Etsy: Attracting Gen Z Shoppers And Growing Sales

Summary

- Etsy's Q2 2023 earnings exceeded expectations, driven by higher Gross Merchandise Sales, revenue, and adjusted EBITDA.

- The company's focus on reliability, including timely deliveries and purchase protection, has led to increased purchase frequency and higher conversion rates.

- The acquisitions of Reverb and Depop could strengthen Etsy's position in the secondhand clothing and musical instruments markets, particularly among Gen Z consumers.

ArtistGNDphotography

Investment Thesis

In my previous article on Etsy, Inc. (NASDAQ:ETSY), I covered the company's vast addressable market and the company's diversification into resale, which formed the central thesis of my bullish stance. In this article, I will discuss some of the company's recent efforts to increase brand awareness and efficiency and will also take a look at the company's recent results and future outlook. Etsy's recent earnings report for the second quarter of 2023 exceeded expectations, driven by higher Gross Merchandise Sales, revenue, and adjusted EBITDA. Etsy has been prioritizing reliability by improving timely deliveries, customer reviews, and purchase protection. This shift has led to increased purchase frequency and higher conversion rates. The introduction of a purchase protection program has significantly reduced issue resolution times and boosted customer satisfaction. The acquisitions of Reverb and Depop could bolster Etsy's position in the thriving markets for secondhand clothing and musical instruments. Depop, Etsy's apparel-resale platform, is attracting young shoppers, with a focus on Gen Z consumers. In my view, the company is currently undervalued, making it an attractive prospect for investors with a long-term perspective.

2Q 2023 Earnings Recap & Outlook

Etsy posted strong second-quarter results with revenue of $628 million and adjusted EBITDA of $166 million beating expectations. The improvement in active buyers was notable, primarily due to a significant 50 basis points year-over-year reduction in monthly churn rates. During the earnings call, the company expressed cautious optimism about achieving year-over-year growth in GMS from May to July. Etsy-owned platform Depop is showing signs of improvement, with positive growth in GMS and revenue, especially in the US market. Despite modest declines in the US domestic business, there were several positive indicators in this earnings report. Etsy's commitment to its product roadmap is impressive, and the advancements in Generative AI technology hold great potential for enhancing search and discovery capabilities and enabling cross-category shopping for Etsy's unique inventory. The company is actively positioning itself as more than just a platform for gift shopping, with ongoing improvements in curation and investments in purchase protection and trust. I believe there is an opportunity for product investments, especially those leveraging Gen AI technologies, to drive significant GMS growth in the fourth quarter.

Efforts to Improve Reliability Reaping Results

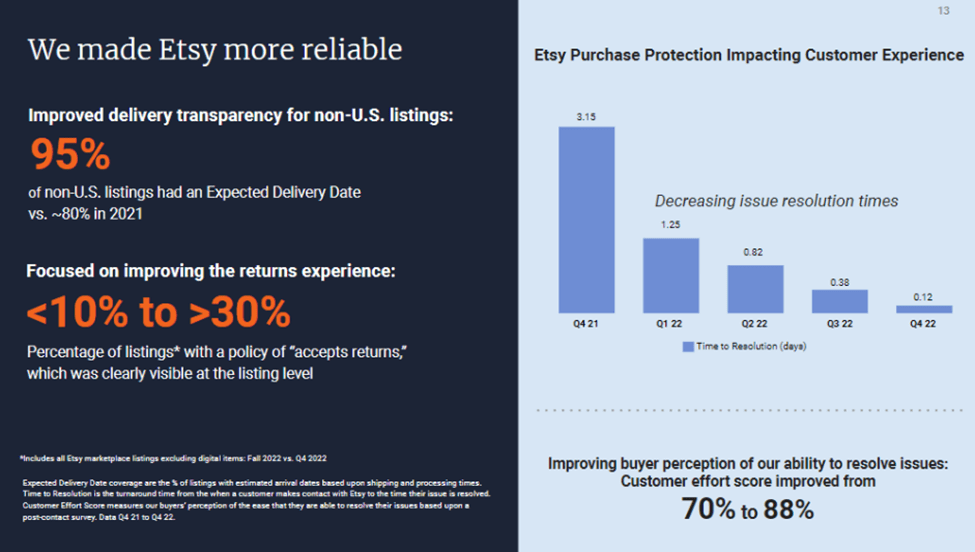

Etsy has significantly prioritized enhancing reliability in several aspects, primarily focusing on timely deliveries, customer reviews, and purchase protection. This strategic shift is pivotal in boosting both the frequency of purchases and conversion rates on the platform. Etsy has made substantial progress in enhancing transparency in delivery, offering buyers greater clarity and confidence when making purchases.

In the second quarter of 2022, the company introduced a purchase protection program aimed at simplifying the shopping and selling processes while providing a safety net for both buyers and sellers on eligible orders, covering issues related to quality or delivery up to a value of $250. This initiative has resulted in an 85% reduction in the time it takes to resolve customer issues, and Etsy's customer satisfaction score has surged to nearly 90%. Furthermore, Etsy's commitment to improving the returns process has led to over 30% of product listings now including clear return policies.

Company Presentation

Increasing Brand Awareness Due to Focus on Marketing Strategy

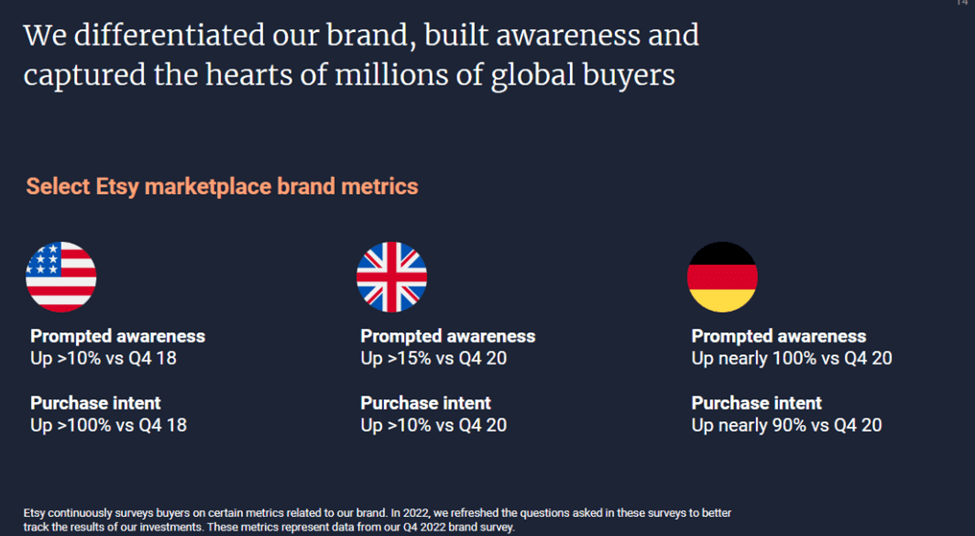

As Etsy isn't always the first choice for purchases outside of special occasions, executives are increasing the investments in brand marketing efforts, including television, digital video, and paid social media campaigns. Although this approach may take some time to show returns, it plays a crucial role in increasing the amount spent by each buyer and raising overall brand awareness.

Etsy has extended this strategy to other regions, leading to a fourfold growth in Germany's Gross Merchandise Sales compared to its 2019 levels. During the fourth quarter, the largest influx of new regular buyers came from Germany and Australia. Additionally, a new partnership with John Legend aimed at empowering female sellers has the potential to further boost the average order value and brand recognition. Etsy's performance-marketing spending resulted in approximately $2.5 billion in annualized gross merchandise sales in 2022, compared to $2.3 billion in 2021. In 2022, the company also improved the relevance of its advertisements, generating over $100 million in annualized revenue from this effort.

Company Presentation

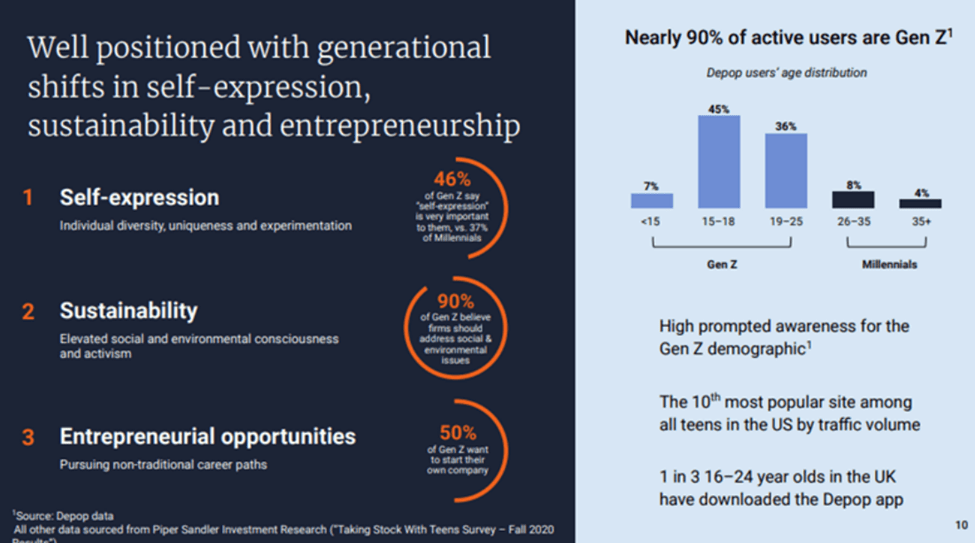

Depop Key to Attracting Young Shoppers

The demand for used products has risen among all age groups in recent years, but it's most pronounced among young shoppers, with 64% of Gen Z and Millennial consumers stating that they prefer to search for secondhand items before buying new one. In 2022, 64% of Gen Z individuals actively sought out used items before considering new purchases, and 82% factored in the resale value before making buying decisions. Depop, Etsy's apparel-resale platform, primarily targets Gen Z consumers, who make up 90% of its active user base. However, there's room for growth, given that there are 62 million Gen Z consumers in the US and 13 million in the UK who are open to purchasing secondhand products. In 2022, Depop had 30 million registered users, up from 28 million in 2021.

Depop allows Etsy to diversify its business into secondhand clothing while also attracting a younger demographic, particularly Gen Z. The global online resale market is experiencing significant growth, providing Etsy with opportunities for expansion in the re-commerce sector. Depop currently has a lower take rate (the fee charged to third-party sellers) than Etsy, but this could potentially increase through integration with Etsy's payment and advertising capabilities. In 2022, Depop's Gross Merchandise Sales surged by 88% to reach $552 million. While Depop may expand beyond apparel, it is likely to remain its primary focus as it continues to cater to younger consumers.

Company Presentation

Valuation & Financial Outlook

Etsy has significant growth potential within its total and online addressable markets. In 2022, Etsy generated more than $13 billion in GMS, and even if it reaches above $15 billion by 2025, as per consensus projections, it would still represent only a small portion of the total market opportunity. This indicates that there is ample room for Etsy to pursue a decade of robust growth in the high-single to low-double-digit range.

I expect Etsy's EBITDA margin could stay below the 30% target in 2023 as it makes more aggressive marketing and product investments, which I believe are needed to drive long-term growth. EBITDA margin accelerated amid pandemic-driven digital demand in 2020-21, reaching over 30%. A return to that level could take time and require that outlays moderate. I expect margin to return to 30%-plus by 2027. Marketing is Etsy's largest expense at 25-30% of sales, but offsite advertising could partially counterbalance some costs as the incremental revenue helps recoup about 35% of the company's performance-marketing spending.

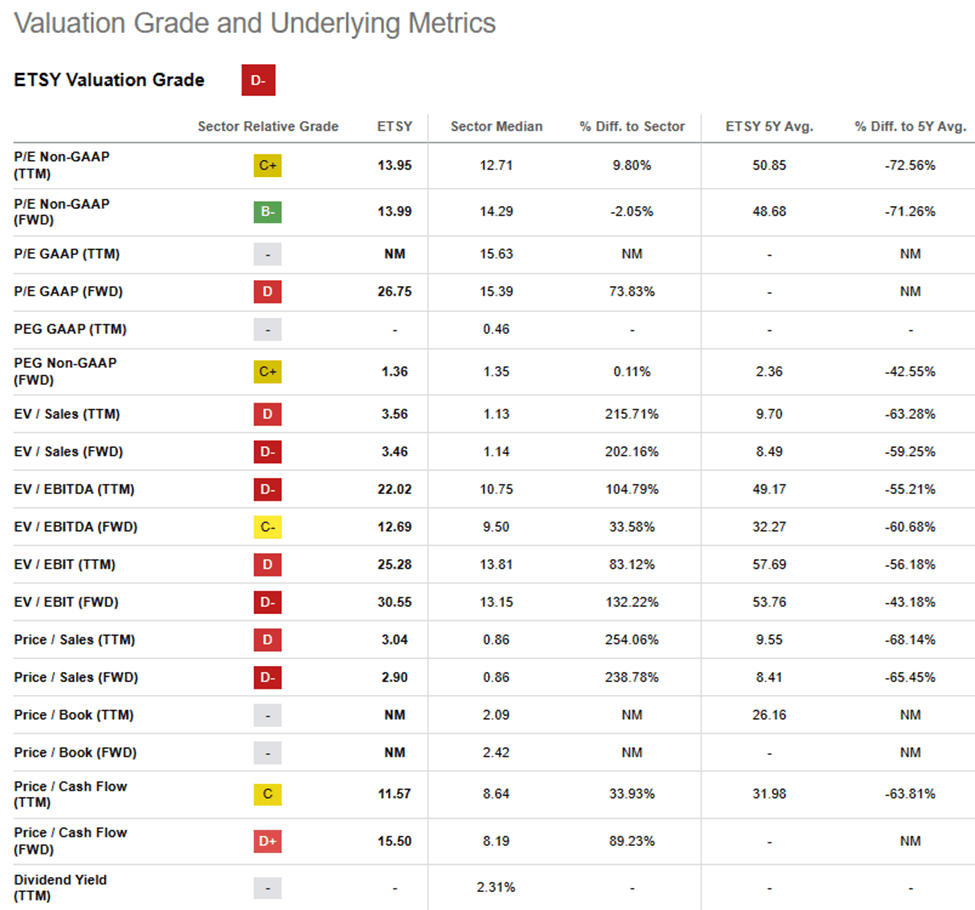

My positive outlook on EBAY is based on its relatively low price-to-earnings ratio and stable fundamentals, despite a slowdown in growth. This is especially notable when compared to other smaller-cap e-commerce companies that are currently operating at a loss. The stock has been trading within a certain range since late February. I acknowledge this multiple is well below recent historical multiples of 20x+ forward EBITDA. I view the stock as transitioning from a strong growth phase to a more mature phase and expect the multiple to adjust accordingly. Hence, I maintain my buy rating on the stock.

Seeking Alpha

Investment Risks

Judging from the recent commentary from e-commerce retailers, it appears that American consumers may be cutting back on non-essential spending due to rising concerns about inflation and shrinking savings. There's also a possibility that consumers are shifting towards more budget-friendly options, potentially leading to an excess of inventory in the retail sector and prompting additional price reductions. In the first quarter, ThredUp observed a 700-basis point increase in the number of higher-income shoppers using its platform as consumers seek more affordable alternatives. Companies like Amazon.com, Inc. (AMZN), Etsy, and Revolve, among others, have also noticed consumers opting for lower-cost products and placing a stronger emphasis on getting better value for their money.

Moreover, Etsy's stock has performed poorly this year, down 43%, while QQQ and FDN have shown strong gains, respectively. Investors have been concerned about Etsy's Gross Merchandise Volume and its ability to attract new customers. The declining efficiency in acquiring new customers poses a risk to the company's growth, which can affect the stock price going forward.

Conclusion

Etsy boasts a substantial customer base of approximately 90 million active buyers on its platform. When compared to other specialized marketplaces within its vertical, Etsy stands out with its larger customer base, a higher number of sellers, and greater gross merchandise sales. The company has placed a strong emphasis on enhancing reliability by improving aspects such as on-time deliveries, customer reviews, and purchase protection. These efforts have resulted in increased purchase frequency and improved conversion rates. The introduction of a purchase protection program has played a significant role in reducing the time taken to resolve customer issues and enhancing overall customer satisfaction. In my view, the company is currently undervalued in historical terms, making it an attractive prospect for investors with a long-term perspective.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.