Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

indications of market fragility emerged throughout the week.

Indian stock markets are exhibiting signs of weariness, contrasting with the ongoing ascent of US markets. In a historic milestone, the S&P500 surpassed the 5,000 mark, and the Nasdaq breached the 16,000 level for the first time. However, Indian markets remained range-bound throughout the week, concluding with a 0.32 percent decline.

The RBI's policy announcement failed to uplift market sentiment. Instead, we saw a selloff immediately following the announcement as markets anticipated a more dovish stance from the governor.

Echoing our outlook from last week, despite trading near all-time highs, underlying structural weaknesses could exert downward pressure on the market. Throughout the week, further indications of market fragility emerged.

Structural weakness continues

This week, the Nifty index attempted to surpass the resistance level of 22126, but it failed. Instead, the Nifty index closed lower, resulting in a negative weekly close. Many of the data points discussed below indicate that the current sideways trend is possibly a distribution, and the Nifty index may eventually drift lower.

Two important downside levels for the Nifty index are the 40DEMA at 21450 and the weekly swing low of 21137. The data points discussed below suggest that these support levels should eventually be broken on the way down.

FIIs briefly trimmed short positions last week, but this week, they have added shorts and are now holding a net short position of 83,853 contracts. We had seen a similar pattern in early February 2023, where they initially trimmed the short position but added to it later, resulting in the Nifty making lower lows. A similar pattern can be expected this time as well.

The 40DEMA at 21450 will be an important support level. Once it is broken on a closing basis, the downside momentum should pick up, and if past data is to be believed, FIIs' short position can reach 1,70,000 contracts.

Source: web.strike.money

Source: web.strike.money

The relevance of the DII's positioning in the index futures has increased significantly in the last few years. The chart below shows that when the market is near the top, the DIIs hold significant short positions, and at the bottom, they hold significant long positions. The DII's short positions in the index futures recently touched the first line at the bottom, around 40,000 contracts, where there has been some short covering. The net short positions in the index futures stand at 23,941 contracts. However, past data shows that shorts in the index futures up to the first line at the bottom have resulted in a correction anywhere between 7-12 percent.

Source: web.strike.money

Source: web.strike.money

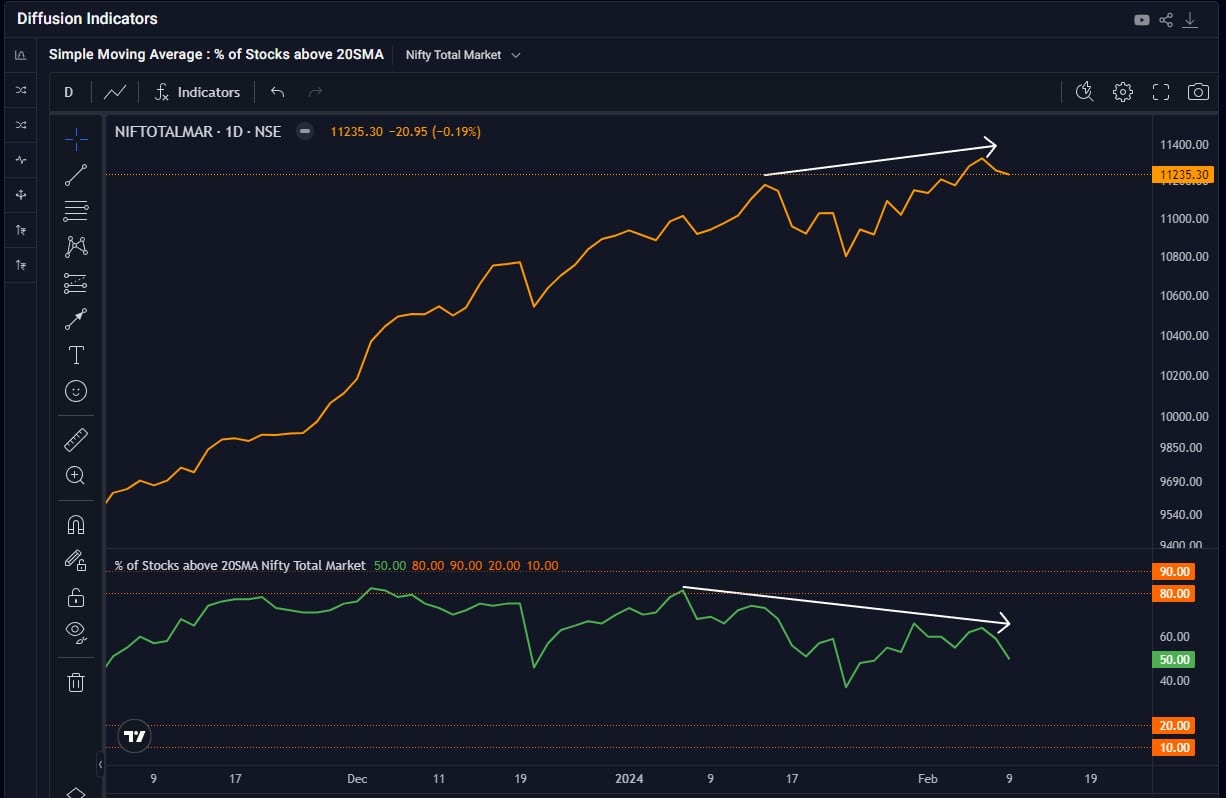

The Nifty Total Market Index (750 stocks) recently surged to a new high, indicating overall market strength and investor confidence. However, the percentage of stocks trading above their 20-day moving average failed to mirror this upward momentum, revealing a potential divergence in market breadth. This discrepancy warrants careful consideration, as it may signal underlying weaknesses or sectoral disparities within the market rally.

Source: web.strike.money

Source: web.strike.money

Indices and Market Breadth

A volatile week ended with the market ending marginally lower, even as the RBI policy was declared during the week, during which the central bank kept policy rates for a sixth consecutive time.

Smaller indices performed much better. The small-cap index touched a new high during the week, while the BSE Mid-cap Index ended with a 1.6 percent gain.

On the sectoral front, the PSU Bank index gained five percent, Healthcare gained 4.4 percent, Oil & Gas index was up nearly 4 percent, Pharma socks were up 3.9 percent and Media stocks gained 3 percent.

FIIs sold equities worth Rs 5,871.45 crore during the week, taking the total sale in February to Rs 7,680.34 crore.

Among top performers during the week were Automotive Stampings and Assemblies, which gained 44.16 percent, Visaka Industries, which was up 34.49 percent, and Jayaswal Neco Industries, which closed the week 27.56 percent higher.

Among the top losers were IFGL Refractories, which fell 27.09 percent, WPIL, which was down 22.62 percent, and Aptech, which lost 16.36 percent during the week.

Global Market

World markets were strong during the week, with the S&P500 touching a new high and crossing the 5,000-point milestone. While the Dow Jones closed unchanged, the S&P500 closed 1.37 percent higher, and Nasdaq was up 2.31 percent.

The MSCI All Country stock index gained 1.4 percent during the week, recording its third straight weekly gain. The Euro Stoxx50 gained 1.30 percent, and CAC 40 gained 0.73 percent.

Chinese markets were the top performers among major markets. Shanghai closed the week higher by 4.97 percent, and Hang Seng gained 1.37 percent. Nikkei also posted a strong performance, gaining 2.04 percent, touching a new 34-year high.

Stocks to watch

BPCL, Canara Bank, Cummins India, EIH Hotels, Hero Moto, OFSS, Lupin, Kirloskar Engines, and Sun Pharma are among the frontline stocks showing strong upside momentum.

Astec, AU Bank, Bata, HDFC Bank, ITC, Naveen Flourine, UPL, Sharda Crop and Deepak Fertiliser.

Cheers,

Shishir Asthana