Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Lyft gains on upbeat forecasts, corrects 2024 margin prediction

Ride-hailing provider Lyft Inc. rose after issuing profit and bookings projections that beat investors’ expectations, signaling that the company’s years-long effort to boost ridership and challenge larger rival Uber Technologies Inc. is paying off.

The company’s shares initially surged in late trading, then gave up much of the gain when Lyft disclosed an erroneous margin projection in its earnings release — later corrected on a conference call. In the statement, Lyft mistakenly said a closely watched measure of profit would increase by 500 basis points, helping propel its share price as much as 67%. Chief Financial Officer Erin Brewer said adjusted Ebitda margin would increase by only 50 basis points in 2024, acknowledging the earlier misprint.

Still, the shares remained up about 17%, buoyed by Lyft’s other bullish predictions. Adjusted earnings before interest, taxes, depreciation and amortization will total $50 million to $55 million in the first three months of the year, the company said in a statement Tuesday, topping analysts’ estimates of $49.5 million. Gross bookings, representing the value of transactions for rides excluding tips, will be $3.5 billion to $3.6 billion, above estimates of $3.48 billion.

Both Lyft and Uber delivered strong earnings reports this quarter, suggesting continued growth in overall rider demand since a nationwide plunge during the pandemic. The two have spent fiercely to recruit and retain enough drivers to meet the rise in orders. Lyft Chief Executive Officer David Risher, who took the helm less than a year ago, has focused the operations on customer satisfaction and has emphasized a return to the basics in an effort to close gap with Uber. Lyft has spent millions of dollars to lure drivers but has had a hard time boosting its rider base.

In the fourth quarter, gross bookings jumped 17% from a year earlier to $3.72 billion, ahead of estimates for $3.67 billion. Revenue was $1.22 billion, up 4% from a year earlier and in line with projections. Shares surged nearly 50% in after-market trading in New York.

“Lyft’s outstanding fourth-quarter performance demonstrates our team’s incredible work to build a solid foundation for profitable growth,” CFO Brewer said. “We’ve entered 2024 with a lot of momentum and a clear focus on operational excellence, which positions the company to drive meaningful margin expansion and our first full-year of positive free cash flow.”

In the fourth quarter, Lyft said the number of active riders on its platform increased 10% from a year earlier to 22.4 million. Last year, Lyft had more than 40 million riders, the highest annual ridership in its history.

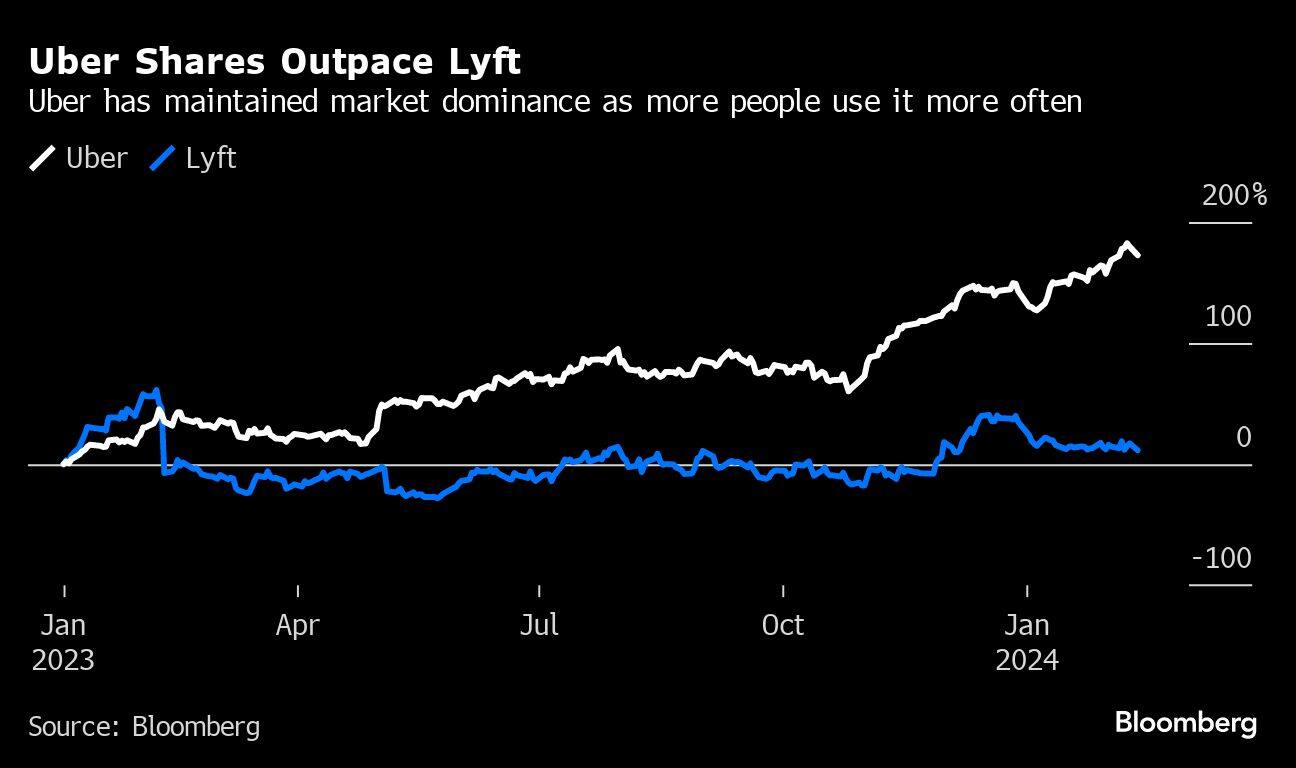

But Lyft still lags behind Uber. According to market research firm YipitData, the company has held around 30% of the US rideshare market compared with 70% for Uber since the second quarter of 2022. Last week, Uber reported its full year of profit as a public company and said trips rose 24% in the quarter to 2.6 billion.

Stabilizing its market share is a critical first step for Lyft in building investors’ confidence “in the long-term story,” analysts at Jeffries Capital Management LLC wrote before the company’s results were released.

Lyft’s shares have gained about 15% in the past 12 months, trailing Uber, which has more than doubled.

The misstated margin prediction, which Lyft attributed to a clerical error, constituted a “black eye moment” for Lyft, said Dan Ives, an analyst at Wedbush Securities. “It’s a debacle of epic proportions,” he said by email. “Never seen an error like this in my almost 25 years on the Street.”

Lyft said adjusted earnings before interest, tax, depreciation and amortization were $66.6 million in the fourth quarter, beating the $56 million estimated by analysts. It reported a net loss of $26.3 million, compared with a loss of $588.1 million a year ago.

Lyft has been making efforts to recruit more drivers and riders to its platform. One project that’s gained traction is the Women+ Connect program, which matches women and non-binary drivers and riders. Since the initiative’s launch in September, 67% of eligible drivers have opted in and kept the feature on 99% of the time, Lyft said.

The company launched in-app video ads in the fourth quarter, and its media revenue in that period exceeded the level achieved in all of 2022, it said, without giving an exact amount.

And, like many areas of the US economy, Lyft also saw a Taylor Swift bump. High-attendance stadium events such as concerts by Swift and Beyonce, the US Open and football games helped boost rides by 35%, Lyft said.

As part of efforts to retain drivers and promote pay transparency, Lyft earlier this month said drivers will earn at least 70% of the amount that riders pay each week, excluding external fees.

But workers say it doesn’t go far enough. Drivers for Uber and Lyft are preparing to strike on Valentine’s Day on Wednesday, to call attention to low pay and what they claim is poor treatment by the app companies, according to a coalition representing drivers.

Both Uber and Lyft drivers are considered independent contractors rather than employees, which has driven criticism from states such as New York, Massachusetts and California. Last November, both companies agreed to pay New York drivers a total of $328 million to prevent further litigation over whether drivers should be classified as employees with traditional legal protections.