3M: A 7%-Yielding, 30% Undervalued Dumpster Fire

Summary

burakpekakcan/E+ via Getty Images

Introduction

It's time to talk about the 3M Company (NYSE:MMM), the second-biggest disappointment from Minnesota after the 0-3 Vikings.

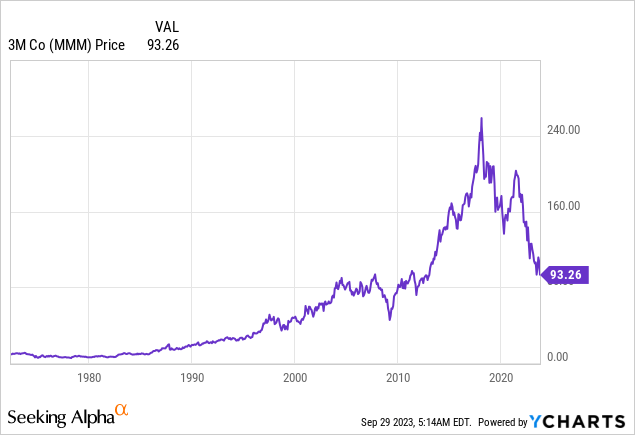

Excluding dividends, 3M shares are trading more than 60% below their all-time high. They are down 22% year-to-date and less than 1% above their 52-week lows.

In other words, we're essentially dealing with the lowest stock price since the early stages of the Great Financial Recovery.

The stock now yields 6.5%, which begs the question: are we going dumpster diving or not?

In this article, I'll assess that question, starting with lawsuit news.

So, let's get to it!

Lawsuits!

More often than not, when I call a stock a dumpster fire (I haven't done it in a long time), I get massive pushback from investors who disagree. When dealing with 3M, however, I've felt that even its long-term investors are getting sick and tired of the many headwinds they had to face over the past few years.

Headlines like the one below don't help.

Wall Street Journal

The Wall Street Journal wrote that 3M recently concluded a historic $6 billion settlement, marking the largest mass tort settlement in U.S. history.

This settlement is part of 3M's efforts to address legal concerns tied to so-called "forever chemicals," for which the company also agreed to pay up to $12.5 billion in a previous settlement.

However, the resolution of these legal challenges is far from over, presenting substantial obstacles for the well-known U.S. manufacturer.

3M faces thousands of lawsuits from individuals and states, alleging that their products containing PFAS chemicals have caused health issues. These cases, including claims related to military-grade earplugs, have become some of the largest product liability litigations in history, leading to significant financial losses for the company.

So, is MMM dead money forever? While one might assume so after being disappointed for many years, there's light at the end of the tunnel.

Now What?

During this year's annual Morgan Stanley Laguna Conference, the company elaborated on some key issues, including lawsuits.

This included a three-pillar strategy to get the company back on track.

Healthcare Spin-off: One of the most significant strategic moves 3M is undertaking is the spin-off of its healthcare business. This decision is on track, with the appointment of Bryan Hanson as the new CEO for healthcare. The spin-off is expected to occur in the first half of 2024, pending regulatory and board approvals.

In 2022, healthcare accounted for roughly a quarter of total sales, adding $8.4 billion in sales.

Risk Reduction: To enhance stability and reduce litigation exposure, 3M has recently made two major announcements:

- Combat Arms Litigation Settlement: 3M has reached a broad settlement of approximately $6 billion, resolving issues related to Combat Arms litigation. This includes $5 billion in cash and $1 billion in 3M equity, payable over seven years. The settlement aims to cover all Combat Arms cases, including potential future claims.

- PFAS Settlement: 3M has also reached a settlement with public water authorities in the U.S. with a present value of $10.3 billion payable over 13 years. This settlement addresses PFAS contamination in drinking water and is comprehensive, covering current and future PFAS compounds.

The third pillar is delivering on the 3M promise to deliver the 3M Model.

[...] you have seen based on what you've seen with our first half results, the team has executed well. They are starting to make progress, whether it is in our supply chain, whether it is making sure that we are taking care of customers, etcetera. And you can see in the first half - when we came into the year, Josh, we had said we see weakness in electronics, we see weakness in consumer and China was a watch item. As we now look at first half in third and fourth quarter, we are still seeing significant slowness in electronics, consumers. I would say that destocking, I think we have got through the worst of it. - 3M (emphasis added)

Related to the point above, like its litigation-free peers, the company also went through economic challenges on top of everything else.

Speaking of these economic challenges, the chart below compares the MMM stock price (% of its all-time high) to the leading economic indicator, the ISM Manufacturing Index. We can see that the correlation with leading indicators remains high, as MMM is still a cyclical business. However, litigation issues massively amplified the downtrend.

TradingView (MMM % Off Its All-Time High, ISM Index)

With regard to its financial outlook, the company used the aforementioned conference to give us some valuable insights.

Revenue Trends: Despite challenges in sectors such as electronics, consumer, and a slowdown in China, 3M's revenue performance has remained resilient. The company has managed to outperform its revenue expectations, partially driven by favorable foreign exchange rates.

3M

Margin Improvement: 3M has shown strong control over its margins, with supply chains gradually stabilizing. The supply chain teams have not only improved productivity but also achieved better yield and efficiency. The restructuring efforts announced in the second quarter have progressed as planned, contributing to margin improvement.

Earnings Guidance: 3M has adjusted its earnings per share guidance for the year, raising it from the original range of $8.50 to $9.00 to a new range of $8.60 to $9.10.

3M

Long-Term Growth Areas: 3M remains committed to investing in promising areas such as climate tech, industrial automation, next-generation electronics, AR/VR, and sustainable packaging. These segments offer GDP-plus growth potential and leverage 3M's material science expertise and digital capabilities.

So, what does this mean for the valuation & dividend?

Valuation & Dividend

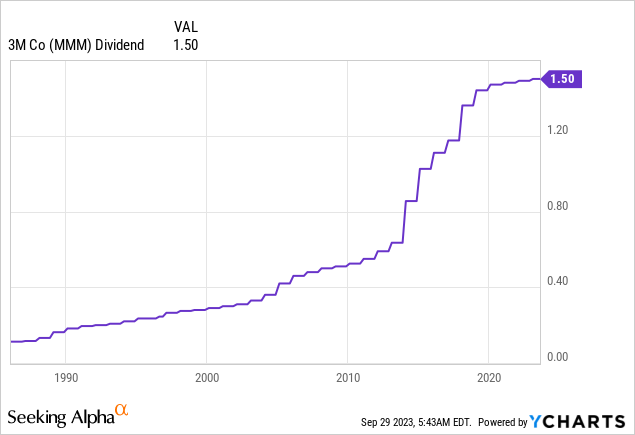

MMM currently pays a $1.50 per share per quarter dividend. This translates to a yield of 6.5%. On February 7, the company hiked its dividend by 0.7%.

The five-year dividend CAGR is 2.7%.

This dividend king is clearly still committed to maintaining more than 60 years of uninterrupted dividend growth.

The question isn't when dividend growth will return. The question is: how safe is the dividend?

Despite litigations, the company maintains a healthy balance sheet. It is expected to lower net debt to $9.3 billion next year, which translates to a leverage ratio of 1.1x, which is very healthy.

Its credit rating has been cut to BBB+, which is still one notch below the A-range it left due to litigation risks.

I believe MMM will work its way up to the A-range again in the next ten years.

The dividend is also protected by a lot of free cash flow. Next year, the company is expected to boost its free cash flow yield to 8.8%. This protects the 7% dividend yield and leaves room for debt reduction.

Leo Nelissen (Based on analyst estimates)

After 2024, free cash flow is expected to surge even higher.

This is based on a favorable growth outlook.

Analysts expect the company to report accelerating EBITDA growth after 2023, with mid-single-digit annual EBITDA growth.

Leo Nelissen (Based on analyst estimates)

If we get an economic growth bottom, I believe these numbers could be higher. However, I'm not yet willing to make that call.

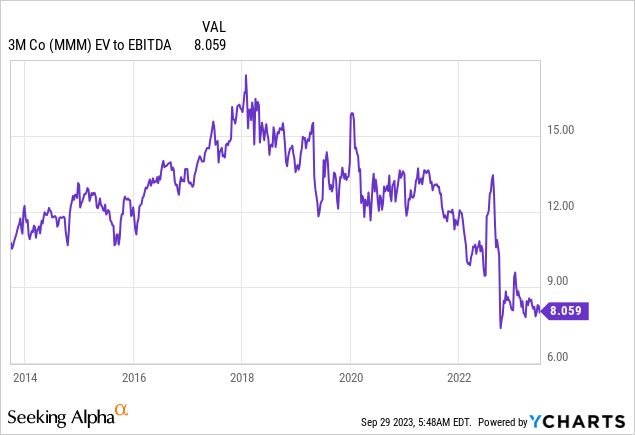

Valuation-wise, this indicates that there's upside.

The stock is trading at less than 8x 2023E EBITDA. That number falls to 6.8x EBITDA using 2025 estimates. Free cash flow growth is expected to accelerate to 12.1% in 2025.

Leo Nelissen (Based on analyst estimates)

Before the pandemic, MMM used to trade close to 13-14x EBITDA. These times are over - at least for now. The mix of litigation and economic risks will keep investors from applying these multiples anytime soon. I believe it will happen again, but not in the next few years.

By applying a conservative 9x multiple, we get a fair stock price of $122, which is 32% above the current price.

I think that makes sense, as there's a lot of hidden value in this dumpster fire. Maybe it is no dumpster fire, after all?

However, I do not urge investors to start catching a falling knife. While I will give MMM a Buy rating due to the favorable risk reward, it is a Speculative Buy rating.

We could see more downside if economic growth further deteriorates, which isn't unlikely.

All things considered, I think it's an interesting distressed high-yield play I may give a shot at some point in the next few months.

Takeaway

In the realm of corporate disappointments, 3M Company stands as a substantial let-down, trading over 60% below its all-time high and grappling with numerous legal battles, notably the historic $6 billion settlement concerning "forever chemicals."

However, amidst the challenges, there's a glimmer of hope. The three-pillar strategy discussed during the annual Morgan Stanley Laguna Conference suggests a potential turnaround, including a strategic healthcare spin-off and risk reduction initiatives.

Despite economic headwinds, 3M's resilience in revenue performance and prudent margin management indicate signs of stability.

While the stock's valuation has suffered, projections hint at a potential upside, making MMM a speculative buy.

Nonetheless, caution is advised, especially in light of potential economic risks that could further test this distressed yet intriguing high-yield opportunity.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)

They must be desperate for good news to announce EPS improvement of 1.18%.

I hold MMM the money that has simply evaporated, some of it was MINE.

Adding a bit every couple of weeks. There is certainly a lot of risks as you’ve outlined but that’s what deep value investing is about. Keep your position size small….luckily the price plunge is doing a great job of managing that for owners!