Sprinklr: Expecting Revenue To Regain Momentum

Summary

- I expect revenue to accelerate back to a 20% CAGR trendline, supported by strong subscription billing growth and CCaaS deals won.

- The company's business model allows it to benefit from the global trend of digital security and the increasing connectivity of the world.

- The CCaaS market presents significant opportunities for Sprinklr, with projected growth and a focus on forging partnerships in the customer service realm.

Charday Penn

Summary

This post is to provide my thoughts on the business and stock after reviewing the business and its latest quarter performance. I am recommending a buy rating for Sprinklr (NYSE:CXM) as I expect revenue to accelerate back to the 20% CAGR trend line eventually. In my opinion, the underlying metrics (subscription billing growth and RPO metrics) along with the CCaaS deals won are indications of growth momentum.

Business Overview

CXM provides a comprehensive social media management system and associated services designed to assist enterprises in adapting their internal networks to the socially connected and empowered customer landscape. The business has two sub-segments: subscription (89% of FY23 revenue) and professional services (11% of FY22 revenue). The subscription business is effectively the profit driver (80% gross margin), as professional services have a gross margin in the low teens. Has done extremely well over the past few years, growing at >20% CAGR at the topline and reaching positive adj EBITDA levels over the last 12 months. Given the nature of CXM's business, it is able to ride on the global secular trend of digital security, and I expect it to continue to benefit from it as the world becomes more connected digitally.

Investment Thesis

CXM has had a fantastic quarter in terms of performance. The growth of subscription revenue (25% y/y), in particular, was a major contributor to the 18% y/y increase in total revenue. While this is a further deceleration from the 20+% CAGR track record, I highlight that CXM could actually grow faster if they are not pivoting away from the lower-margin professional services business. In my opinion, having the business grow slightly slower while margins improve much faster is a better narrative than growing with low margins. For comparison, revenue growth decelerated from 22% in 4Q23 to 18.5% in 2Q24, but margins have increased by 600 bps since then.

I am less worried about the growth trajectory as Billings growth continues to indicate strong momentum. If we only look at the numbers that have been reported, we see that billings of $179 million grew 19% year over year, which is slower growth than the 23% seen in the previous quarter. However, I don't think that is reflective of the actual performance, as subscription billings should be the metric to focus on. Recall that management is pivoting away from the lower-margin professional services business. If we just focus on subscription billings, they grew by 23% y/y, which is above the revenue 20% CAGR trend. Notably, the year-over-year increases in RPO and cRPO for the quarter were 35% and 22%, respectively, up from 23% and 19%, respectively, in the previous quarter. In my opinion, the RPO is an early indicator of the growth trajectory, so I'd like to spend some time discussing it. On the call, management mentioned several significant CCaaS (Contact Center as a Service) deals across all its primary theaters. The deal with Deutsche Telekom was cited as an example; by the end of 2024, over 4,000 agents located in eleven different countries (under the entire European contact center operations) are expected to be using the Sprinklr platform. I believe this demonstrates CXM's ability to be a full-stack replacement solution provider.

we once again saw several meaningful CCaaS deals close across all three of our primary theaters. And the majority of our service deals won were with new logos. During the second quarter, we continued to add new customers and expand with existing customers. This includes world-class brands like Deutsche Telekom, LVMH, Novo Nordisk, Toyota, and TransUnion. Here are some examples. In Q2, one of the largest technology companies signed a multi-year $60 million plus ELA Agreement, expanding its partnership with Sprinklr across all four of our product suites, as it drives tech consolidation across its company-wide ecosystem.

Matt, excellent question. I'm glad you asked it. We are doing more of real contact center RFPs and proving ourselves to be complete Unified Replacement Solutions for legacy players. More so in the last two quarters than we have ever done before. 2Q24 earnings results call

As CXM continues to enhance its offerings and evolve into a more effective full-stack replacement solution provider, I anticipate a growing presence in the CCaaS sector. From my perspective, the CCaaS market presents significant opportunities due to the increasing demand for unified platforms that assist businesses in streamlining their customer service operations and leveraging the data generated by their marketing and sales endeavors. According to research by Fortune Business Insights, the CCaaS market is projected to reach a value of $16.4 billion by 2030, reflecting a CAGR of 18% from 2023 to 2030. To better seize this opportunity, the management is directing its attention toward forging partnerships in the customer service realm, specifically targeting the contact center market.

Valuation

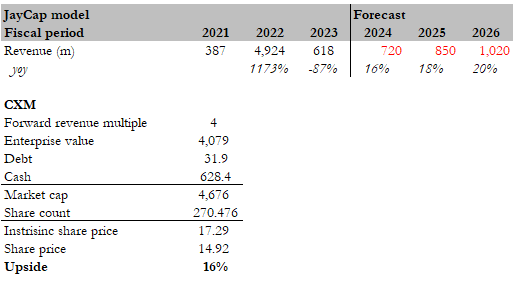

Own calculation

I believe the fair value for CXM based on my model is $17. My model assumptions are that growth will reaccelerate back to 20% as the subscription segment becomes a larger part of the business. The underlying growth drivers (RPO metrics, subscription billings, and the success seen in the CCaaS space) remain strong as well, which further supports my view of growth acceleration. While not shown in my model, I expect profitability to continue increasing as the business scales, which should have a positive impact on multiples. Nonetheless, I assumed the same 4x revenue multiple as of today, as CXM has yet to show an acceleration in growth.

Risk

CXM provides a highly advanced, scalable solution for many front-office operations, making it possible to manage even the most intricate omnichannel customer support and marketing operations. While this is ideal for large corporations that need detailed configurations, it is less suitable for small and medium-sized businesses (SMBs) that prefer straightforward options.

Conclusion

I recommend a buy rating for CXM. I expect the company's revenue to regain momentum, returning to the 20% CAGR trendline. In particular, CXM's expansion into the CCaaS sector aligns with the growing demand for unified customer service platforms, enhancing its growth potential. My model suggests a fair value of $17, assuming a reacceleration in growth as the subscription segment gains prominence.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.