Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Market likely to be volatile due to monthly expiry week

The market extended its upward journey for yet another week ended on February 23 with the Nifty hitting a historic high with above-average volumes despite FII outflow, though it was a volatile week. Positive global cues post Nvidia Corporation's earnings, stable oil prices, and the rally in most sectors (barring technology, PSU and select energy counters) boosted the market sentiment.

Hence, overall, the bulls are likely to maintain their stronghold over Dalal Street though there may be volatility and consolidation due to the monthly expiry of February futures & options contracts scheduled on February 29, with a focus on quarterly GDP numbers by India & US, monthly global manufacturing PMI data, and auto sales, this week, experts said.

For the last week, the benchmark indices ended at a fresh record closing high (every week). The Nifty 50 rallied 172 points to 22,213, and the BSE Sensex rose 716 points to 73,143, while broader markets underperformed frontline indices as the Nifty Midcap 100 index was up 0.3 percent and Smallcap 100 index fell 0.1 percent.

"Next week market might take a pause ahead of various global economic data releases. US would be reporting its Q4 GDP numbers along with the initial jobless claim, PCE data and consumer confidence for February," Siddhartha Khemka, head - of retail research at Motilal Oswal Financial Services said last week.

Besides this, factors such as the movement of the dollar index, US bond yields, and crude oil prices will also influence market dynamics, said Santosh Meena, head of research at Swastika Investment.

However, the overall trend remains positive, experts believe. Thus, Siddhartha Khemka recommends investors continue with buy on dips strategy.

Here are key factors to watch out for:

Q3FY24 GDP

On the domestic front, the market participants will keep an eye on the quarterly GDP numbers for the quarter ended December 2023 due on February 29. Most economists expect the numbers to be lower than the 7.6 percent growth recorded in the previous quarter with support from the manufacturing space, but much higher than the 4.5 percent growth reported in the year-ago period.

Rahul Bajoria, MD & Head of EM Asia (ex-China) Economics at Barclays, who sees headline growth at 6.7 percent YoY for Q3FY24 compared to previous quarter, said value added in manufacturing was likely aided by an improvement in profit margins, while growth in most other sectors decelerated.

Also read: What drove Nvidia’s march to $2 trillion m-cap, and what’s next for this AI play?

"Domestic demand continues to drive GDP, but early signs of recovery in external demand likely supported net exports," he added.

Meanwhile, the second estimate for full-year (FY24) economic growth numbers will also be released on the same day, i.e. February 29. As per the preliminary estimates, the growth is estimated at 7.3 percent for the current financial year, against 7.2 percent in the previous year.

Domestic Economic Data

Further, the fiscal deficit and infrastructure output data for January, too, will be announced on February 29 (post-market hours).

Apart from this, all eyes will also be on the HSBC Manufacturing PMI (final) numbers for February scheduled on March 1. In January, the PMI hit a four-month high at 56.5, recovering from an 18-month low of 54.9 level in the previous month, which experts feel may remain better in February too.

Foreign exchange reserves for the week ended February 23 will also be released on March 1.

Also read: SEBI proposes to relax rules for ETFs and index funds; to make them more robust

Auto Sales

The focus this week will also be on the auto sales data for February, which will be announced at the beginning of next month. Hence, auto stocks like Maruti Suzuki, Mahindra & Mahindra, Ashok Leyland, Tata Motors, TVS Motor Company, Bajaj Auto, Hero MotoCorp, Eicher Motors, Escorts etc will be in focus.

The Nifty Auto index has been in an uptrend for a fourth consecutive month, rising more than 7 percent so far in February, beating the benchmark Nifty 50 which gained 2.2 percent in the current month.

US GDP

Globally all eyes will be on the US economic growth numbers for the fourth quarter ended December 2023. The second estimate for the said quarter will be released on February 28. As per the advance estimates published in January, the economy grew 3.3 percent in Q4-CY23, against 4.9 percent growth in the previous quarter.

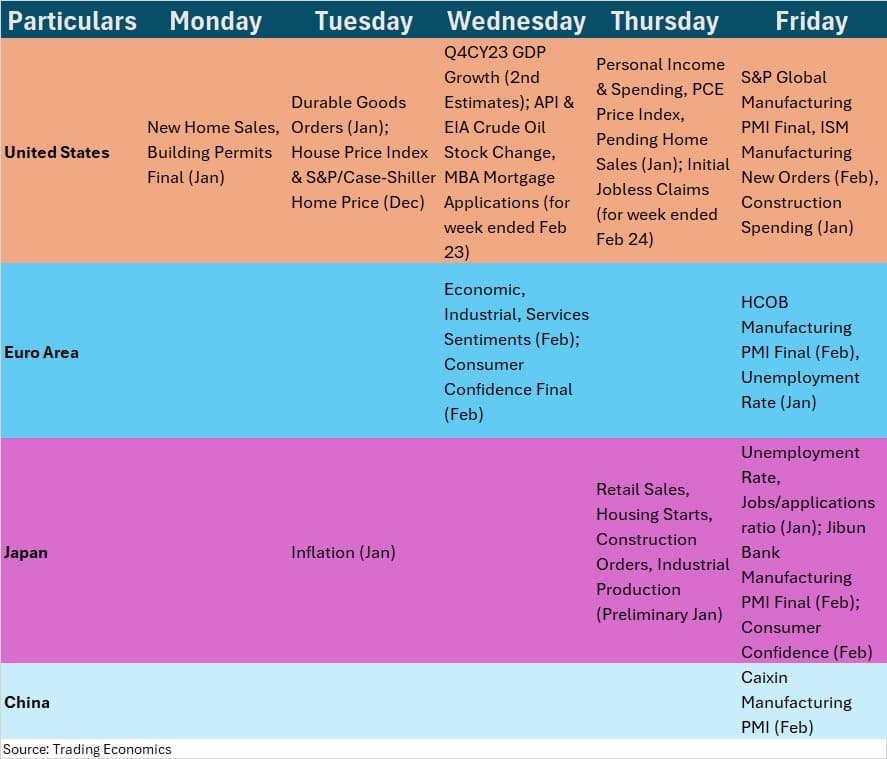

Global Economic Data

Apart from GDP numbers, the participants will also focus on the US new home sales, durable goods orders, personal income & spending, and pending home sales data for January this week. Meanwhile Japan will release its inflation numbers, retail sales, and the unemployment rate for January, during the week.

Further, globally, Manufacturing PMI (final) data for countries will be released on March 1.

FII Flow and Oil Prices

In addition to all the above data points, institutional flow will also be an important factor to watch and within that, domestic institutional investors remain dominant players in boosting equity markets to historic highs despite foreign institutional investors outflow.

FIIs remained net sellers for the last week to the tune of Rs 1,939 crore given the US bond yields at elevated levels, though the outflow slowed down compared to the previous week (at Rs 6,238 crore). Their total net outflow for the current month stood at Rs 15,857 crore in the cash segment.

However, DIIs have net bought Rs 3,533 crore for the week gone by, in addition to Rs 8,732 crore of buying in the previous week, taking the total inflow close to Rs 21,000 crore for February.

The 10-year US treasury yield closed at 4.25 percent on Friday against 4.28 percent on a week-on-week basis.

Meanwhile, the Brent crude futures, the international benchmark for oil prices, tested the resistance placed at the downward-sloping resistance trendline but failed to close above the same. Overall, the prices continued to consolidate for a fifth consecutive week with a hurdle on the higher side at around $84 a barrel as experts feel decisively closing above the same can drive a further rally in oil prices.

Brent crude futures closed at $80.8 a barrel, down 3.2 percent during the week.

The action seems to be unstoppable in the primary market given the strong mood in the secondary market as six IPOs worth more than Rs 3,300 crore will be hitting Dalal Street next week with the Platinum Industries and Exicom Tele-Systems public issues opening on February 27 till February 29, while the Bharat Highways Infrastructure Investment Trust IPO will be opening for subscription during February 28-March 1. GPT Healthcare will close its IPO next week on February 26.

In the SME segment, the Owais Metal and Mineral Processing IPO will be opening on February 26, Purv Flexipack IPO on February 27, and MVK Agro Food Product's initial public offering on February 29 for three working days while Sadhav Shipping will close its IPO on February 27.

Further, in the mainboard segment, the trading in Juniper Hotels and GPT Healthcare equity shares will commence on the BSE and NSE with effect from February 28 and February 29, respectively, while in the SME segment, Zenith Drugs will list its equity shares on the NSE Emerge on February 27, Deem Roll Tech on February 27, and Sadhav Shipping on March 1.

Technical View

Technically, the Nifty 50 seems to be on a northward trajectory despite intermittent consolidation and minor corrections. As long as the index holds 21,900 (which coincides with the 21-day exponential moving average-EMA), the uptrend is likely to continue in the coming sessions with the next hurdle on the higher side at the 22,400 level, followed by the 22,500 mark, experts said.

"In the short term, the index can move towards 22,400 and a move above it can take it to 22,700. Support on the lower end is placed at 21,900, while strong support anticipated in the range of 21,600-21,550," Arvinder Singh Nanda, senior vice president at Master Capital Services said.

Both price and momentum indicators suggest a continuation of the positive price action.

F&O Cues

Options data indicated that the Nifty 50 may face the next resistance at the 22,500 level, with support at the 22,000 mark.

On the Call side, the maximum open interest was seen at 23,000 strike, followed by 22,500 strike & 22,300 strike, with writing at 23,100 strike, then 22,300 & 22,500 strikes, while on the Put front, 21,000 strike owned the maximum open interest, followed by 22,000 and 21,500 strikes, with writing at 21,200 strike, then 22,200 & 22,300 strikes.

Meanwhile, the volatility cooled down further in the week and failed to sustain above 200-week EMA (placed at around the 16 level), giving some comfort for bulls. The India VIX, the fear index, fell 1.64 percent WoW to 14.97 level.

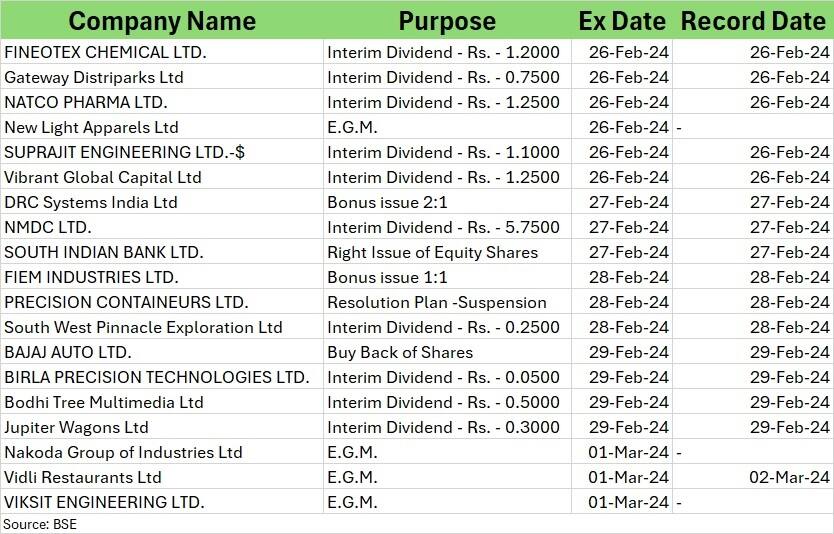

Corporate Action

Here are key corporate actions taking place this week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.