Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

The logistics unit of the General Elections Commission delivers election materials by motorbike to remote polling stations in Lampung on Feb. 11. Photographer: Perdiansyah/AFP/Getty Images

Indonesia’s election on Wednesday is raising questions over whether the nation’s bid to become an electric-vehicle hub poses enough economic benefit to outweigh environmental risks.

The three presidential contenders are proposing different ways to continue President Joko Widodo’s policy of using the country’s mineral riches to become an EV producer. A deadly furnace explosion in December was the latest flashpoint, stoking discontent among Indonesians contending with unemployment and poverty despite the surge in EV-related investments.

“Investments have focused on quantity, not quality,” said Andry Satrio Nugroho of the Institute for Development of Economics and Finance in Jakarta. “This is homework for the future government to create quality natural-resource downstream models and investments that open new jobs and also maintain the environmental quality that’s key to long-term economic prosperity and equality.”

That remaining task will go toward the next leader of Southeast Asia’s largest economy. The EV boom has brought in much-needed dollars to boost exports, stabilize the currency and spur economic growth. In the nation’s mining towns, however, labor groups are still fighting for better pay and working conditions.

Here are four charts that show the impact of the EV boom on Indonesia’s economy so far:

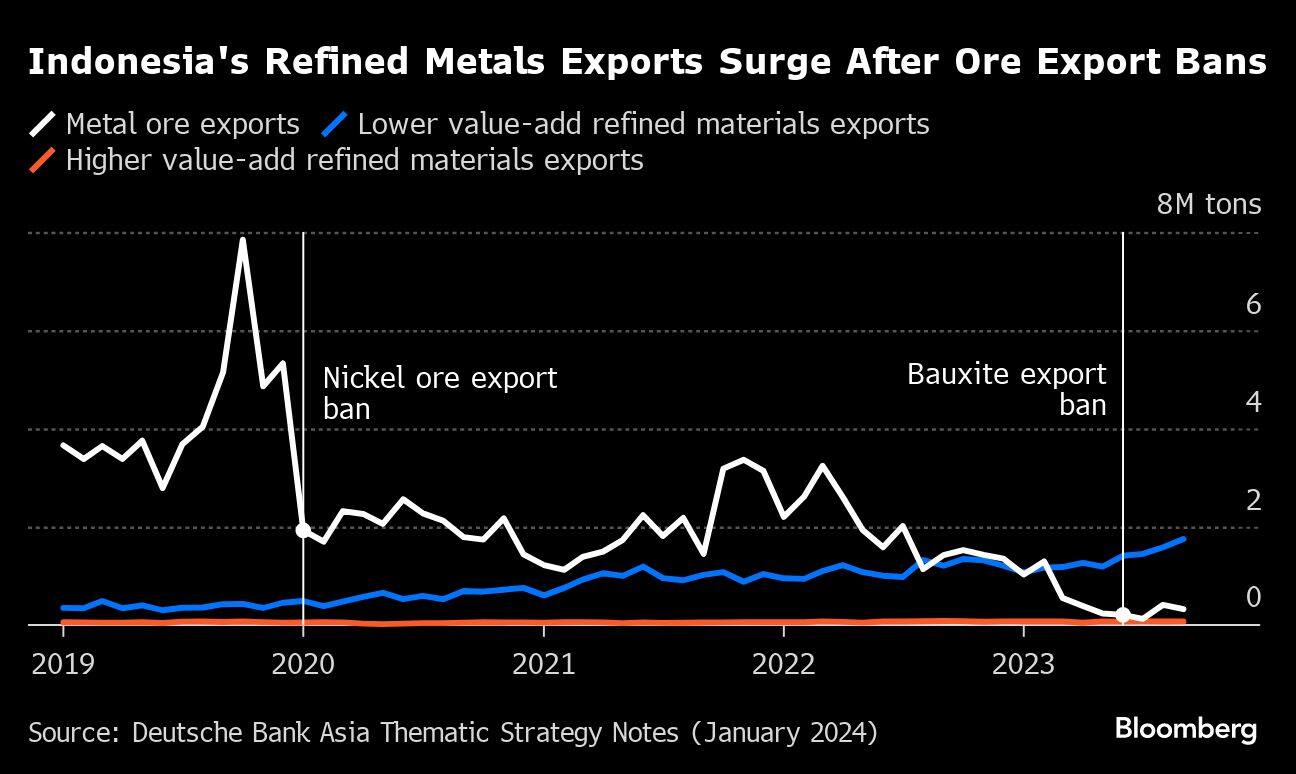

The bans on mineral ore exports have boosted shipments of refined metals. However, it’s still dominated by lower-value added products like stainless steel and nickel intermediaries instead of higher-value EV battery components, “this suggests that downstreaming in Indonesia is still in its early stages, but there are signs that the efforts are paying off,” according to a Deutsche Bank AG report.

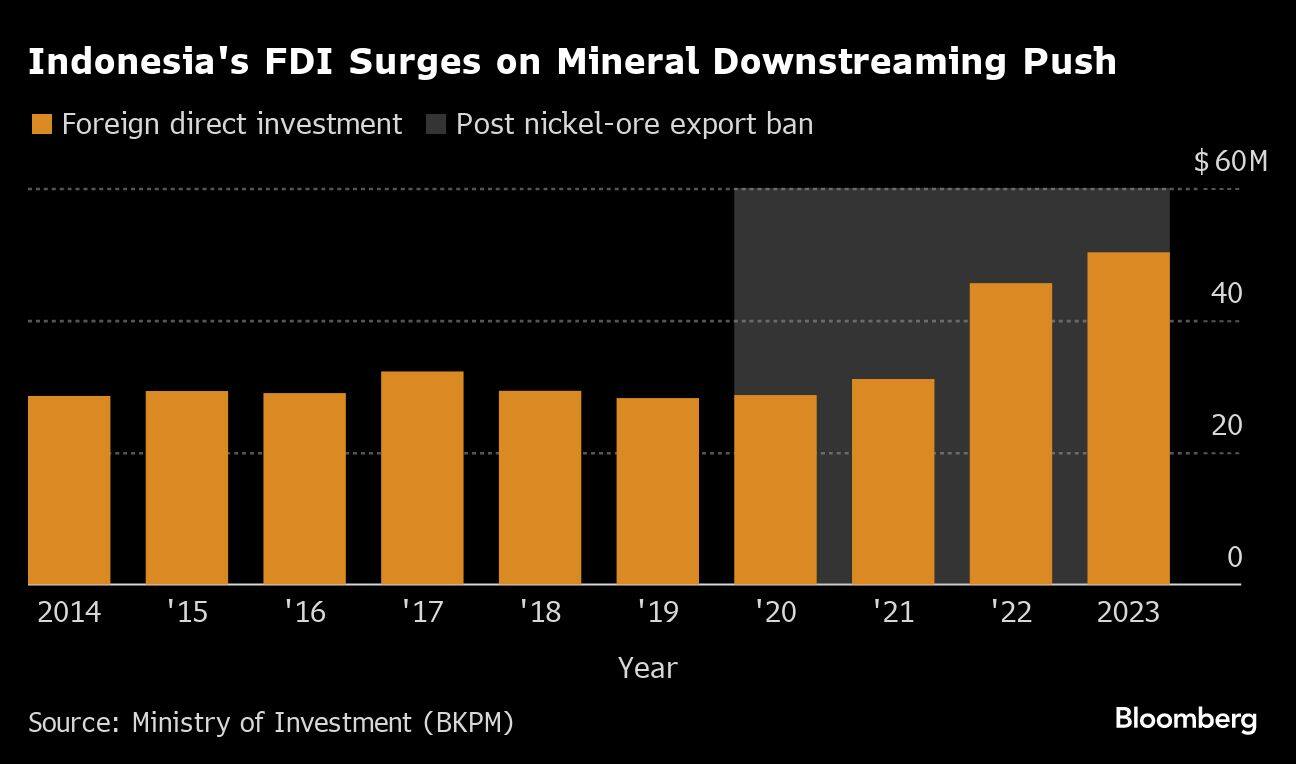

Indonesia has attracted over over $50 billion of foreign direct investments in 2023, with about a quarter of that going into the base metal industry. The investment ministry expects further downstreaming in other industries including agriculture to continue attracting investors, especially with upcoming export bans for bauxite and tin.

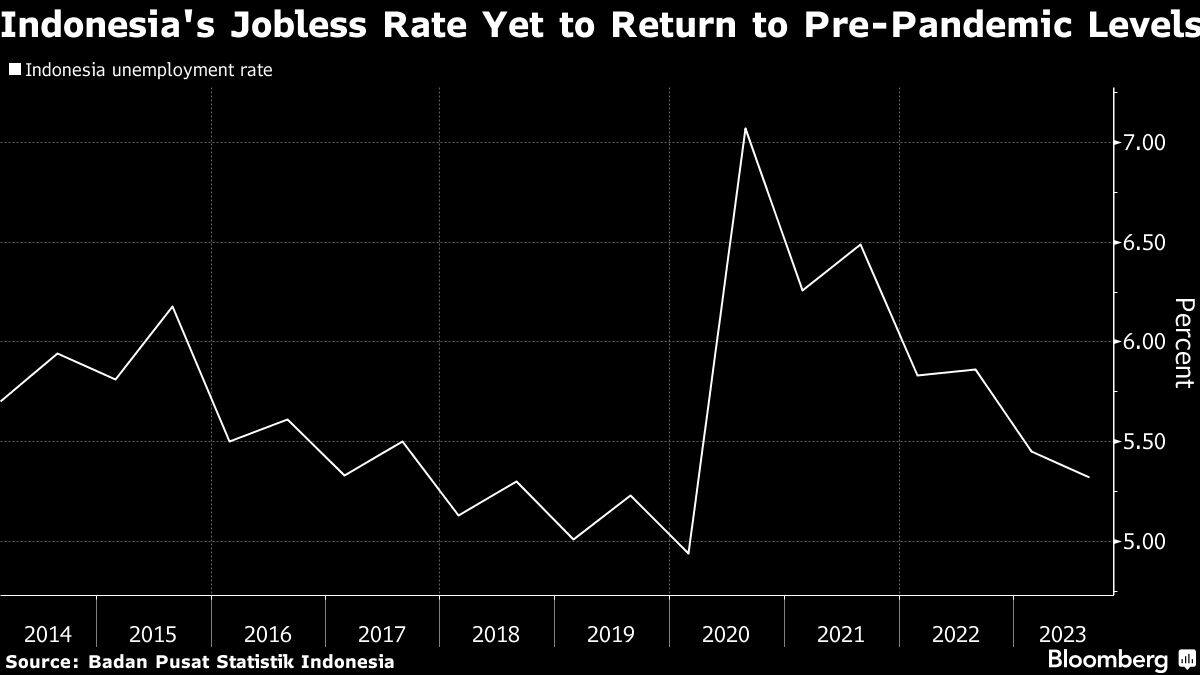

Job creation has lagged behind. Jokowi said that nickel processing employed 71,500 workers in Central Sulawesi and 45,600 in North Maluku, the two provinces that saw the most EV-related investments. That would be a 40-fold increase from 2015. Still, unemployment ticked up in North Maluku to 4.31% last year, from 3.98% in 2022, and the national jobless rate is still hovering above where it was before the pandemic.

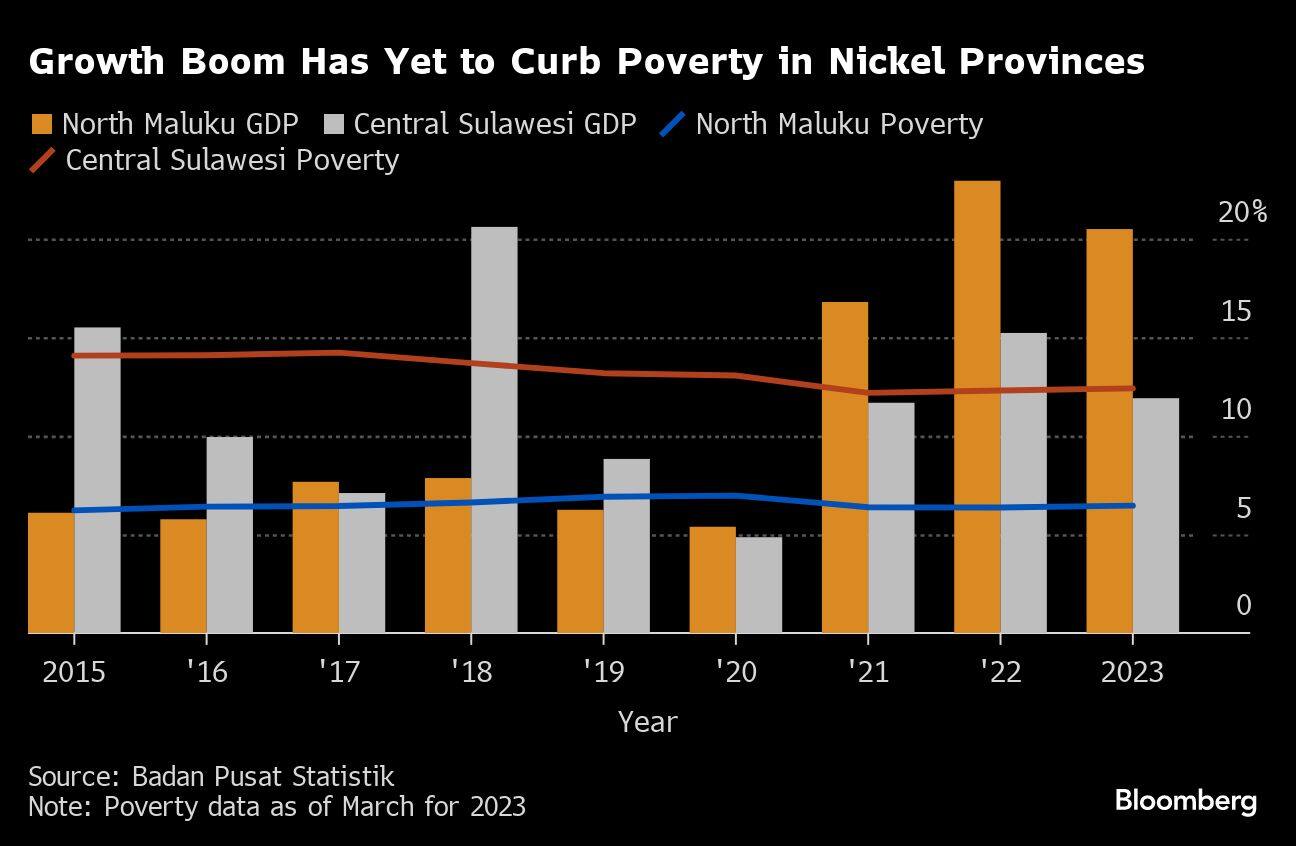

The poverty rate in North Maluku and Central Sulawesi rose last year, even as the provinces charted double-digit growth every year since 2021. Downstreaming still benefits a handful of communities and could worsen social gaps, said Indef’s Nugroho. A lack of environmental protection could also threaten other livelihoods like farming and fishing that underpin jobs and price stability, he added.