Aehr Test Systems: Time For A Breather (Rating Downgrade)

Summary

- Aehr Test Systems just experienced a rapid 50% gain in its share price due to strong fundamental growth and short covering.

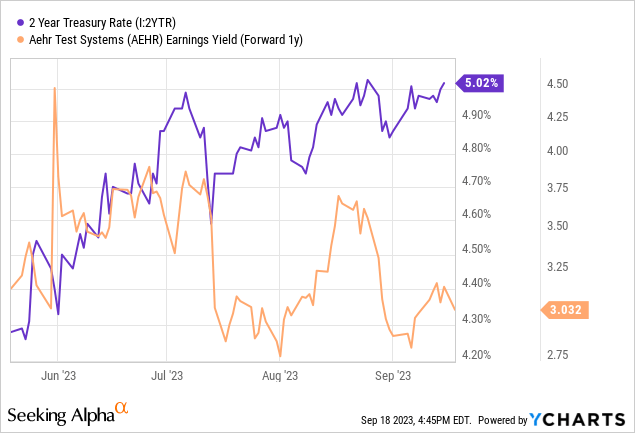

- The Aehr valuation is not as bullish as my May article effort, with falling earnings yields (on higher share pricing) matched against rising interest rates this summer.

- I am projecting a breather into the end of 2023, with price declining back to $40 as my immediate forecast, before another leg higher begins.

cagkansayin

In May here I wrote about the unique technical and fundamental setup for Aehr Test Systems (NASDAQ:AEHR) at $32 a share. I suggested a low-volume gain in shares following a few months of selling, combined with a high short interest position betting against future success, could generate above-average gains over the summer (assuming solid underlying business growth would continue). And, when the company reported strong fundamental growth, short covering did take place, creating a rapid +50% gain in the share quote.

Seeking Alpha Article - Paul Franke, Aehr Test Systems, May 20th, 2023

Several readers have asked me if my view has changed in recent weeks. My answer is Yes. Expecting another period of consolidation, perhaps until the end of the year, makes sense today. Does that mean the company is an outright Sell? Not necessarily, but traders and even many long-term investors may want to liquidate part of their position or hedge it through either covered calls or selective put option buying.

The main reason for my change of heart is the valuation has reached for a higher height, while the global economy's "prospects" have turned down a little since May. In my opinion, growth stocks should now be avoided, as long-term interest rates moving higher this summer will eventually cause a weaker economy and a knockdown in pricing for equities on the "expensive" side of the ledger, like Aehr. (I have written a number of bearish articles on Big Tech names for example over the summer months.)

Valuation Getting Stretched

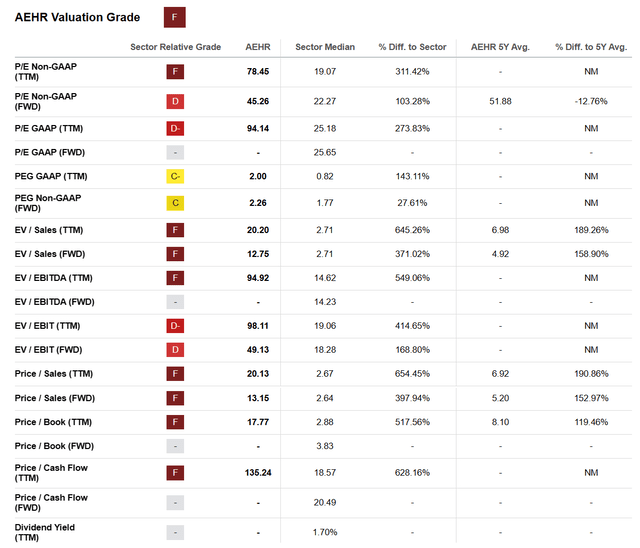

The way Seeking Alpha counts things, the relative valuation of Aehr vs. peers and competitors in testing equipment and semiconductors has moved from a Grade of "C" in May to an "F" in September. Why?

Seeking Alpha - Aehr Test Systems, Valuation Grade, September 17th, 2023

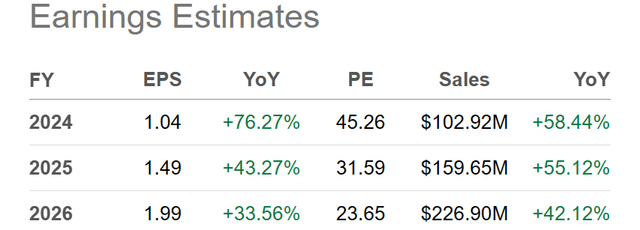

The majority of individual companies have traded flat to lower in price vs. the large uptick in Aehr is one reason. Another is the rise in long-term interest rates of 0.5% to 1% since May has taken a leg out of the valuation support for the stock. Right now, analysts are projecting an earnings yield of 2% for fiscal year 2024 (ending next May), roughly 3% for FY 2025, and closer to 4% for FY 2026, on a $50 stock quote.

Seeking Alpha Table - Aehr Test Systems, Analyst Estimates for 2023-25, Made September 17th, 2023

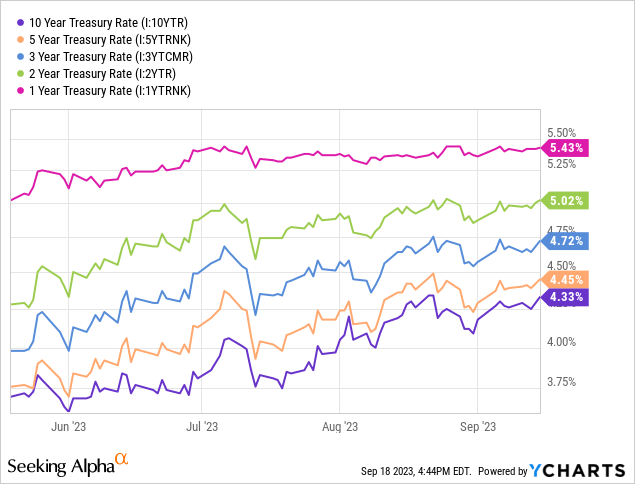

Sure, the growth rates are phenomenal at Aehr. However, I can lock in risk-free Treasury yields well above 4% into the middle of 2026. The guaranteed 4.5% to 5.5% annual yield from bonds, on top of the guaranteed 100% return of my upfront investment appears to be a far smarter place to park capital, especially if a recession is approaching into calendar 2024.

YCharts - Various Treasury Yields, Since May 19th, 2023

Back in May, similar Aehr earnings yield calculations were nearer Treasury rates, translating into investors receiving a decent business return on investment in addition to the promise/hope of outsized business growth delivering HIGHER operating yields than Treasury rates three years from now. So, the investment equation has changed, arguing against ownership.

YCharts - Aehr Test Systems Forward Earnings Yield vs. 2-Year Treasury Rate, Since May 19th, 2023

Technical Momentum Picture

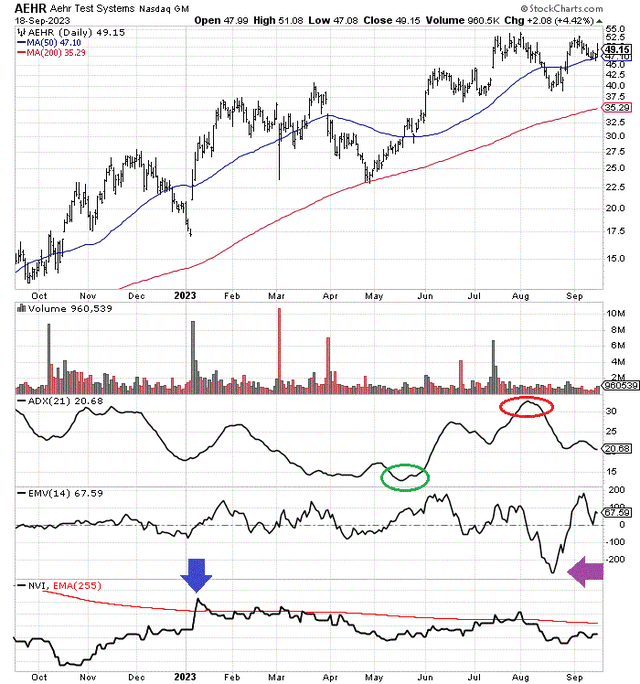

The momentum chart readout has remained somewhat bullish in my research, looking at daily formula-based sorts on thousands of equities. If my only data on the company to make a decision was centered around technical analysis, Aehr would be closer to a Buy rating.

That's not to say some technical issues of weakening momentum do not exist. Below I have drawn a 12-month chart of daily price and volume changes. The first point to highlight is the low 21-day Average Directional Index of May (circled in green) jumped to the highest reading of the year in early August (circled in red). I much prefer buying stocks with low-volatility ADX scores, before a big upswing in price.

Second, the 14-day Ease of Movement indicator highlighted an unusual lack of buyers later in August (purple arrow). Basically, it didn't take much volume selling to drive the stock quote down by almost -25% over three weeks. In a perfect world of technical trading, EMV should be quite positive as price rises.

Third, Negative Volume Index scores have been sliding since January (blue arrow). As opposed to regular buying trends on slower-news days (which I prefer), weaker-volume sessions have witnessed a greater number of sellers than buyers, on average. NVI zigzags are something to worry about, although not necessarily a deal breaker for bulls historically.

StockCharts.com - Aehr Test Systems, 12 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

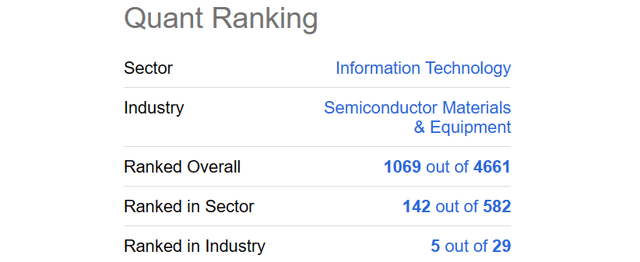

Is now the time to dump all of your Aehr shares? Probably not. Seeking Alpha's computerized sorting system still gives the stock a Top 20% rank out of 4,661 equities.

Seeking Alpha Table - Aehr Test Systems, Quant Rank, September 17th, 2023

Yet, I do feel now is the time to hedge gains or lighten up your position. If you do not want to sell your shares, one successful strategy may be to sell covered calls a few months out for an expiration, near the money for a strike price.

At the very least, I would wait for lower pricing to initiate buy order. I am projecting a $40 price as an area having slightly better valuation statistics to support owning the company again. And, a drop to $35 is not out of the question if a recession appears into early 2024.

Nevertheless, for upside surprises, I can envision strong operating results holding the share quote in the $45 to $50 range into January. The company's focus on building new testing equipment for silicon carbide-based and other power semiconductors sold to the rapidly expanding electric vehicle [EV] industry could support higher quotes again during 2024.

I personally sold my Aehr position for a nice gain, buying in the low-$30s and liquidating in the low-$40s months later. (I like to take quick gains in non-taxable brokerage accounts, for compounding reasons.)

Weighing all the pros and cons for this investment name, I am downgrading my rating from Buy in May to Hold/Neutral in September.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)