W. P. Carey: A Gift For Passive Income Seekers

Summary

- W. P. Carey stock price and valuation multiples have reached a multi-year low due to market concerns over inflation and interest rate risks.

- Such concerns may be justifiable for the REIT sector as a whole.

- But specific to WPC, the market has neglected its unique strengths that made it better shielded from these headwinds.

- As such, the stock now offers a high current yield and high price appreciation potential, an appealing combination for income investors.

- Looking for a helping hand in the market? Members of Envision Early Retirement get exclusive ideas and guidance to navigate any climate. Learn More »

NosUA

WPC valuation near decade-low

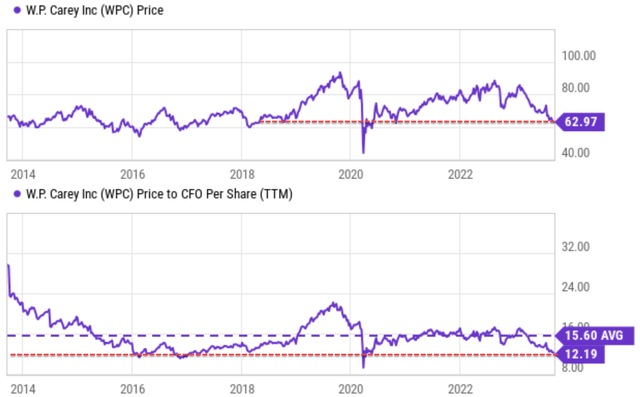

The stock prices of W. P. Carey (NYSE:WPC) have corrected to a multi-year bottom, largely due to market concern over inflation and interest rate risks. As seen in the top panel of the chart below, its current price is where it was in 2018 if you ignore the outliers during the COVID panic sale.

While on the other hand, its business fundamentals remain solid, and earnings have been growing at a healthy pace. When a stagnating price is combined with stable fundamentals, the net result is a very compressed valuation as seen in the bottom panel of the chart. To wit, at the price of this writing (around ~$63), its P/AFFO multiple is only 12.2x. It's not only far below the historical average of about ~15.6x but also near the bottom levels in a decade.

The market concern that caused such valuation compression in my view is of course not baseless. Both high inflation and high interest rates can hurt REITs and WPC in many ways. Inflation can increase the cost of operating expenses, such as insurance and maintenance. Inflation can erode the value of REITs' real estate assets as the true purchasing power of the dollar declines. And as for high interest rates, it's common knowledge among REIT investors that REIT companies typically rely on debt financing. Hence, higher interest rates can increase their borrowing costs and pressure their profit.

The goal of this article is to scrutinize the above traditional wisdom more closely. My thesis is that it will respond much less sensitively to these headwinds than the average REIT sector thanks to its differentiating business model. Thus, the market concern is overblown, in my view. Such overreaction created an excellent buying opportunity, especially for income-oriented investors considering its generous and consistent payouts.

A gift for income investors

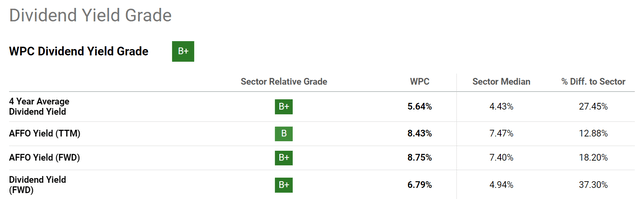

The table below shows WPC's dividend scorecard relative to its own historical record and also the sector. As seen, the stock currently yields 6.8% on a FWD basis. Such a yield is far above its four-year average dividend yield of 5.64% (by more than 27%) and also far above the sector median of 4.94% (by more than 37%).

Such a generous dividend yield is not only relatively insensitive to inflation but also can help income investors fight inflation. A key differentiation factor in WPC's business model is its net lease structure, which helps to mitigate inflation risk substantially. Under the net lease structure, the tenant is responsible for all the expenses and the inflation risks involved, such as property tax obligations, insurance costs, and maintenance costs. As such, WPC is not as exposed to rising costs as other REITs. Moreover, thanks to the premium quality of its assets, the company has been able to grow its earnings at a pace far exceeding that of inflation. For example, its revenue growth has averaged at 11.6% CAGR in the past three years, and its FFO averaged at 6.34% CAGR.

Next, I will explain why the concern over high interest rates also is overblown.

Interest rate risk and debt

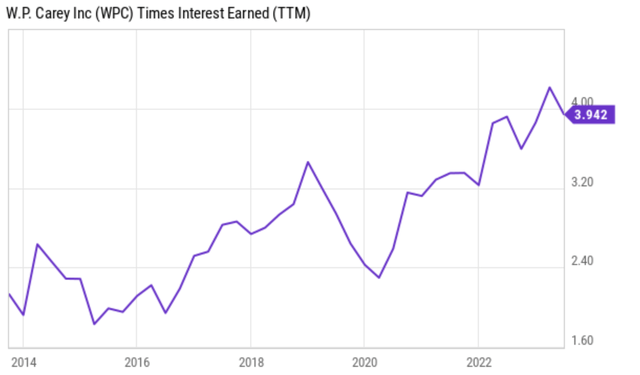

As aforementioned, it's certainly true that REITs are in general sensitive to interest rates as they rely heavily on debt financing. However, WPC offers a few unique advantages to differentiate itself from the average sector too. First, its leases are mostly long-term, which serves to mitigate interest rate risk. Furthermore, WPC's leases typically have fixed interest rates. As a result, its borrowing costs are not directly/immediately affected by rising interest rates. Second, WPC's diversified portfolio of commercial properties offers another layer of protection against interest rate changes. Some of its tenants may respond negatively to a high-rate environment but some of them may respond positively. Finally, as you can see from the chart below, WPC's leverage is currently at the lowest point in a decade when measured by interest coverage.

Such a low leverage not only helps to better shield it from interest risks but also provides capital allocation flexibility, especially powerful at a time when the overall REIT sector is under pressure. Indeed, it has been quite active with new investments recently. The year-to-date investment totaled at a substantial $735 million. Of course, it also has been divesting some of its properties. But overall, the divestiture is almost negligible (for total proceeds of around $43 million in the past quarter).

Among the new investments, the most notable one is the acquisition of Apotex. Apotex is Canada's largest generic pharmaceutical company. The acquisition involves a sale-leaseback transaction. The transaction is structured so that A) WPC funded the acquisition of 11 properties, including four R&D and manufacturing campuses for $468 million, and B) the transaction involved a triple net master lease with 3% fixed annual escalators over a 20-year term. Moreover, WPC financed the transaction entirely with internal funds thanks to its capital flexibility.

In a nutshell, the Apotex acquisition serves as an excellent example of its strengths mentioned so far: Long-term leases, built-in escalators to fight inflation, and capital allocation flexibility to make opportunistic acquisitions.

Final thoughts: Concerns over risks are overblown

I do not see any fundamental risk specific to WPC at this point. The company faces many of the risks common to other REITs. The leading risk is the possibility of an economic downturn. A recession could lead to a decline in demand for commercial properties, which usually respond more sensitively than other more defensive sub-sectors. Another risk involves tenant defaults (again, a risk common to other REITs too). After the completion of the Apotex acquisition, I anticipate such risk to increase a bit. Apotex will be its third-largest tenant by that time, replacing U-Haul (assuming U-Haul's repurchase of 78 self-storage properties) and representing a high weight in its revenue mix. Although overall, my view is that WPC has a well-managed and well-diversified portfolio of properties. The risk of tenant default is minimal to start with. The impact of one single tenant would be even lower.

To conclude, I attribute the recent pressure on WPC to market concern over inflation and interest rate risks. Such concerns may be justifiable for the sector as a whole. But specific to WPC, I view such concern as overblown. My thesis is that WPC is better positioned to respond to these headwinds than the average REIT sector thanks to its unique strengths. And the top ones in my mind are its net lease structure, long-term leases, built-in inflation escalator, and record-high interest coverage. Thanks to these differentiating factors and the valuation compression, the stock now offers both a high current yield and high price rebound potential, an appealing combination for income-oriented investors.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.

This article was written by

** Disclosure** I am associated with Envision Research

I am an economist by training, with a focus on financial economics. After I completed my PhD, I have been professionally working as a quantitative modeler, with a focus on the mortgage market, commercial market, and the banking industry for more than a decade. And at the same time, I have been managing several investment accounts for my family for the past 15 years, going through two market crashes and an incredible long bull market in between.

My writing interests are mostly asset allocation and ETFs, particularly those related to the overall market, bonds, banking and financial sectors, and housing markets. I have been a long time SA reader, and am excited to become a more active participator in this wonderful community!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

thanks for the nicely presented article on WPC.

This is one of my largest holdings even at its current share price @ ~4% of my portfolio. I am going to continue to buy in small amounts up to %5 of the portfolio, and whenever the price of the stock goes up in the future I will likely trim 1%.

I am a pre retiree looking for safe passive income, WPC works for me.

I really like the triple net lease space.

Fish

Long WPC, O, NNN, ADC