Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty likely to face resistance at 21,700-21,800 in case of rebound

The Nifty50 defended its long upward-sloping support trendline, though it formed a long bearish candlestick pattern on the daily charts on February 12. If the index manages to defend the same in the coming sessions, then it may face resistance at 21,750-21,800 levels, but in case of further selling pressure, the 21,500 level is expected to act as immediate support for the Nifty50, experts said.

On February 12, the BSE Sensex was down 523 points at 71,072, while the Nifty 50 fell 167 points to 21,616, due to selling pressure in the banking & financial services, metal, FMCG and oil & gas stocks. The major selling pressure was seen in broader markets as the Nifty Midcap 100 and Smallcap 100 indices were down 2.5 percent and 4 percent, respectively.

"The daily chart shows the index forming a lower top, signalling diminishing bullish sentiment. The momentum indicator aligns with this bearish outlook, displaying a crossover," Rupak De, senior technical analyst at LKP Securities said.

He feels the Nifty might remain in sell-on-rise mode as long as it remains below 21,850. On the downside, the support is situated at the 21,500 level, he said.

Shrikant Chouhan, head- of equity research at Kotak Securities said for traders the 21,800 level would act as a trend decider level. Below this, the market could slip to 21,550-21,500.

"On the flip side, above the 21,800 level the sentiment could change, and the chances of hitting 21,870-21,900 would turn bright," he said.

The increase in volatility above the 16 mark also caused discomfort for bulls. India VIX, the fear index, jumped 3.98 percent to 16.06, from 15.45 levels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,576, followed by 21,515 and 21,417 levels, while on the higher side, it may see immediate resistance at 21,772 followed by 21,833 and 21,931 levels.

Meanwhile, on February 12, the banks played a key role in dragging the benchmark Nifty down. The Bank Nifty dropped 752 points or 1.65 percent to 44,882 and formed a long bearish candlestick pattern on the daily charts. The index managed to defend the 200-day EMA (exponential moving average) on a closing basis, which is expected to be a critical support.

"The Bank Nifty might not witness a further weakness as it has reached long-term support. Crucial support is placed at 44,500-44,400 while resistance is placed at 45,750-45,800," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 44,662 followed by 44,399 and 43,974 levels, while on the higher side, the index may see resistance at 45,514 followed by 45,777 and 46,203 levels.

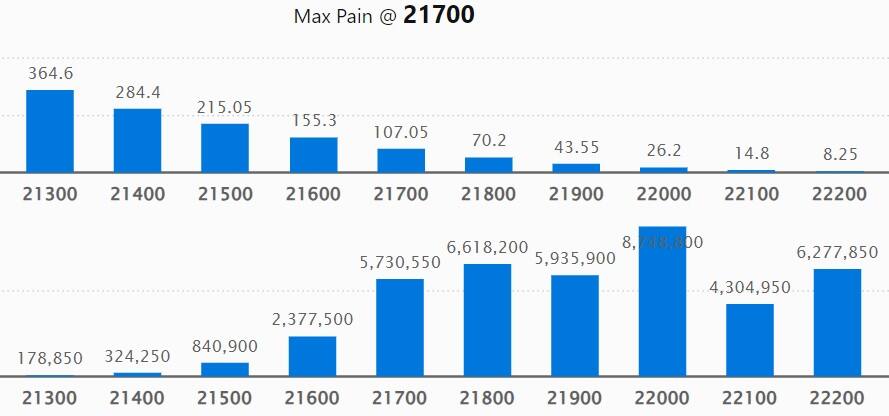

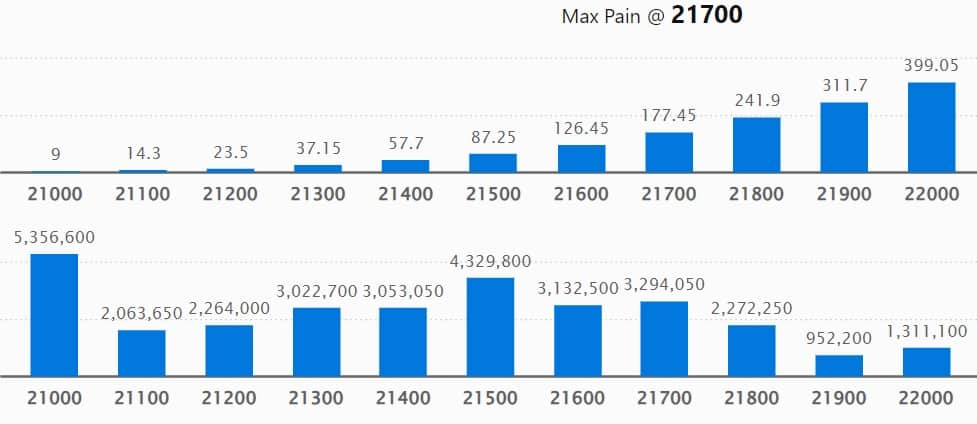

As per the weekly options data, the maximum Call open interest was seen at 22,000 strike with 87.48 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 73.63 lakh contracts, while the 21,800 strike had 66.18 lakh contracts.

Meaningful Call writing was visible at the 21,700 strike, which added 33.47 lakh contracts followed by 21,900 and 21,800 strikes adding 32.91 lakh and 29.37 lakh contracts, respectively.

The maximum Call unwinding was at the 22,700 strike, which shed 10.32 lakh contracts followed by 22,600 and 23,000 strikes, which shed 1.88 lakh and 30,450 contracts.

On the Put side, the 21,000 strike owned the maximum open interest, which can act as a key support level for Nifty, with 53.56 lakh contracts. It was followed by 20,800 strike comprising 53.11 lakh contracts and then 21,500 strike with 43.29 lakh contracts.

Meaningful Put writing was at 20,800 strike, which added 20.18 lakh contracts, followed by 21,300 strike and 21,400 strike, which added 10.35 lakh contracts and 9.26 lakh contracts.

Put unwinding was seen at 21,500 strike, which shed 6.14 lakh contracts, followed by 22,000 strike, which shed 4.29 lakh contracts and 21,800 strike, which shed 3.1 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Hindustan Unilever, Havells India, Sun Pharmaceutical Industries, Bharti Airtel and Nestle India saw the highest delivery among the F&O stocks.

A long build-up was seen in 21 stocks, which included Astral, HCL Technologies, L&T Technology Services, Coforge and Voltas. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 70 stocks saw long unwinding including State Bank of India, Siemens, United Breweries, Oberoi Realty and Alkem Laboratories. A decline in OI and price indicates long unwinding.

75 stocks see a short build-up

A short build-up was seen in 75 stocks including Bharat Forge, Ipca Laboratories, Bandhan Bank, National Aluminium Company and REC. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 21 stocks were on the short-covering list. This included Divis Laboratories, Escorts Kubota, Aurobindo Pharma, Wipro and LTIMindtree. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell to 0.85 on February 12, against 1 level in the previous session. The PCR below 1 indicates that the trading volume of Call options is higher than the Put options, which generally indicates a bullish trend ahead.

For more bulk deals, click here

A total of 564 companies will be releasing their December quarter earnings on February 13, including Eicher Motors, Hindalco Industries, Siemens, Zee Entertainment Enterprises, IRCTC, Bharat Heavy Electricals, Bosch, National Aluminium Company, Gujarat Gas, Indiabulls Real Estate, Innova Captab, INOX India, Medi Assist Healthcare Services, Info Edge India, NBCC, Oil India, Rashtriya Chemicals & Fertilizers, and Sula Vineyards.

Stocks in the news

Coal India: The country's largest coal mining company has recorded consolidated profit at Rs 9,093.7 crore for the third quarter of FY24, growing 17.8 percent over a year-ago period, backed by higher other income and a healthy operating margin with a fall in input cost. Revenue from operations grew by 2.8 percent YoY to Rs 36,154 crore for the quarter.

JSW Energy: JSW Neo Energy, a wholly owned subsidiary of the company, has received a Letter of Awards for a wind capacity of 500 MW from Solar Energy Corporation of India (SECI).

Steel Authority of India: The state-owned steel company has reported a consolidated net profit of Rs 423 crore for the October-December period of FY24, falling 22 percent on a high base as in Q3FY23, there was an exceptional gain of Rs 298 crore. Revenue from operations fell 6.8 percent year-on-year to Rs 23,349 crore for the quarter.

Hindalco Industries: Subsidiary Novelis has recorded net income attributable to common shareholders at $121 million for the quarter ended December FY24, growing 10-fold over $12 million in the year-ago period. Net sales decreased 6 percent YoY to $3.9 billion for the third quarter of the fiscal year 2024, driven by lower average aluminium prices as shipments were in line with prior-year levels.

Dilip Buildcon: The construction and infrastructure development company has registered a 3.3 percent on-year decline in consolidated profit at Rs 107.4 crore despite healthy topline, and operating numbers, impacted by lower exceptional gains. Revenue from operations during the quarter at Rs 2,876.8 crore increased by 23.87 percent over a year-ago period.

Skipper: The power transmission & distribution structures manufacturer has reported a 115.3 percent on-year increase in net profit at Rs 20.4 crore for the third quarter of FY24 despite a weak operating margin, boosted by topline. Revenue from operations grew by 80.2 percent YoY to Rs 801.6 crore for the quarter.

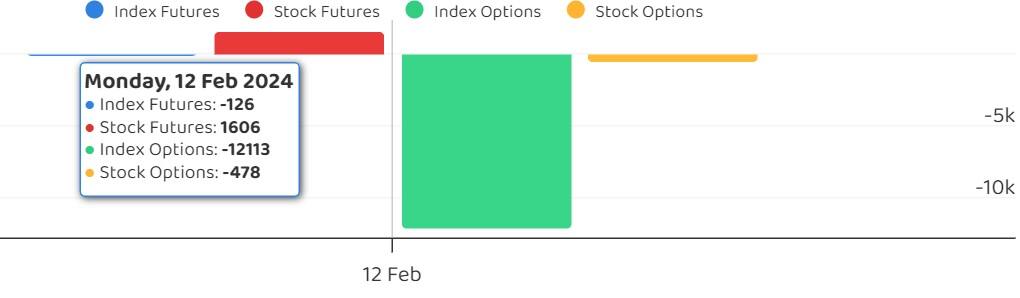

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 126.60 crore, while domestic institutional investors (DIIs) purchased Rs 1,711.75 crore worth of stocks on February 12, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Aditya Birla Fashion & Retail, and Bandhan Bank to the F&O ban list for February 13, while retaining Ashok Leyland, Aurobindo Pharma, Balrampur Chini Mills, Biocon, Delta Corp, Hindustan Copper, India Cements, Indus Towers, Punjab National Bank, SAIL and Zee Entertainment Enterprises to the said list. However, UPL was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.