4 Bond Market Trends Impacting BND

Summary

Viktor Aheiev

The Vanguard Total Bond Market Index Fund ETF (NASDAQ:BND) is one of the largest, most well-known bond index ETF in the market. As the Federal Reserve nears the end of the current hiking cycle, thought to have a look at several important bond market developments.

Federal Reserve rates are at their highest levels in decades, as are bond yields.

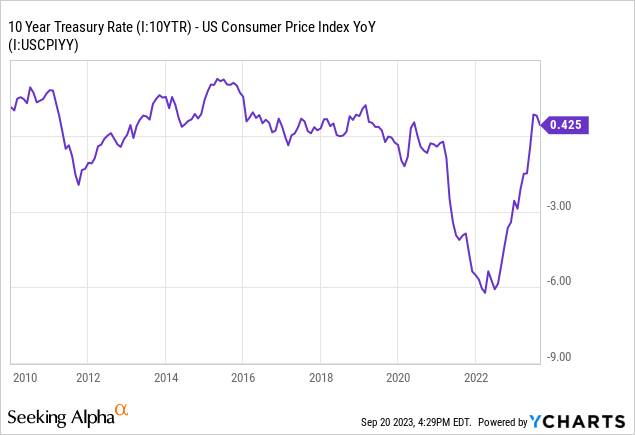

Real interest rates are slightly positive, due to rate hikes, but slightly below their historical averages, as inflation remains elevated. Under these conditions, rates are likely to remain higher for longer.

Longer-term bonds yield less than shorter-term securities, as investors expect significant rate cuts in the coming months.

Credit spreads are slightly narrower than their long-term historical averages, less so compared to more recent years.

In my opinion, as inflation remains slightly elevated, rates are likely to remain higher for longer. Due to this, and considering prevailing interest rates, short-term bonds and variable rate securities are likely to outperform bonds moving forward. As such, I would not be investing in BND at the present time.

BND - Quick Overview

A quick overview on BND before looking at recent bond market developments.

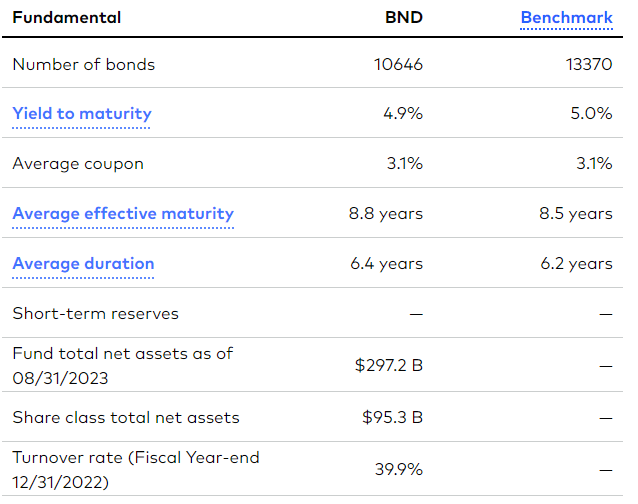

BND is a diversified bond index ETF, tracking the Bloomberg U.S. Aggregate Bond Index. It is a relatively simple, broad-based index, tracking the overall U.S. bond market, including treasuries, investment-grade bonds, mortgage-backed securities (MBS), and other government-related securities. It does exclude high-yield corporate bonds, although these only account for around 8% of the U.S. bond market.

BND itself is an incredibly diversified fund, with investments in over 10,000 securities from most relevant bond sub-asset classes.

BND BND BND

BND provides investors with broad-based exposure to U.S. bonds. These securities have been impacted by several recent developments. Let's have a look at these.

Bond Market Developments

Highest Federal Reserve Rates in Decades

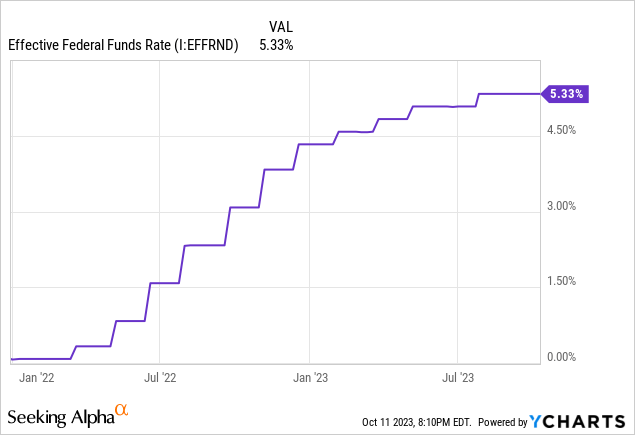

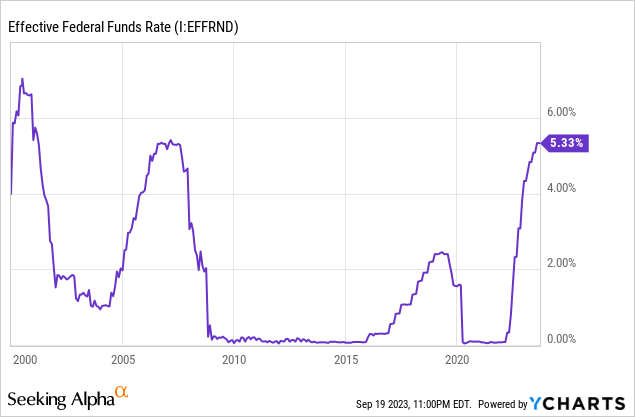

Inflation skyrocketed from early 2021 to mid-2022, leading to an aggressive set of rate hikes from the Federal Reserve. Rates are up around 5.25% since early 2022, and further hikes are possible, if perhaps not certain.

The recent rate hikes have been very aggressive, both in their magnitude and speed. These have caused rates to spike to their highest levels in decades. Rates were last higher in early 2000, and for a very brief period of time. Rates were consistently higher prior to the 90s, but economic conditions were much different back then.

Data by YCharts

Higher Fed rates have led to higher rates on most bonds and bond sub-asset classes, with effectively all of these yielding more than their 10Y historical averages. Senior loan / leveraged loan yields look particularly attractive at 11.2%.

JPMorgan Guide to the Markets

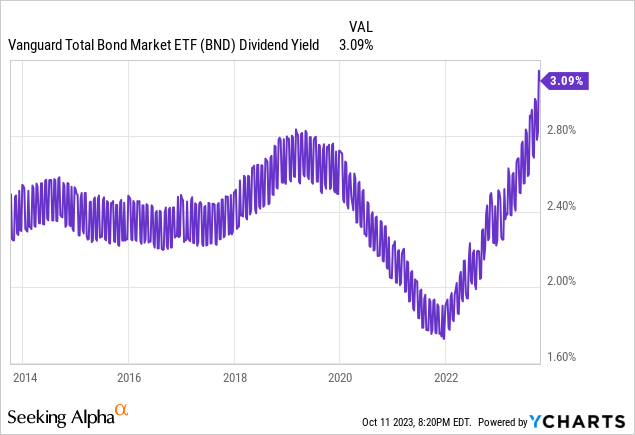

BND itself has also seen its dividends and yield rise. Growth has been slower than above / when compared to Fed hikes, as it takes a few years for a bond fund to fully replace its bond portfolio. BND's dividends should continue to grow in the coming years, contingent on the Fed not drastically cutting rates.

Real Interest Rates

Although nominal interest rates have increased a lot since early 2022, real interest rates are only very slightly positive, as inflation remains elevated. In other words, higher inflation and higher rates have mostly cancelled each other out, with little real impact to investors. Rates do seem very slightly below post-2010 averages, but the difference is very small.

Data by YCharts

Real rates are lower than their long-term historical averages, although economic conditions were very different in prior decades. Data as per JPMorgan, disregard the negative real yields for 2Q2023, that data point is outdated.

JPMorgan Guide to the Markets

In my opinion, under current conditions, the Fed is very unlikely to cut rates: inflation remains above target, and real interest rates do not seem excessive. I analyzed these issues in more depth here.

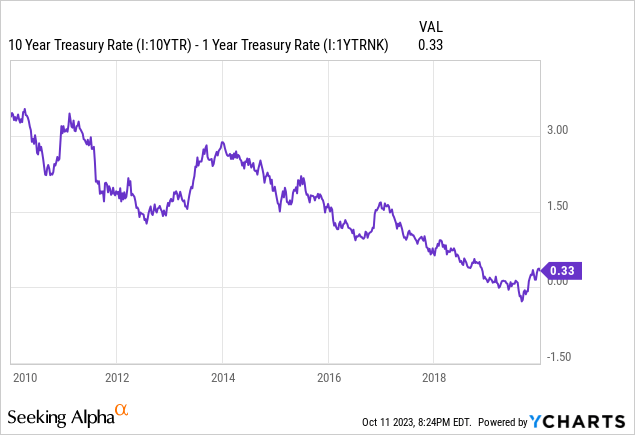

Inverted Yield Curve and Term Premia

In most cases, long-term bonds yield more than comparable short-term securities, to compensate investors for the added interest rate risk, and for tying up investor capital for longer. As an example, 10Y treasuries yielded more than 1Y treasuries for most of the 2010s, with the exception of a couple months in late 2019.

Right now, the opposite is true, with most shorter-term bonds yielding more than comparable long-term securities. As an example, a quick look at the U.S. treasury yield curve.

U.S. Treasury Yield Curve

As can be seen above, longer-term treasuries yield less than shorter-term treasuries, with the exception of the 20Y, which yields a bit more than the 5Y and 10Y. The yield curve is inverted as investors expect significant rate cuts in the coming years, and are pricing bonds accordingly.

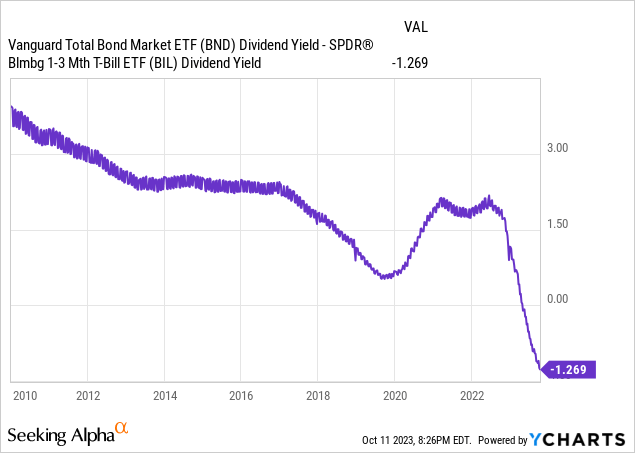

BND itself currently yields less than t-bill ETFs, first time in the fund's history.

In my opinion, longer-term bonds are very poor investment opportunities right now, due to their comparatively low yields, high interest rate risk, and as I believe the Fed will keep rates higher for longer. Looking at BND itself, I see very few reasons to invest in the fund when t-bills yield +1.0% more, and have much more stable prices / shareholder capital.

Credit Spreads

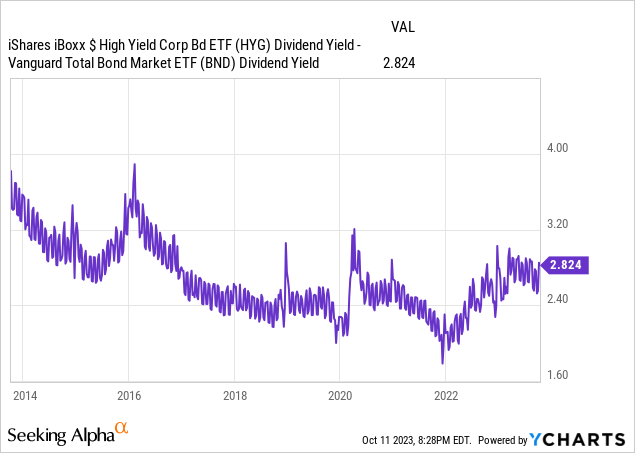

Higher inflation and interest rates have caused economic and financial conditions to somewhat deteriorate. As the economy worsens, some of the riskier, less resilient companies have difficulties paying back their debt. For some, higher rates makes it prohibitively expensive to roll-over their debt as well. Investors are generally loathe to loan money to risky enterprises when the economy is weak or, at least, are not willing to do so cheaply. The result is rapidly increasing high-yield bond interest rates and spreads.

As per JPMorgan, high-yield bonds currently yield around 4.3% more than comparable investment-grade bonds, up from around 1.0% in late 2021. Spreads remain somewhat below their long-term historical averages.

JPMorgan Guide to the Markets

As for BND itself, spreads between the fund and high-yield corporate bond ETFs have widened since late 2021 as well, in-line with the above.

In my opinion, credit spreads seem reasonable enough, with both high-yield bonds and investment-grade bonds offering decent yields, in-line with their risk and broader market conditions. I would focus on high-yield bonds, due to their good dividends, and as analysts seem to discount the possibility of a sizable recession or significant increase in default rates moving forward. BND focuses on investment-grade bonds, so I would not be investing in the fund. Other more risk-averse investors might disagree.

Conclusion

Federal Reserve hikes have led to the highest interest rates in decades, although inflation remains stubbornly high. Under these conditions, focusing on short-term and variable rate bonds and funds seems best. BND is neither, so I would not be investing in the fund at the present time.

Profitable CEF and ETF income and arbitrage ideas

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan de la Hoz has worked as a fixed income trader, financial analyst, operations analyst, and as an economics professor. He has experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs.

Juan is a contributor to the investing group CEF/ETF Income Laboratory holdings are also monthly-payers, for faster compounding and steady income streams. Other features include 24/7 chat, and trade alerts.Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.