Pros Vs. Cons - Why I'm Passing On Charter Communications

Summary

Matteo Colombo

Introduction

So far this year, I have discussed two telecom giants. Struggling Verizon Communications (VZ) and T-Mobile U.S. (TMUS), which has done very well over the past few years. You can access these articles here and here.

One company I have never discussed is Charter Communications (NASDAQ:CHTR).

With a market cap of almost $70 billion, it's the fifth-largest player in its sector.

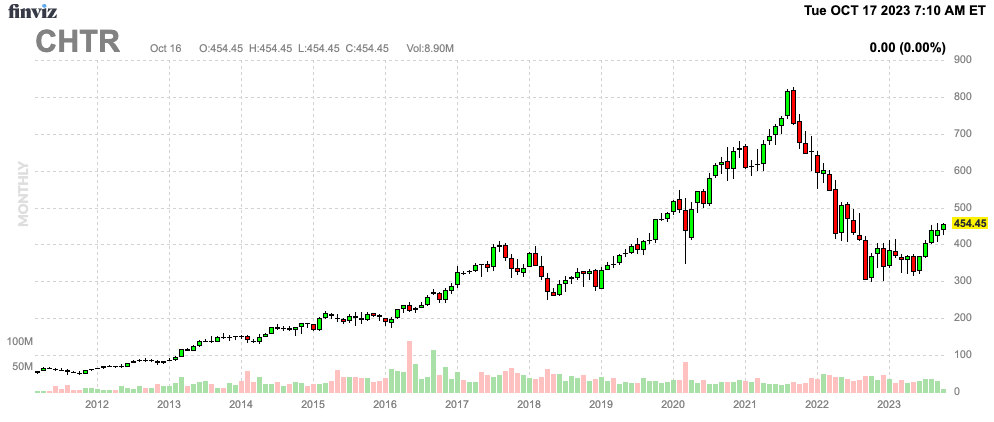

Although the company does not pay a dividend, it has generated more wealth for investors than the two sector peers I just mentioned.

Since its re-emergence from bankruptcy, the stock has returned 20.9% per year, beating the S&P 500 by more than 800 basis points per year.

Portfolio Visualizer

A big part of this performance was based on a few key factors.

- The company has a strong business portfolio capable of generating strong free cash flow.

- Management has been eager to buy back stock.

- So far, its BB+ credit rating (below investment grade) hasn't caused any issues, allowing management to engage in the aforementioned buybacks.

- The company is using new partnerships and products/services to penetrate the market.

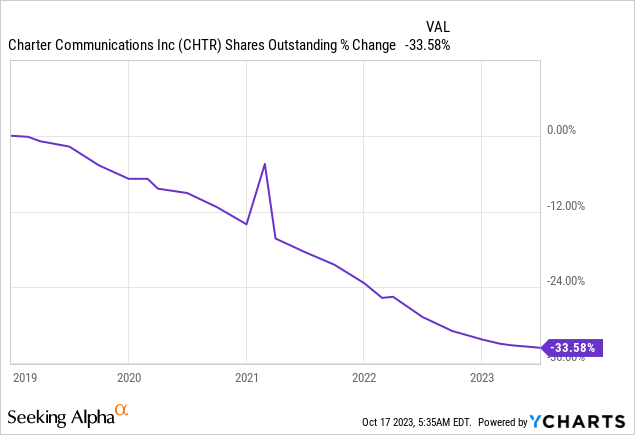

Over the past five years alone, CHTR has bought back 34% of its shares. Normally, I use the past ten years. However, in 2016, the company merged with Time Warner Cable.

In this article, I want to look at recent events, the company's valuation, and the longer-term risk/reward.

Essentially, I want to figure out if the company with a junk balance sheet, but a good track record over the past ten years, is worthy of our money at current levels.

So, let's get to it!

Where's The Growth?

Last month, the Wall Street Journal published a lengthy article on the future of cable TV.

Wall Street Journal

The article started by making the case that the traditional cable TV industry, a foundation of the TV sector valued at around $200 billion, is facing a crucial turning point.

The long-standing alliance between programmers and distributors is beginning to crumble as both sides seek to protect their interests in an evolving media landscape increasingly focused on streaming.

As a result, a highly visible rift has emerged between Disney (DIS) and Charter Communications, the star of this article and the nation's second-largest pay-TV provider.

The dispute (which has now been resolved!) left approximately 15 million Spectrum cable service customers without access to Disney's channels, particularly ESPN. Charter even hinted at the possibility of exiting the pay-TV business altogether.

Essentially, consumers are rapidly abandoning cable TV in favor of more flexible and cost-effective streaming options. Major entertainment companies like Disney, Warner Bros. Discovery (WBD), and Paramount Global (PARA) are enticing viewers to cut the cord by placing high-value cable content, such as news and sports, on their streaming platforms.

I didn't know how bad it was until I read that 42 million households have abandoned traditional pay-TV plans over the past ten years...

Wall Street Journal

Having said that, Charter and Disney fixed their issues.

As reported by Reuters:

The agreement on Monday to settle an epic battle between Walt Disney and Charter Communications over distribution rights is ushering the end of the lucrative, decades-old pay-television bundle and creating a template for future deals that includes streaming services, nine current and former senior media executives who have worked on these agreements told Reuters this week.

As part of the Disney/Charter agreement, the second-largest cable company in the U.S. now has the rights to distribute streaming video services. These services were created to prepare for the decline of traditional cable TV. In exchange, Disney has agreed to eliminate eight of its less popular networks, which marks the end of bundles with too many channels.

This move is expected to save customers money as they no longer need to pay for the same content on both cable and streaming services.

During last month's Bank of America Securities Media, Communications and Entertainment Conference, Charter said that the Disney resolution set a precedent for its company, suggesting potential moderation of content cost growth for consumers in future affiliation agreements with large content providers.

This signals a strategic direction for Charter in managing its content costs and maintaining a balanced approach to value offerings. Especially in the current economic climate, this is a very important step.

Charter also expressed confidence in regaining market share in the broadband domain by focusing on superior speeds, reliability, and network upgrades.

Charter Communications

They anticipate that consumer demands for higher bandwidth and capacity requirements, coupled with their network upgrades, will drive customers back from fixed wireless operators to Charter's offerings.

Their strategic approach positions them well to compete effectively and maintain a significant market presence.

Charter's growth plans include rural customers.

For example, Charter's progress in Rural Digital Opportunity Fund ("RDOF") plans showed positive momentum, exceeding expectations in both building passing and high penetrations across various products.

Charter Communications

Their approach involves efficient penetration and a disciplined bid strategy, ensuring economic viability in their rural expansion efforts.

According to the FCC (emphasis added):

The Rural Digital Opportunity Fund is the Commission’s next step in bridging the digital divide. On August 1, 2019, the Commission adopted a Notice of Proposed Rulemaking (NPRM) proposing to establish the $20.4 billion Rural Digital Opportunity Fund to bring high speed fixed broadband service to rural homes and small businesses that lack it. On January 30, 2020, the Commission adopted the Rural Digital Opportunity Fund Report and Order, which establishes the framework for the Rural Digital Opportunity Fund, building on the success of the CAF Phase II auction by using reverse auctions in two phases. The Phase I auction, which began on October 29, 2020, and ended on November 25, 2020, awarded support to bring broadband to over five million homes and businesses in census blocks that were entirely unserved by voice and broadband with download speeds of at least 25 Mbps.

Charter Communications

With that said, in its second quarter, the company added 77,000 new Internet customers and a substantial 648,000 Spectrum mobile lines, underscoring the success of its Spectrum One offering and ongoing network expansion efforts.

Charter Communications

During the earnings call, the convergence of mobile and WiFi services was a central theme, with a notable 11% of Internet customers now utilizing mobile services.

This integrated approach is projected to be a key driver of future Internet growth for the company.

Furthermore, Charter emphasized the success of Spectrum One, their advanced WiFi product, which has gained traction with over 45% of Internet customers adopting it.

The impending launch of Xumo, a groundbreaking platform granting access to linear and DTC video content, was also highlighted as a significant upcoming milestone.

And the concept around Xumo was to, through a joint venture with Comcast, have an ownership in an independent entity, which is Xumo that provides better functionality and exist for customers today where they can integrate all of their DTC SVOD and linear services in a single place with unified search and discovery with a voice remote. And so that will be our platform of choice to deliver to our video subscriptions going forward. And ultimately, I expect us to provide that to some broadband customers over time as well. - CHTR 2Q23 Earnings Call

Charter Communications

Unfortunately, higher interest expenses have turned a $13 million EBITDA gain into a pre-tax income decline of $340 million.

Charter Communications

Charter reported an increase in annualized cash interest to $5.1 billion, reflecting the impact of higher interest rates. The rise in interest expense played a role in the net income decline.

Despite this, the company highlighted that it remained operationally efficient, improving EBITDA by 1.3% year-over-year in the quarter, indicating cost management effectiveness.

The debt principal stood at $97.8 billion, and the net debt to the last 12-month adjusted EBITDA ratio was 4.47x, slightly above the company's target leverage range.

Despite this, Charter remains committed to maintaining a prudent balance between growth and financial stability. The company's goal is to hover just below the high end of its targeted leverage range of 4x to 4.5x.

Charter Communications

Looking at the overview below, we see that the company has no major maturities in 2023.

However, after 2023, a wall of maturities is waiting. In 2025, the company will have to service more than $7 billion in debt.

The current weighted average cost of debt is 5.2%. The weighted average life of its debt is 13.1 years. 84% of it has a fixed rate.

Charter Communications

It has a BB+ credit rating, which is a junk rating. That's a less fancy word for a non-investment grade rating.

Valuation

Analysts agree with the company's comments on stronger growth in the future. While CHTR won't turn into a fast-growing company, it is expected to maintain positive annual EBITDA growth in the low-to-mid-single digit range.

Leo Nelissen (Based on analyst estimates)

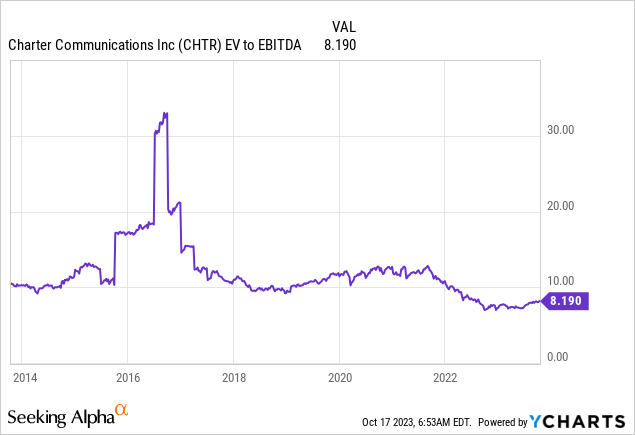

With that said, CHTR has traded close to 11-12x EBITDA prior to 2022. Now, the stock is trading at 8.2x EBITDA.

I believe that a lower multiple is warranted due to the risks of prolonged elevated interest rates. For now, that isn't a huge issue, but if we see elevated rates on a prolonged basis, the company's average cost of debt could soar significantly, hurting its bottom line over the next few years.

When applying an 8.0x EBITDA multiple, we get roughly 9% upside to a fair value of $496.

Leo Nelissen (Based on analyst estimates)

The current consensus price target is $485.

The good news is that free cash flow is strong. The company's implied 2025E free cash flow yield exceeds 7%, which means if it refrains from boosting buybacks, it has plenty of cash to repay debt.

FINVIZ

Having said that, as much as I like CHTR's business, I do not believe that it will return to its former glory of outperforming capital gains as long as interest rates are elevated.

The impact on its balance sheet is simply too big, and if I wanted to bet on growth in the communications sector, I would likely opt for a faster-growing stock.

That's just my two cents. While I'm not making the case that CHTR will go bankrupt or that anyone who's happy with its performance should start selling immediately, I want to mention that I do not like the risk/reward for my personal strategy.

Takeaway

Charter Communications has been a solid wealth generator, boasting a strong business portfolio and strategic management.

Recent negotiations with Disney mark a crucial turning point in the cable TV industry, signaling CHTR's adaptability to the evolving media landscape.

With a focus on broadband expansion, rural initiatives, and innovative products like Spectrum One and Xumo, the company is positioning itself for future growth.

However, challenges lie in the face of higher interest expenses and debt maturities post-2023, affecting its valuation and risk profile.

While analysts foresee modest growth, the risk of prolonged elevated interest rates warrants caution.

Pros Vs. Cons

Pros:

- Strong business portfolio and cash flow

- Effective stock buybacks for investor benefit

- Strategic partnerships and product expansion

- Focus on broadband growth and rural expansion

- Positive customer growth in Internet and mobile lines

- Healthy free cash flow for potential investments

Cons:

- High debt levels and associated interest expenses

- Future debt maturities and interest rate risks

- BB+ credit rating (non-investment grade)

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.