IWC: Micro-Cap Index ETF, Uncompelling Investment Thesis

Summary

for personal or commercial purposes

The iShares Micro-Cap ETF (NYSEARCA:IWC) is a simple micro-cap index ETF. IWC provides investors with diversified exposure to an underexplored equity niche, and sports a cheap valuation. The fund has consistently underperformed since inception and is quite risky too. In my opinion, IWC's risks and downsides outweigh its positive. As such, I would not be investing in the fund.

IWC - Fund Overview

IWC is a simple micro-cap index ETF, tracking the

Russell Microcap(R) Index. It is a relatively simple index, investing in the 1,000 smallest securities in the Russell 2000 index, and the next 1,000 smallest securities by market-cap. As with most indexes, applicable securities must also meet a basic set of inclusion criteria.The resultant index and fund both include around 1,500 securities. This is 500 less than expected, for unclear reasons, but I think there are simply not 2,000 securities meeting all relevant inclusion criteria, lax as they are (the U.S. is only so large).

IWC

IWC provides investors with diversified industry exposure. Health care is overweight, due to the large number of publicly traded biotech micro-caps. Financials is overweight too, due to the many smaller local banks and investment management firms in the country. Utilities, consumer staples and communications are all underweight, presumably due to economies of scale.

IWC

IWC is about as diversified as a micro-cap fund can be which, in my opinion, isn't that much. Micro-caps are an incredibly small equity market niche, a tiny, unrepresentative portion of U.S. public equity markets. As such, small position sizes are ideal, in my opinion at least.

With the above in mind, let's have a look at IWC's positives and negatives, starting with the negatives.

IWC - Negatives and Risks

High Risks and Volatility

IWC focuses on micro-cap stocks, which tend to be very risky, much more so than average.

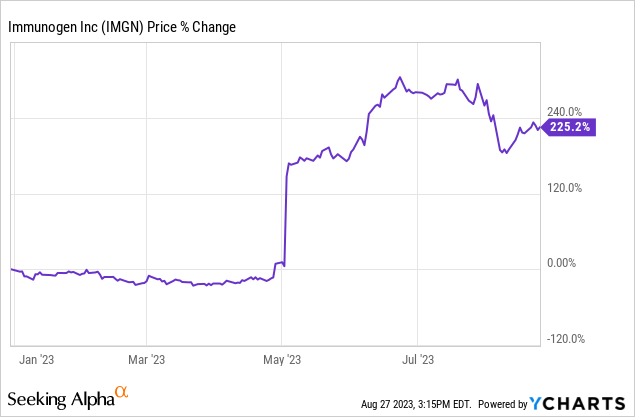

Some of the risks are due to the business models and business realities of many micro-caps. Biotech micro-caps, for instance, are strongly dependent on a couple of drugs and pharmaceutical trials for their revenues, past and future. A successful clinical trial almost certainly means significant revenue growth, and a surging share price. As an example, ImmunoGen's (NASDAQ:IMGN), the fund's largest holding, saw its share price surge 95% this past May, due to a successful phase 3 clinical trial.

Data by YCharts

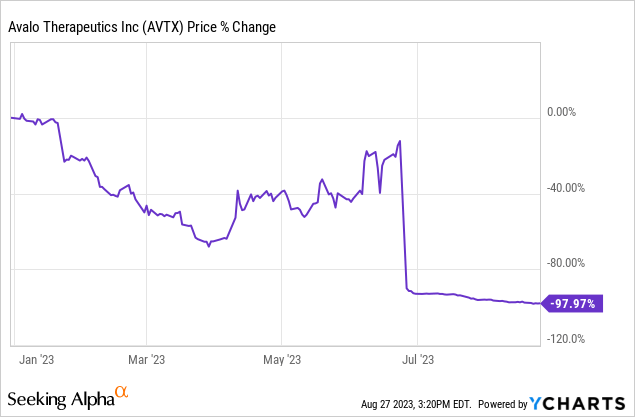

An unsuccessful clinical trial, on the other hand, means much lower growth, and a plummeting share price. As an example, Avalo Therapeutics' (AVTX) share price dropped by almost 90% this past June, after an unsuccessful clinical trial.

Data by YCharts

Biotech micro-caps are very risky investments. IWC invests quite heavily in these, and so is very risky too.

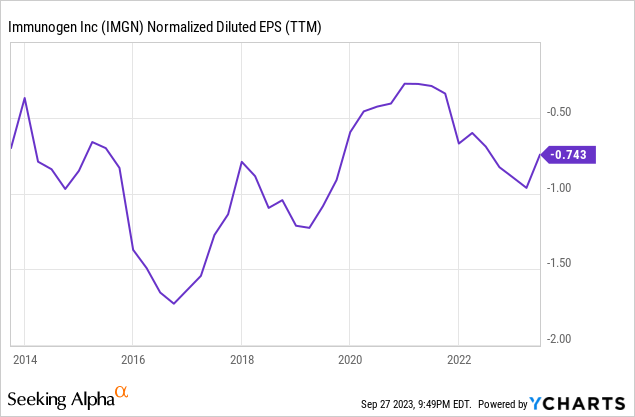

Some micro-cap stocks have very weak financials, which boost risks further. ImmunoGen, for instance, has been an unprofitable enterprise for over a decade.

Negative earnings means the company must finance its operations and R&D with either cash-on-hand, debt, or selling shares. ImmunoGen seems to mostly use cash and, as per an old annual report, has cash runway into 2024. In practice, ImmunoGen's successful clinical trial all but solves these issues, but not all trials are successful, nor do all companies have so much cash.

As a final point, micro-caps are also very volatile because investors believe so, and trade them accordingly.

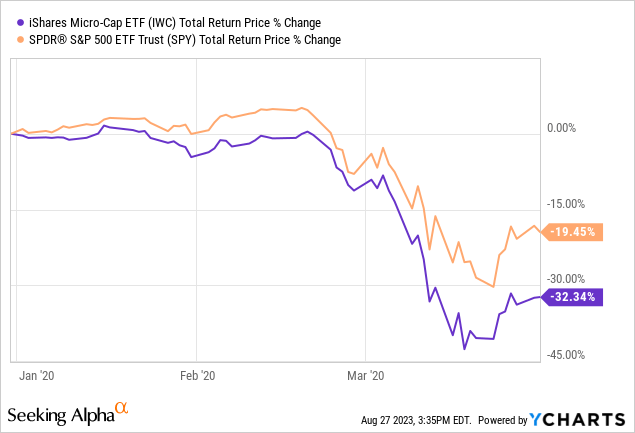

Due to the issues above, IWC tends to experience significant, above-average capital losses during downturns and recessions, as was the case in 1Q2020.

Data by YCharts

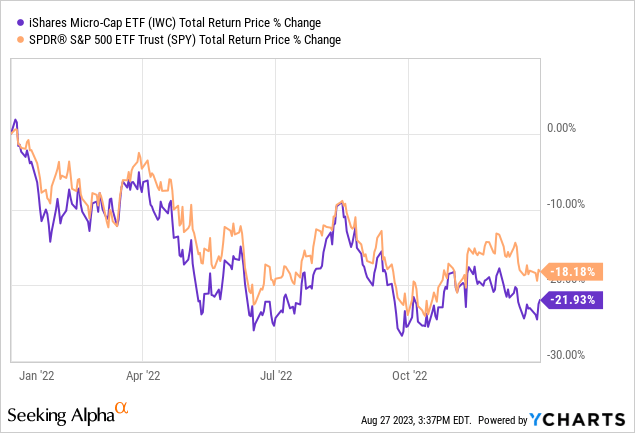

It was also the case in 2022, although much less so.

Data by YCharts

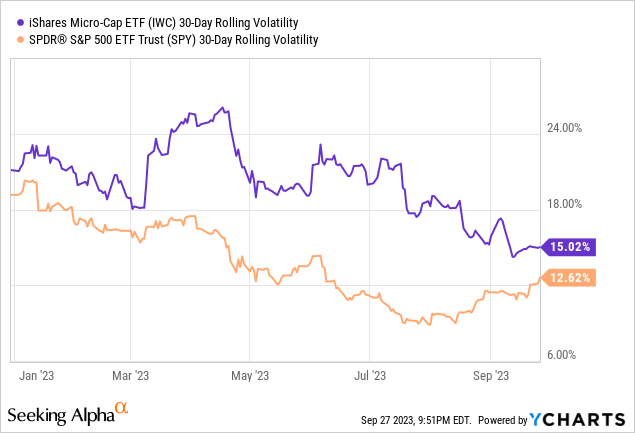

IWC's volatility is also much higher than average.

IWC is an incredibly risky, volatile fund, a significant negative for its investors.

Sub-Par Performance Track-Record

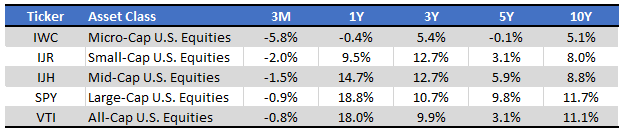

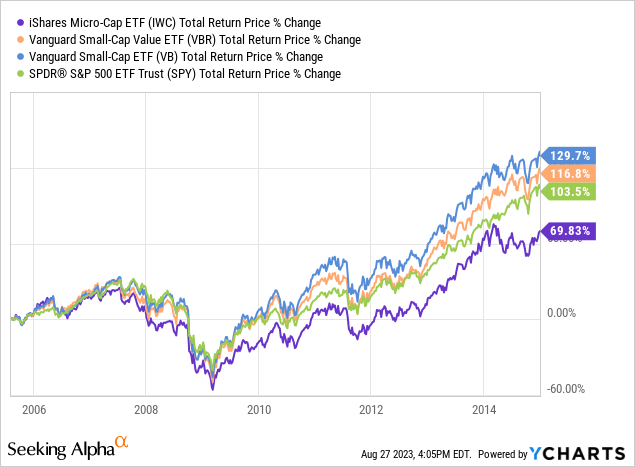

IWC's performance track-record is quite weak, with the fund underperforming most of its peers since inception, and for most relevant time periods.

Seeking Alpha - Chart by Author

Some of the smaller value indexes and funds had strong returns in the years prior to / immediately after the financial crisis, but that is not the case for IWC.

Data by YCharts

IWC's performance is, overall, quite weak, and a significant negative for the fund and its shareholders. Although performance could always improve moving forward, these results should give all shareholders pause, especially considering their consistency.

IWC - Positives and Benefits

Cheap Valuation, In Theory

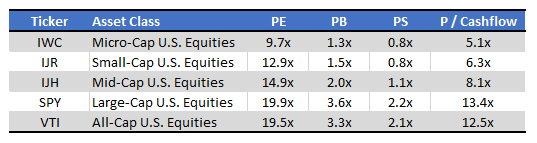

IWC's valuation metrics are all quite, and much lower than those of its peers.

Morningstar - Chart by Author

From the above, it seems that IWC currently trades with a cheap valuation. There is a catch, however. Most PE ratios are calculated excluding companies with negative earnings, which biases these ratios upwards. For funds with significant investments in unprofitable companies, PE ratios might be significantly biased upwards, rendering them uninformative. IWC's micro-cap holdings are, in many cases, unprofitable, so these are important issues for the fund.

In my opinion, IWC almost certainly trades with a cheap valuation, as these issues impact all relevant funds in some magnitude or another, and because the (imperfect) data we have available shows significant valuation gaps. IWC's cheap valuation is an important, if uncertain, benefit for the fund and its shareholders.

Access to Niche Investment Assets

IWC provides investors with exposure to a small equity niche: micro-caps. These stocks are not included in most of the larger, better-known U.S. equity indexes, including the S&P 500 and Nasdaq-100. There is some overlap between IWC and the Russell 2000, but not a whole lot.

Etfrc.com

IWC's underlying holdings are likely not included in many / most investor portfolios. As such, an investment in the fund could increase an investor's portfolio diversification, reducing risk and volatility. This is something of a benefit for shareholders, tempered by the fact that IWC's underlying holdings are riskier than most.

IWC - Other Considerations

IWC is a micro-cap index ETF. In my opinion, index investing is a sub-par investment approach for most micro-cap companies, especially micro-cap biotech. For these companies, a deeper understanding of their (potential) products and clinical trials seems warranted. My personal understanding is that knowledgeable investors can achieve outsized returns in the sector, by differentiating between the more promising and the more speculative companies.

On a more general note, active management can, potentially, be much more profitable in the micro-cap sector, at least for smaller retail investors. Buffett and Munger both seem to think so, with Munger stating that very competent, but small, investors should focus on obscure stocks for mispriced opportunities. Buffett himself has said that it's a huge structural advantage not to have a lot of money, and that he could deliver 50% a year on $1 million.

At the same time, some of the more important benefits to indexing are lost in a micro-cap index fund. There is some diversification, but not a whole lot, as this is a relatively small industry niche. Larger institutional investors tend to ignore micro-caps, so their prices are not necessarily reasonable. The entire sector is much less efficient than large-caps, so a market-based index strategy might not work as effectively. I personally feel much more confident holding a diversified portfolio of blue-chip stocks like Microsoft (MSFT), Johnson & Johnson (JNJ), and other S&P 500 companies, than a diversified portfolio of unprofitable biotech companies and niche miners.

In my opinion, a micro-cap index portfolio simply does not seem like an effective, viable choice. I'm not surprised the fund has so consistently underperformed in the past.

Conclusion

IWC is a simple micro-cap index ETF. IWC provides investors with diversified exposure to an underexplored equity niche and sports a cheap valuation. The fund has consistently underperformed since inception and is quite risky too. In my opinion, IWC's risks and downsides outweigh its positive. As such, I would not be investing in the fund.

Profitable CEF and ETF income and arbitrage ideas

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan de la Hoz has worked as a fixed income trader, financial analyst, operations analyst, and as an economics professor. He has experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs.

Juan is a contributor to the investing group CEF/ETF Income Laboratory holdings are also monthly-payers, for faster compounding and steady income streams. Other features include 24/7 chat, and trade alerts.Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.