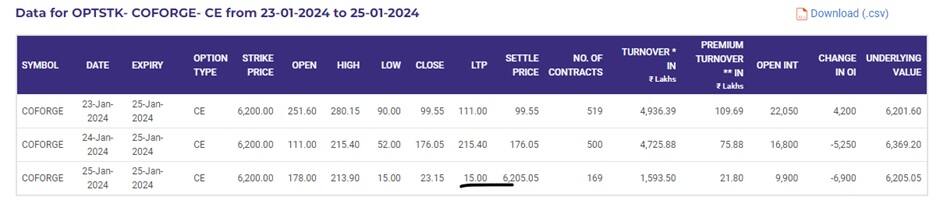

Compare this to the near ATM strike of 6200 which closed at Rs 15 (although fair price was Rs 5 but that’s still ok) but a 600 points OTM call option getting traded at a ridiculous price for 2 consecutive sessions is something which is hard to fathom. Clearly there is something massively wrong in the methodology adopted by NSE on option pricing rules.

There were many other underlyings which had the same problem in Jan expiry and across their options chain - Ultratech, Persistent, Coforge, OFSS just to name a few.

What’s the solution?

In my opinion, this circuit rule on stock option pricing should go away. Brokers have become advanced and if you try to buy/sell an option at a completely off price, they usually nudge you before you are allowed to place that order. However, if NSE still wants to keep the circuits, they should be logical.

Far OTM options like the one we saw in the example of Coforge should have a lower circuit of 5 paise on the expiry day and upper circuit again can be dynamic.

Another suggestion is these circuit breakers should be dynamic and should get revised on their own at a certain interval without a trade actually taking place. Current requirement of circuit breakers to get revised is based on a certain number of trades happening which doesn’t look very logical.

NSE needs to look into these concerns raised and work out an optimal solution that does not put retail traders at a serious disadvantage.

(The author is a Singapore-based independent derivatives trader)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.