Why We Like U.S. Fixed Income

Summary

- At the start of the year, many investors predicted 2023 would be the year of the bond. Instead, while fixed income returns have struggled, US equities have delivered double-digit returns.

- Stocks have benefited from conservative investor positioning at the end of 2022, a resilient US economy, and the expectation of an AI-led investment boom.

- Going forward, we believe there is a compelling case for being long US fixed income over equities.

DNY59

By Paul Mielczarski

At the start of the year, many investors predicted 2023 would be the year of the bond. Instead, while fixed income returns have struggled, US equities have delivered double-digit returns.

Stocks have benefited from conservative investor positioning at the end of 2022, a resilient US economy, and the expectation of an AI-led investment boom.

Going forward, we believe there is a compelling case for being long US fixed income over equities:

- The economic outlook for lower inflation and slower growth favors US bonds. The Federal Reserve (Fed) is likely done raising rates, and the focus will shift to an easing cycle. Core inflation momentum is converging toward the Fed's 2% target. The labor market is rebalancing rapidly, due to lower labor demand and strong labor force growth, which should lead to lower wage growth. Global growth is rolling over, led by China and Europe. While US growth has been resilient so far, we expect growth to slow as monetary policy lags kick in.

- US agency mortgage-backed securities look particularly attractive, with a higher yield than equities. We believe US fixed income valuations overall are compelling versus equities. Within fixed income, our preference is for agency mortgage-backed securities (MBS), which offer similar yields to investment grade bonds but with no credit risk and lower duration risk. The chart below compares the forward-looking US equity earnings yield with the yield on agency MBS. For the first time in 20 years, mortgage bonds have a higher yield than stocks (see Exhibit 1).1

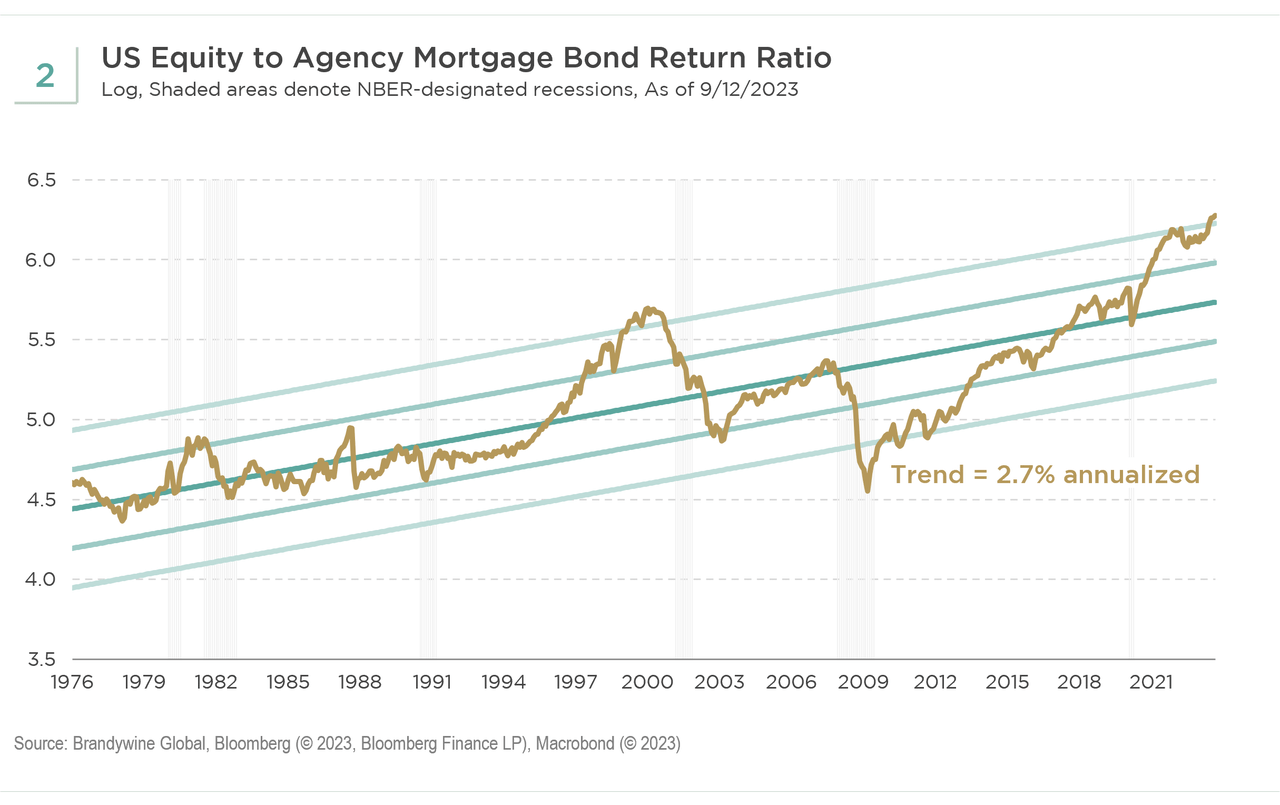

- Lower volatility over equities also supports the case for bonds. Return volatility of mortgage bonds is roughly 50-75% lower than US equities, making them very attractive from a portfolio construction perspective. In the late 1990s, equity yields were significantly below MBS yields, and that episode ended badly for US equity investors. The chart below shows that the equity-to-MBS return ratio is already more than two standard deviations above its long-term trend (see Exhibit 2).2 The last time we saw that was at the peak of the equity market bubble in 2000.

- Bonds may provide advantages across a range of economic outcomes. Overall, we believe US fixed income offers investors attractive asymmetry across a range of economic scenarios. In a soft-landing scenario, bonds are likely to generate decent returns, although they may struggle to outperform cash. In a deeper growth slowdown or financial shock, they could significantly outperform equities.

While US growth resilience has been surprising this year, it is important to recall that the full impact of the Fed’s cumulative, aggressive tightening is still to come. We see a variety of factors suggesting slower growth ahead and supporting our outlook for US bonds.

1 Exhibit 1 uses the S&P 500 Index to derive the earnings yield for US equities and the Bloomberg US Mortgage-Backed Securities (MBS) Index to derive the Agency MBS yield.

2 Exhibit 2 uses the MSCI USA Index to derive the equity total return and the Bloomberg US Mortgage-Backed Securities (MBS) Index to derive the Agency MBS total return.

The S&P 500 Index is a broad measure of U.S. domestic large cap stocks. The 500 stocks in this capitalization-weighted index are chosen based on industry representation, liquidity, and stability.

The MSCI USA Index is designed to measure the performance of the large and mid-cap segments of the US market. With 628 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

The Bloomberg US Mortgage-Backed Securities (MBS) Index tracks fixed-rate agency mortgage-backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (OTCQB:FNMA), and Freddie Mac (FHLMC). The index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon, and vintage.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by