Freeport-McMoRan Stock: Buckle Up For The Copper Surge

Summary

erlucho

Introduction

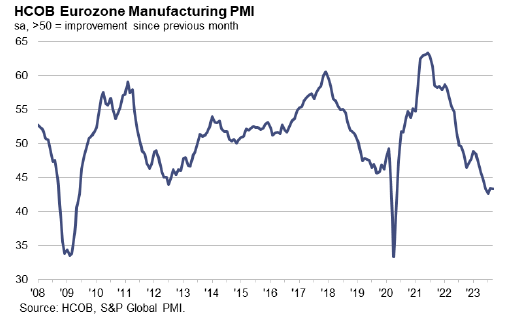

The global economy isn't in a great spot. For example, in the Eurozone, manufacturing sentiment remains at its lowest levels since the Great Financial Crisis (excluding the brief pandemic implosion). Even worse, S&P Global (SPGI) reported that new orders are falling at a pace not seen since the survey began in 1997.

S&P Global

In the U.S., we're seeing similar developments, albeit at less severe levels.

The Philadelphia Fed manufacturing index is contracting again at a pace similar to the 2015 manufacturing recession.

Federal Reserve Bank of Philadelphia

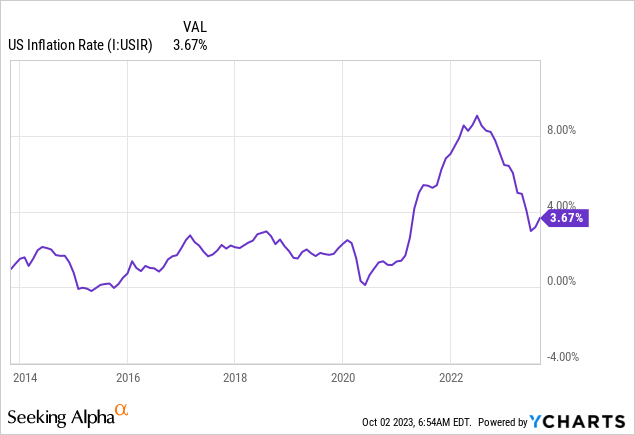

To make things worse, inflation has turned out to be very sticky, rising for two consecutive months instead of continuing its decline to the Fed's 2% target.

The market is now afraid (and rightfully so) that we're about to enter a situation of potential stagflation, which will cause the Fed to choose between fighting inflation and protecting economic stability.

That's not a great situation to be in, to put it mildly.

This is hurting copper, which brings me to the star of this article: Freeport-McMoRan (NYSE:FCX).

Roughly two months ago, I wrote an article titled Freeport-McMoRan: Riding The Copper Boom, A Top Pick.

Below is a part of my takeaway. Emphasis has been added:

My bullish stance on Freeport-McMoRan is rooted in the robust demand for copper driven by the energy transition and strong growth in emerging markets.

While the global economy faces challenges, commodities like copper and oil remain resilient, indicating the potential for further price increases if economic growth indicators bottom.

FCX is well-positioned to capitalize on these tailwinds with its solid production capabilities and expansion plans.

[...] To capitalize on cyclical exposure, starting with small investments and adding to positions during corrections may be a prudent strategy.

Overall, I expect commodities to heat up as economic growth bottoms and supply constraints persist, potentially driving further gains for FCX shareholders.

One of the things I emphasized back then is the tricky mix of long-term secular tailwinds and shorter-term cyclical headwinds. This is very hard to navigate and makes finding an entry a challenge.

In this article, I'll elaborate on all of this, using new developments on macro and company levels, as cyclical demand is further weakening. Meanwhile, Freeport remains in a terrific spot to expand operations and capitalize on long-term secular demand growth.

As challenging/tricky as these times may be, I have little doubt that FCX is setting itself up for a massive bull run starting the moment economic growth expectations bottom.

So, let's dive into the details!

Secular Growth Versus Cyclical Headwinds

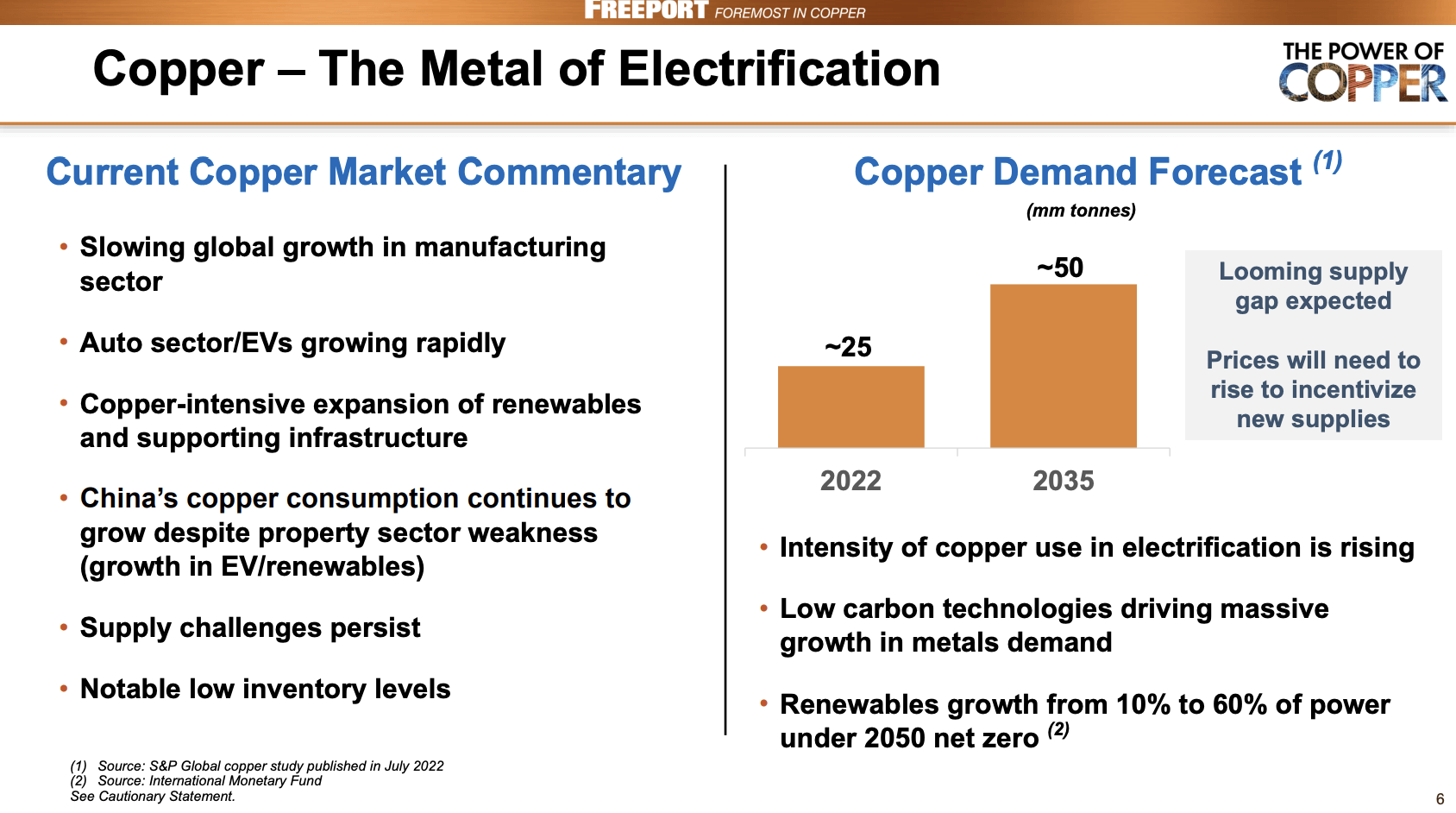

The secular copper bull case is based on a massive increase in demand related to net zero technologies. For example, by 2035, the demand for copper is expected to double to 50 million metric tons. Renewables will be a major driver of this demand.

Freeport-McMoRan

According to Wood Mackenzie:

Low-carbon copper demand over the next 20 years is the equivalent to 60% of the current market size. The uptake of electric vehicles (EVs) accounts for 55% of this demand - the largest single sector contributing to the rise in copper demand.

Looking at the overview below, we see that the average electric car requires roughly 5x as many metals as a conventional car. The average electric car needs more than 50 kilograms of copper.

International Energy Agency (Via ING)

This is what S&P Global wrote last year:

Copper scarcity may also jeopardize international security. Projected annual shortfalls will place unprecedented strain on supply chains. The challenges this poses - reminiscent of the 20th-century scramble for oil - may be accentuated by an even higher geographic concentration for copper resources and downstream industry to refine it into products.

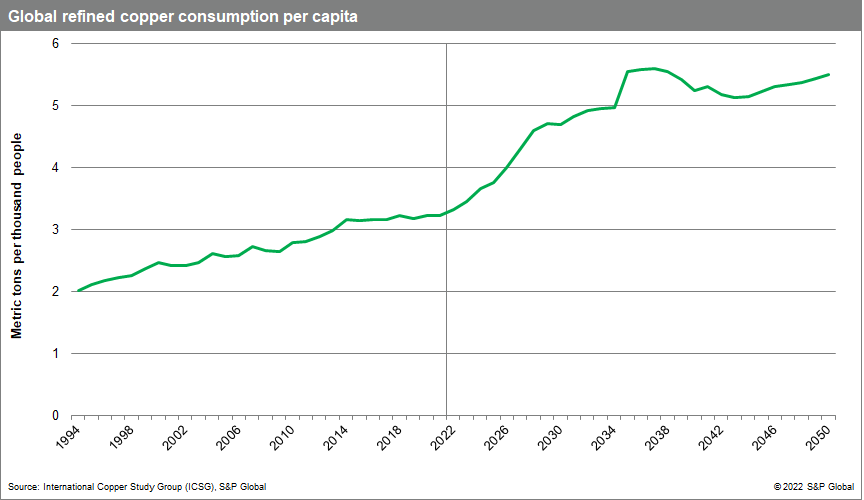

Global copper consumption (per capita) is expected to almost double over the next thirty years.

S&P Global

Despite these tailwinds, COMEX Copper prices have lost a quarter of their value from last year's peak.

TradingView - COMEX Copper

The problem is that we need cyclical demand to rebound in order to get the full benefit of longer-term tailwinds.

After all, the biggest driver of copper demand is cyclical demand, like equipment and construction.

Global X ETFs

That's why I started this article by mentioning cyclical weakness in Europe and the U.S. I left out China.

China's demand is more than 50% of global demand, which makes it the single-biggest driver of prices.

Right now, China is not in a great position.

Bloomberg

Bloomberg dove into the issues facing demand in China.

According to the article (emphasis added):

"Consumption is lagging the previous few years due to the macroeconomic environment," said Hai Jianxun, a sales executive at Henan Yuxing Copper Co., which makes pipes used in items like air-conditioners. "The whole industry is finding it very difficult."

Copper prices have traded in a narrow range for months after China's recovery from the pandemic lost all momentum. The government's recent measures have just about stabilized the economy, but reports of lackluster demand will worry investors because the autumn is usually a busy period for fabricators of the metal in China's highly seasonal economy.

Bloomberg

A quarter of China's copper demand is driven by construction, an industry that has become the nation's ground zero of economic issues.

Furthermore:

That suggests the autumn peak season will disappoint. While the fabricators that shape metal into various forms for other manufacturers have boosted production, the increase hasn't been tied to rising orders, said Ye Jianhua, an analyst with researcher Shanghai Metals Market, citing a survey of factories.

"We haven't seen any signs of peak demand from a single end-user segment yet," said Ye. "Spot trading is barely satisfactory. Premiums are falling. In general, consumption is lagging."

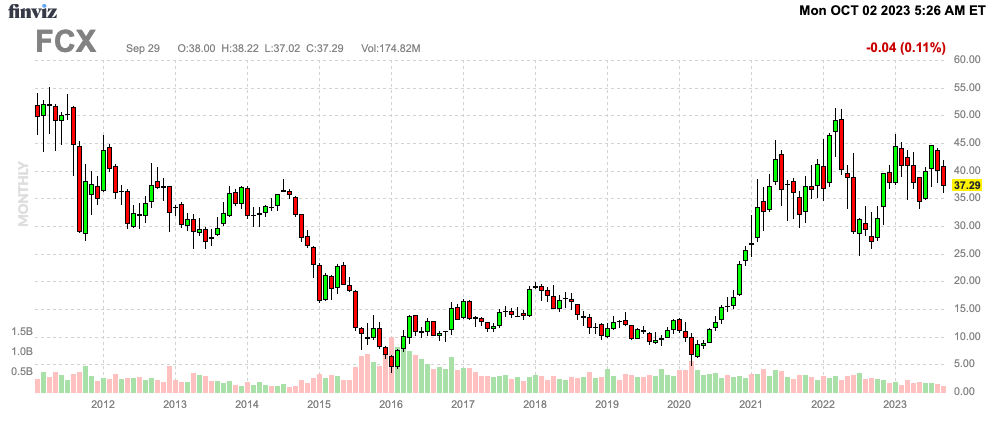

This is also weighing on FCX. The stock is down 26% from its 2022 highs and down 1% year-to-date, underperforming the S&P 500 by 13 points.

The good news is that unlike in prior (manufacturing) recessions like 2014/2015 and 2020, the stock is holding up quite well, which is likely due to the long-term favorable demand due to environmental measures.

FINVIZ

It also helps that FCX's business remains rock-solid.

FCX Remains In Great Shape

During last month's Jefferies Industrial Conference, the company elaborated on ongoing issues driving copper demand.

The company shared an optimistic outlook on the copper market, emphasizing the pivotal role of China's rapid growth, debunking industry expectations, and reshaping copper demand and pricing dynamics.

I think it's striking this past year that the news out of China has been so negative. I mean every day, property markets, financial markets is so negative and yet China demand, which hasn't grown like it once did set records and inventories remain low. So even in this negative environment and with a world worrying about global recession, which it's better now than it was 6 months ago. Central Bank's activity, the fact that copper inventories remain low, prices have come off some but they haven't tanked. I'm just more and more encouraged about the commodity and more Freeport is placed in it.

Freeport also highlighted the challenges posed by the scarcity of previously considered abundant copper resources. These challenges included shifting from traditional cyclical development to a more complex model due to the emergence of China and the realization of resource limitations.

Furthermore, Freeport emphasized the evolving demand dynamics, including factors from the new economy, such as energy transition and artificial intelligence.

Despite recent negative news concerning China, Freeport remained bullish on copper, highlighting sustained demand and constrained inventories as encouraging factors.

And if the world emerges as I'm getting increasingly confident that well, there's going to be a shortage of copper, prices will go higher, Freeport would do great.

In other words, the company seems to agree with my view that it takes a cyclical bottom for prices to fly again.

The company also acknowledged the challenges tied to resource nationalism in various countries, which is one of the biggest issues flying under the radar.

I believe that as commodity prices rise, developing nations will figure out how much leverage they have to pressure developed nations when it comes to resources. While I cannot make the case that Freeport will have major issues, other companies could run into tremendous operating risks overseas, which will make supply growth on a major scale even harder. This is bullish for commodity prices and the reason I only bet on proven mining companies with subdued geopolitical risks.

Freeport-McMoRan

During another conference, the Morgan Stanley Laguna Conference in mid-September, the company focused on its Grasberg assets in Indonesia. Freeport was the first foreign investor in Indonesia and operates one of the biggest copper mines in the world.

The second thing, and this is a very exciting opportunity for us is when we first started in Indonesia, as I mentioned, we've been there since the 1970s, late '60s. And in 1991, we signed a new contract with the government that had a primary term to 2021 and 2 10-year extensions to 2041.

And currently, we do not have rights beyond 2041. But the resource, as Carlos was saying, is extremely long-term in nature, it's vast. And the more we have done there, the more we have discovered that there are alternatives to continue to mine in this area. And so we started having discussions about a year ago with the government after the President visited our site about the positive aspects to the government and to Freeport of potentially extending the operation beyond 2041 to encourage investment and continuity so that the benefits of what we provide there, all the jobs, all the tax revenues, the economic velocity that we provide in this region could continue long term.

Furthermore, an essential aspect of FCX's growth strategy involves maximizing opportunities within its existing operations, particularly focusing on brownfield projects in Bagdad and Lone Star. This comes with lower risks than certain M&A projects.

Freeport-McMoRan

In light of these developments, it helps that FCX has a healthy balance sheet. As of June 30, it has less than $1 billion in net debt, allowing the company to spend a lot of free cash flow on buybacks and (special) dividends.

Since June 30, 2021, the company has distributed $3.4 billion to shareholders, which is more than 6% of its market cap.

Once commodity prices accelerate again, I expect very juicy dividends.

Why?

Because of the company's earnings power.

Once copper trades at $5.00, the company has the ability to generate close to $10 billion in operating cash flow and almost $16 billion in EBITDA.

Freeport-McMoRan

If we subtract $3.8 billion in expected 2024 CapEx, we get the potential of $6.2 billion in free cash flow at $5.00 copper. That's 12% of its market cap.

Although copper is trading 35% below $5.00, it gives us an idea of what FCX is capable of.

I also believe that copper will exceed $5.00 during the next cyclical upswing.

Valuation

Based on the context of the company's earnings power, I believe that shares are undervalued. The current consensus price target is $48, which is 30% above the current price.

Although I need to make the case that FCX shares are unlikely to show meaningful upside momentum until we get an economic growth bottom, I expect shares to exceed $60 over the next 1-2 years, especially if we get a rebound in inflation.

The company's earnings power is so strong that the stock could trade at 8x free cash flow once copper prices hit $5.00.

Even a 12x free cash flow multiple would not be too much in a scenario where secular and cyclical growth forces unite.

This could give FCX the potential for a $74.4 billion market cap in my base-case scenario. That's 40% above the current price.

On a longer-term basis, I expect that FCX has the potential to double.

I will maintain a Buy rating, which I will upgrade to Strong Buy once we get more data regarding a potential economic rebound.

The only reason why I do not own FCX is my position in Caterpillar (CAT). For now, I focus on dividend growth in the machinery industry before I expand into mines. I have been a shareholder since 2020.

Takeaway

While the global economy faces some turbulence, the demand for copper, driven by the energy transition and emerging markets, remains robust. The shift towards net-zero technologies, particularly electric vehicles, promises to double copper demand by 2035.

However, the current challenges in cyclical demand, especially in China, are affecting copper prices. Yet, despite these short-term hurdles, FCX stands strong with a resilient business. The company's long-term outlook remains positive, and it's well-positioned to capitalize on the sustained demand for copper.

Looking ahead, the prospects for FCX look promising. As commodity prices potentially rise and copper scarcity becomes more pronounced, FCX's earnings power and market value could soar.

While it may take time for economic growth to rebound, FCX's potential for long-term growth and a potential double in value make it an intriguing prospect for investors.

So, in a nutshell, keep an eye on FCX-it could be gearing up for a significant bull run once the economic outlook brightens.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (19)

That is more useful