Cavco Industries: An Ideal Addition To Your Portfolio

Summary

- Energy, cyclicals, and communications sectors are outperforming their peers in the market.

- Cavco Industries is a potential stock to watch as it operates in an ideal market and has performed well.

- The stock has the potential for a breakout on the point-n-figure chart and has solid fundamentals.

Ekaterina Chizhevskaya/iStock via Getty Images

Introduction

All eyes will be on the Fed this week, but markets had their own say on options triple witch week with some significant selling to close the week. Bears have something to leverage for this week, while bulls look anxiously over their shoulders.

The good news is, that the longer your investment time frame is, the smaller these day-to-day, or even Fed decision market moves, play in your decision.

So what's good in the market?

The best place to start is to look at what sectors are outperforming their peers. For this analysis, I'm going to look at the performance of sectors from the time of the S&P peak on July 27th to today, this way we can see what sector, and therefore, which stocks, are swimming against the tide.

S&P Sector performance since July peak (Stockcharts.com)

The pockets of green are coming from three S&P sectors:

1. Energy

2. Cyclicals

3. Communications

Of the S&P member stocks, Eli Lilly (LLY) was the main outperformer over this period, but it's also part of an underperforming healthcare sector, so I have removed this as an option.

The number two outperformer was integrated downstream energy company, Marathon Petroleum (MPC). However, this stock has been on a charge since the 2020 lows of $13.41, and at $153.81 it's hard to see how much further this can go before the inevitable consolidation kicks in. This is the case for a large number of energy stocks, so I have excluded other high-ranking stocks from this sector for further review.

If we cast our net further afield, what we want is a Goldilocks stock, that has performed well from a price perspective, but not one that has become super extended.

We can add another filter to the mix, and that's to look at the list of undercovered stocks of Seeking Alpha, for that diamond in the rough. If we limit ourselves to Communications and Cyclical stocks, one stock that pops out of the list is Cavco Industries (NASDAQ:CVCO).

Price action

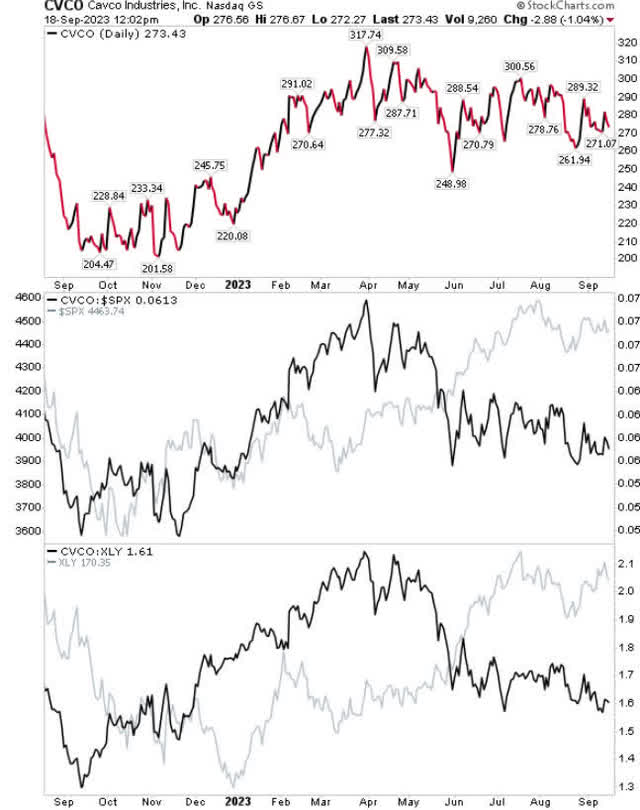

The stock has been trading sideways for most of 2023, and while it has outperformed both the S&P and the consumer discretionary (XLY) sector throughout this period, it has lost some ground over the summer.

Stocks that trade sideways have neither the interest of buyers nor sellers, but with strong-performing sectors, investors will be looking for alternatives that haven't yet hit 52-week highs, and Cavco Industries fits the bill here.

CVCO relative price performance (Stockcharts.com)

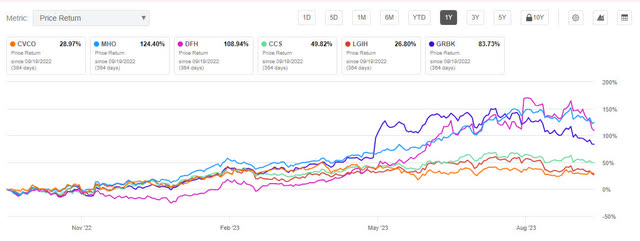

The stock does lag in relative price performance against home-building peers, although all home builders have performed strongly over the past year.

Homebuilder relative price performance (Seeking Alpha)

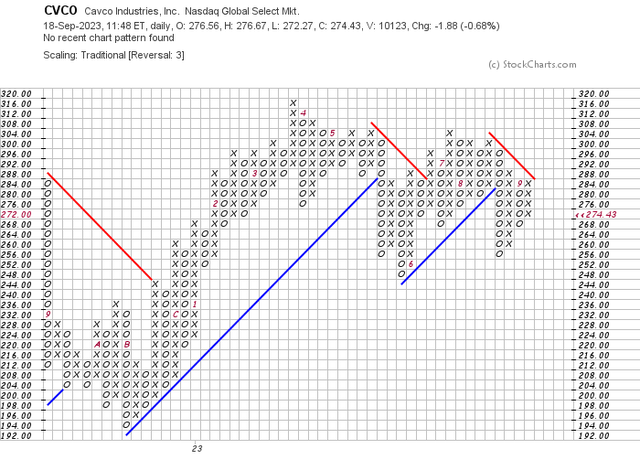

This neutrality extends into the point-n-figure chart. Most chartists use an OHLC or candlestick chart to study price action, but price momentum is best represented by a point-n-figure chart. A point-n-figure price does not use time as its x-axis, but instead uses price direction; switching between "X"s when price is rising, and "O"s as price falls. The switch from "X" to "O" is determined by a consecutive 3-square move up or down in price. On the point-n-figure chart, Cavco Industries is range bound between $256 and $304 and is currently running higher along a column of "X"s; if it can get to $308 it will trigger a breakout on this chart, and will likely see it attract the attention of technical traders, if not some algorithmic systems too.

CVCO point-n-figure chart (Stockcharts.com)

Business outlook

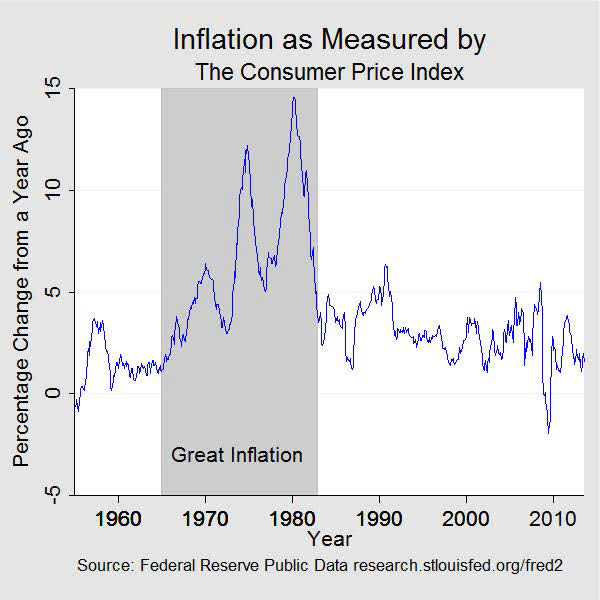

As part of the housing sector, Cavco Industries does have vulnerabilities. Wednesday's Fed decision notwithstanding, high mortgage interest rates curb demand for housing. However, it should be noted, high interest rate environments don't last long, and even during the 1970's, when inflation and borrowing rates rose to double digits, they quickly peaked before falling back to single digits. The current period of inflation is more a reversion to mean after an extended period of flat to negative interest rates, than any reaction to global factors comparable to the late 60s and early 80s (post-war global trade boom, pressure on us dollar reserves Vietnam war, oil crisis). Stresses in the housing sector are global, but are likely to finish sooner than many expect.

Great inflation of the 1970s (Federal reserve)

Cavco Industries does have a business advantage though in that its target market is the provision of affordable homes, and there is a shortfall of 7 million affordable homes in the US, with more and more families falling into the Cavco sphere as inflation eats into housing budgets, slowing business growth, leading to job losses.

The housing sector has commodity exposure, chiefly lumber prices. Lumber prices have been relatively stable and well off the highs from the Covid peak, so raw material costs shouldn't be a key concern at this point. Oil prices have been a different story as they surge toward new 52-week highs, contributing to existing inflationary (and therefore interest rate) pressures for home buyers.

Lumber prices (tradingeconomics) oilprices (tradingeconomics)

Peer performance

Cavco Industries has strong relative performance metrics to its peers; year-on-year revenue growth runs at 7.7% to a peer median of 6.79%. It has a positive EBITDA compared to a negative decline in the sector, and EPS GAAP Growth year-on-year of 26.3% is well ahead of the sector median of 2% (source). This is not a struggling housing stock.

The opportunity

Cavco Industries has much to offer the savvy investor. It sits in an ideal market as a provider of affordable homes with 'cookie cutter', factory-built homes. In that area, it has the traditional target market of upcoming Generation Z, and millennials still struggling to get onto the housing ladder, operating in states that remain affordable (and some, not so affordable...).

However, there is an alternative market for Cavco homes that's not well advertised but is likely to be more lucrative. While many may see this as a risk factor (again, keeping its price suppressed), I would view this as an opportunity.

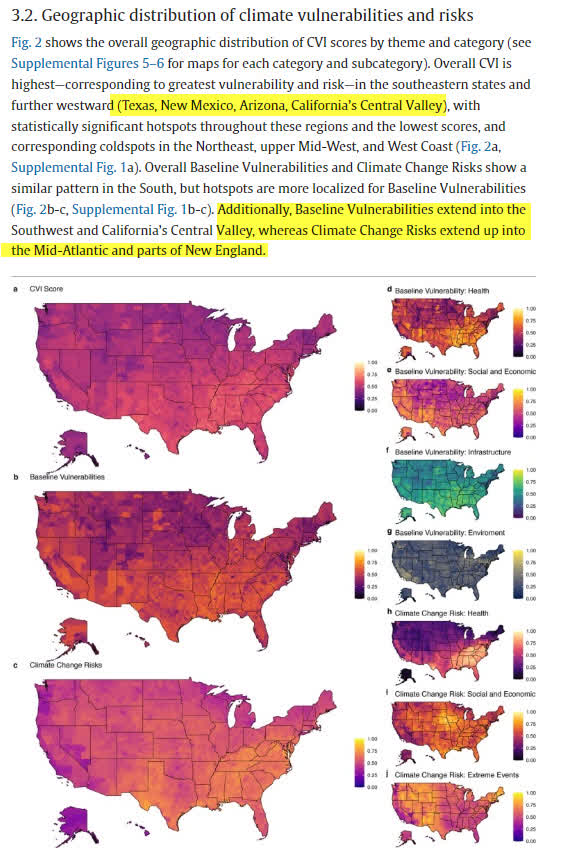

Cavco Industry operates in states vulnerable to extreme climate events; namely Arizona, California, New Mexico, Texas, Louisiana, Oklahoma, and North Carolina, so while it may not market itself as a provider of homes in states at high risk of extreme climate events (no doubt, for political reasons in these mostly Republican voting states), it has positioned itself in a way that allows it to react and fill a market need. And let's not forget, for 2023, US has set a record for the most natural disasters in a single year that have cost $1 bn or more; that is a big market to fill.

Geographic risk to climate events (Science Direct)

Factory-built homes may not be viewed as a long-term option, particularly for high-value homes lost by fire or flooding (although many of the Sears catalog homes from the early twentieth century are still standing today), think how difficult it will be for residents to secure the services of builders and contractors when many of their (high net worth) neighbors are looking for these same services at the same time? Cavco can fill this gap, either as a temporary home or as a home on a more permanent basis.

But that's the key risk here you might say...

Yes, Cavco has negative exposure with its insurance group, Standard Casualty. And it was clear in its most recent quarter the negative effects climate events had on gross profit. However, once bitten, twice shy. Any insurance company not adjusting its risk assessment to such events will go bust. And while insurance risk remains a key factor for Cavco going forward, I would be looking for Cavco to focus more on the provision of housing in vulnerable areas, while curtailing and adjusting the risk exposure of its insurance arm.

So why is this flying under the radar?

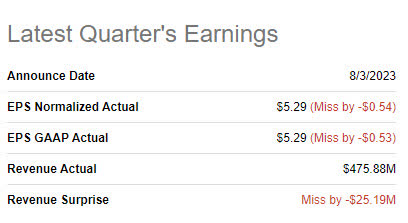

Earnings are an obvious start; it missed on its forecast last release due to higher insurance claim costs. But then again, the stock is not widely covered, with just three analysts tracking it, so the probability of a missed earnings report is higher. At the same time, I wouldn't be expecting a great flurry of news when the stock does report a better-than-expected quarter.

Last quarter earnings performance (Seeking Alpha)

The stock doesn't pay a dividend, so while it's in the housing sector, there is no "REIT" style aspect to this stock. This will keep it off the list of some pension funds and personal IRAs looking for that dividend kicker. Another reason to keep it off the interest list of investors.

Outlook

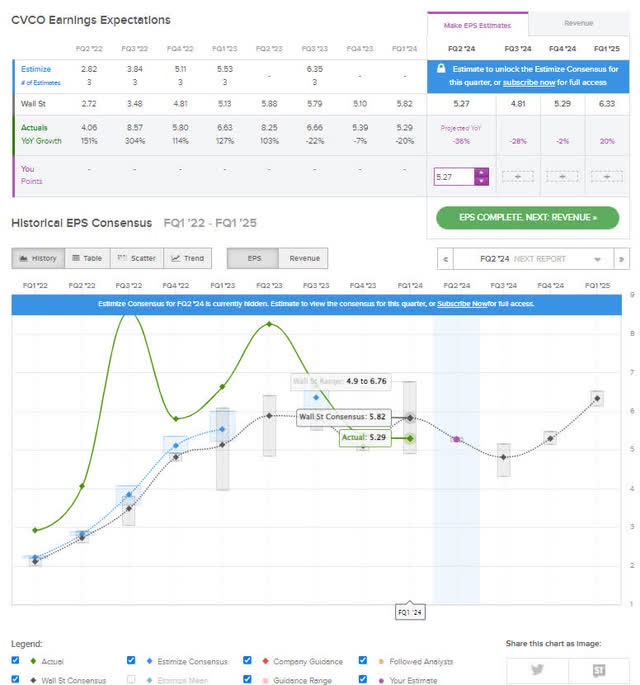

The tail end of Covid had impacted earnings over 2022, but the earnings estimates into the latter part of 2024 - while projected to be down on 2023 - remain well above reported 2022 figures. It should be noted, Cavco Industries Inc has generally reported earnings well above Wall Street analyst expectations, with only the last couple of quarters coming in as "disappointing".

CVCO estimize earnings forecast (Estimize.com)

The stock has $366 million in cash and only $30 million in debt for the most recent quarter, with a healthy enterprise value/EBITDA ratio of 7.09.

So what we have is an under-the-radar home builder, with solid fundamentals - yet "boring" price action - that is still part of a broader bullish sector move and is ready to join the party. When the company focuses more on the home-building aspect and turns away from insurance, it will become a true winner.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.