When I was a student in the U.K., I remember that renting appliances like washing machines and televisions was the norm for some people, especially students living in short-term accommodations. Israeli startup Xyte (pronounced “excite”) has just raised $30 million, as it sees a return to this sort of hardware-as-a-service model to be the way forward for manufacturers whose margins are under constant pressure. If it works so well for software-as-a-service, why not hardware?

Xyte let me take a look at its 27-slide deck to see how it pulled it off. Was I excited by Xyte’s deck? Sadly, no. This 27-slide deck was short on the information that I would need as an investor to make an informed decision on whether or not to invest in it. Let’s break down what I saw.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Xyte’s deck features 27 slides, some with redacted information. The redactions relate to its customers and trading figures, which is both fair enough and also makes it a bit trickier to get a picture of the full company.

- Cover slide

- Company overview, including some team details

- Team slide

- Opportunity slide

- Opportunity 2 slide

- Market slide

- Problem slide

- Value proposition slide

- Solution slide

- Solution 2 slide

- Solution 3 slide

- Dedicated interfaces slide

- Traction slide

- “Any industry, any size” slide (customer base)

- Value proposition slide

- Business transformation slide

- “Unique business and commerce platform” slide

- Customer study slide

- “Pioneering a new product category” slide

- “A single, integrated platform” slide

- Team 2 slide

- Interstitial slide

- Business model slide

- Go-to-market slide

- “Forecast and drivers” slide

- Investment summary slide

- Closing slide

Three Two things to love

You might think that with 27 slides, there would be plenty to pick from for the “three good things” section. Dear reader, I’m not gonna lie: Try as I might, I really struggled to find three good things about this deck.

So, let’s talk about the two sparks of brilliance I could spot in this inky void of despair:

Opening summary

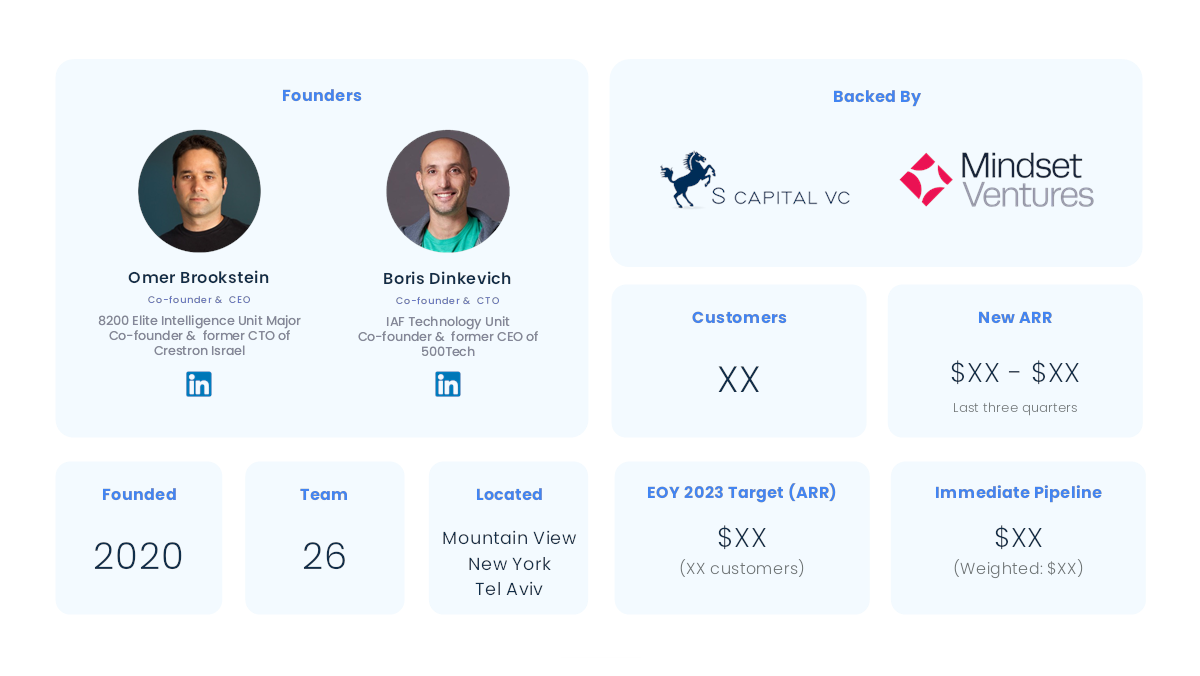

[Slide 2] A very well-done at-a-glance slide. Image Credits: Xyte

Even with some of the core numbers redacted, it shows off a lot of important information at a glance that will likely get an investor to take note. In fact, I think this slide will become my recommended template for most startups raising money — it’s crisp, clear, and to the point, and it helps set the scene for what’s to come.

Pulling it all together

I have a lot of respect for summaries, and this deck pulled it off not once, but twice. The first one sets the stage, and the second one (below) summarizes the same story once more, but through the lens of an investor.

[Slide 26] A solid summary pulling it all together. Image Credits: Xyte

Minor tweaks aside, I think this “investment summary” slide does a lot of work, and I’m glad the team chose to include it.

In the rest of this teardown, we’ll look at three things Xyte could have improved or done differently, along with its full pitch deck!