Intel: Strategic Shift Could Yield Huge Growth And Margin Expansion

Summary

- Intel is undergoing a strategic shift towards becoming a chip fab and has launched Intel Foundry Services to compete with TSMC and Samsung.

- The shift could make Intel a competitive choice compared to competitors like TSMC, which faces geopolitical instability.

- The firm appears to be around 11%-35% undervalued, but caution is warranted given the recent profitability struggles Intel has faced.

- Current rating: Buy.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Intel (NASDAQ:INTC) is a semiconductor chip design and manufacturing firm currently undergoing a transformative strategic shift. The firm created the popular x86 CPU architecture that has dominated the PC industry for decades.

However, a recent shift towards ARM based products has led Intel to launch their Intel Foundry Services business segment with the aim of taking on TSMC (TSM) and Samsung in the fabrication division of the semiconductor industry.

This shift could make Intel a highly competitive and reliable choice compared to competitors such as the Taiwanese TSMC who suffer from geopolitical instability and uncertainty.

While valuations are cheap especially when considering the possibility for huge profits from the successful execution of their strategic shift, uncertainty regarding this transition limits my ability to assign anything more than a Buy rating for now.

Company Background

Intel is an American technology company specializing in semiconductor chip manufacturing. The firm is the world's largest microprocessor manufacturer by revenue and was originally the developer of the x86 chip architecture present in most current-day personal computers.

The firm supplies processing units to computer manufacturers such as HP, Dell, Lenovo and Acer to name a few. The firm has also recently begun diversifying their product portfolio to also include graphics processing units in a bid to enter into direct competition with Nvidia (NVDA) and AMD (AMD).

In 2021 Intel established their new "Intel Foundry Services" (IFS) business division. This ambitious expansion into the foundry business with the goal of becoming the second-largest foundry in the world by 2030 clearly illustrates the firm's desired direction over the coming decade.

While this vertical expansion within the semiconductor industry is an understandable step for Intel, the process of achieving these lofty goals will require huge amounts of time and capex.

Current CEO Pat Gelsinger has significant amounts of experience both with Intel before his 2021 appointment to CEO as well as generally within the Silicon Valley tech space.

I believe his successful track record along with direct experience relating to chip design and management at Intel during his stint as VP means Gelsinger is well suited to leading Intel through this huge phase of vertical integration and expansion.

Economic Moat - In Depth Analysis

Intel has historically been an Integrated Device Manufacturer (IDM) whereby the firm designs and manufactures their own semiconductor chips while simultaneously outsourcing a large portion of lower-end chip manufacturing to pure-play foundry companies such as TSMC.

The firm has built itself a wide economic moat based primarily on both their hugely successful x86 CPU chip designs and the cutting-edge manufacturing processes the company has developed in recent times. I believe these factors help provide the company with a competitive edge within the market.

Intel has a huge raft of IP and industry knowledge when it comes to processor design and manufacturing. The firm was responsible for developing the x86 chip design now used in most PC processors and for many years has enjoyed a dominant market position as the go-to x86 chip manufacturer.

While the company has mostly produced some of the most innovative, powerful and efficient computer processors to date, the firm has had some difficulties over the past few years keeping up with their own track record of progress.

Recent difficulties moving to their smaller 4nm node for manufacturing has held up chip designs which could yield much higher power per watt performance metrics for their processors.

When combined with an increasingly competitive chip design environment where Apple (AAPL), Google (GOOG) (GOOGL) and now reportedly Microsoft (MSFT) are looking to begin manufacturing their own processors has put Intel's chip design expertise to the test.

The significant successes Apple in particular has enjoyed with their transition to their own in-house "M" series ARM-based chips has eaten into Intel's dominant market position both quantitatively and qualitatively from a public sentiment perspective.

These design and manufacturing missteps combined with perfected execution from Intel's competitors has led to investor sentiment souring regarding the firm's ability to continue as a dominant player in the microchip market in the future.

I believe this sentiment is excessive and has undermined Intel's still wide economic moat and established position within the chip industry.

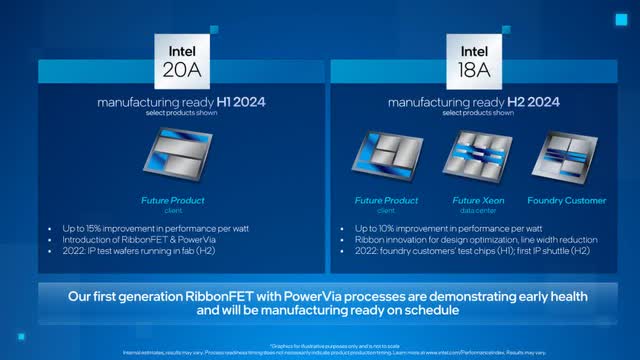

Intel Innovation Press Release

Intel has continued to innovate within the chip manufacturing space and continues to develop innovative new processes which should help produce even smaller node chips. Their newest 18A and 20A fabrication processes are scheduled to be ready for commercial manufacturing in H2 and H1 of 2024 respectively.

These innovative fabrication processes should enable huge performance per watt improvements for their latest chips and acts to demonstrate the genuine market-leading development currently taking place at Intel.

The proposed improvements should allow Intel to compete more effectively with Apple's "M" series chips and could help defeat AMD's persistent gains both in terms of popularity, market share and performance within the PC industry.

Intel's 18A and 20A fab processes will also be offered to IFS customers which should help attract key fabless manufacturers such as MediaTek and Qualcomm (QCOM) away from competitors such as TSMC. Gelsinger assured investors on a recent conference call that seven out of the 10 largest foundry customers have active pipeline engagements with Intel to benefit from these new processes.

Gelsinger also stated that there are 43 potential new IFS customers awaiting finalization of the 18A and 20A processes which could provide the company with huge and sustained revenue growth.

Intel has also partnered with ARM on a multigeneration collaboration to enable chip designers to build low-power compute system-on-chips (SoCs) processors using the 18A process. This mobile focused SoC partnership will see ARM customers benefitting from Intel's cutting edge 18A process technology.

This partnership illustrates Intel's newfound ability to take a slice out of the semiconductor chip pie even when it isn't their own product being manufactured. This key ARM and IFS partnership sets a precedent and should help get the ball rolling for Intel to sign multiple other large-scale chip manufacturers to utilize their foundry services.

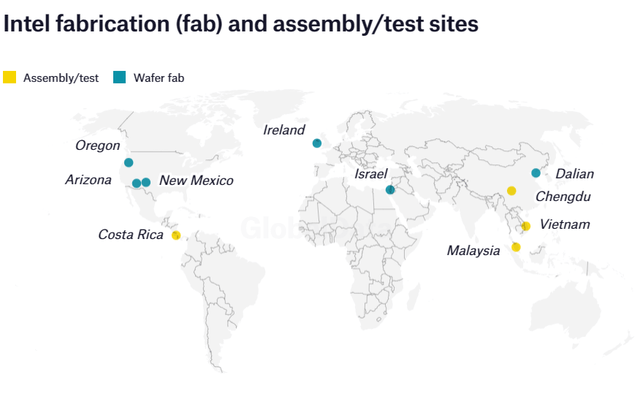

While Intel has process technology which rivals that of TSMC, the company also has one key trump card in their hand: they operate primarily in the U.S. and EU.

Intel is spending over $40B on building fabs in the U.S. alone with four new production plants, two in Chandler, Arizona, two in Ohio and one advanced packaging facility in New Mexico in the pipeline for the company.

The firm also has a wafer fab in Kildare, Ireland which illustrates Intel's desire to target Western markets with their products. By operating in politically and socially stable environments (when compared to the current state of Southeast Asia), Intel is able to offer a more reliable and less risky product to chip designers.

Intel announced that a $25B chip manufacturing plant would also be opened in Kiryat Gat, Israel along with a letter of intent being signed to increase the planned investment in their Magdeburg (Germany) plant too.

Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B) divested its stake in Intel's competitor TSMC not because the company is unsuitable or poorly managed, but probably simply because of the excessive geopolitical risk arising from China's hostile foreign relations. Therefore, I believe Intel has a real and tangible competitive advantage thanks to their strategic geographic positioning.

Intel also does large amounts of business with the U.S. Department of Defense who in 2021 inked a deal with the firm to provide commercial foundry services for RAMP-C chips. These will once again be fabricated using Intel's 18A node.

Such defense contracts provide Intel with a huge and reliable set of revenues that increase the stability of the firm's earnings. The recent CHIPS incentive program in the U.S. should help boost Intel's profitability and margins even through the ambitious IFS expenditure phase.

Overall, I believe Intel is about to benefit from unrivalled multi-business synergies and vertical integration efficiencies. Their extensive and still market-leading chip design abilities combined with the creation of dedicated foundry services could create a synergetic business with significant IP and knowledge sharing enhancing the abilities of both business both as independent entities and Intel as a collective.

I still believe that the company's chip design team is capable and primed to regain their streak of successful product executions especially with the assistance of Intel's own manufacturing process improvements. I also see IFS becoming a formidable player in chip manufacturing and absolutely capable of rivaling TSMC and Samsung in the space.

Therefore, I believe Intel still has a robust and wide economic moat that is about to get even wider. While poor execution and significant capital expenditure have soured some analysts opinions regarding the firm's moat, I believe little tangible damage has been done to their market position.

While increased competition within the chip design space has begun to rival Intel's dominance, the firm's pivot to becoming a more holistically involved business within the semiconductor industry should help the firm regain their stride. I see Intel's moat providing the firm with a competitive advantage for the next 25 years.

Financial Situation

The last five years have been relatively positive for Intel from a fiscal performance perspective. The company has managed to achieve 5Y average gross, operating and net margins of 54.24%, 24.30% and 23.15% respectively.

These margins illustrate that fundamentally, and prior to 2022 and the significant investment into IFS, Intel has been a significantly profitable firm operating with healthy margins.

For the same 5Y period Intel has also managed ROA, ROE and ROIC of 12.07%, 21.85% and 15.55% respectively. These figures, especially the healthy 15% ROIC once again affirm the hypothesis that fundamentally Intel has a highly profitable and efficient business operation that is characterized by excess returns on their invested capital.

However, if analyzing FY22 in isolation and the current progress of FY23, a different story begins to be told. FY22 saw Intel achieve a ROIC of just 5.75% and net margins of just 12.71% compared to 25.14% the previous year.

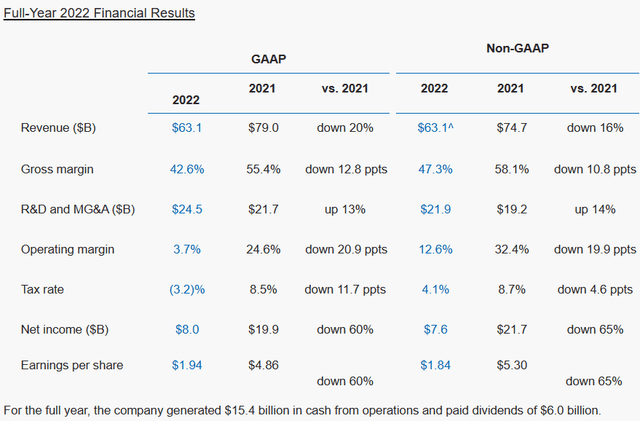

Full-year 2022 Earnings Press Release

FY22 represented the first set of financial results that began to be compromised by Intel's significant capex into their IFS foundries and fabrication plants. The year also saw their EBITDA margin contract by 10% from 42% to 33% YoY as a result of the highly inflationary macroeconomic environment increasing COGS while revenues simultaneously fell 20% YoY.

The decline in sales was led by a huge 36% drop in their client computing group ('CCG') business segment sales and a 33% drop in Data Center and AI ('DCAI') revenues.

These poor fiscal results overruled the progress Intel made towards getting their Intel 4 node to be manufacturing-ready which should help the development of even more power-efficient and high performance CPUs in the coming years.

FY22 also saw the firm continue to develop their Intel 3 node with progress being noted as proceeding on schedule.

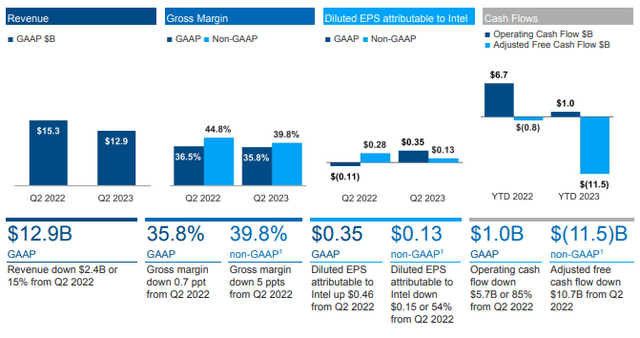

FY23 has been more encouraging thanks to their strong qualitative achievements and IFS progress being supported by increasingly positive fiscal results. Intel's most recent Q2 results saw revenues beat expectations by $900M while gross margins were 2.3ppt above the April outlook.

Still, revenue for Q2 was down 15% YoY while EPS was down a whopping 54% YoY.

These relatively weak results were still driven by much the same reasons as the firms lackluster FY22 earnings. Weak CCG revenue due to declining Intel Core processor sales led to bloated inventories which the firm has been working hard to reduce.

IFS also saw huge improvements in operating margins with a reduction from -235% to just -62% with revenues growing 307% YoY. Considering that over half of IFS production fabs are yet to be operational, these improvements illustrate that Intel is applying their decades of efficient and cost-effective operational practices into their IFS business too.

Intel also provided a revised Q3 outlook expecting revenue to be around $12.9-13.9B with gross margins of 43%. These still represent YoY decreases of 13% and 2.9ppt respectively.

The weak gross margin in particular is due to increasing COGS for their CCG segment and server business. While the current macroeconomic conditions have proved challenging for all firms, Intel has suffered acutely from this most likely due to the huge focus on financing their IFS expansion.

When these metrics are combined with total operating income for Q3 falling to -$1.1B along with the six months ended Jul 1, 2023 seeing losses of -$2.5B compared to profits of $3.6B the year before, it is not difficult to see why valuations for the company have dropped so significantly.

Much of Intel's revenues hinge on the crucial CCG segment which, due to weaker than expected PC sales and notebook sales in particular has led to volumes decreasing significantly. A decline in demand for PC's hurts Intel directly which illustrates the reliance the firm has historically held on a strong consumer computer marketplace.

However, considering the new diversification into a more supply-chain oriented provider of fabrication services, Intel stands to significantly increase the robustness of their revenues. IFS in particular should help reduce Intel's overall profitability fluctuations by decreasing the proportion of revenues exposed to the volatile consumer market.

Intel continues to develop more cloud-oriented and AI focused technologies too with their Data Center and AI segment which should see sustained growth moving past FY23. While compromising macroeconomic conditions have slowed what was initially expected to be an even more rapid adoption of AI and the Internet of Things into more business processes, Intel should see long-term gains from this business segment.

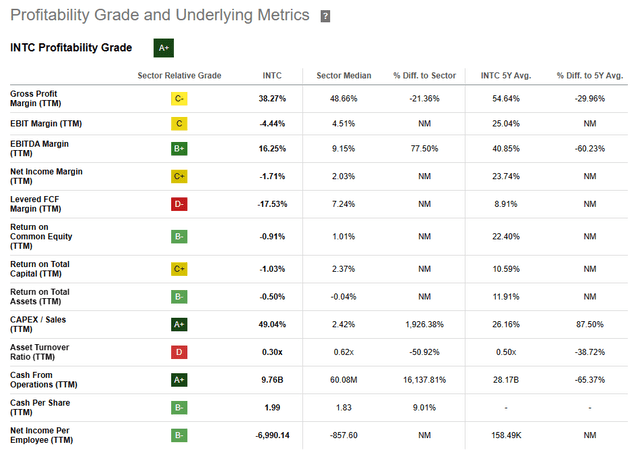

Seeking Alpha | INTC | Profitability

Seeking Alpha's Quant assigns Intel with an "A+" profitability rating. I believe this is a slightly optimistic summary of Intel's current profit generation abilities considering the losses the firm has posted for 2023.

Intel's balance sheet is still in relatively healthy form. The firm currently has $43.4B in current assets with current liabilities amounting to $27.18B. This current liquidity leaves the firm with a current ratio of 1.60 and a quick ratio of 1.0 exactly.

Total assets amount to $185.6B with total liabilities just $81.2B. This leaves the firm with an excellent debt/equity ratio of 0.49.

While these metrics suggest that Intel's capital allocation is sound, it must be considered just how intensive the firm's fab plans are on capital. Considering the firm's more lackluster FCF and profitability both last year and in 2023 so far, Intel will have to utilize large credit facilities to fund these projects.

While I ultimately believe the IFS business is key to Intel's survival and success moving forwards, it is undeniable that these expansions will take a toll on what have traditionally been very well managed balance sheets.

Nonetheless, it is exactly this history of sound capital allocation that leads me to believe that Intel will be able to manage the debt they are taking on while ensuring that future returns are extracted in excess of invested capital.

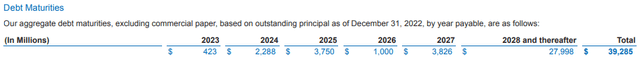

The firm's aggregate debt maturities amount to $39.285B.

The earliest major maturities of these debentures is 2024 with a majority maturing well beyond 2028. This staggered and well executed debt repayment profile reduces the risk Intel faces of illiquidity.

However, the $2.3B due in 2024 will most likely strain the firm's profitability especially if a macroeconomic slowdown leads to continuing declines in PC and data center revenues.

Intel has obtained an A2 credit rating from Moody's for their senior unsecured domestic notes. The agency believes the outlook is negative for Intel due to the expectation of the firm increasing their debt over the coming years. A2 is classified as credit obligations which are "judged to be of upper-medium grade" and "low credit risk" by Moody's.

Overall, I believe Intel is an outstandingly profitable firm that, due to recent expansion into the fab industry combined with short-term macroeconomic headwinds coinciding with some missed execution of products has led to worse than anticipated earnings.

Fundamentally the firm remains a profitability powerhouse that just needs time to turn the ship around. I do not believe that long-term profitability has been compromised and believe their solid and robust economic moat will provide the company the competitive advantages required to excel in the coming years.

Valuation

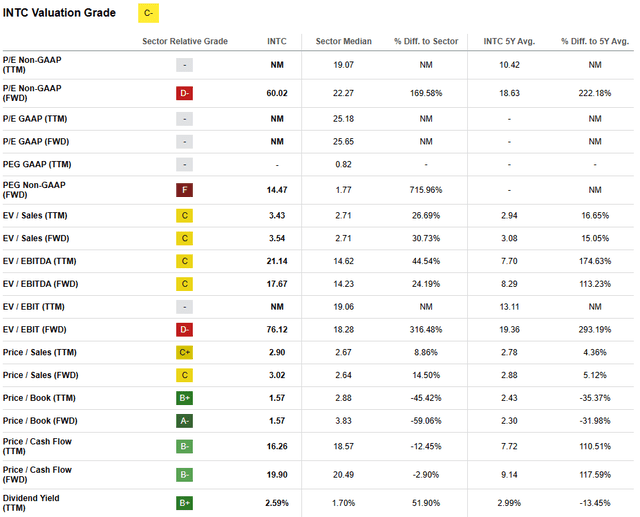

Seeking Alpha | INTC | Valuation

Seeking Alpha's Quant assigns Intel with a "C-" Valuation rating. I believe this is may actually be quite an accurate representation of the value present in Intel stock today due to the uncertainty regarding the time required for the firm to return to profitability.

The firm currently trades at a P/E GAAP FWD ratio of 8.18x along with a P/CF TTM of just 16.26x. Their FWD EV/EBITDA of 17.67x is a little elevated to my liking especially when considering their EV/Sales TTM and FWD of just 2.90x and 3.02x respectively.

These basic valuation metrics suggest Intel may be trading somewhere around a fair valuation compared to what the company is currently worth.

Seeking Alpha | INTC | Summary Chart

From an absolute perspective, Intel shares are trading at relatively low valuations. Over the last 5Y, the firm has produced -16.6% returns with a mid-2021-2022 selloff resulting in a significant valuation degradation.

YTD however the firm has rallied thanks to investors viewing the material qualitative gains Intel has made with IFS and their new node advancements positively leading to a 31% rise.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison being to paint the value picture present at Intel, a more quantitative assessment must be made.

The Value Corner

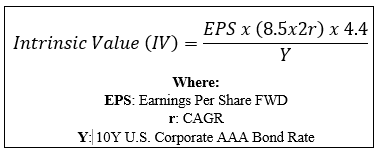

By utilizing The Value Corner's Intrinsic Valuation Calculation, one can better understand what value exists in the company from a more objective perspective.

Using Intel's current share price of $37.88, an estimated 2023 EPS of $1.80, a conservative "r" value of 0.09 (9%) and the current Moody's Seasoned AAA Corporate Bond Yield ratio of 4.95x, I derive a base-case IV of $42.40. This represents an 11% undervaluation in the firm.

When using a marginally more optimistic CAGR value for r of 0.14 (14%) to reflect a scenario where Intel aces the execution of new processes, fabs and consumer chips, Intel appears to be undervalued by around 35% with an intrinsic value of $58.40 per share.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe Intel is trading somewhere between a roughly fair valuation and a significant undervaluation. This is due to the uncertainty surrounding the timeline Intel requires to make their new strategic shift profitable and enticing for shareholders.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations given the uncertainty of the macroeconomic environment and Intel themselves. While Intel shares have seen a strong YTD rally, whether or not this will continue is difficult to predict.

The firm's short-term performance is tied to the general sentiment surrounding U.S. and global economic performance as a whole with a recession potentially leading to dropping share prices. A slower rebound in PC sales could also significantly harm Intel's short-term profitability and weak Q4 results could lead to very pessimistic valuations for the firm.

In the long term (2-10 years), I see a completely different future for Intel. I believe they will be able to regain the successes they have previously seen both in their CCG segment and in the rapidly growing IFS business.

The IFS business could become Intel's largest business segment by revenue if the firm is able to capture large and influential customers such as Apple or Qualcomm. Furthermore, the stability provided by business with the U.S. Department of Defense along with significant U.S. subsidies should help bolster results and valuations.

Risks Facing Intel

Intel faces some material risks with the primary factors coming from competition within their CCG segment and the potential for IFS to struggle to achieve profitability.

In the CCG segment, the real threat of the entire notebook segment switching to ARM based processors would harm Intel significantly. Intel's x86 architecture can be more powerful than ARM-based ones but at the cost of power efficiency. Because of this, ARM is rapidly becoming a more favorable processor for mobile devices due to the possibility for ultra-long battery life.

If Microsoft's next Windows version begins the transition to ARM, Intel may begin to see a rapid and marked decrease in demand for their x86 CPUs.

The risk that IFS takes longer than expected to begin returning tangible profits for the company is also a key risk currently facing Intel. While IFS has the potential to become a truly essential element of the semiconductor business, the timeline for Intel to achieve this is cloudy.

Much depends on how fast fabs are opened and the number of customers Intel is able to attract. While Intel does have multiple tangible IP advantages compared to its competitors such as TSMC, the potential for failed or partial execution of some new innovations is always present.

If these two aforementioned risks were to coincide, Intel could see a rapid and sudden decrease in profitability which ultimately could limit the firm's ability to develop and expand their IFS business. Simply put, IFS's success is the key to Intel's prosperity and survival in my view.

From an ESG perspective Intel faces very little risk. Both environmentally and socially the firm is committed to creating a positive effect on all stakeholders engaged in business operations with the firm.

For a more ESG conscious investor, Intel may be one of the best tech companies at satisfying the increasingly stringent demands corporations are facing for environmental, social and governance responsibility. Of course, opinions may vary and I implore you to conduct your own ESG suitability research should this be of concern to you.

Summary

Intel is an interesting company with a huge amount of achievements and history in the rearview mirror. The company's track record sets a precedent for the company to keep performing and innovating which ultimately has begun placing a strain on the firm's cash flows.

Increased CCG competition from the rapid growth in popularity of ARM SoCs instead of x86-based CPUs has coincided with Intel's launch of IFS and the ensuing capital requirements needed to fund the expansion. While IFS should ultimately provide Intel with a huge set of business synergies and a solid position within the semiconductor industry as a fabricator, the time required to achieve this status is unclear.

This has led to deteriorating results souring investor sentiment and sending shares downhill. While a strong YTD rally has sparked some hope for short-term valuations, I believe volatility may be present in the coming months.

However, in the long-term Intel is in a stronger position than ever. I believe they have increased the robustness of their economic moat and have reacted appropriately to a changing market environment. I have little doubts that Intel is in the prime position to benefit from the growing demand for chips by tapping into multiple business segments within the industry.

Considering the uncertainty and hopes of a bright future for the firm, I rate Intel a Buy. The slight yet real undervaluation still present in shares should help create some wiggle room for investors even if short-term results are less than stellar. I see Intel as a medium-risk hold that could yield patient value- and growth-oriented investors with outsized long-term gains.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.