Surveyors forecast further falls for office capital values

The survey tracks occupier and investment sentiment across the three main commercial property types – office, retail and industrial

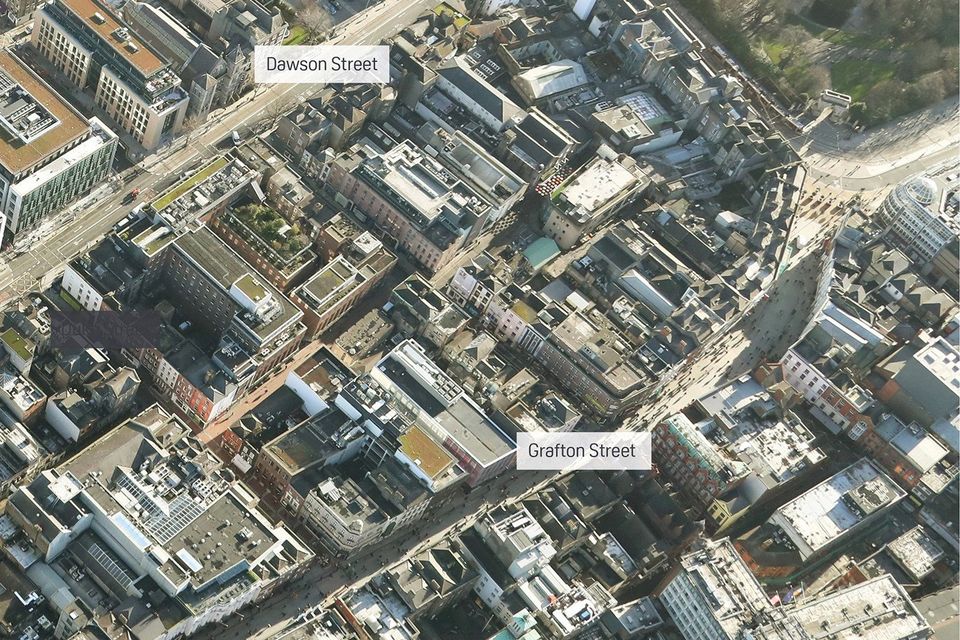

Half of chartered surveyors expect prime office capital values to decline by up to 10pc in 2024 while a further 10pc believe values will fall by an even bigger margin, a new survey has found. Those figures from the Society of Chartered Surveyors Ireland’s Annual Commercial Property Review and Outlook Report 2024 follow a 15.8pc fall in Dublin 2 office values in 2023 as measured by the MSCI/SCSI index.

In contrast, SCSI’s latest figures for prime industrial property record 42pc of surveyors saying they believe capital values will remain the same and 41pc saying they will rise. On the retail front, 43pc of surveyors anticipate that prime retail capital values will remain unchanged this year while 34pc expect values to decline by up to 10pc.

This survey tracks occupier and investment sentiment across the three main commercial property types – office, retail and industrial.

The findings on value were largely mirrored with rents. For example, while 31pc expect prime office rents to remain unchanged, 20pc expect them to fall by between 0pc and 5pc, while a further 23pc expect them to fall by more.

Read more

Just as with capital values, prime industrial property is once again expected to have the highest increase in rents this year. While 31pc believe rents will remain unchanged, 42pc believe rents will increase by between 0pc and 5pc with another 18pc believing they will rise further.

In retail, a much more nuanced picture emerges with just under half (49pc) expecting prime retail rents to remain unchanged, 27pc believe they will rise and 25pc expect them to fall.

The chair of the SCSI’s Commercial Agency Committee, Arlene Maguire, said it was clear the overall outlook for the commercial property market remained very challenging.

“Our report found that six out of 10 chartered surveyors believe the commercial property cycle is in either an early or mid-downturn phase while 18pc said they believed it had reached its bottom point.

“Sixty-six per cent of respondents reported a deterioration in general credit conditions in Q4 2023 and while this was down slightly on last year, it demonstrates the difficult conditions of the current market which are being driven by multiple changes in interest rates by the ECB and a growing preference among Irish banks to lend for building with better ESG compliance.”

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news