Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty requires to hold 22,000 mark for further uptrend

With the bulls gaining strength in the late hour of trade despite weak global cues, the Nifty50 may extend its upward journey in the coming sessions. If the uptrend continues, then the index may face resistance at the psychological 22,000 mark, followed by a near-record high of 22,126, while the immediate support is expected to be at 21,700 and crucial support remains at 21,500 level, experts said.

On February 14, the BSE Sensex rallied 268 points to 71,823, while the Nifty 50 recovered little more than 300 points from the day's low and ended with 97 points gains at 21,840, forming a long bullish candlestick pattern on the daily timeframe which has engulfed the small bull candles of previous few sessions.

This pattern could be considered as a bullish engulfing pattern, which indicates a short-term bottom reversal for the Nifty. The index defended 21,500 as well as upward sloping support trendline.

"The immediate support of 21,500 has been held on Wednesday's volatile session and the short-term uptrend seems to be gaining momentum. Nifty is currently placed at the edge of breaking above the immediate hurdle of 21,850 levels and a decisive move above this resistance is likely to pull Nifty towards 22,000-22,100 levels in the short term," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

Immediate support is at 21,720 levels, he feels.

On the higher side, Ruchit Jain, lead research at 5paisa.com also feels the Nifty needs to surpass the recent highs (22,126) to confirm a continuation of the uptrend.

Technically, the Nifty index has been in a consolidation phase for the last few days which seems to be a time-wise correction. "The index has managed to defend the 40 DEMA support which is placed around 21,500 now. Thus, this becomes a make or break level for the short term and only on a breakdown below this, one should then expect any price-wise corrections," he said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,617, followed by 21,536 and 21,406 levels, while on the higher side, it may see immediate resistance at 21,871 followed by 21,958 and 22,088 levels.

Meanwhile, on February 14, the Bank Nifty extended gains for yet another session, rising 406 points to 45,908 and formed a long bullish candlestick pattern on the daily charts after consistently defending upward sloping support trendline.

"The Bank Nifty has respected the 200-day moving average (44,900) once again and until it slips below that we can expect the positive momentum to continue till 46,500-46,900," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 45,146 followed by 44,837 and 44,337 levels, while on the higher side, the index may see resistance at 46,028 followed by 46,456 and 46,956 levels.

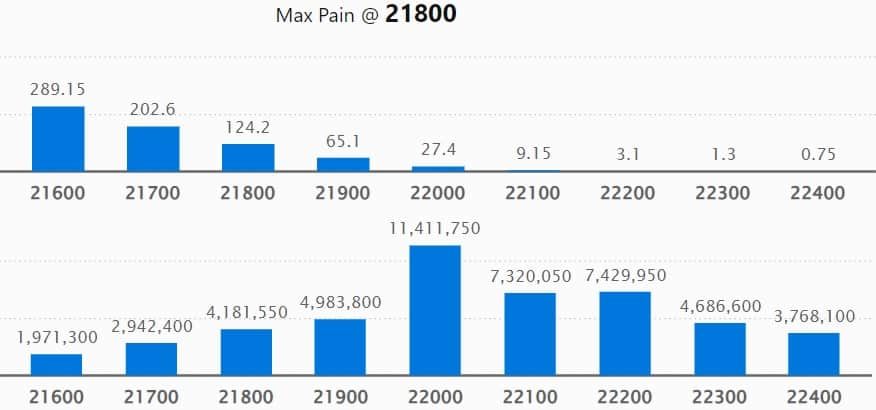

On the weekly options data front, the maximum Call open interest was seen at 22,000 strike with 1.14 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,200 strike, which had 74.29 lakh contracts, while the 22,100 strike had 73.2 lakh contracts.

Meaningful Call writing was visible at the 22,100 strike, which added 31.02 lakh contracts followed by 22,000 and 22,100 strikes adding 23.39 lakh and 17.29 lakh contracts, respectively.

The maximum Call unwinding was at the 21,800 strike, which shed 13.13 lakh contracts followed by 21,700 and 22,600 strikes, which shed 10.87 lakh and 10.75 lakh contracts.

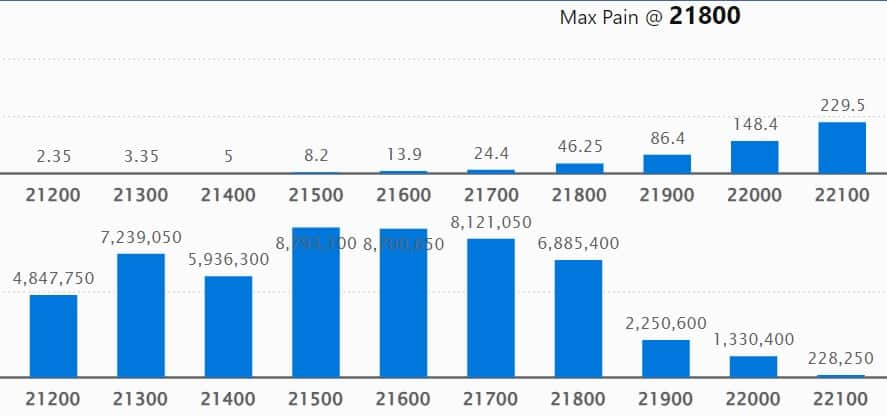

On the Put side, the 21,000 strike owned the maximum open interest, which can act as a key support level for Nifty, with 97.02 lakh contracts. It was followed by 21,500 strike comprising 87.93 lakh contracts and then 21,600 strike with 87 lakh contracts.

Meaningful Put writing was at 21,300 strike, which added 45.11 lakh contracts, followed by 21,600 strike and 21,800 strike, which added 42.72 lakh contracts and 42.28 lakh contracts.

Put unwinding was seen at 20,800 strike, which shed 5.58 lakh contracts, followed by 20,900 strike, which shed 3.79 lakh contracts and 20,500 strike, which shed 30,700 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Marico, Bharti Airtel, Hindustan Unilever, UltraTech Cement and Pidilite Industries saw the highest delivery among the F&O stocks.

A long build-up was seen in 72 stocks, which included Hindustan Copper, IndiaMART InterMESH, Indian Oil Corporation, Vedanta and Indian Hotels. An increase in open interest (OI) and price indicates a build-up of long positions.

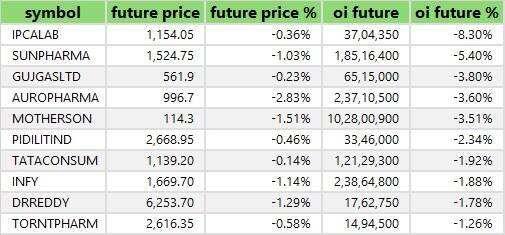

Based on the OI percentage, 15 stocks saw long unwinding including Ipca Laboratories, Sun Pharmaceutical Industries, Gujarat Gas, Aurobindo Pharma and Samvardhana Motherson International. A decline in OI and price indicates long unwinding.

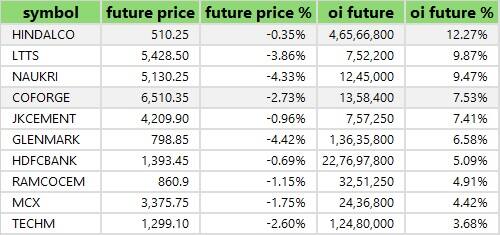

38 stocks see a short build-up

A short build-up was seen in 38 stocks including Hindalco Industries, L&T Technology Services, Info Edge India, Coforge and JK Cement. An increase in OI along with a fall in price points to a build-up of short positions.

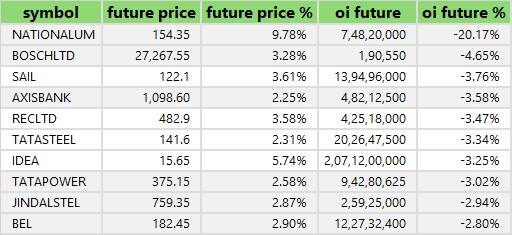

Based on the OI percentage, 62 stocks were on the short-covering list. This included National Aluminium Company, Bosch, Steel Authority of India, Axis Bank and REC. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, jumped to 1.24 on February 14, against 0.99 levels in the previous session. The PCR above 1 indicates that the trading volume of Put options is higher than the Call options, which generally indicates increasing bearish sentiment.

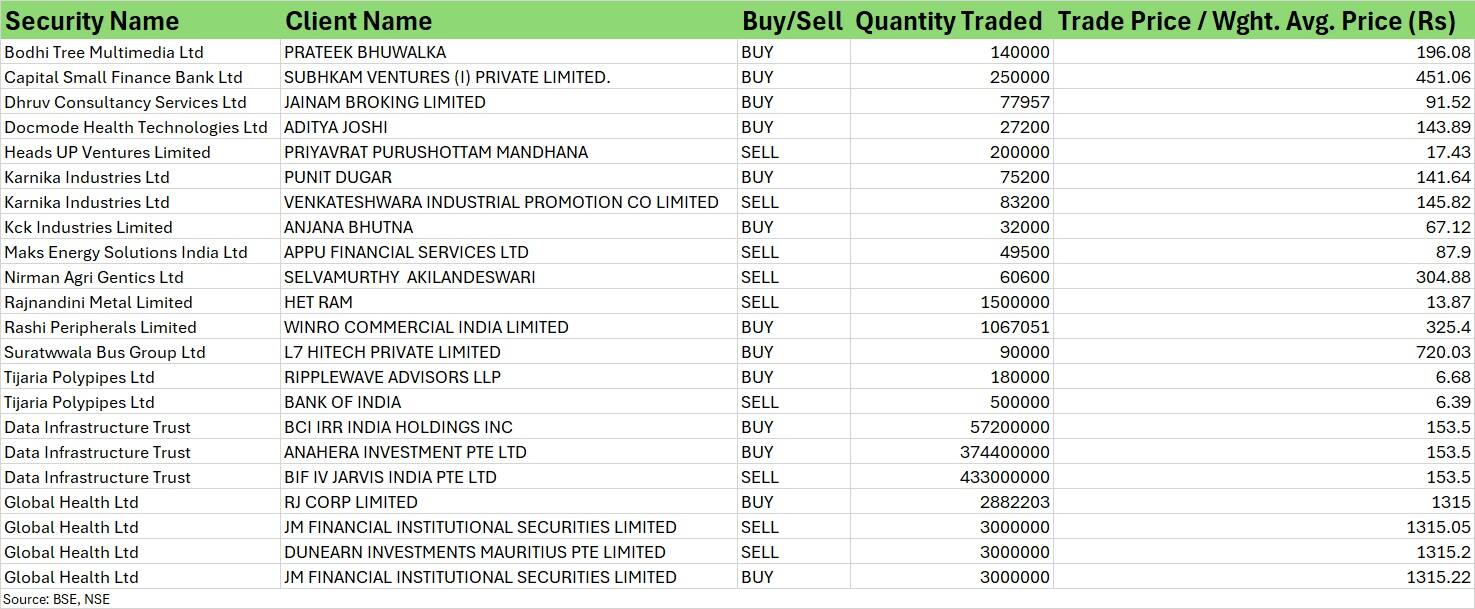

For more bulk deals, click here

EPACK Durable, R Systems International and Ballarpur Industries will release their quarterly earnings scorecard on February 15.

Stocks in the news

Utkarsh Small Finance Bank: The board of directors of the small finance bank will meet in due course to evaluate the proposal for a reverse merger of the holding company Utkarsh CoreInvest with the bank.

One 97 Communications: The company, its subsidiaries and its associate, Paytm Payments Bank, have received notices and requisitions for information, documents and explanations from the authorities, including the Enforcement Directorate (ED), with respect to the customers that may have done business with the respective entities. The company and its associates have continued to provide such information, documents and explanations to the authorities as is being required by them. Paytm Payments Bank does not undertake outward foreign remittances.

NMDC: The state-owned iron ore company has recorded a 62.6 percent on-year growth in consolidated net profit at Rs 1,470 crore for the quarter ended December FY24, backed by healthy topline and operating numbers. Consolidated revenue from operations grew by 45.4 percent year-on-year to Rs 5,410 crore for the quarter.

Glenmark Pharmaceuticals: The pharma company has posted a consolidated net loss of Rs 449.6 crore for the October-December period of FY24 against a profit of Rs 185.8 crore in the year-ago period, impacted by lower India and US businesses. Revenue from operations fell 19.1 percent year-on-year to Rs 2,506.7 crore for the quarter.

Hindustan Unilever: The FMCG major is in talks with the Andhra Pradesh government to collaborate on palm oil production in the state.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 3,929.60 crore, while domestic institutional investors (DIIs) purchased Rs 2,897.98 crore worth of stocks on February 14, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Hindustan Copper to the F&O ban list for February 15, while retaining Aditya Birla Fashion & Retail, Ashok Leyland, Aurobindo Pharma, Balrampur Chini Mills, Bandhan Bank, Biocon, Delta Corp, India Cements, Indus Towers, National Aluminium Company, Punjab National Bank, SAIL and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.