Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Christopher Wood, Global Head of Equity Strategy at Jefferies

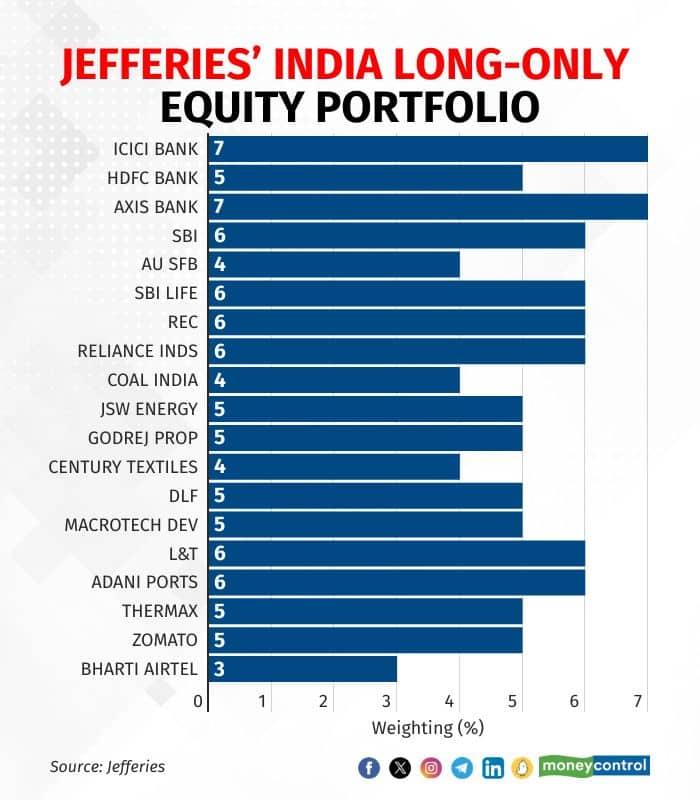

Chris Wood of Jefferies has announced adjustments to the India long-only portfolio, ahead of upcoming general elections. In the India long-only portfolio, a new investment in Bharti Airtel will be introduced, accounting for 3 percent weight.

This addition will come by reducing the investment in Reliance Industries by three percentage points. The allocation to HDFC Bank will be reduced by two percentage points.

Meanwhile, investments in Axis Bank and State Bank of India will each be increased by one percentage point.

Follow our live blog for all the market action

As for the global long-only portfolio, Wood has reduced the investment in HDFC Bank will be reduced by two percentage points while the investments in Axis Bank and TSMC were increased by one percentage point each.

Wood writes in his note that the interim budget was a pleasant surprise to GREED & Fear. "It is testament to the confidence of Indian Prime Minister Narendra Modi ahead of the pending general election in April-May that his government announced a budget on 1 February that is almost devoid of vote-buying populism," he writes.

With government capex set to increase 17 percent year-on-year to Rs 11.11 lakh crore in FY25, Wood reiterates L&T GREED & Fear's 6 percent weighting in that stock in the India long-only portfolio and a 5 percent position in the Asia ex-Japan long-only portfolio.

"It has been an ongoing feature of Modi’s government that the fiscal deficits have been used mainly to finance infrastructure investments rather than transfer payments," he said.

Wood also concluded that investors should pay more attention to PSU stocks as they are 'cheaper part of the Indian market' and government's focus remains on privatisation.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.