Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

According to the JM Financials report, the weak growth in allocations for Roads and Water is reflective of slower project awards in FY2023 - FY2024.

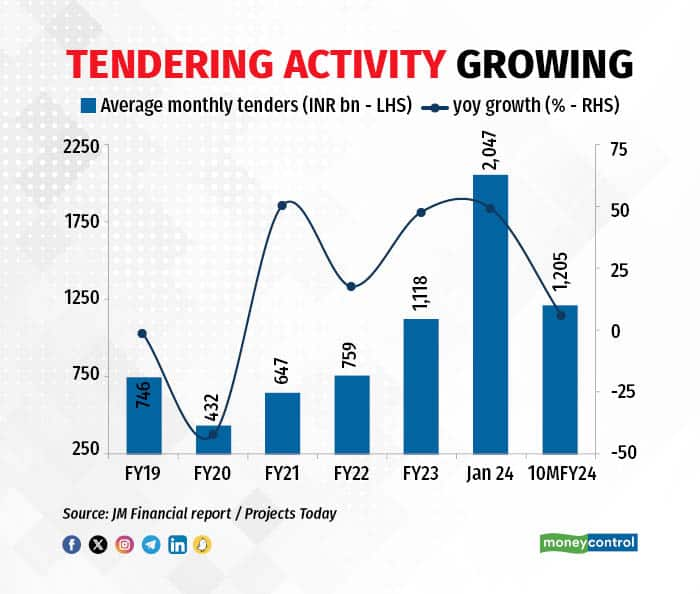

Tendering activity in the infrastructure segment reached record levels in January 2024, a 48 percent YoY growth and a month-on-month (MoM) surge of 81 percent, amounting to Rs 20,500 crore. This growth was driven by "robust tendering activities" from the Maharashtra State Road Development Corporation (MSRDC) and the National Highways Authority of India (NHAI), according to JM Financials.

Tendering is the process for organisations to invite bids or proposals from potential contractors. In January 2024, the major contributors to tender issuances were MSRDC (Rs 4,820 crore), NHAI (Rs 3,220 crore), State Public Works Departments (PWDs) (Rs 2,200 crore), National Highways and Infrastructure Development Corporation Limited (NHIDCL) (Rs 740 crore), and Public Health & Municipal Engineering Department, Telangana (Rs 350 crore).

According to the report, key recipients for these tenders have been L&T (Rs 303 billion) and BHEL (Rs 194 billion) in the listed space and Polaris Smart Meter (Rs 52 billion) in the unlisted space.

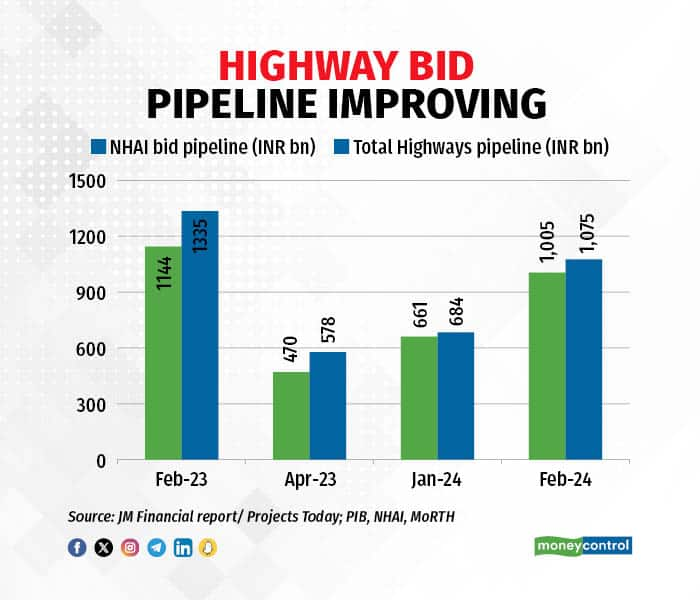

Highway awarding continues to remain weak, bid pipeline improves

But despite the increase in tendering, the lag in awarding and construction continues to be seen across the segment, especially within highways. Awarding refers to the bid being selected and construction here refers to the execution. According to JM Financial, for 10MFY2024, highway awarding and construction continued to remain weak, the JM Financial report highlighted. For the period, around 3481 kilometer was awarded, and around 7,658 kilometers were constructed. While awarding has been weak, the highways and bridges bid pipeline improved to Rs 1.1 trillion - NHAI (Rs 1 trillion), EPC (Rs 46 billion), HAM (Rs 570 billion), and BOT (Rs 389 billion).

In a conversation with Moneycontrol, talking about the NHAI, Uttam Kumar Srimal, Senior Research Analyst - Cement and Infra, Axis Securities had previously said that while the NHAI debt level has elevated in the last few years, they are reducing it through asset monetization and also looking to offer more projects through the BOT level that NHAI does not have to finance. "With a good pipeline of projects, we do not see problems in future growth," he added. A similar view was shared in an October 2023 report by HDFC Securities. "We believe that concerns about debt may get tackled from FY31 onwards as NHAI is capable of meeting its debt commitments on its own and solely relying on budgetary support for additional NH capex," the HDFC Securities' report said.

Subdued budget allocations

In the February 1 interim budget, while the overall capex for the infrastructure segment grew 17 percent to Rs 11.1 trillion over FY24, Highways, Railways and Water segments saw subdued allocations. According to the JM Financials report, the weak growth in allocations for Roads and Water is reflective of slower project awards in FY2023 - FY2024.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.