Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty likely to surpass 22,000 soon

With the healthy bounceback after a day of correction, the market seems to be on positive footing and negated the formation of Shooting Star kind of bearish reversal pattern last Friday. Hence, if the Nifty 50 manages to fill the big bearish gap created on January 17 by climbing over 21,970, then 22,126, the record high level can't be ruled out in coming sessions, experts said, adding the crucial support remains at 21,600-21,500 area.

On February 6, the BSE Sensex jumped 455 points to 72,186, while the Nifty 50 rose 158 points at 21,929 and formed bullish candlestick pattern on the daily charts, which almost engulfed the bearish candle of Monday.

"This pattern is signalling that the bearish candle pattern formation of last two sessions (Friday and Monday) could be nullified soon. This is positive indication," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

Minor positive pattern like higher tops and bottoms is intact and the market is now on the way up towards the new higher top formation at new all- time highs. The crucial opening downside gap of January 17 is now placed at the verge of decisive upside breakout at 21,970 levels, he feels.

Immediate support is at 21,750 and the next overhead resistance to be watched around 22,125 levels, he said.

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, also feels both price and momentum indicators are suggesting towards continuation of the positive momentum. However, considering the recent sharp reversals from the upper boundary (22,000) one needs to be cautious on the long side, he warned.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,791 followed by 21,741 and 21,659 levels, while on the higher side, it may see immediate resistance at 21,949, followed by 22,005 and 22,087 levels.

Meanwhile, on February 6, the Bank Nifty remained under pressure for yet another session, underperforming benchmark indices. The index was down 135 points at 45,691 and formed bearish candlestick pattern on the daily timeframe, may be looking cautious ahead of RBI policy meet outcome scheduled on February 8 and weekly expiry of F&O contracts tomorrow.

"The lack of a clear trend indicates that a breakout is awaited to determine the market direction. The support is positioned at 45,500, while the immediate hurdle lies at 46,000," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

A successful break above 46,000 is anticipated to propel the index towards 46,500 on the upside, he added.

As per the pivot point calculator, the Bank Nifty is expected to take support at 45,562 followed by 45,466 and 45,312 levels, while on the higher side, the index may see resistance at 45,728 followed by 45,967 and 46,122 levels.

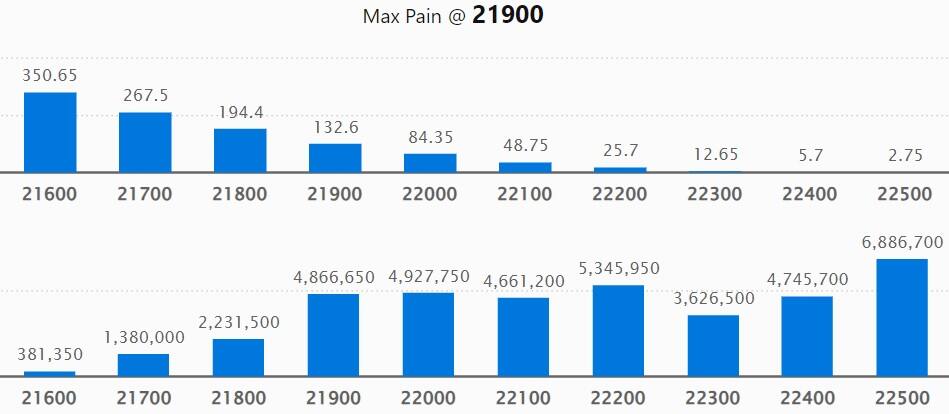

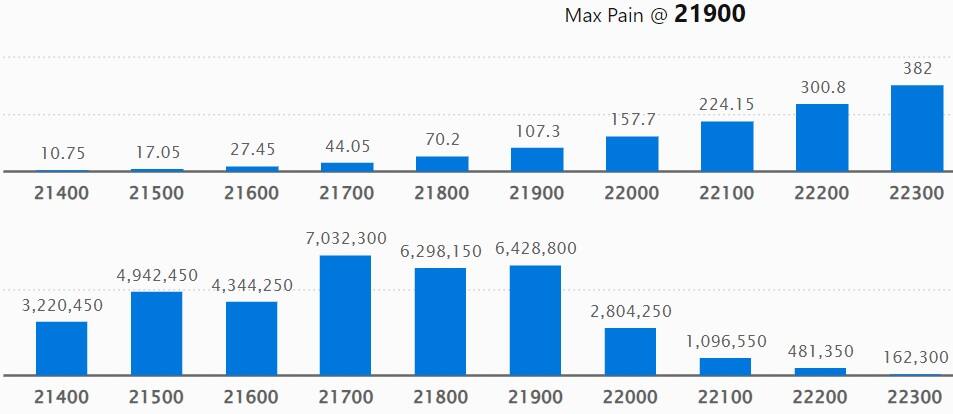

As per the weekly options data, the maximum Call open interest was visible at 22,500 strike with 68.86 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 23,000 strike, which had 67.09 lakh contracts, while the 22,600 strike had 57.43 lakh contracts.

Meaningful Call writing was seen at the 22,600 strike, which added 18.15 lakh contracts followed by 22,500 and 22,200 strikes adding 10.9 lakh and 9.34 lakh contracts, respectively.

The maximum Call unwinding was at the 22,000 strike, which shed 23.67 lakh contracts followed by 21,800 and 22,900 strikes which shed 12.04 lakh and 8.28 lakh contracts.

On the Put front, the 21,000 strike owned the maximum open interest, which can act as a key support level for Nifty, with 76.84 lakh contracts. It was followed by 21,700 strike comprising 70.32 lakh contracts and then 21,900 strike with 64.28 lakh contracts.

Meaningful Put writing was at 21,900 strike, which added 39.45 lakh contracts, followed by 21,800 strike and 21,700 strike, which added 34.65 lakh contracts, and 29.61 lakh contracts.

Put unwinding was seen at 20,500 strike, which shed 7.08 lakh contracts, followed by 20,800 strike, which shed 6.47 lakh contracts, and 20,600 strike, which shed 4.04 lakh contracts.

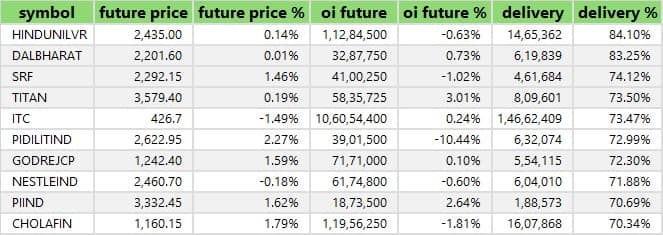

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Hindustan Unilever, Dalmia Bharat, SRF, Titan Company, and ITC saw the highest delivery among the F&O stocks.

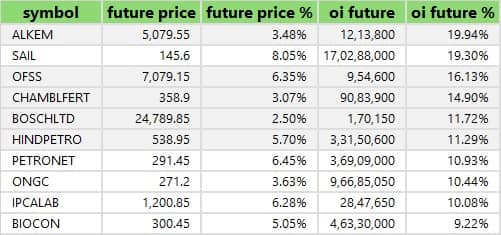

A long build-up was seen in 65 stocks, which included Alkem Laboratories, Steel Authority of India, Oracle Financial Solutions Software, Chambal Fertilisers & Chemicals, and Bosch. An increase in open interest (OI) and price indicates a build-up of long positions.

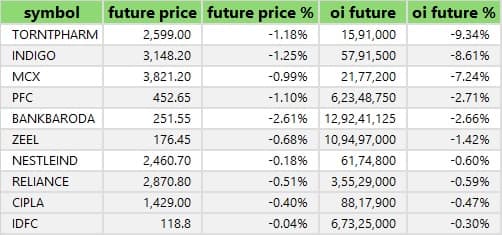

Based on the OI percentage, 11 stocks saw long unwinding including Torrent Pharmaceuticals, InterGlobe Aviation, MCX India, PFC, and Bank of Baroda. A decline in OI and price indicates long unwinding.

30 stocks see a short build-up

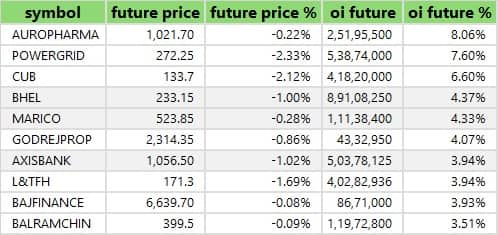

A short build-up was seen in 30 stocks including Aurobindo Pharma, Power Grid Corporation of India, City Union Bank, BHEL, and Marico. An increase in OI along with a fall in price points to a build-up of short positions.

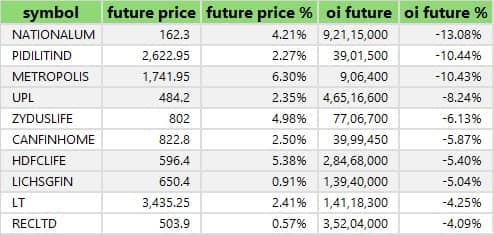

Based on the OI percentage, 79 stocks were on the short-covering list. This included National Aluminium Company, Pidilite Industries, Metropolis Healthcare, UPL, and Zydus Lifesciences. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, jumped to 1.11 on February 6, compared to the 0.89 level in the previous session. The above 1 PCR indicates that the Put volumes are higher than the Call volumes, which generally indicates an increase in bearish sentiment.

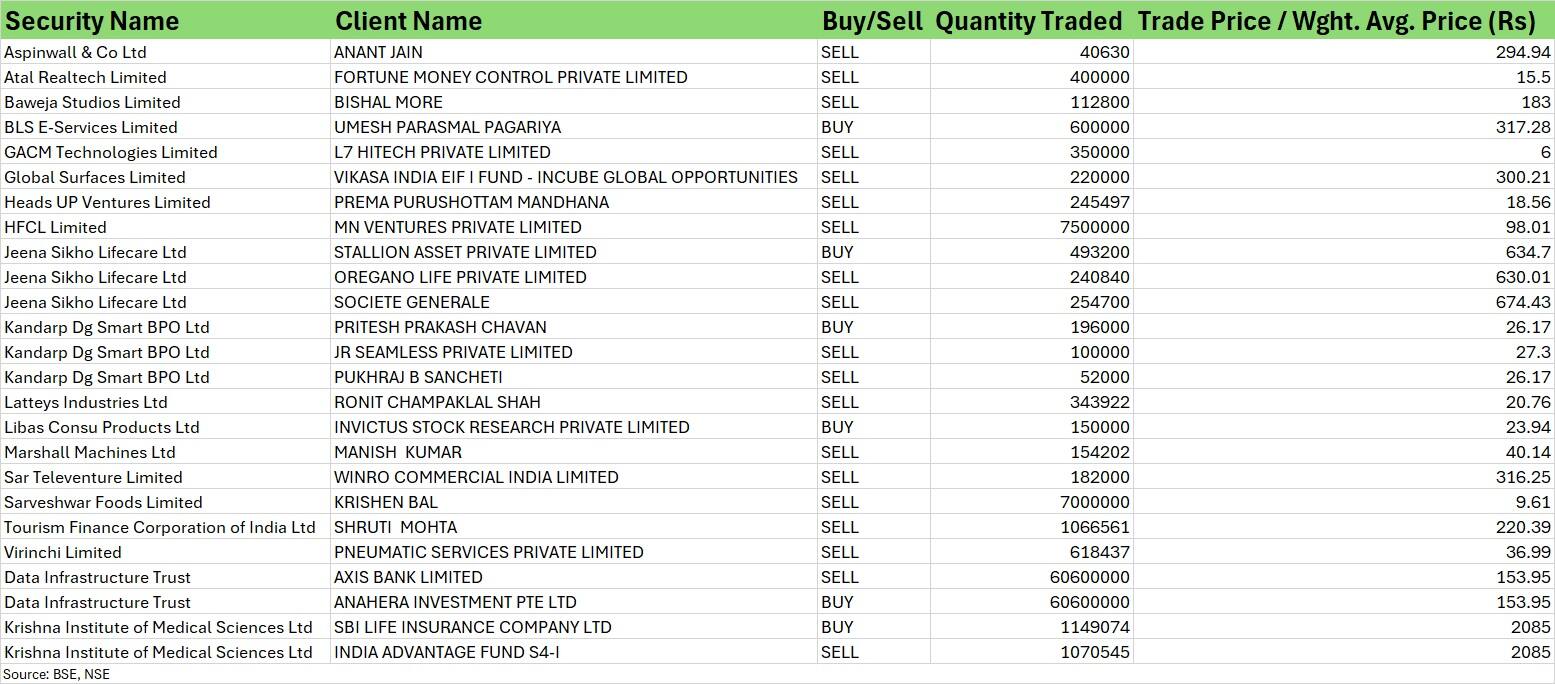

For more bulk deals, click here

Tata Consumer Products, Power Grid Corporation of India, Nestle India, Lupin, Manappuram Finance, Apollo Tyres, Ashoka Buildcon, Borosil Renewables, Cummins India, General Insurance Corporation of India, JK Paper, Parag Milk Foods, Protean eGov Technologies, Sobha, Trent, and Zuari Agro Chemicals will release December quarter earnings scorecard on February 7.

Stocks in the news

Lupin: The pharma company has received approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application for Bromfenac ophthalmic solution, to market a generic equivalent of BromSite ophthalmic solution of Sun Pharmaceutical Industries, in the United States.

Biocon: The biopharmaceutical firm has received tentative approval for its ANDA for Dasatinib tablets from the US FDA. This product is indicated for use in the treatment of Philadelphia chromosome positive chronic myeloid leukemia in adults.

Kotak Mahindra Bank: The Competition Commission of India (CCI) has approved acquisition of 70 percent stake in Kotak Mahindra General Insurance Company by Zurich Insurance Company.

Britannia Industries: The biscuits maker has recorded consolidated profit at Rs 555.66 crore for the quarter ended December FY24, falling sharply by 40.4 percent compared to year-ago period due to high base. In Q3FY23, the net profit included exceptional gains of Rs 375.6 crore. Revenue from operations grew by 1.4 percent YoY to Rs 4,256.3 crore for the quarter.

NLC India: The coal mining company has reported consolidated net profit at Rs 250.4 crore for October-December period of FY24, against loss of Rs 406.7 crore in corresponding period of last fiscal, despite lower topline and operating numbers. Consolidated revenue from operations fell by 14 percent YoY to Rs 3,164.4 crore during the quarter.

FSN E-Commerce Ventures: The Nykaa brand operator has recorded a 106 percent on-year growth in net profit at Rs 17.5 crore for quarter ended December FY24, with revenue increasing 22 percent to Rs 1,788.8 crore and gross merchandise value growing 29 percent over a year-ago period.

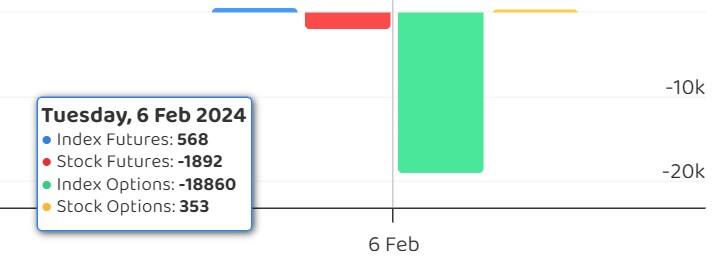

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 92.52 crore, while domestic institutional investors (DIIs) purchased Rs 1,096.26 crore worth of stocks on February 6, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added Ashok Leyland to the F&O ban list for February 7, while retaining Hindustan Copper, India Cements, Indus Towers, National Aluminium Company, UPL and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.