A 5%-Yielding Dividend King - Should You Buy Federal Realty?

Summary

Matteo Colombo

Introduction

Real estate may be the most fascinating sector at the moment. Not necessarily because it holds some of the best income stocks on the market, but mainly because it has become the center stage of current economic turmoil.

Rising rates, deteriorating economic growth, and a potential mountain of distressed debt are keeping investors far away from this sector.

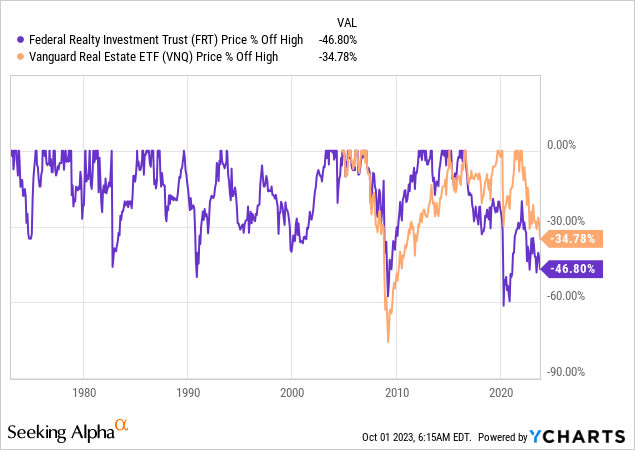

Federal Realty (NYSE:FRT), the dividend king founded in 1962, is currently in the steepest downturn since the Great Financial Crisis, trading roughly 47% below its all-time high. The Vanguard Real Estate ETF (VNQ) is trading 35% below its all-time high, underperforming the S&P 500 by roughly 25 points.

Roughly two months ago, I wrote an article titled Federal Realty - The King's 4% Yield Is A Dealbreaker. In that article, I explained that FRT stands strong despite headwinds. However, its 4% yield wasn't a great deal in light of other opportunities.

When it comes to dividend stocks, Federal Realty stands out as a strong contender. It has maintained an impressive streak of dividend growth for over five decades, even during challenging economic times.

The strong performance in Q2 indicates that occupancy rates have improved, and the future outlook is optimistic, despite challenges.

However, tempered enthusiasm is warranted due to FRT's modest yield of just above 4%, which trails high-yield investments.

While FRT's diverse portfolio mitigates risks, its lackluster dividend growth and underperformance against comparable ETFs raise some concerns.

Now, FRT yields 5%, which is why I'm writing this article. A lot has happened over the past two months, including the recognition of the market that rates may stay elevated for longer.

On top of that, Federal Realty presented at the Bank of America Global Real Estate Conference, which gave us a lot of intel to work with.

So, let's get to it!

Federal Realty Is A King With Strong Numbers In A Tough Environment

I own just two REITs. While I have other REITs on my watchlist, I'm extremely careful when it comes to adding new investments. This goes for all sectors. Not just REITs.

One of the issues I have with REITs is that I often distrust management. REITs thrive on making a lot of financial decisions. When done wrong, it can be costly. Medical Properties Trust (MPW) is one example of that.

Federal Realty may not have the dividend growth rates it had in the past, but it is still hiking every year, maintaining a 56-year consecutive dividend growth streak with an average annual dividend growth rate of 7%.

Federal Realty

This includes the Great Financial Crisis, the pandemic, and every recession before that.

Its portfolio of top-tier assets is one reason it is doing so well.

This S&P 500 member owns 102 properties (103 going into this year), including roughly 3,300 commercial tenants, 26 million square feet, and 3,100 residential units.

Federal Realty

Although the company has a lot of exposure in areas that people want to avoid (California and the Northeast), it has properties that stand out.

While I completely agree that the situation in markets like California is far from perfect, these markets have benefits. Income is one of them. When it comes to FRT's assets, no retail REIT has a more dense target audience of high-income individuals, as seen in the Best-in-Class Demographics chart below.

Its markets also come with higher entry barriers and limited competition. Especially in California, new supply is a tailwind - despite some demand headwinds.

Federal Realty

The company stands out when it comes to reaching wealthier customers, which also limits some of the issues peers are having in markets like Southern California.

Federal Realty

Furthermore, with regard to the company's assets, they are not just random retail assets but often mixed-use properties that go well beyond just shopping.

38% of the company's assets are mixed-use centers. 27% are community centers.

Federal Realty

With regard to its tenants, the company has only eight tenants that account for more than 1% of its annual base rent. No tenant has more than 2.7% exposure, with TJX Companies (TJX) being the largest tenant.

The company's office exposure is 13%. That's 13% of the other segment, which accounts for 5% of its total rent. This makes office exposure irrelevant, which is a good thing in this market.

Federal Realty

Having said that, in its second quarter, the company noted that both leased and physical occupancy showed improvement compared to previous quarters and years.

The company reported a 94.3% leased rate and a 92.8% physical occupancy at quarter-end, which is an increase of 10 and 20 basis points, respectively, compared to the first quarter.

Small shop occupancy experienced substantial gains, with a 310 basis point increase since 1Q22.

The company also emphasized the significance of its residential portfolio, constituting 3,100 apartments, which remained 98% leased and contributed to an 11% rise in property operating income compared to the prior year's second quarter.

The residential and office components are vital components of their mixed-use neighborhoods, both boasting 98% occupancy, further enhancing the portfolio's overall resilience.

Federal Realty

In general, the move to increasingly include residential exposure is genius, as it not only adds value to existing buildings (shoppers closer to shops) but also de-risks its business due to less cyclical demand.

As a result, the company revised its FFO per share guidance for 2023, increasing it by $0.04 per share at the midpoint to a new range of $6.46 to $6.58 per share.

This revision reflected expected FFO growth of about 2% to 4% over 2022, which is based on the company's optimism about the year's trajectory despite challenges.

The midpoint of this guidance indicates a dividend coverage ratio of 67%, which means the company's dividend has a big margin of safety.

Furthermore, the dividend is protected by a healthy balance sheet. The company has a BBB+ rated balance sheet with $1.3 billion in total liquidity and a 6x net debt ratio. The company is comfortable with current debt levels and expects these levels to be maintained throughout 2024.

Federal Realty

This guidance midpoint is also good news for its valuation.

The company is now trading at 13.9x 2023 FFO guidance. This is above the sector median of 11.4x but well below its longer-term average, which makes sense given the deteriorating health of the industry.

Having said that, there's more to it, especially because the company just updated us on new developments.

Federal Realty Stands Strong, Despite Risks

During the aforementioned Bank of America conference, Federal Realty updated us on new developments - including its view on the economy.

With regard to above-average inflation, the company has contractual rent bumps.

FRT has advantageous lease bumps, attributed to a higher proportion of small shop space that tends to grow annually, even during inflationary periods.

Federal Realty

The only problem is that these escalators protect against average inflation. Above-average inflation tends to be negative for companies like FRT (and so many others). It's one of the reasons why investors have dumped REITs in recent months.

In 2023 and 2024, roughly 20% of the company's leases expire. This will show us how strong lease demand is (renewals) and how much pricing power the company has when it comes to new long-term leases. So, that's definitely something worth keeping an eye on.

It also needs to be seen how tenants with limited pricing power handle this environment (emphasis added).

When I think about today's tenants that you worry about a little bit, whether it's big lots or it's a JoAnn Fabrics or it's a Rite Aid or the at-home potentially. When you think about those tenants, I do think there's a common threat. They are the tenants where there is really price sensitivity of their customers. Think about that for a minute. Because if inflation stopped today, every cost is 20% or so higher than it was 2 or 2.5 years ago, whether we're talking about construction, whether we're talking about operating costs, whether we're talking about labor.

With regard to the market, FRT noted that the leasing environment remains robust. Tenants seem to adopt a strategic, long-term approach in setting up their portfolios, anticipating future positioning rather than being driven solely by short-term sales fluctuations.

This approach implies a sustained demand for retail spaces. Although potential signs of consumer weakness need to be monitored, the overriding strategy within the retail sector seems to remain unaffected, allowing FRT to maintain a positive outlook for the open-air business.

FRT also holds a positive perspective on office assets within mixed-use centers, as it recognizes a potential undersupply in specific subsectors despite an oversupplied overall office market in the United States.

According to the company, the demand for office spaces within its mixed-use communities, providing full amenities, has been substantial.

The emphasis lies on the attractiveness of these environments to tenants seeking to downsize their space while upgrading to superior locations, which is another benefit of mixed-use retail, which I underestimated before analyzing FRT.

In other words, it is really hard to make the case that FRT is in trouble, as it continues to benefit from strong tenants, the increasing benefits of a mixed-use strategy, and its stellar balance sheet.

However, I also cannot make the case that the stock is free of risks. While I'm not worried that FRT will run into so much trouble that it needs to cut its dividend, I wouldn't be surprised if the company reported that some of its tenants had increasing trouble dealing with rent hikes next year.

Verdict

I like Federal Realty. It's a well-managed company with a clear strategy to improve its business. This includes taking what works (diversification and top-tier locations) and further enhancing the value by expanding into residential and small-scale office markets.

I believe that this mixed-use strategy will work well for many years to come.

Also, the company has a top-tier balance sheet and a well-protected dividend that will likely be hiked for many years to come.

The problem is that FRT won't likely rally until the market gets confidence that inflation will come down, allowing the Fed to cut rates. For now, the market is pricing in a scenario of higher rates and inflation, potentially causing a hard landing.

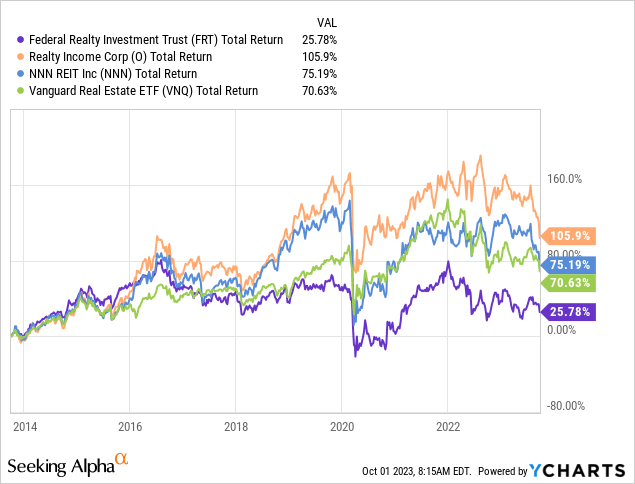

While FRT's valuation has incorporated a lot of potential weakness, it also does not help that other REITs like Realty Income and NNN REIT (NNN) now offer >6% yields, more than 100 basis points more than FRT.

Over the past ten years, both of these stocks have beaten the VNQ benchmark. FRT has not.

Yes, FRT is now yielding 5%, but to me, that is not enough. Regardless of whether I'm looking for income or growth, FRT is a pass for me.

I can either buy higher-yielding REITs with similar stability or go for lower-yielding REITs with faster growth.

Having said that, I expect FRT's relative performance to improve. This article is by no means a call to get people to dump FRT stock.

Hence, I agree with what Mr. Paul Drake wrote in a recent article, which I recommend to readers:

In the near future, we can expect de minimal dividend increases until affairs are in better order as described above. Then it looks like raises in the ballpark of 4% for the foreseeable future. These are likely to come up in response to inflation, as rents adjust with a few-year lag. After that, who knows?

FRT remains a good stock for investors seeking a modest yield (4.2% now) that will eventually grow more or less with inflation. This certainly includes retirees whose main goal is to go fishing rather than tend their investments.

Takeaway

Federal Realty stands resilient amidst economic challenges, maintaining a 56-year streak of dividend growth.

The company's diversified portfolio and focus on high-income markets position it favorably, while the strategic inclusion of residential exposure and a strong balance sheet reflect a forward-thinking approach.

However, potential risks tied to above-average inflation and lease renewals deserve vigilance.

While FRT presents a 5% yield, competitive REITs offer higher yields.

Hence, for now, FRT remains a Hold for me.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

www.business.com/...

"The company's occupancy rates have improved, and its future outlook is optimistic, but concerns remain about its modest yield and underperformance compared to other ETFs"Obviously FRT is not an ETF