Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty likely to be in range of 21,500-22,000

The market is expected to remain in a consolidative phase in the coming sessions with key support at 21,600-21,500 zone, while the hurdle on the higher side is expected to be at 22,050, the high of last week, experts said, adding if the index breaks the support, then selling pressure may extend further to 21,300 but surpassing the resistance (22,050) may take it to a new high.

On February 9, the BSE Sensex rallied 167 points to 71,595, while the Nifty 50 rose 64 points to 21,783 and formed bullish candlestick pattern with lower shadow on the daily charts, indicating buying interest at lower levels. Further, the index also held 21-day EMA (exponential moving average 21,670), which can be an immediate support for the index.

"Overall, the sideways price action is likely to continue. The range of consolidation is likely to be 21,600 – 22,050," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

According to Nagaraj Shetti, senior technical research analyst at HDFC Securities, the overall uptrend status of Nifty remains intact and there is a possibility of further upside towards 22,000 levels in the near term. Any dips down to 21,600-21,500 levels could be a buying opportunity, he feels.

Meanwhile, the broader markets witnessed a sharp correction. The Nifty Midcap 100 index was down 0.89 percent and Nifty Smallcap 100 index fell 1.4 percent. Thus, the action could shift to the frontline while the midcap and small cap enter a consolidation phase, Jatin feels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,672, followed by 21,631 and 21,564 levels, while on the higher side, it may see immediate resistance at 21,799 followed by 21,847 and 21,914 levels.

Meanwhile, on February 9, the banks provided healthy support to the benchmark Nifty 50 as the Bank Nifty jumped 623 points or 1.4 percent to 45,635 and formed long bullish candlestick pattern on the daily charts after a big red candle in previous session.

The Bank Nifty bulls successfully defended the crucial support level of 45,000, establishing it as a critical support zone.

"The fall witnessed in the previous trading session did not continue on Friday and Bank Nify reversed sharply from the 45,000 level. The pullback can continue towards 46,000 – 46,200 where the key daily moving averages are placed," Jatin Gedia said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 45,076 followed by 44,873 and 44,545 levels, while on the higher side, the index may see resistance at 45,713 followed by 45,935 and 46,263 levels.

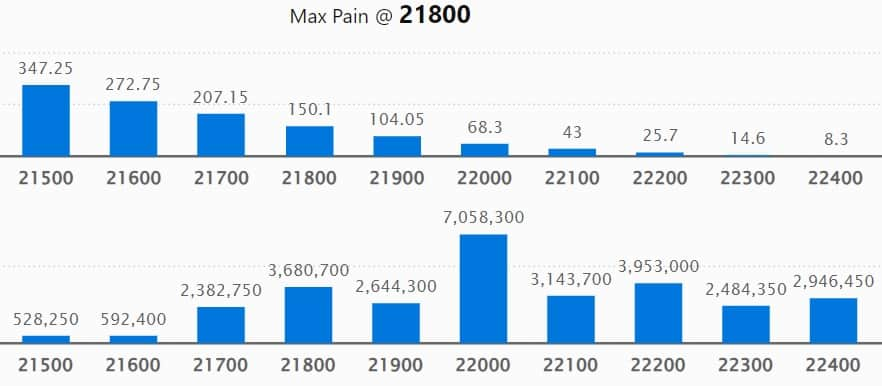

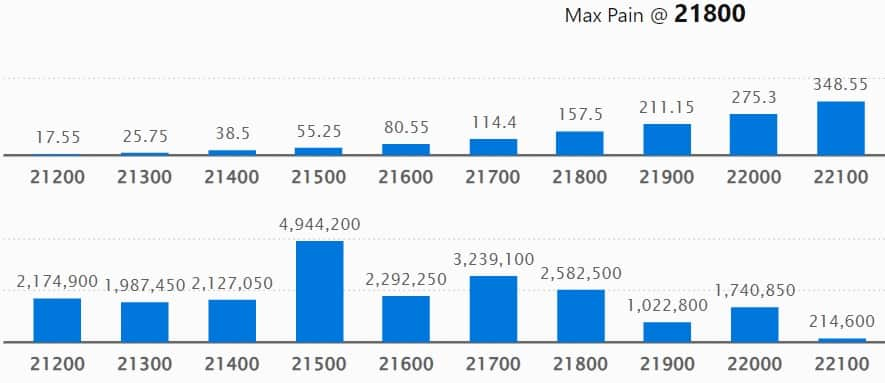

On the weekly options data front, the 22,000 strike owned the maximum Call open interest, with 70.58 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 23,000 strike, which had 54.03 lakh contracts, while the 22,700 strike had 48.57 lakh contracts.

Meaningful Call writing was visible at the 22,700 strike, which added 19.59 lakh contracts followed by 22,500 and 22,200 strikes adding 14.31 lakh and 13.68 lakh contracts, respectively.

The maximum Call unwinding was at the 22,900 strike, which shed 2.59 lakh contracts followed by 21,900 and 20,500 strikes, which shed 46,550 and 2,700 contracts.

On the Put side, the maximum open interest was seen at 21,500 strike, which can act as a key support level for Nifty, with 49.44 lakh contracts. It was followed by 21,000 strike comprising 44.56 lakh contracts and then 20,500 strike with 33.76 lakh contracts.

Meaningful Put writing was at 21,500 strike, which added 22.23 lakh contracts, followed by 20,500 strike and 21,700 strike, which added 15.73 lakh contracts and 12.08 lakh contracts.

Put unwinding was seen at 21,900 strike, which shed 3.03 lakh contracts, followed by 22,000 strike, which shed 2.19 lakh contracts and 22,100 strike, which shed 51,450 contracts.

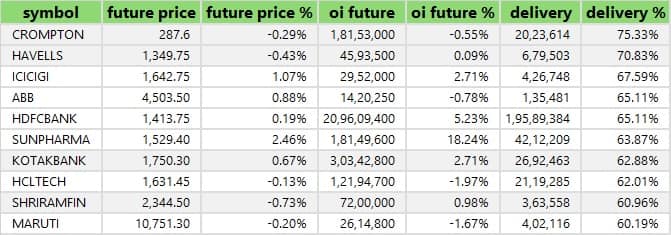

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Crompton Greaves Consumer Electricals, Havells India, ICICI Lombard General Insurance Company, ABB India, and HDFC Bank saw the highest delivery among the F&O stocks.

A long build-up was seen in 43 stocks, which included Zee Entertainment Enterprises, Sun Pharmaceutical Industries, PI Industries, ACC, and Bharat Forge. An increase in open interest (OI) and price indicates a build-up of long positions.

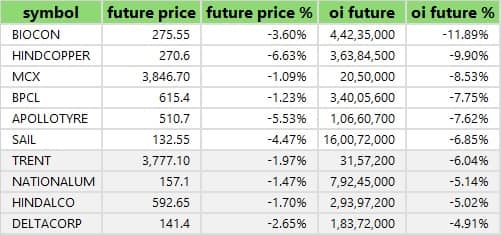

Based on the OI percentage, 52 stocks saw long unwinding including Biocon, Hindustan Copper, MCX India, BPCL, and Apollo Tyres. A decline in OI and price indicates long unwinding.

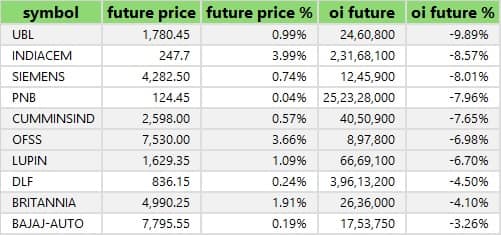

45 stocks see a short build-up

A short build-up was seen in 45 stocks including Power Finance Corporation, MRF, Ramco Cements, REC, and Indian Oil Corporation. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 47 stocks were on the short-covering list. This included United Breweries, India Cements, Siemens, Punjab National Bank, and Cummins India. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, remained at 1 on February 9 as well, compared to the previous session. The PCR at 1 indicates that the trading volume of Put options is equal to the Call options, which generally indicates a neutral trend ahead.

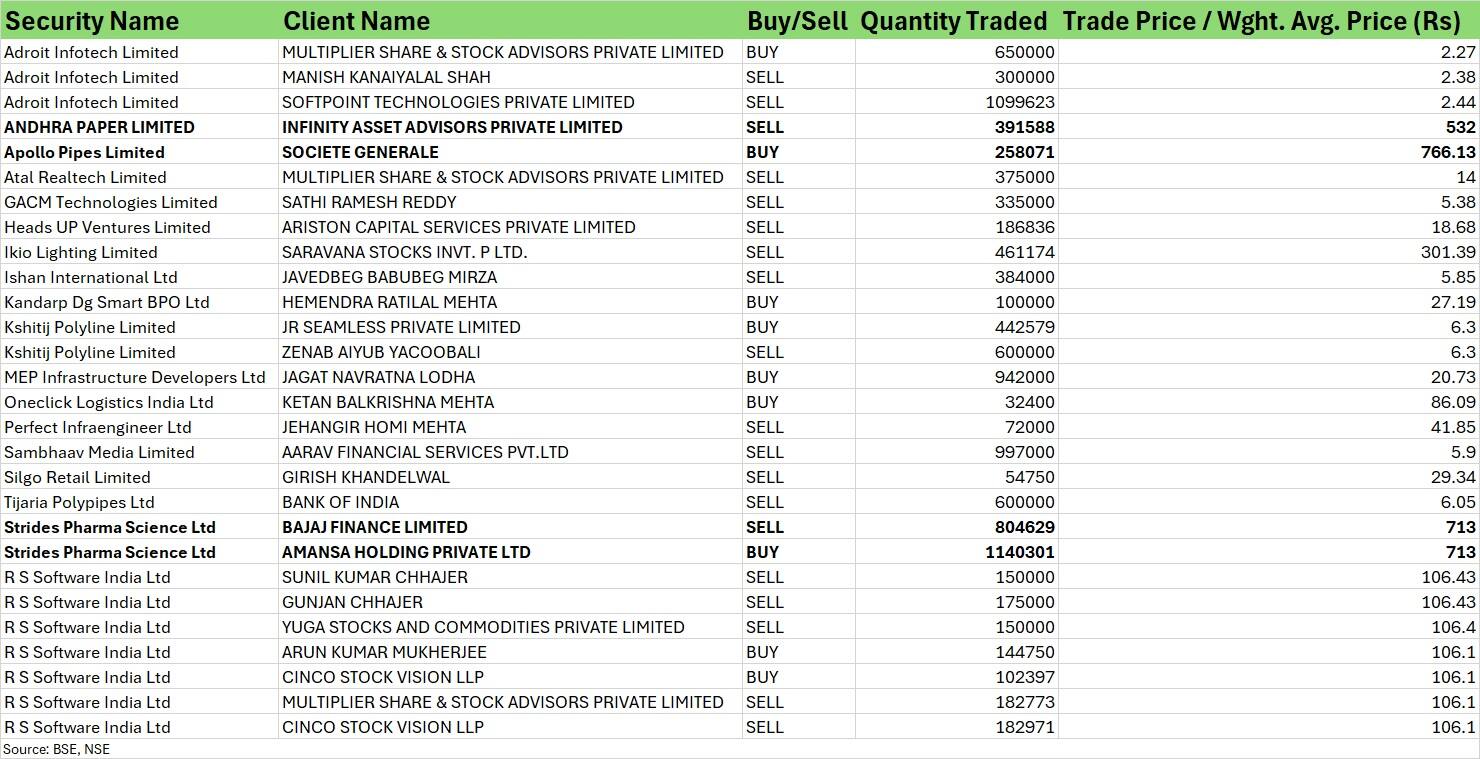

For more bulk deals, click here

Total 480 companies will be releasing their quarterly earnings scorecard on February 12 including Coal India, Bharat Forge, Allcargo Logistics, Anupam Rasayan India, BLS E-Services, Cera Sanitaryware, Dilip Buildcon, GSK Pharmaceuticals, Hindustan Aeronautics, HEG, Krsnaa Diagnostics, Mazagon Dock Shipbuilders, Samvardhana Motherson International, NHPC, Steel Authority of India, and Skipper.

Stocks in the news

Apeejay Surrendra Park Hotels: The Park Hotels is set to list its equity shares on the bourses on February 12. The final issue price has been fixed at Rs 155 per share.

Oil and Natural Gas Corporation: The state-owned oil & gas exploration company has recorded consolidated profit at RS 9,536 crore for the quarter ended December FY24, down 13.7 percent compared to year-ago period. Revenue from operations dropped 9.8 percent YoY to Rs 34,789 crore for the quarter, with crude oil price realisation falling 6.4 percent YoY to $81.59 a barrel.

Aurobindo Pharma: The pharmaceutical firm has recorded consolidated net profit at Rs 936 crore for October-December period of FY24, rising sharply by 90.6 percent over a year-ago period backed by strong operating numbers. Revenue from operations for the quarter increased by 14.7 percent YoY to Rs 7,352 crore, with growth seen across multiple businesses.

Divis Laboratories: The pharma company has reported net profit at Rs 358 crore for third quarter of FY24, rising 17 percent over corresponding period of last fiscal, with revenue from operations increasing 8.6 percent YoY to Rs 1,855 crore.

Multi Commodity Exchange of India: The commodity exchange has posted net loss of Rs 5.35 crore for quarter ended December FY24, against profit of Rs 38.79 crore in corresponding period of last fiscal despite strong topline growth. Revenue from operations grew by 33.4 percent YoY to Rs 191.5 crore for the quarter.

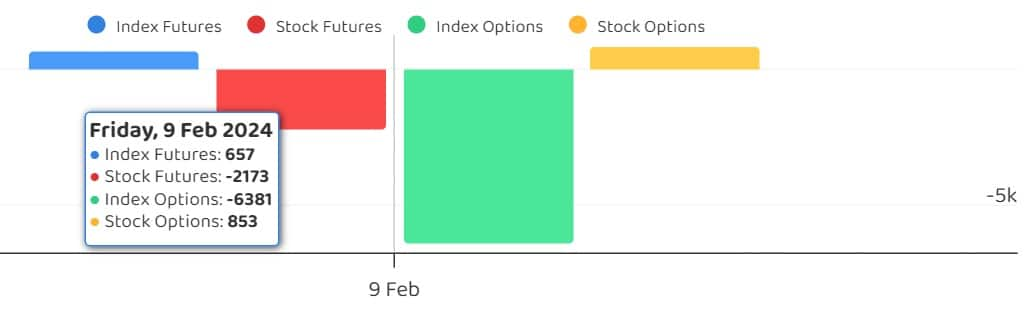

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 141.95 crore, while domestic institutional investors (DIIs) sold Rs 421.87 crore worth of stocks on February 9, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Zee Entertainment Enterprises to the F&O ban list for February 12, while retaining Ashok Leyland, Aurobindo Pharma, Balrampur Chini Mills, Biocon, Delta Corp, Hindustan Copper, India Cements, Indus Towers, Punjab National Bank, SAIL and UPL to the said list. However, National Aluminium Company was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.