General Electric's Comeback: Up 60% YTD And Room For Double-Digit Annual Returns

Summary

jetcityimage

Introduction

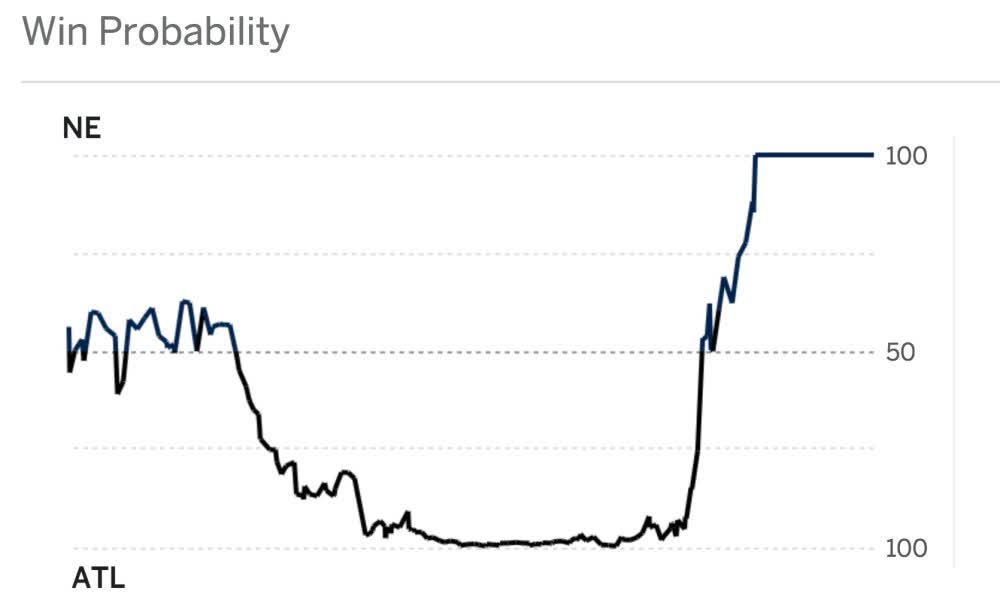

General Electric (NYSE:GE) may be one of the best examples of a successful corporate comeback. I don't know if comparisons to the Patriots vs. Falcons Super Bowl are appropriate, but it sure feels a bit that way.

Throughout almost the entire game, people thought the New England Patriots were done, with an implied win probability below 1%.

ESPN (Via ForTheWin)

Then, they started one of the biggest comebacks in sports history.

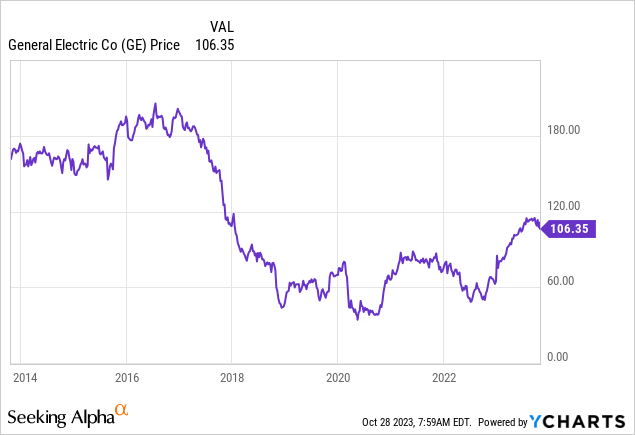

General Electric is different yet similar. What used to be one of the most successful conglomerates in history turned into an efficient way to quickly lose money between 2017 and 2020.

Now, the company is back.

After spinning off its Healthcare segment, the company is now close to becoming a pure-play aerospace company, with full order books, successful programs with a bright future, and a healthy balance sheet with room for aggressive shareholder distributions in the future.

Also, even after rising more than 60% this year, I believe there's more room to run.

So, let's get to it!

When Everything Goes Right

On August 27, I wrote an article titled Why General Electric Is One Of The Best Aerospace Plays On The Market.

In a dynamic aerospace market, my preference leans towards robust suppliers with pricing power, like General Electric, over aircraft manufacturers.

With its strategic focus on advanced engines, GE stands out as a dominant player benefiting from accelerating aviation demand, which is emphasized at events like the Paris Air Show.

The company’s commercial engine and service revenue surged, and its defense sector orders more than doubled.

[...] Backed by impressive guidance, GE has the potential for sustained double-digit EBITDA and free cash flow growth, positioning it as an undervalued contender in the aerospace industry.

The good news is that every bullish thing I've mentioned in the past few quarters is turning into reality - not because I'm so great at predicting but because General Electric keeps performing so well.

For example, in the just-released third quarter, General Electric delivered strong financial results.

Orders increased significantly, with service orders up 15% and equipment orders up 22%.

General Electric

The company saw an 18% increase in revenue, attributed to strong market demand, improved execution, and pricing.

Notably, all segments contributed to a remarkable adjusted margin expansion of 760 basis points. Adjusted earnings per share reached $0.82, a year-over-year increase of almost $1.00.

Excluding last year's wind-related charges, adjusted margin still expanded by 400 basis points, and EPS increased by $0.59, more than tripling the previous year's performance.

Aerospace

GE Aerospace, which will be a standalone company next year, reported robust demand, with GE and CFM departures growing in the mid-teens year-over-year.

Orders were up by 34%, driven by strong growth in equipment and services.

Revenue increased by 25%, led by commercial engines and services. Profit in GE Aerospace grew by over $400 million, with margins expanding to 20.4%.

Commercial services and external spare parts were significant profit drivers.

General Electric

As an investor with more than 25% aerospace exposure, I love to see how well GE is doing. Order growth is almost mind-blowing, as it now fully benefits from both the commercial rebound and defense strength.

To add some color, GE Aerospace is actively expanding its fleet of commercial engines, which currently includes 41,000 commercial engines and 26,000 rotorcraft and combat engines.

This expansion is a response to the growing demand and the company's vision of defining the future of flight. Notably, commercial engine deliveries have seen a substantial 30% year-to-date increase.

General Electric

The benefits of this include significant aftermarket sales growth for decades to come, which is one of the benefits of investing in aerospace.

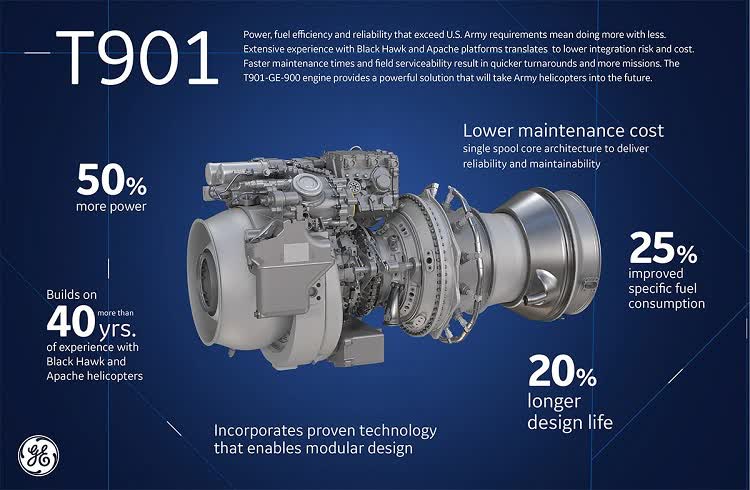

Furthermore, during its earnings call, the company highlighted its contribution to the U.S. Army's future attack reconnaissance aircraft prototypes through the delivery of T901 flight test engines.

This program is expected to enhance military capabilities by providing increased power, lower lifecycle costs, and reduced fuel consumption.

The T901 engine was developed by GE, leveraging its extensive experience in powering the Black Hawk and Apache helicopters with the T700 engine for over four decades, a design that clocked up over 100 million flight hours. The new T901 engine builds on this success, providing a 50% increase in power and a reduction in life cycle costs due to its simplified design and fewer parts. In addition, the engine’s fuel efficiency will improve the enduring fleet’s range, loiter time and fuel consumption, all while reducing maintenance and sustainment costs. - Metal AM

General Electric

On top of that, the company noted defense funding for its XA 100 program, which is an advanced defense engine that is set to compete with the F-135 engine from Pratt & Whitney (owned by RTX (RTX)) for a place in the mighty F-35 fighter.

However, even with these strong results, we're far from satisfied. Through our lean transformation, we're making real progress, improving flow and eliminating waste. For example, our team in Pune, India has increased output of LEAP high pressure turbine manifolds by 3x. But we need to do more, as do our suppliers, given the pace of demand for both aftermarket services and new engine deliveries. - GE 3Q23 Earnings Call

Vernova & A Pending Spin-Off

The renewable energy segment's performance wasn't poor either.

GE Vernova's results improved due to lean practices, better underwriting, selectivity, and productivity, particularly in the grid and onshore segments.

- Orders in renewables grew by 3% in the quarter and over 80% year-to-date, reaching nearly $18 billion.

- Grid orders increased by over 50% in the quarter.

- Revenue in the onshore business grew by 14%, and offshore revenue more than tripled year-over-year.

General Electric

The power segment showed solid year-over-year revenue growth and margin expansion with seasonally lower outages. Equipment orders grew slightly, while services declined slightly.

Revenue in power grew by 9% due to pricing and higher scope on heavy-duty gas turbines and aero-derivative equipment.

Profit increased by roughly 60%, with 200 basis points of margin expansion, driven by higher volume, pricing, and productivity.

The Offshore Wind segment, however, has faced challenges in 2023, reporting losses of approximately $1 billion. GE anticipates similar losses in the following year but expects substantial improvements in cash performance.

General Electric

The power segment continues to expect low single-digit revenue growth for the year, with better year-over-year profit.

Adding to that, as expected, GE has announced more details regarding its plans to spin off GE Vernova and launch GE Aerospace early in the second quarter of 2024.

These new entities will be listed on the New York Stock Exchange. The company has made strategic hires and promotions to ensure strong leadership for these businesses.

General Electric

For example, GE Vernova is on track to file a confidential Form 10, with the initial public filing expected in the first quarter.

Early in March, both GE Vernova and GE Aerospace plan to hold investor days to further communicate their strategies and outlook.

Outlook & Valuation

Based on this context, the company raised its full-year guidance due to the strength of GE Aerospace and the improvement in GE Vernova.

They now expect revenue growth in the low teens, up from low double digits, with adjusted EPS expected to be between $2.55 and $2.65, up $0.40 at the midpoint.

General Electric

This increase is largely due to an improvement in operating profit, which is expected to be in the range of $5.2 to $5.5 billion, and an increase in free cash flow to $4.7 to $5.1 billion, up $550 million at the midpoint.

So far:

- The company is fully benefitting from both defense and commercial demand growth.

- Despite industry-wide pressure on margins (most hike revenue guidance but not profit guidance), the company has raised guidance across the board.

- Even its non-aerospace segments are strong, even though offshore is weak, which I expect to continue.

- The company is gaining momentum in certain defense segments and could take away orders from RTX in certain segments, although I expect the impact on RTX to be limited.

- The valuation is attractive.

Despite a 60% rally year-to-date, the stock is attractive. GE is trading at 41x earnings. While that may sound like a lofty valuation, the company is expected to grow earnings by 70% next year, followed by a 30% surge in 2025.

These numbers are visible in the overview below.

Even if the company returns to its 28.5x 5-year normalized earnings multiple, it could return 21% per year through 2025. That's how powerful this company is - theoretically speaking.

FAST Graphs

The current consensus price target is $131, which is 24% above the current price.

Last month, Deutsche Bank (DB) gave the stock a $141 target, which I believe is fair.

I even think GE can rise as high as $150 without being overvalued.

I have to say that I like GE so much that I'm considering buying it despite having more than 25% aerospace exposure.

So, needless to say, while the market could see short-term pullbacks due to economic headwinds, I expect this company to have a very bright future.

The company is also expected to generate close to $8 billion in 2025E free cash flow, which translates to a 6.6% free cash flow yield.

As the company has a net leverage ratio of roughly 1x EBITDA and a BBB+ credit rating, we're likely looking at a wave of buybacks in the next few years, boosting EPS for many years to come.

Realistic risks are mainly potential cyclical headwinds, ongoing supply chain issues in the industry hurting margins, and elevated rates hurting financing of large projects in the aerospace industry. I believe that all risks are subdued for GE.

Takeaway

General Electric's impressive financial results, soaring order growth, and strategic moves, including the pending spin-off of GE Vernova, prove its resilience and potential.

GE's improved guidance, strong performance across segments, and attractive valuation make it an enticing investment opportunity.

Despite a 60% rally year-to-date, the stock remains appealing, with potential for significant growth in the coming years.

With a net leverage ratio of approximately 1x EBITDA and a solid credit rating, GE's future is promising, marked by buyback potential and sustained EPS growth.

As an investor, I'm strongly considering adding GE to my portfolio, confident in its bright future and robust free cash flow prospects.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

About GE

| Symbol | Last Price | % Chg |

|---|