Rumble: Speculative Play (Rating Upgrade)

Summary

- Rumble Inc. stock has plummeted, making it an appealing buy for investors looking for an entry point.

- The platform's focus on free speech has not resulted in significant organic growth, with content creators only using Rumble as a last resort or when well compensated.

- The stock offers a better value at 6x '24 sales, which is cheap for the strong growth rates.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Learn More »

wildpixel

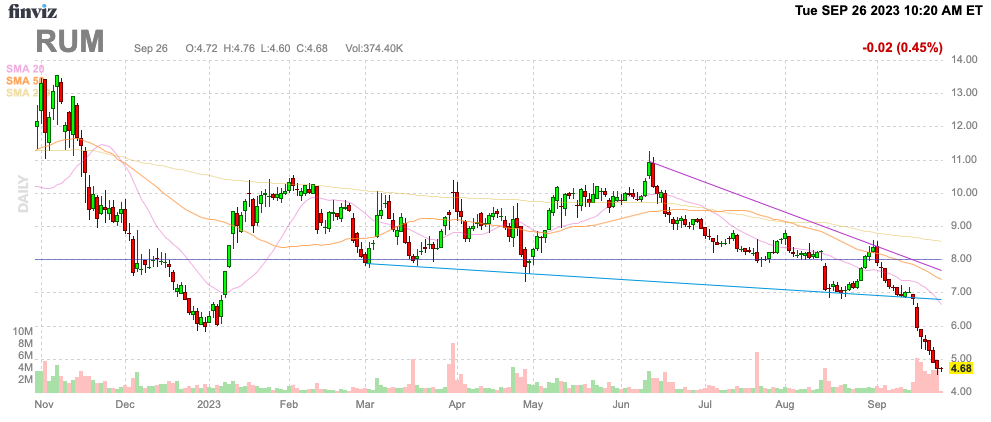

As with any stock, Rumble Inc. (NASDAQ:RUM) is a lot more appealing now that the stock has plummeted without any change in the business prospects. The market selloff and drama over Russell Brand could provide an interesting entry point for the free speech video sharing platform. My investment thesis is a speculative Buy after the stock collapsed below $5.

Source: Finviz

Free Speech

While Rumble pushes the free speech concept, the platform doesn't appear to rake up a lot of organic growth. The biggest complaint about the business is the company buying content versus the content providers flooding the platform due to the benefits of free speech. Said another way, content creators only appear interested in Rumble as a last resort, or when the platform compensates them to make the shift worth the effort.

The Russell Brand drama is a prime example of the issue and benefit with the free speech video platform. The entertainment personality has been anonymously accused of rape and assault by multiple women from 2006 to 2012 based on a media investigation, but he hasn't even been arrested or charged with an actual crime.

YouTube and other platforms have automatically demonetized his traffic. In reaction, Russell Brand pushed followers towards Rumble, but he only made the move after getting pushed out by YouTube, where he has 6.65 million subscribers.

While Rumble has backed his rights to a voice due to the lack of proven allegations, advertisers like Burger King are leaving the platform and the UK has questioned the validity of his traffic being monetized. Mr. Brand only has 1.62 million followers on Rumble in a sign of how the monetization levels would be far lower, even if Rumble could monetize at the same rate per user as YouTube.

The numbers are also a sign of how the followers aren't completely portable. A YouTube subscriber might never sign up to Rumble to view his content.

Investors will definitely want to watch how his users grow over the next few weeks as Russell likely moves all of this shows to Rumble and no longer posts on YouTube. Rumble ended last quarter with only 44 million MAUs, so 6+ million followers would definitely provide an overall boost to users on the platform.

On Rumble, Mr. Brand can provide premium content on Locals to bypass the complete need for advertiser revenues.

Appealing Below $5

One of my original research articles on Rumble highlighted that a valuation of $5 was where the stock got interesting. Rumble regularly traded above $10 during this period, but the former SPAC got really expensive at those levels.

The recent insider lockup expiration provided a catalyst for selling the stock. CEO Chris Pavlovski claims no plans to sell his over 140 million shares amounting to nearly 45% ownership, and naturally most insiders wouldn't find the current price below $5 appealing at all.

In fact, an investor should be watching for the CEO and/or Directors to actually load up on shares as a sign the stock has hit a bottom. If the SPAC price was appealing at $10 over a year ago, insiders should find Rumble very appealing now that the business model is developing with Q2 revenues soaring 468% to $25 million.

The video platform has signed up a lot of sports leagues to shift the business dynamics from a conservative political slant, but the user base remains mostly tied to politics. The MAU base slumped since the mid-term elections, with the 80 million MAUs dipping nearly 50% by Q2'23.

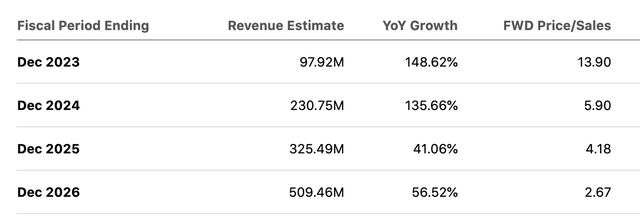

The stock valuation has now slipped to the point to where a company targeting 100%+ growth only trades at 6x forward sales. Rumble is quickly becoming a value play after going public at valuation levels closer to 20x to 30x sales.

The main remaining issue is whether Rumble can profitably grow, and this requires organic users. The company has committed over half the cash balance to content creators, and someone like Russell Brand needs to drive a far higher follower base to pay these creator fees.

Analysts forecast the company becoming profitable in 2024. The company will see a huge boost from the U.S. Presidential elections next November, with analysts targeting sales soaring next year in the 2H with quarterly revenues jumping to $70 million, from only $25 million during the current quarter.

The Russell Brand story will both prove whether the concept of a free speech will ultimately drive users, or if Rumble is just an alternative platform at a fraction of the scale when YouTube de-monetizes content creators. A big part of the story is whether Rumble is able to maintain advertisers in the process and avoid governments like the U.K. shutting down the business.

Takeaway

The key investor takeaway is that Rumble Inc. is now a speculative buy below $5. The free speech video platform still needs to prove the business model works with escalating costs. The company has to prove revenues can scale faster than content payments.

Investors must be willing to lose capital to invest in Rumble Inc. here. The stock is a speculative buy based on the growth opportunity ahead with the new content and the U.S. Presidential elections next year, but the inability to maintain advertisers could wipe out all of the benefits of a free speech platform adding to the risks.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.

This article was written by

Stone Fox Capital (aka Mark Holder) is a CPA with degrees in Accounting and Finance. He is also Series 65 licensed and has 30 years of investing experience, including 10 years as a portfolio manager.

Mark leads the investing group Out Fox The Street where he shares stock picks and deep research to help readers uncover potential multibaggers while managing portfolio risk via diversification. Features include various model portfolios, stock picks with identifiable catalysts, daily updates, real-time alerts, and access to community chat and direct chat with Mark for questions. Learn more.Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RUM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

Just stop embarrassing yourself as a bad troll. SFC literally issued multiple Sell ratings on $RUM at $10 and the stock is now trading below $5, but you're here saying we get nothing right. The only thing worse than a troll is a factually wrong troll.

Think the pendulum has swung since the Parlor focus with Musk taking over Twitter and the evils of social media colluding with the govt being unearthed. Govts and influential corporations will try to pressure the removal and demonetization of content, but they also face a Bud Light moment going too far. Not as worried about those issues as much as people not showing up on Rumble.

He was accelerating his shift a little before the first Twitter Files were produced, in Dec. 2022. Missouri v. Biden appears to be headed toward the Supreme Court; but this latest censorship push against Brand isn't from America, nor Canada where Rumble is based, but instead comes immediately on the heels of a new and openly censorious law enacted in Great Britain. If this turns out to be frivolous, Burger King et.al. may see a Bud Light type reaction.As far as this stock, or any long play, it seems to be worth considering only after this market turns around and not before.

How hard was he pushing Rumble? He posted far too much content on YouTube to be serious about the move to Rumble unto now.$RUM has possibly already bottomed. Not sure one should wait too much longer to start buying.