Astria Therapeutics: Too Much Baggage, Too Strong A Competition

Summary

- Astria Therapeutics (formerly Catabasis Pharma) has raised $100 million and acquired Quellis to develop STAR-0215, a plasma kallikrein inhibitor for hereditary angioedema (HAE).

- STAR-0215 has a longer half-life than existing HAE treatments, potentially offering a longer duration of action.

- The company is currently conducting a proof of concept trial for STAR-0215 in HAE patients, with results expected in mid-2024.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Pgiam/iStock via Getty Images

Today we will look at Astria Therapeutics (NASDAQ:ATXS), which was once known as Catabasis Pharma. Right at the outset, I want to state categorically that I have a problem with companies that change their names. A name change can occur in many ways, some benign, some not so benign. A name change can occur due to a) a company merging with another in order to gain quick access to NASDAQ, b) a company switching to a new business segment, say from oncology to immunology, and c) a company wishing to hide bad history. This last one is a problem. These companies exist to take care of their management alone, and when one shell is worn out, they switch to a new one, trusting in the forgetfulness of the market.

A cursory glance is not enough to judge which is which; sometimes, a company that has baggage may be taken over by another for its real assets, and the new company may have the old name, but new management, and new pipeline. The key to understanding whether a name change is benign is to look at management and history together. If there is bad history (basically bad trial data) and the new company has the same old management, it is time to be cautious.

Sometimes, this rule is broken, like, it appears, with Catabasis-Astria. Catabasis, which I used to follow, failed a pivotal DMD trial in 2020. The same CEO does remain - Jill Milne. However, she was able to raise $100mn from some major funds even after the DMD failure - which is impressive. The company used these funds to buy a privately held company called Quellis, one of whose assets was a monoclonal antibody inhibitor of plasma kallikrein, STAR-0215. STAR-0215 is now the lead candidate of the new company, Astria.

STAR-0215 targets HAE. There are 8 approved medications for HAE, which can be divided into three major classes and two major types. The three classes are plasma kallikrein inhibitors, bradykinin B2 receptor antagonists, and C1 Esterase Inhibitors; and the two types are, preventive treatments which are generally long acting, and treatments for acute HAE attacks, which are intense but short acting. STAR-0215’s claim to eminence is that it is a plasma kallikrein inhibitor that is longer acting than the long acting ones. It has a half life of 110 days, so it can be a very long duration treatment option.

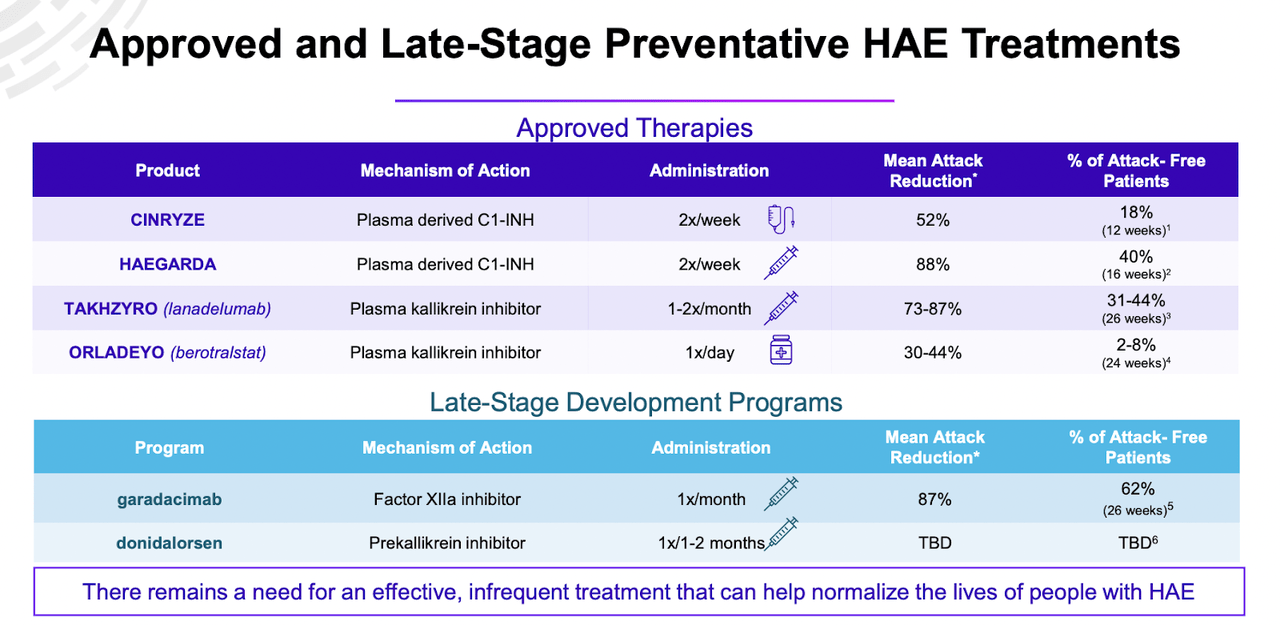

The company provides a picture of the competition:

STAR-0215 has shown it has a best-in-class pk profile with long 3 to 6 months dosing, so it fits into a very significant gap in the therapy landscape seen above - if it can show strong numbers in attack reduction in a large number of patients.

STAR-0215 preclinical data was published in the Journal of Pharmacology and Experimental Therapeutics. I will reproduce the data in full, because a careful reading of the text will clear a number of concepts about HAE and how the molecule works:

Hereditary angioedema (HAE') is a rare autosomal dominant disorder caused by a deficiency in functional C1 esterase inhibitor (C1-INH), a serpin family protein that blocks the activity of plasma kallikrein. Insufficient inhibition of plasma kallikrein results in the overproduction of bradykinin, a vasoactive inflammatory mediator that produces both pain and unpredictable swelling during HAE attacks, with potentially life-threatening consequences. We describe the generation of STAR-0215, a humanized immunoglobulin G1 (IgG1) antibody with a long circulating half-life (t1/2) that potently inhibits plasma kallikrein activity, with a >1000-fold lower affinity for prekallikrein and no measurable inhibitory activity against other serine proteases. The high specificity and inhibitory effect of STAR-0215 is demonstrated through a unique allosteric mechanism involving N-terminal catalytic domain binding, destabilization of the activation domain, and reversion of the active site to the inactive zymogen state. The YTE (M252Y/S254T/T256E) modified fragment crystallizable (FC') domain of STAR-0215 enhances pH-dependent neonatal Fc receptor (FC'Rn) binding, resulting in a prolonged t1/2 in vivo (⁓34 days in cynomolgus monkeys) compared to antibodies without this modification. A single subcutaneous dose of STAR-0215 ({greater than or equal to} 100 mg) was predicted to be active in patients for 3 months or longer, based on simulations using a minimal physiologically based pharmacokinetic (mPBPK) model. These data indicate that STAR-0215, a highly potent and specific antibody against plasma kallikrein with extended t1/2, is a potential agent for long-term preventative HAE therapy administered every 3 months or less frequently.

So what we get from here is the mechanism with which HAE works, and how each target protein comes together to produce it. We also see the extended activity duration of the molecule as predicted in simulations. There are preclinical hints of specificity and efficacy.

This data was followed by phase 1a data in healthy volunteers, which showed a safe and tolerable profile with mild AEs. Other key efficacy-related data were:

Results show rapid and sustained achievement of STAR-0215 concentrations consistent with clinical benefit (≥12 µg/ml1-3 ) after single subcutaneous doses

Concentrations are proportional to dose

Estimated half-life is up to 117 days, >5 times longer than lanadelumab

Long elimination phase consistent with YTE-modification

A number of model estimates were made for duration and attack reduction, and these were all best in class. For example, validated models predicted a greater than 90% attack reduction, and also predicted best results even at 6 month dosages. The company is now running a proof of concept trial in HAE patients, with results expected in mid-2024.

Financials

ATXS has a market cap of $234mn and a cash reserve of $203mn. Research and development expenses were $9.1 million for the three months ended June 30, 2023, while general and administrative expenses were $6.0 million. At that rate, they have a cash balance of 15-18 quarters.

ATXS stock is largely held by institutions. Key holders are FMR, Xontogeny and Perceptive. There is no insider purchase.

Risks

Despite what I said, the bad history is a bit of a worry, especially when we realize that this once-failed company really has just a single asset to establish itself. Now, that asset has one thing going for it - it can be given at longer intervals than existing therapies. However, in the larger scheme of things, that, alone, will not matter. STAR-0215 also has to beat the well-diversified competition in reducing HAE attacks. While there are early positive signs, there is no human patient data; and we know how much can go wrong between the lab and the clinic.

Bottom line

ATXS is doing some interesting work, but the field is so diversified, they really have to work harder than ever to prove themselves, especially because they have no fallback option. The market certainly sees the problem clearly, and therefore does not assign much value to the company beyond its cash. I have no reason to doubt the market’s wisdom right now; but we will see.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.