Star Bulk Carriers Is Still An Attractive High-Yielding Buy

Summary

- Star Bulk Carriers is a Greece-based shipping company that transports bulk commodities such as iron ore, minerals, grains, and fertilizers worldwide.

- I review the market outlook for dry bulk carriers and also reassess my previous "Buy" rating for SBLK stock.

- SBLK's balance sheet looks healthy. The cash flow generation is still solid. With strategic refinancings and vessel sales, I believe SBLK is poised for a resilient and promising future.

- Cheap valuation, high forwarding dividend yield, and potential improvement of the dry bulking market make SBLK a great "Buy" for income-seeking investors.

- Looking for a helping hand in the market? Members of Beyond the Wall Investing get exclusive ideas and guidance to navigate any climate. Learn More »

sandsun

Instead of an investment thesis

You are now reading my 6th article on Star Bulk Carriers (NASDAQ:SBLK). This Greece-based shipping company transports bulk commodities such as iron ore, minerals, grains, and fertilizers worldwide. For those who don't know, SBLK has a fleet of 128 dry bulk carriers, including various vessel types ranging from 52,000 to 210,000 DWT. They also provide vessel management services.

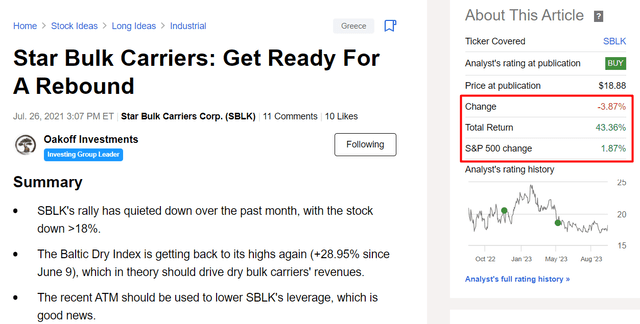

The first time I wrote about SBLK was in July 2021, when the stock was trading at ~$19 (almost the same as it is now). 2 years have passed since then and the company's market capitalization has not changed. However, thanks to the excellent dividends SBLK continues to pay out, a potential investor would earn a phenomenal 43%, beating the market's return for the same period many times over.

However, since my last article [published in May 2023], the stock has significantly underperformed, although it is flat in terms of total return:

Since a lot of time has passed in the meantime, the company has presented its latest quarterly figures and the situation in the dry bulk carrier market has also adapted a bit to the new realities, I decided today to update my coverage and answer the question: Is SBLK still an attractive investment for income-seekers?

The Market Conditions

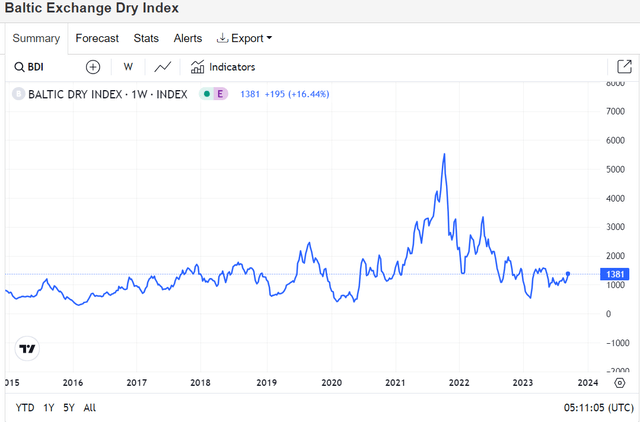

A few hours ago, Reuters reported that the Baltic Exchange's dry bulk sea freight index climbed for the 7th consecutive session, driven by rising demand in various vessel segments. The overall index, including Capesize, Panamax, and Supramax rates, surged 3.9% to 1,340, reaching its highest level since May 2023. Iron ore futures rose for 4 sessions due to low inventories and restocking before the holidays, though concerns about steel market weakness persisted.

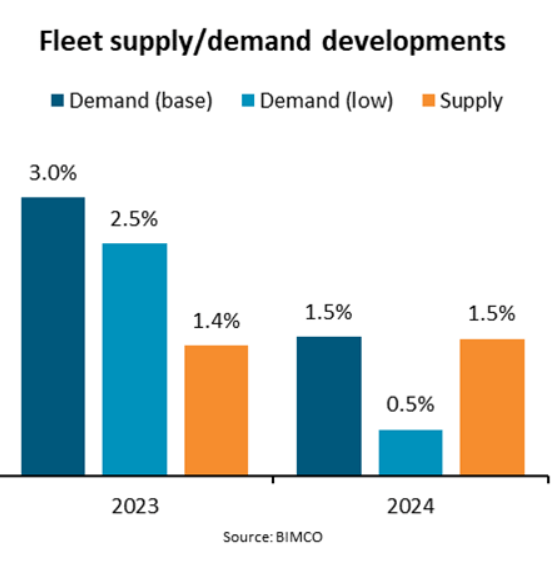

As the analysts at BIMCO wrote on September 5th, spot rates were likely to rise slightly in the second half of 2023 compared with the August level. This had to happen partly because China's economy did not weaken as quickly as expected, but also because fleet demand growth was expected to exceed supply growth in 2023, according to BIMCO's calculations.

But the same analysts draw a worse picture for the dry bulk carriers' fleet supply/demand balance in 2024:

In 2024, freight rates could remain around 2023 levels or even weaken as demand growth slows. We expect lower growth in iron ore shipments, and we believe coal volumes could begin to fall. However, unlike in 2023, grains and minor bulks could drive demand, supporting the smaller segments. Lastly, rates for supramax ships may get pressured as a significant number of new ships are due to be delivered.

Source: BIMCO, Q3 forecast

BIMCO, Q3 forecast

Overall, the macro and micro pictures for dry bulk carriers are deteriorating for the reasons described above - I assume this is why most of SBLK's peers, as well as the company itself, have been generally flat in recent weeks despite the rise in the Baltic Dry Index.

Based on the data analyzed, I expect that SBLK and other bulk shippers will have to settle for significantly lower freight rates next year due to the general cooling of the global economy.

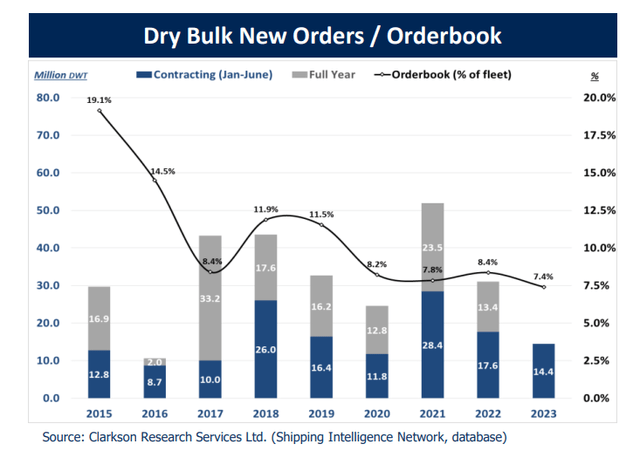

On the positive side, however, the orderbook remains quite low historically, which should provide some stability to companies' future earnings.

So in other words, vessel supply is anticipated to remain limited over the next 18 months, particularly in 2024, contributing to a favorable market environment. Also, infrastructure efforts in China, a resilient coal market, and the influence of relatively high oil prices are expected to bolster SBLK's prospects, in my view.

It all depends on the valuation of each company and what management has done in recent quarters. These are precisely the things I would like to examine in more detail in the next section of my article.

Star Bulk's Financials And Valuation

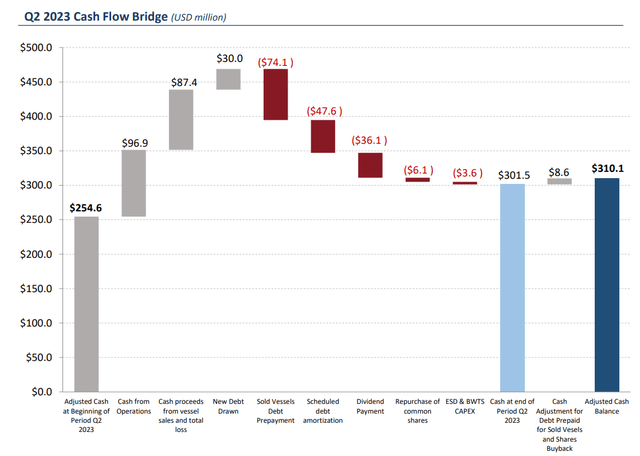

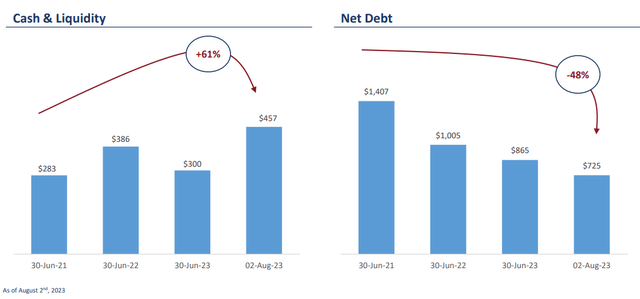

In the second quarter of 2023, Star Bulk Carriers achieved robust financial results, reporting a net income of $44 million, with an adjusted net income of $49 million, equivalent to $0.47 per share. SBLK's adjusted EBITDA for the quarter stood at $96 million. During this period, they declared a dividend of $0.40 per share and executed a share buyback program, repurchasing $6.1 million worth of shares outstanding. The sale of five Supramax vessels built in 2012 in China yielded excellent returns, with a cash multiple of 4.6x on the equity invested and an IRR of approximately 42%, according to the latest earnings call. Furthermore, the company strengthened its balance sheet and had cash and cash equivalents of $310 million at the end of the quarter, up about 22% from the beginning of the quarter, with most of the increase coming from strong operating cash flow.

Actually, SBLK has a total cash balance of $457 million (pro forma for the delivery of two remaining Supramax vessels) and a total debt of ~$1.19 billion. The company's fleet has a scrap value exceeding $800 million based on a scrap price of $400 per light dead weight ton. They've set a cash threshold of $409 million, above which they will distribute dividends. With strategic refinancings and vessel sales, I believe SBLK is poised for a resilient and promising future, with nine unlevered vessels and a next 12-month amortization of $177 million.

Continuing the theme of financial stability in terms of valuation, SBLK looks quite attractive in this regard compared to most other companies. For example, the debt-to-equity ratio in its classic form (YCharts calculations) is below average for SBLK, while the EV/EBITDA multiple for the next year is also below average. That is, roughly speaking, investors on average pay a higher "credit risk premium" for the average peer compared to SBLK, making the latter a relatively more attractive investment.

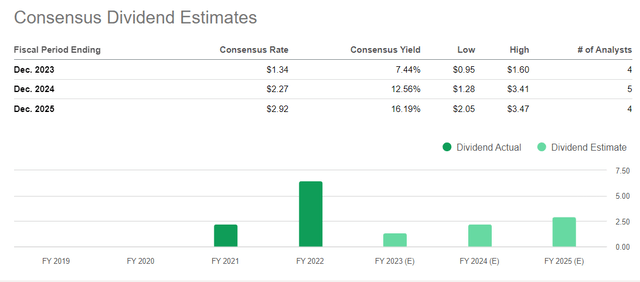

The negative industry momentum that has unfolded in recent months seems to point to a bottoming - if that is the case, then the potential turnaround of the industry should result in a re-rating that could make SBLK an "obviously undervalued stock" given its current dividend yield. I put the above phrase in quotes for a reason - it's still not "obvious for Mr. Market," in my opinion, exactly when the reversal will occur. At the same time, however, investors in SBLK already have a margin of safety of sorts, because even against a backdrop of relatively negative consensus EPS and revenue numbers, the forwarding dividend yields are more than attractive:

Risks To Keep In Mind

One significant risk is the unpredictability of stock price movements, making it challenging to accurately time investments. As I noted in my last SBLK article, dollar-cost averaging may mitigate this risk by spreading investments over time. It should work especially well if there's a margin of safety, which is present in this particular case, in my view.

Furthermore, the dry bulk shipping industry is exposed to potential downturns in the shipping cycle. Lower freight rates can reduce shipping companies' revenues, impacting profitability and cash flow. Currently, the Baltic Exchange Dry Index is at its approximate historical average, at a crossroads, so we'll likely see more volatility after the second half of 2023.

Vessel values may also decrease during such cycles, adversely affecting the balance sheets of companies with substantial vessel fleets. Additionally, if SBLK cannot generate sufficient cash flow to service its debt, it might need to raise additional debt or equity, potentially diluting the value of existing shares and increasing financial vulnerability, particularly in changing market conditions. This situation could result in the suspension of dividends.

Your Takeaway

While there are some very important risks that every reader should consider, I believe SBLK is an interesting cyclical dividend stock that is still in its sweet spot. Given the company's current cheap valuation and its ability to pay a healthy dividend, I think SBLK should delight its investors with nominal and overall growth once the global economy picks up, which we are currently a long way from.

I reiterate my previous "Buy" rating on SBLK stock.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You'll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.

This article was written by

Quantitative equity research analyst. Colliding data science and finance to find a stock's mispricing.

Constantly looking for a reasonable balance between growth and value.

>5 years of experience in personal portfolio management with an average annualized return of ~21%.

Disclaimer: Associated with Danil Sereda, another Seeking Alpha contributor

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.