Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Market likely to take support at 21,500

Bears returned to power at Dalal Street after the expected RBI policy meeting outcome and dragged the Nifty 50 below the 10-day EMA (exponential moving average - 21,750), which acted as a support in the recent past. The Nifty50 may see some more selling pressure in coming days but 21,500 is expected to be a crucial support to watch out for, experts said, adding as long as the 21,500 holds, the index may rebound and remain ranged at 21,500-22,126 levels.

On February 8, the banking & financial services, auto and FMCG stocks pulled the market down. The BSE Sensex plunged 724 points or 1 percent to 71,428, while the Nifty 50 dropped 212.5 points to 21,718 and formed a long bearish candlestick pattern on the daily charts with higher volumes.

"After the repeated testing of the key overhead resistance of the previous opening downside gap of January 17 at 21,970 levels in the last 3-4 sessions, the bulls seem to have given up eventually and the market declined from the highs on Thursday," Nagaraj Shetti, senior technical research analyst, HDFC Securities said.

He feels the short-term trend of Nifty seems to have turned down and one may expect some more weakness in the short term. "The near-term uptrend of the market remains intact and further weakness down to the immediate support of 21,550-21,500 levels could be a buying opportunity," he said.

Overall, Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, also expects the consolidation to continue with negative bias.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,666 followed by 21,584 and 21,452 levels, while on the higher side, it may see immediate resistance at 21,750 followed by 22,012 and 22,144 levels.

Meanwhile, on February 8, the Bank Nifty played a crucial role in the market downtrend, falling 807 points to 45,012 and forming a long bearish candlestick pattern on the daily charts after decisively breaking down the consolidation, with higher volumes. The index is just 350 points away from its 200-day EMA now.

Hence, Jatin Gedia expects the weakness to persist and expects the Bank Nifty to drift towards 44,430- 44,000 from a short-term perspective. However, on the upside, 45,500-45,600 shall act as an immediate hurdle, he feels.

As per the pivot point calculator, the Bank Nifty is expected to take support at 44,871 followed by 44,566 and 44,075 levels, while on the higher side, the index may see resistance at 45,130 followed by 46,158 and 46,650 levels.

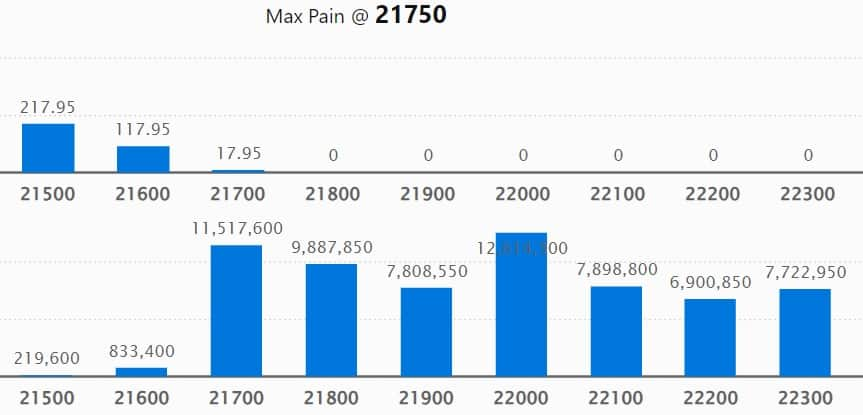

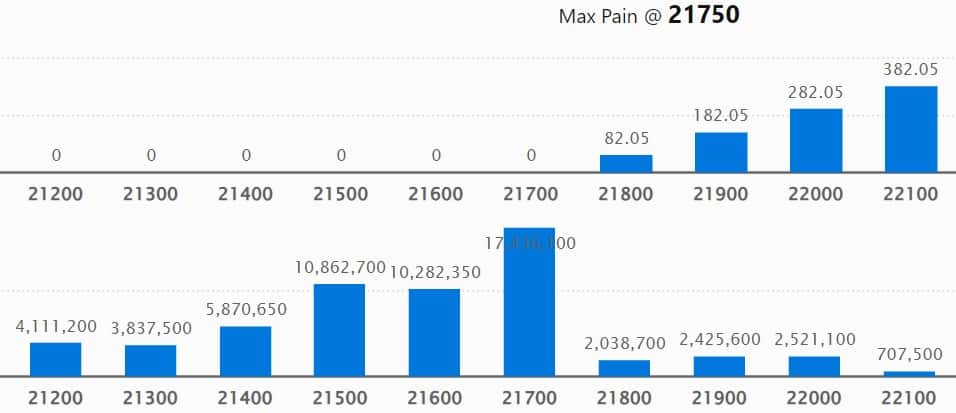

On the weekly options data front, the maximum Call open interest was seen at 22,000 strike with 1.26 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,700 strike, which had 1.15 crore contracts, while the 21,800 strike had 98.87 crore contracts.

Meaningful Call writing was seen at the 21,700 strike, which added 1.05 crore contracts followed by 21,800 and 22,000 strikes adding 84.13 lakh and 38.17 lakh contracts, respectively.

The maximum Call unwinding was at the 23,000 strike, which shed 17.84 lakh contracts followed by 22,300 and 22,900 strikes, which shed 11.43 lakh and 8.14 lakh contracts.

On the Put front, the 21,700 strike owned the maximum open interest, which can act as a key support level for Nifty, with 1.74 crore contracts. It was followed by 21,500 strike comprising 1.08 crore contracts and then 21,600 strike with 1.03 crore contracts.

Meaningful Put writing was at 21,700 strike, which added 98.67 lakh contracts, followed by 21,600 strike and 21,500 strike, which added 52.44 lakh contracts and 40.39 lakh contracts.

Put unwinding was seen at 21,900 strike, which shed 62.72 lakh contracts, followed by 21,800 strike, which shed 53.28 lakh contracts and 21,000 strike, which shed 16.79 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. United Spirits, Dalmia Bharat, Havells India, PVR INOX and Shriram Finance saw the highest delivery among the F&O stocks.

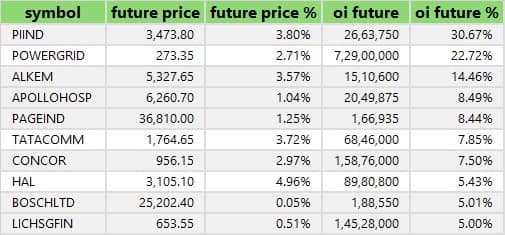

A long build-up was seen in 24 stocks, which included PI Industries, Power Grid Corporation of India, Alkem Laboratories, Apollo Hospitals Enterprise and Page Industries. An increase in open interest (OI) and price indicates a build-up of long positions.

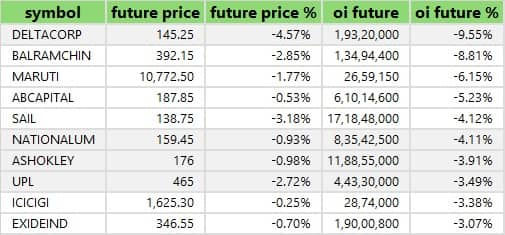

Based on the OI percentage, 48 stocks saw long unwinding including Delta Corp, Balrampur Chini Mills, Maruti Suzuki, Aditya Birla Capital and SAIL. A decline in OI and price indicates long unwinding.

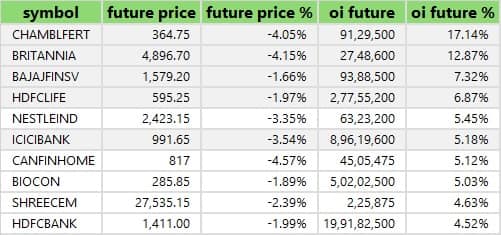

81 stocks see a short build-up

A short build-up was seen in 81 stocks including Chambal Fertilisers, Britannia Industries, Bajaj Finserv, HDFC Life Insurance Company and Nestle India. An increase in OI along with a fall in price points to a build-up of short positions.

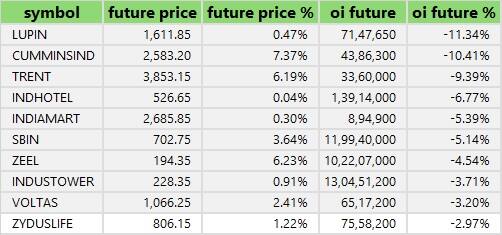

Based on the OI percentage, 34 stocks were on the short-covering list. This included Lupin, Cummins India, Trent, Indian Hotels and IndiaMART InterMESH. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, remained at 1 on February 8, compared to the previous session. The PCR at 1 indicates that the trading volume of Put options is equal to the Call options, which generally indicates a neutral trend ahead.

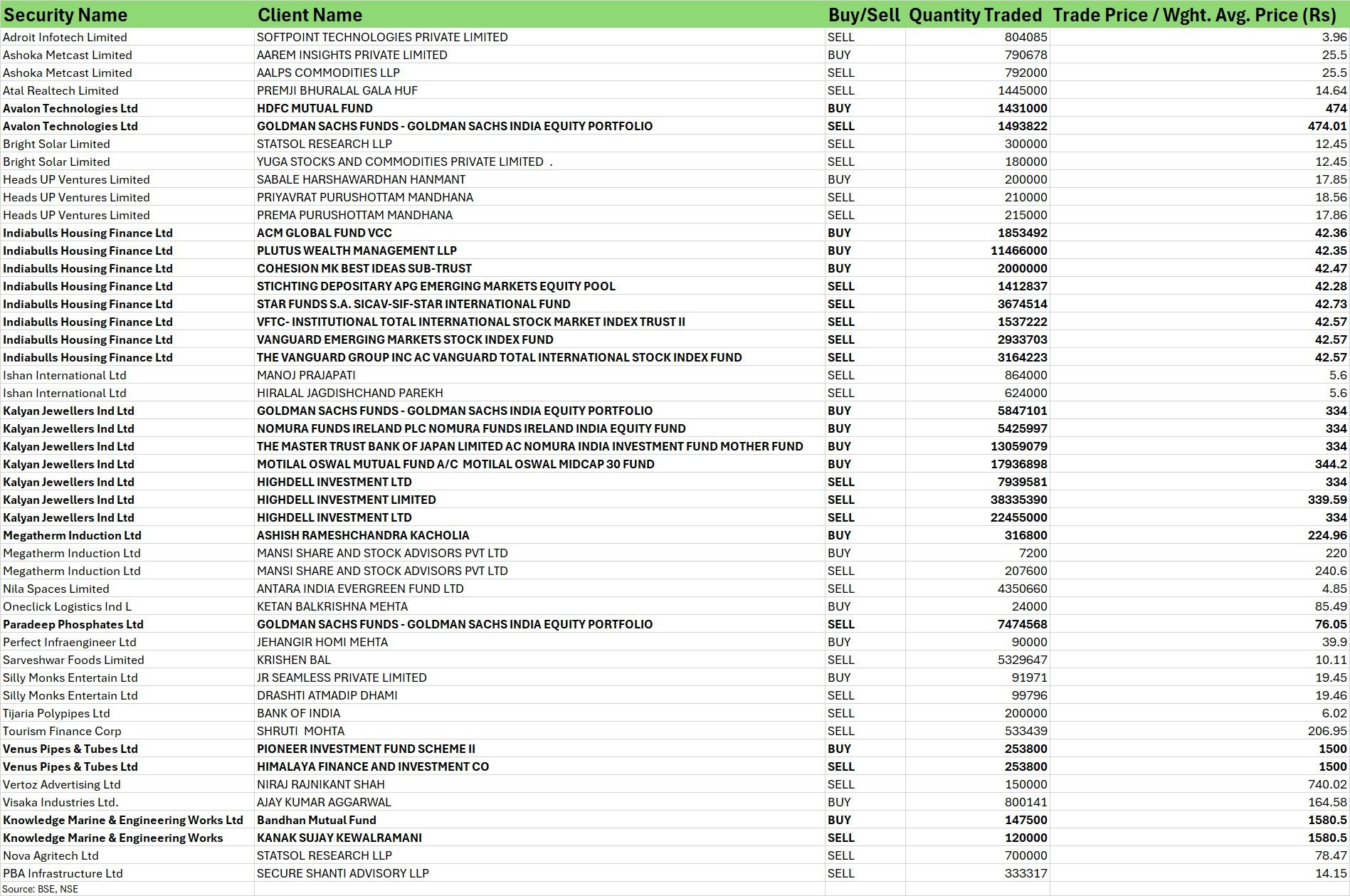

For more bulk deals, click here

Results on February 9 and February 10

Hero MotoCorp, Tata Power Company, Honasa Consumer, Zydus Lifesciences, Alkem Laboratories, Bandhan Bank, Campus Activewear, Cello World, DOMS Industries, Emami, Finolex Cables, Indian Railway Finance Corporation, MRF, The New India Assurance Company, Pfizer, PI Industries, Shree Renuka Sugars and Sundaram-Clayton will release December quarter earnings on February 9.

Oil and Natural Gas Corporation, Aurobindo Pharma, Divis Laboratories, Multi Commodity Exchange of India, Amber Enterprises India, Flair Writing Industries, Jagran Prakashan, TVS Electronics, Updater Services and Uflex will be releasing December quarter earnings on February 10.

Stocks in the news

Life Insurance Corporation of India: The state-owned life insurance company recorded a standalone profit at Rs 9,444.4 crore quarter ended December FY23, growing sharply by 49.1 percent over a year-ago period. Net premium income for the quarter at Rs 1,17,017 crore, increasing 4.7 percent compared to the corresponding period of last fiscal, and net commission grew by 3.2 percent YoY to Rs 6,520 crore for the quarter.

Bharat Heavy Electricals (BHEL): The state-owned power equipment manufacturer has received an order from HPGCL (Haryana Power Generation Corporation) for setting up the 1x800 MW ultra supercritical expansion unit at DCRTPP Yamuna Nagar. The contract value is more than Rs 5,500 crore.

Biocon: The biopharmaceutical firm has recorded a consolidated net profit of Rs 660 crore for the October-December period of FY24, against a loss of Rs 41.8 crore in the corresponding period of the last fiscal. Revenue from operations for the quarter at Rs 3,953.7 crore increased by 34.4 percent over a year-ago period.

United Breweries: The Kingfisher beer maker has reported a standalone net profit of Rs 84.85 crore for the third quarter of FY24, against a loss of Rs 2.14 crore in the corresponding period of last fiscal, backed by healthy operating numbers and higher other income. Revenue from operations for the quarter grew by 13.1 percent YoY to Rs 1,822.66 crore.

Torrent Power: The Gujarat-based power company has recorded a consolidated net profit of Rs 359.8 crore for the quarter ended December FY24, declining sharply by 47.4 percent compared to the year-ago period, impacted by lower topline and dismal operating numbers with higher fuel cost. Revenue from operations fell 1.2 percent year-on-year to Rs 6,366 crore for the quarter.

Suryoday Small Finance Bank: The small finance bank has registered a 217 percent on-year increase in net profit at Rs 57.22 crore for the October-December period of FY24, with other income rising 102.3 percent YoY to Rs 51.9 crore and pre-provision operating profit increasing 80.5 percent to Rs 114.2 crore for the quarter. Net interest income during the quarter jumped 33.9 percent to Rs 245.7 crore compared to the same period last year.

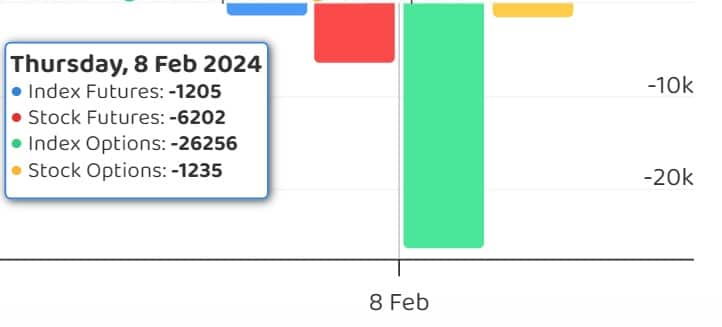

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 4,933.78 crore, while domestic institutional investors (DIIs) purchased Rs 5,512.32 crore worth of stocks on February 8, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Aurobindo Pharma, Biocon, and Punjab National Bank to the F&O ban list for February 9, while retaining Ashok Leyland, Balrampur Chini Mills, Delta Corp, Hindustan Copper, India Cements, Indus Towers, National Aluminium Company, SAIL and UPL to the said list. However, Zee Entertainment Enterprises was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.