Enbridge Preferred Stocks: Far Better Than Any U.S. Preferred Stocks

Summary

- Enbridge preferred stocks are investment grade BBB- rated preferred stocks with yields that crush U.S. preferred stocks of similar quality.

- Additionally, they are tax-benefitted with high yields that are “qualified” for extremely large after tax yields.

- In this article, I look at Enbridge and a couple of these Enbridge preferred stocks and document how undervalued they are.

- I believe their reset rates are a strong catalyst for sizeable price gains over the coming months.

OGphoto

At our Conservative Income Portfolio service we take pride in the fact that we cover all preferred stocks, all baby bonds, and all traditional bonds, not just in 1 or 2 sectors but in all sectors. Additionally, we cover Canadian preferred stocks. In order to know which fixed-income securities are the most undervalued, you really need to do the work of covering all of them. And I can tell you that currently Canadian preferred stocks provide the best values in the investment-grade preferred stock space and we are currently recommending some of these great values to our subscribers.

Enbridge

Enbridge (NYSE:ENB) is a large Canadian energy company that has investments in energy infrastructure. It is one of the blue chips in this space with a BBB+ credit rating. ENB has investments in pipelines, utilities, renewable energy, energy services and storage facilities. Its investments are not just in Canada but also the USA. It is a "dividend aristocrat" with dividend increases every year for more than 25 years. That's why it is surprising that they offer such attractive high yielding preferred stocks.

While ENB is one of the most written about companies on Seeking Alpha, with most writers taking a bullish stance on the company, it seems that there is almost no coverage of the ENB preferred stocks which are clearly great values. You get yields on the preferred stock that are greater than the common stock but with more safety.

Enbridge Preferred Stocks

Not only do ENB preferred stocks provide more safety and higher yields than the common stock but they also provide interest rate protection as they have many preferred stocks that have their interest rates reset every 5 years based on either the U.S. 5 year treasury note or the government of Canada's (GOC) 5 year note depending on which preferred stock we are talking about. That doesn't mean that the common stock can't outperform the preferred stocks on a total return basis, but for fixed-income investors these are must own preferred stocks in my opinion.

Enbridge Preferred Stocks Are Very Undervalued

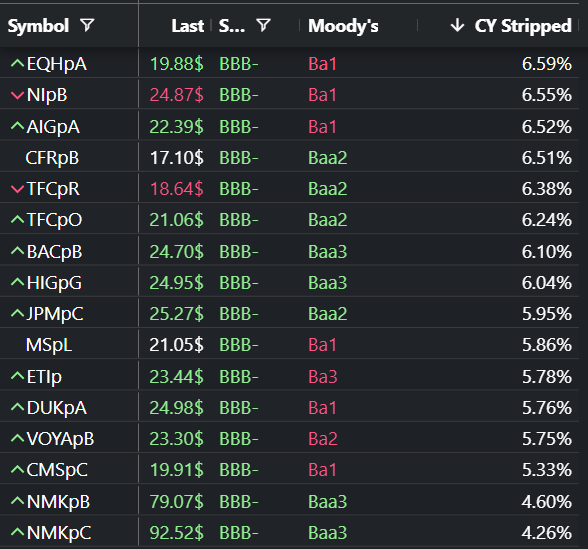

In order to document the undervaluation of ENB preferred stocks I have screened all preferred stocks that have the same BBB- rating of ENB and that also pay a "qualified" dividend. I have also eliminated those preferred stocks that have a Moody's rating below Ba1 and those trading over par. And for companies with multiple preferred stocks, I have shown only 1 representative preferred stock so as to be able to fit the following chart on 1 screen that I could copy.

Author

As you can see, the average yield for BBB- preferred stocks tends to be around 6% with the maximum being 6.59%. Now let's looks at 2 ENB preferred stocks to see how they compare to these U.S. BBB- preferreds in the above chart.

Enbridge Series 5 Reset Rate Preferred Stock (OTCPK:EBGEF) (ENB.PF.V)

While ENB has many preferred stocks, the majority are denominated in Canadian dollars (CAD) and generally must be traded on the Toronto Stock Exchange (TXS). This preferred stock is denominated in U.S. dollars (USD) so currency fluctuations are not an issue and they can be purchased by most of the brokers that don't support trading on the TSX.

The U.S. symbol for this U.S. denominated preferred stock is EBGEF (OTCPK:EBGEF). It can also be purchase on the TSX using the symbol ENB.PF.V. Here is the relevant information.

Last Trade $19.75.

Current Yield 6.9%.

Resets 3/1/2024 at the U.S. 5 Year Note plus 2.82%.

At the current 5 year note rate of 4.62%, EBGEF would reset at a yield of 9.53%.

Qualified Dividend.

Rating BBB-

While the current stripped yield of 6.9% is better than other U.S. BBB- preferred stocks, already making it undervalued. But what really makes this an outstanding preferred stock is that the dividend is going to reset much higher with an announcement sometime in February barring a total crash in the U.S. 5 year treasury note yield. With the U.S. 5 year note currently at 4.62%, that would jump the yield to 9.53% at its current price. That is obviously an enormous yield relative to other BBB- preferred stocks which max out at 6.5%. And it is an enormous "qualified" yield in general providing a very large after tax yield.

What this means to me is that we are likely to see the price of EBGEF rise significantly as we move closer to the reset announcement in less than 5 months. The fact is that EBGEF is currently set to reset at 4.9% higher than the U.S. 5 year note. That is an enormous spread over treasuries for an investment-grade security. So regardless where the 5 year note trades between now and when the dividend resets, this is going to be a great preferred stock and will very likely rise in price over the coming months.

Enbridge Series 3 Reset Rate Preferred Stock (ENB.PR.P)

This preferred stock is denominated in Canadian dollars (CAD) and ENB Canadian denominated preferred stocks tend to provide even higher yields than those denominated in U.S. dollars. I am not sure why this is so, but I assume that investors trust the U.S. dollar to hold up better than the CAD. So if you are not a Canadian, changes in the exchange rate between the CAD and USD will affect the value of your dividend, possibly in a good way and possibly in a not so good way. Here are the relevant details on ENB.PR.P.

Last Trade $16.54 CAD.

Current Yield 6.71%.

Resets on 3/1/2024.

At the current Canadian 5 year note rate of 4.26%, EBGEF would reset at a yield of 10.35%

Qualified Dividend.

Rating BBB-

So ENB.PR.P resets on the same day as EBGEF (ENB.PF.V) but at the current yield on the Canadian government's 5 year note it will reset at 10.35%, .82% higher than EBGEF and a yield that is 6.09% higher than the Canadian 5 year note. Again, that is a huge spread over treasuries for an investment-grade security which provides a lot of safety against downside price moves. And given the tax break that this preferred gets, being that the dividend is qualified, the after-tax yield is equivalent to a bond with an 11.3% to 12.3% yield depending on your tax rate.

So this is an excellent buy for Canadian investors and also for Americans with brokers who allow trading on the TSX. Interactive Brokers is one broker where Americans can buy ENB.PR.P but I believe most other U.S. brokers will not support trading CAD denominated preferred stocks. That is unfortunate but EBGEF offers a great alternative and without any exchange rate concerns.

Why I Believe We Will See A Sizeable Price Rise In These Preferreds Over The Coming Months

Honestly, I am surprised that these preferred stocks sell at prices offering such a large potential yield that is so oversized versus other preferred stocks with the same credit rating, but uncertainty over where the 5 year note yield will be as March approaches seems to be the culprit. It seems that probabilities don't matter to investors and probabilities should be everything in investing. Heck, the 5 year note could be even higher than now and the reset rates could be even higher than the numbers I am providing. Who knows!

So when the reset rate starts to become more certain as time goes by, I expect the prices of these preferred stocks to rise. Even if the 5 year note yields drops over the coming months, I would expect these preferred stocks to still move higher despite the reset yield moving lower because the interest rate environment will also be lower. What matters in pricing is not the absolute yield but the spread over treasuries given the credit rating.

So if the Canadian 5 year note drops rather sharply from 4.26% to 3.5% before we lock in a new dividend on ENB.PR.P, the reset yield will drop to 9.45%. But a 9.45% yield will still have almost a 6% higher yield than the hypothetical future 3.5% yielding Canadian 5 year note. That is still a huge and juicy spread. Thus, I would expect ENB.PR.P to move higher even if the reset yield drops from where it would currently reset. And note that both EBGEF and ENB.PR.P sell way below par so there is also quite a bit of long-term upside capital gains potential.

And one should understand that once the yield resets, the new dividend is locked in for 5 years until the next reset. While we saw big moves in NLY-F and AGNCN from their lows to much higher prices now that they are floating, they do carry the risk of a financial problem causing the Fed to slash short-term rates and seeing their yields suddenly plunge. That is not the case with a dividend that will be locked in for 5 years. So I expect higher prices when they reset but without the risk that you have with LIBOR/SOFR fixed-to-floaters.

Enbridge Bonds

Interactive Brokers

The ENB 2033 bond currently has a YTM of around 5.9% showing the confidence investors have in this company. But it also shows that their preferred stocks are bargains in comparison to the bond. The spread between the likely preferred stock yields and the bond yields is very large, abnormally large I would say, making the preferred stocks a much better value. And that doesn't even include the tax benefit that the preferreds get for paying "qualified" dividends.

Note

For U.S. residents with taxable accounts, there will be withholding of 15% of your dividends on ENB preferred stocks but you can recover all of that by filing a Foreign Tax Credit form at tax time.

Summary/Conclusion

- At our Conservative Income Portfolio service, we cover all of the Canadian reset-rate preferred stocks and there are many to like. Currently, Canadian preferred stocks are very undervalued and look to be much better investments than U.S. preferred stocks.

- In this article I highlighted 2 preferred stocks from investment-grade Enbridge (ENB) with potential reset yields that are enormous relative to U.S. preferred stocks with the same credit rating. Both will have their dividends reset on March 1st, 2024 and both pay qualified dividends.

- The first is an investment-grade (BBB- from S&P) U.S. dollar denominated preferred stock with the symbol EBGEF or ENB.PF.V. The dividend on this preferred stock is set to reset based on the U.S. 5 year treasury note. At the current treasury note yield and at the current price of EBGEF, the yield will reset to 9.53%. Compare this to U.S. BBB- preferred stocks whose yields tend to be closer to 6% and you can see why I really like this preferred stock. I believe the price of EBGEF will see a nice rise as we move toward its reset-rate date. And the spread over treasuries is so high that EBGEF should be a great value regardless of where the U.S. 5 year note trades in February when the dividend is reset.

- The second recommendation trades on the Toronto Exchange (TSX) only and is denominated in Canadian dollars. Thus, it may be difficult for many U.S. residents to buy as few brokers support trading on the TSX. Interactive brokers supports TSX trading and the symbol there is ENB.PR.P. At the current Canadian 5 year note yield, ENB.PR.P would reset at a whopping 10.35%, unheard of for an investment-grade qualified dividend paying preferred stock. Trading at $16.54 Canadian leaves a lot of upside to the $25 par and I expect it to make a nice move higher as we approach the March 1st reset date. The current reset rate provides a yield that is more than 6% better than the Canadian 5 year note which is an enormous spread over treasuries for an investment-grade security. Thus, like EBGEF, this preferred stock should be a great value regardless of where the Canadian 5 year trades in February when the dividend reset is decided.

- Given that the ENB 10 year bond yields only 5.9%, these preferreds look grossly undervalued and I expect the total return on these preferred stocks to be excellent over the coming months and year. Between the expected capital gains and the high yield, I expect it will be a race to see whether dividends or capital gains provide the most income from these preferred stocks over the coming year.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking to start building a Fixed Income Portfolio?

Conservative Income Portfolio targets the best Preferred Stocks and bonds with the highest margins of safety. We strongly believe that the next decade will belong to fixed income irrespective of whether you are conservative or aggressive in your approach! Get in on the ground floor of our recently started Bond and Preferred Stock Portfolios.

If undervalued fixed income securities, bond ladder, “pinned to par” investments and high yielding cash parking opportunities sound like music to your ears, check us out!

This article was written by

Preferred Stock Trader has 30 years experience investing in preferred stocks and bonds. He utilizes a proprietary screening software researching high yield preferred stocks and bonds that are undervalued relative to securities with similar profiles for high total returns.

Preferred Stock Trader contributes to the investing group Conservative Income Portfolio include: covered call opportunity portfolio, long term portfolio of stocks and bonds, exclusive articles for members, previews of public articles in advance, macro analysis, and community chat.Analyst’s Disclosure: I/we have a beneficial long position in the shares of EBGEF AND ENB.PR.P either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (42)

Of my most favourite trips.

By my math, 4.62 plus 2.82 equals 7.44%. How do you get 9.53%?