Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

There are various steps an investor should take to invest successfully over a long period of time.

In this article let us dive into the life of Vikas : A 30-year-old investor whose investment philosophy is to invest only in the stocks that are a part of his daily lifestyle

Vikas is an IT Engineer who has a penchant for travelling and eating out at various restaurants. He likes to spend his money on experiences and maintains a healthy work-life balance.

On weekends, Vikas watches movies, spends time with his family, does grocery shopping, plays sports and makes the most of his free time.

Vikas, just like any other young investor, relied on advice given by finance influencers and famous social media personalities. One such advice that he came across was to invest only in the brands that you know. This resonated very well with him as he does a lot of research before making any purchase.

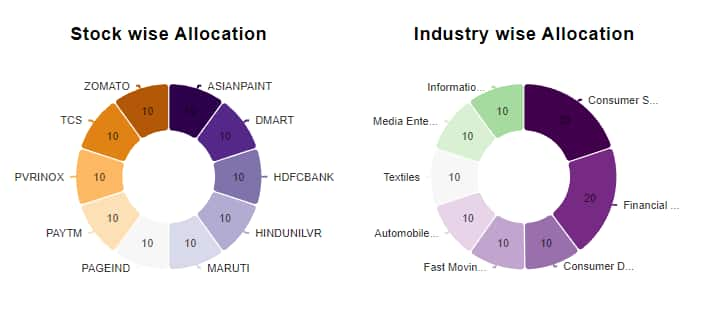

Let us have a look at the brands that Vikas uses in his daily life. (The following brands are selected just for illustrative purposes of this article and there is no other motive)

Vikas has a bank account with Hdfc Bank which he uses as his primary account for all transactions. He uses Paytm as his payments interface.

He buys his groceries in bulk from D-Mart every once in two weeks. Most of his household products are from Hindustan Unilever.

His daily wear mostly comprises garments from Page Industries (Jockey).

He watches movies at PVR cinemas on the weekend.

He recently re-modelled his bedroom so he used Asian Paints products.

He drives a Maruti Suzuki SUV.

He uses the app Zomato to order food and search for restaurants.

Since he works in the IT sector his preference is TCS as an investment.

Another advice that he read on social media is: The smaller your investment portfolio the more profit you can make.

Based on this investment thesis this is his portfolio:

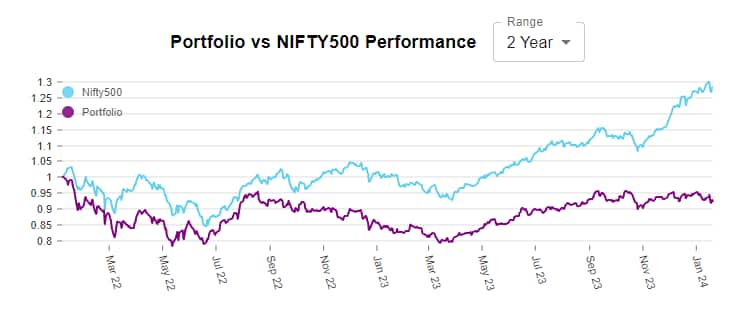

This is how his portfolio would have performed in the past two years:

If Vikas invested Rs 1 lakh in his investment portfolio on January 20, 2022 it would be Rs 87,000 on February 6, 2024.

However Rs 1 lakh invested in the Nifty 500 Index would be Rs 1.3 lakh.

Basically, Vikas was better off if he invested in a single Index ETF.

The story of Vikas can be compared to many investors who fall in the trap of Familiarity bias.

The familiarity bias is a phenomenon in which people tend to prefer familiar options over unfamiliar ones, even when the unfamiliar options may be better.

This bias is often explained in terms of cognitive ease, which is the feeling of fluency or ease that people experience when they are processing familiar information.

When people encounter familiar options, they are more likely to experience cognitive ease, which can make those options seem more appealing.

To avoid familiarity bias, it is important to carefully evaluate all options, including unfamiliar ones, and to consider their relative metrics rather than relying solely on familiarity.

There could be a set of popular stocks that may have done well. However, it is important to not be a victim of familiarity bias.

Just because a brand is popular it does not mean that it will make you a profit on your investments.

What could Vikas do to optimise his investment portfolio? Answer: Follow a data backed approach.

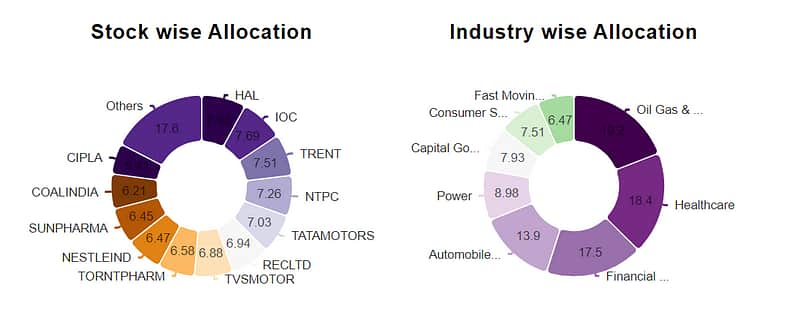

SEBI-registered investment advisors analyse various factors that have a long term relation with asset prices. These factors are used to rank the stocks in the universe and relevant optimisation techniques are used to assign weights to the portfolio.

Let us look at an example of a data backed approach.

Consider a sample of Large Cap companies that are fundamentally strong backed by price momentum and apply a Risk Parity asset allocation approach to optimise for a maximum Sharpe ratio.

This is the sample portfolio.

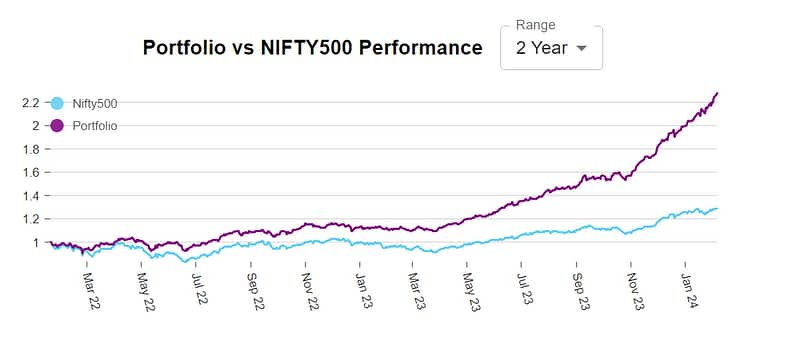

This is the two-year performance with respect to Nifty 500.

There are various steps an investor should take to invest successfully over a long period of time. The first step would be to reduce psychological biases while making investment decisions.

This sample portfolio was created using concepts of quantitative finance by a SEBI Registered Investment Advisor. You can find such SEBI registered advisors on the ARIA (Association of Registered Investment Advisors) website.

Do you know anyone like Vikas who might have fallen prey to the familiarity bias?

Rohan Borawake is Co-Founder & CEO, Sabir Jana is Co-Founder and Head of Quantitative Research, at FinSharpe Investment Advisors. Views are personal, and do not represent the stand of this publication.