Fastenal: Intriguing Story But Too Steep Price

Summary

- Fastenal Company manufactures and sells industrial and construction supplies to businesses.

- The company has demonstrated impressive long-term financial performance with stable growth and margins.

- The current valuation of the stock is excessively high with a significant DCF model downside, leading to a sell-rating at the current price.

urbancow

Fastenal Company (NASDAQ:FAST) manufactures and sells industrial and construction supplies to businesses. The company has demonstrated very impressive long-term financials. As the company’s valuation reflects an excessively good performance from the company, though, I have a sell-rating for the stock at the current price.

The Company

Fastenal provides industrial supplies – the company’s offering includes products such as screws, safety gloves, and electrical tools:

Fastenal's Offering (fastenal.com)

The company sells these products mostly in the United States, Canada, and Mexico, but does also sell internationally.

Fastenal’s stock price has risen by around 122% in the past ten years, translating to a CAGR of 8.3%:

10-Year Stock Chart (Seeking Alpha)

In addition, the company pays out a quarterly dividend, with an estimated forward yield of 2.54%.

Financials

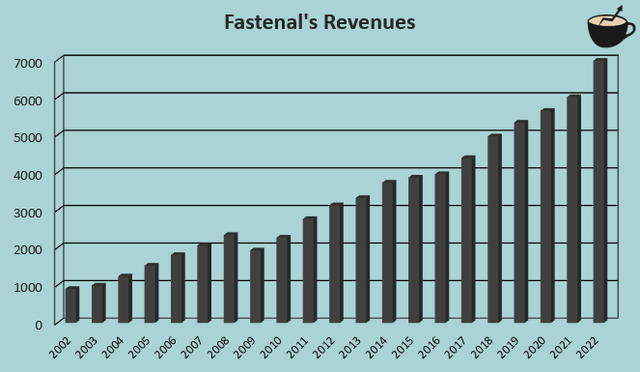

The company has achieved a very good compounded annual growth of 10.8% from 2002 to 2022 in a very stable manner.

Author's Calculation Using TIKR Data

Impressively, the growth has been mostly achieved organically – Fastenal has less than $300 million in cash acquisitions from 2013 to 2023. Compared to the company’s current market capitalization of around $32 billion, the acquisitions seem to play a very minimal part in Fastenal’s story.

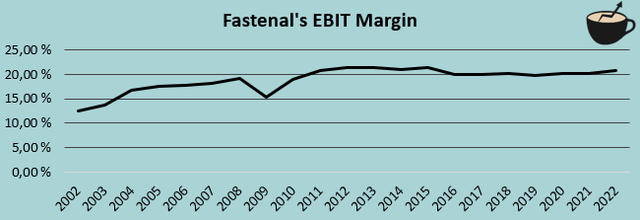

More than just a good growth rate, Fastenal has achieved a stable and high EBIT margin. The company’s trailing margin stands at 20.7%, a very healthy rate around the company’s medium-term average:

Author's Calculation Using TIKR Data

Demonstrating Fastenal’s margin stability, from 2012 to Q2/2023, the company’s margin has fluctuated between a very tight range on a quarterly basis – in the period, the company’s lowest margin is 18.68% and highest is 22.65%; very few companies are able to keep such a stable margin.

Many of the companies that I’ve recently written about have recently seen declining earnings as interest rates have risen and as the economy’s having some turbulence – Fastenal on the other hand has only reported growing earnings. In the first half of 2023, Fastenal’s EBIT rose by 6.3% from the previous year’s period. In the company’s Q2 earnings presentation, the company commented the quarter to have been challenging – I don’t see such challenges in the achieved financials.

Fastenal’s balance sheet is quite non-threatening – the company has around $350 million in long-term debt, a very low amount compared to the company’s size and its earnings. Of the debt, $150 million is in current portions. The company has kept its debt level very low for a long period. Although this decreases the risk level for investors, I believe a higher amount of debt would provide Fastenal with a cheaper financing alternative, creating shareholder value for investors. Fastenal also has a healthy cash balance of around $244 million.

Valuation

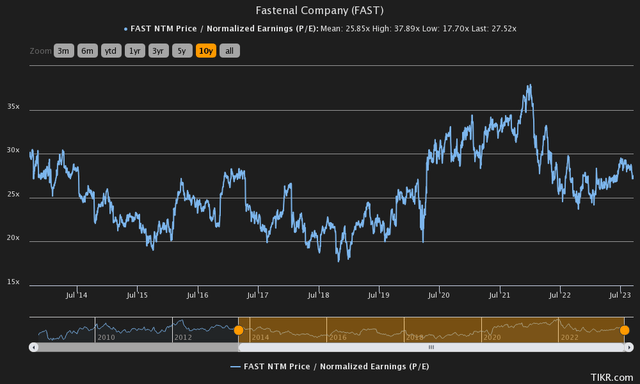

Although the company has very impressive financials, I am not so optimistic about Fastenal’s valuation. Fastenal currently trades at a forward price-to-earnings ratio of 27.5, around the company’s ten-year average of 25.9.

As interest rates are currently higher than in the period, a higher required rate of return should be expected – I don’t see the current price as a good opportunity looking through this lens.

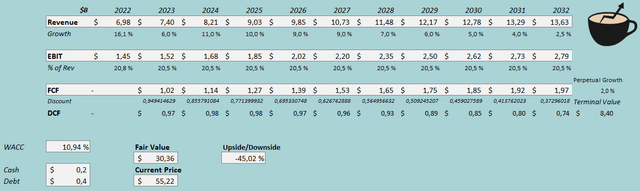

To get a better grasp of the valuation, I constructed a discounted cash flow model in my usual manner. In the model, I estimate a slightly lower growth for 2023 than the company’s historical rate, as in H1 the company only had a growth of 7.5% - I conservatively estimate a growth of 6% for the year. Going forward, I estimate Fastenal to accelerate the growth from 2023 with a growth of 11% in 2024. After the year, I estimate the company’s growth to slow down in steps into a perpetual growth of 2%. The DCF model’s estimates amount to an estimated revenue CAGR of 6.9% from 2022 to 2032.

As for Fastenal’s margin, I estimate further stability – I have a stable margin of 20.5% in 2023 as well as the company’s entire future. I don’t see any catalysts to estimate a varying margin from Fastenal’s medium-term history. These estimates along with a cost of capital of 10.94% crafts the following DCF model, with an estimated fair value of $30.36, around 45% below the stock’s current price, signifying a substantially overvalued stock:

DCF Model (Author's Calculation)

Fastenal could potentially surprise the DCF model's estimates to the upside, creating a fair value that's closer to the current price; for example, the company could expand its margin or have a growth that's greater than in my estimates - the CAGR of 6.9% is lower than Fastenal's historical rate.

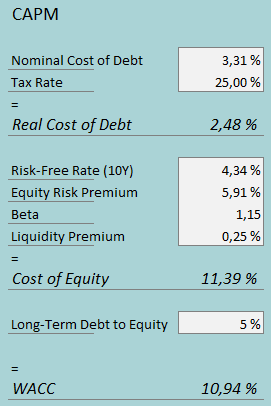

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author's Calculation)

In Q2, Fastenal had $2.9 million in interest expenses. With the company’s current amount of interest-bearing debt, Fastenal’s interest rate would be 3.31% - the company seems to have managed to keep a very good interest rate. Fastenal’s debt-to-equity ratio has been historically very low though – in the model, I estimate a long-term debt-to-equity ratio of only 5%.

For the risk-free rate, I use the United States’ 10-year bond yield of 4.34%. The used equity risk premium estimate of 5.91% is Professor Aswath Damodaran’s latest estimate.

Yahoo Finance estimates Fastenal’s beta to be 1.15 – the company has kept a very good earnings level despite a turbulent current economy, and in the financial crisis Fastenal’s operating income only fell by 34% for a single year. I believe the beta could be significantly lower in the future, as Fastenal has demonstrated stabile earnings throughout economic turbulence with very little debt, but for the time being, I use Tikr’s estimate in my CAPM.

Finally, I add a small liquidity premium of 0.25%, crafting a cost of equity of 11.39% and a WACC of 10.94%, used in the DCF model.

Takeaway

Fastenal is an amazing company with a very impressive past. Unfortunately, though, I have to have a negative view of the stock as an investment at the current price – the price seems to price in way too much from the company as my DCF model estimates a downside of 45%. Even with a lower beta of 0.8, that could be theoretically argued for the stock, the DCF model would point towards a downside of 29% - with a beta of 0.46 the stock would be correctly priced with my DCF model estimates, a figure around Walmart’s beta of 0.49. I don’t see such a beta as reasonable.

If the stock price falls, I would be ready to change my view of the investment opportunity. For the time being, though, I have a sell-rating for the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.