Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Expert picks these 3 stocks for double-digit gains

The rebound in the Nifty from corrections indicates strong demand at lower price points. Currently, the index is consolidating between 21,430 and 22,126 levels on the daily charts, showing a short-term sideways trend.

Key technical indicators, notably the relative strength index (RSI), remain positive, maintaining levels above 60 on weekly and monthly intervals. However, the daily RSI hovers around 55, suggesting a neutral momentum in the short term.

Looking ahead, immediate resistance levels for the Nifty are seen at 22,126, representing the life high, with an additional barrier at 22,500 mark. On the downside, crucial support levels are identified at 21,430 and 21,100.

Given the current chart structure, short-term volatility is anticipated. The recommendation is to consider buying near the support zone of 21,550 – 21,500, targeting an upside potential ranging from 22,126 to 22,500 levels. It's advisable to implement a strict stop-loss at 21,430 on a closing basis to effectively manage risks.

Here are three buy calls for next 2-3 weeks:

Aegis Logistics: Buy | LTP: Rs 426.7 | Stop-Loss: Rs 395 | Target: Rs 489 | Return: 15 percent

Aegis Logistics is currently trading at its lifetime highs, reflecting robust momentum in the market. Recently, the stock broke out of an Inverted Head and Shoulders bullish chart pattern, accompanied by a surge in volume surpassing the 21-week average, indicating increased investor participation.

Additionally, Aegis Logistics confidently trades above crucial moving averages, including the 12-week and 26-week exponential moving averages (EMA).

Moreover, the momentum study RSI (relative strength index) has witnessed a breakout of the trendline connecting from 2022, suggesting a continuation of momentum. This alignment not only reinforces positive momentum but also instills confidence in the stock's continuous upward trajectory.

Looking ahead, we anticipate further upward movement in prices, targeting Rs 489 level. It is recommended to set a stop-loss at Rs 395 based on closing values.

Punjab National Bank: Buy | LTP: Rs 129 | Stop-Loss: Rs 117 | Target: Rs 155 | Return: 20 percent

PNB is currently trading within a well-defined rising structure, reaching its 52-week highs, indicative of strong momentum in the market. The stock consistently establishes higher highs and higher lows, initially breaking out from its 2019 swing high. Notably, there has been a significant surge in volume, surpassing the 10-week average, suggesting a sustained upward trend.

Maintaining its position comfortably above key averages such as the 12-week and 26-week EMAs, PNB demonstrates a continuation of the uptrend on the upside. Furthermore, the MACD (moving average convergence divergence) study depicts a rising trend in positive territory, reinforcing the bullish momentum and signaling a favorable outlook for PNB in the current market conditions.

The ratio chart of PNB against Nifty has witnessed a breakout from the 2020 swing, indicating continued outperformance compared to the broader market.

Looking ahead, we anticipate further upward movement in prices, targeting Rs 155 level. It is recommended to set a stop-loss at Rs 117 based on closing values.

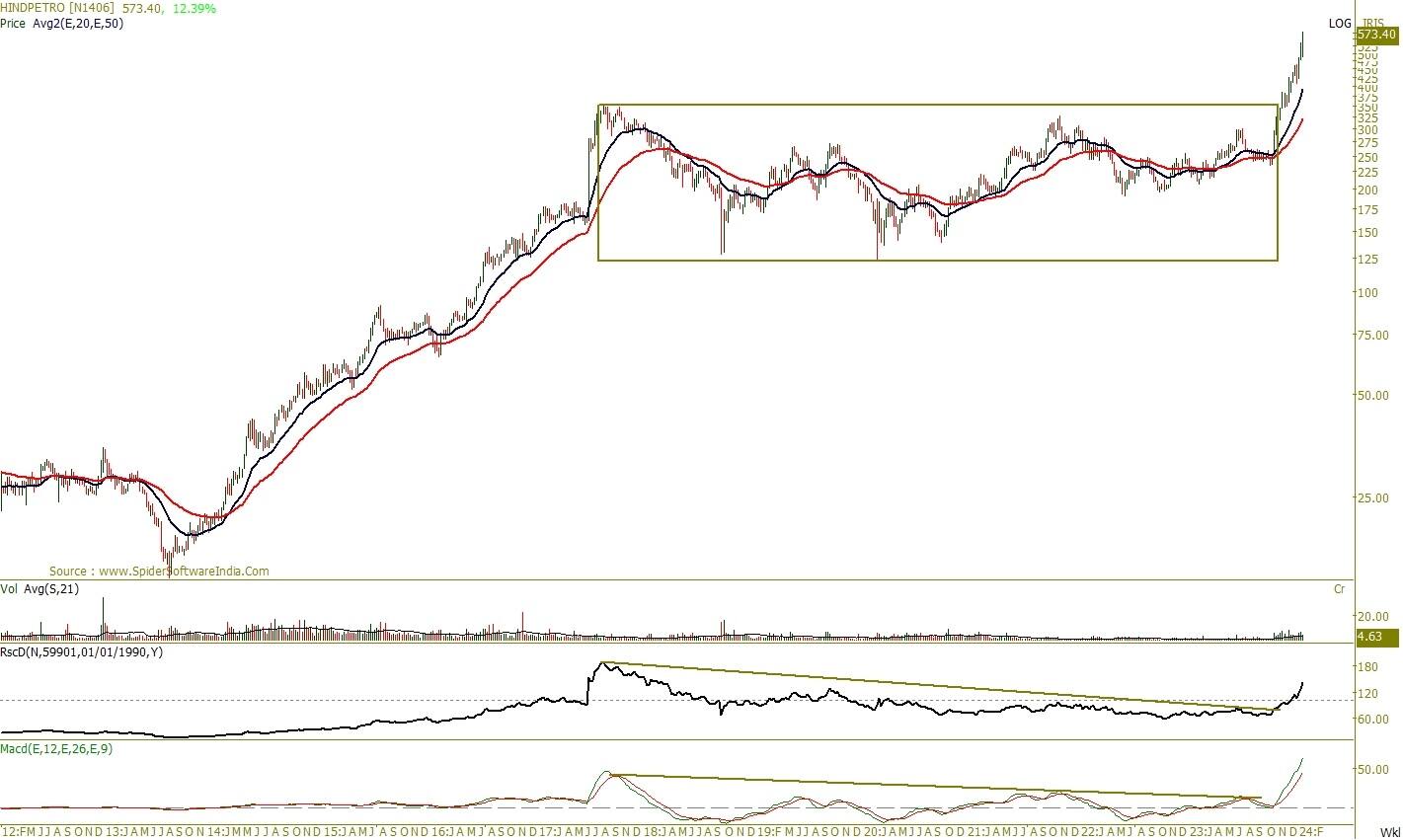

Hindustan Petroleum Corporation: Buy | LTP: Rs 575 | Stop-Loss: Rs 527 | Target: Rs 671 | Return: 17 percent

Hindustan Petroleum is presently trading at its life highs, indicating a strong and resilient momentum in the market. The stock has demonstrated a robust structural development, forming higher tops and higher bottoms since its low point in November 2023. This consistent upward trajectory aligns with a classical uptrend, highlighting a robust price structure.

An important observation reveals that the stock was in a classical uptrend from 2013 to 2017. However, following this period, it entered a consolidation phase lasting approximately five years. Now, the stock is demonstrating remarkable resilience by sustaining well above the congestion phase, indicating a robust upward trend.

Furthermore, the stock maintains its position above both the 20-week and 50-week EMA, reinforcing the bullish trend. The MACD has been in the positive territory, underscoring the trend's strength backed by substantial momentum.

A notable observation lies in the ratio chart of Hindustan Petroleum against Nifty, which has experienced a breakout of the sloping trendline. This development underscores the stock's robust strength and potential for sustained outperformance compared to the broader market.

Looking forward, there is an anticipation of further price ascent towards Rs 671 mark. It is recommended to set a stop-loss at Rs 527, strictly based on the closing basis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.