EPI: Profitable Indian Companies Benefiting From Macro Momentum

Summary

- WisdomTree India Earnings ETF has outperformed by focusing on profitable companies through an earnings-weighted investing strategy.

- Strong macro data out of India including momentum in consumption is a positive tailwind for local stocks.

- EPI is a good option to gain exposure to one of the fastest-growing emerging markets.

- Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Learn More »

Kagenmi

The WisdomTree India Earnings ETF (NYSEARCA:EPI) invests across Indian companies for exposure to the local stock market. The fund features a rules-based strategy by investing only in profitable companies, which is a factor recognized as supporting positive long-term equity returns.

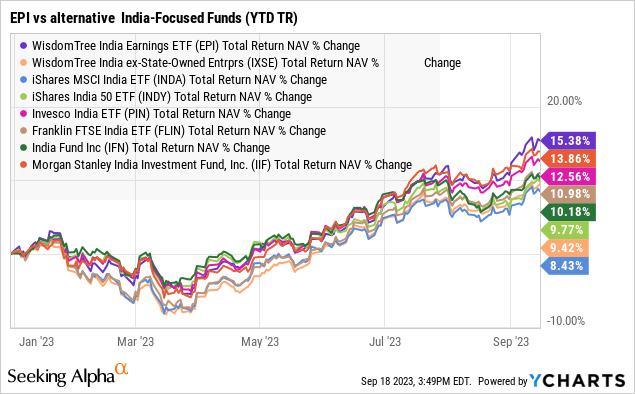

Indeed, the data shows that the fundamentals-first approach by EPI has paid off, with the fund outperforming the Indian equity market over the last several years. Year to date, EPI has returned 15% compared to an 8% gain in the iShares MSCI India ETF (INDA) as a key benchmark.

In our view, EPI is a good option for investors to access a basket of high-quality Indian stocks that are well-positioned to climb higher. The attraction here is the strong outlook for the Indian economy, which is generating one of the highest levels of GDP growth in the world with favorable demographics.

What is the EPI ETF?

EPI technically tracks the "WisdomTree India Earnings Index". Companies eligible must have positive earnings through the trailing 12-month period while meeting a minimum $200 million market capitalization and trading liquidity threshold. The fund and underlying index are rebalanced annually.

A unique aspect here is that the fund is "earnings-weighted". This means that companies with a lower price-to-earnings multiple gain importance relative to a traditional market cap-weighting methodology. The implication here is that the strategy takes on a "value" tilt with a lower P/E valuation multiple compared to the broader universe of Indian stocks.

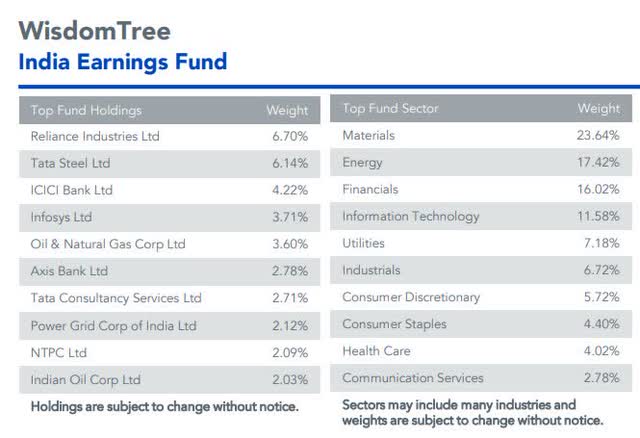

Going through the current portfolio, EPI is invested across 419 stocks highlighting the breadth of the Indian equity market. Materials and Energy are the two most well-represented sectors, together contributing 41% of the fund. This is followed by Financials at 16% and Information Technology at 12%.

Multinational conglomerate "Reliance Industries Ltd" is the single largest holding with a 6.7% weighting. Tata Steel Ltd (OTC:TATLY) at 6.1% and ICICI Bank Ltd (IBN) with a 4.2% weighting round out the top 3 holdings. Keep in mind that many of the Indian stocks included in the fund do not have an actively traded U.S. share listing. The exposure to companies otherwise unavailable for trading by U.S. investors is another strong point of EPI.

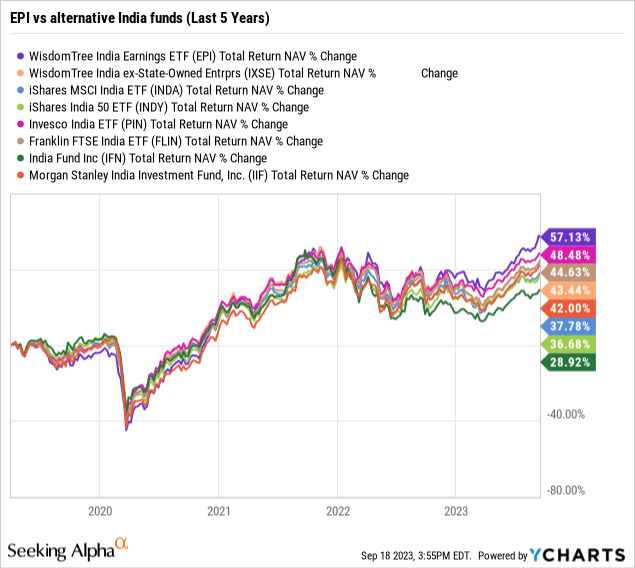

As mentioned, the India Earnings Fund has historically outperformed its benchmark, including the last 5 years and several other India-specific ETFs. The explanation here is that by excluding companies that are currently unprofitable, the concentration of EPI in companies that have stronger fundamentals between recurring profits and are capable of distributing a regular dividend has proven to be a winning strategy.

Thinking about this year, higher interest rates globally and uncertain macro conditions have pressured companies that are unproven and often highly leveraged. EPI systematically avoids companies with cash flow issues or over-leveraged balance sheets.

While it's true that other segments of the market like small-caps and higher growth can sometimes outperform, EPI's simple screening process appears to generate some consistent excess returns for the Indian market.

India Macro Update

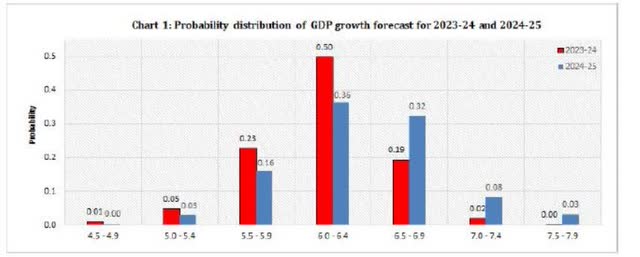

The story of India's economy this year has been a continuation of strong growth. Following a world-leading 7.2% GDP increase for the 2022-2023 fiscal year, the latest data from the Reserve Bank of India suggests 6.1% GDP growth in 2024 and 6.5% into 2025 as an average among published professional forecasters.

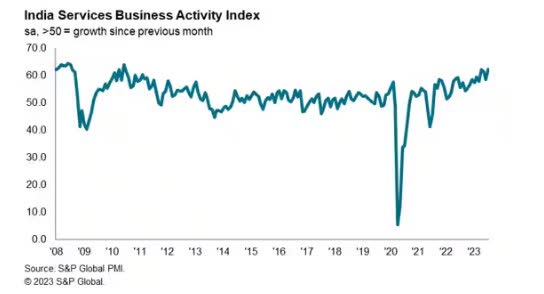

The latest India services business activity index indicates that the strength is widespread in the economy across several industries. The local PMI posted a monthly reading of 62.3 in July, the highest reading since 2010. That aspect of positive sentiment on the business side bodes well for further momentum.

source: SPGlobal

Importantly consumer demand has been a growth driver, which is being reflected in strong credit growth. While headline inflation in India has been running above policymakers' targets, the good news is a sense that the CPI has peaked with a sharp move lower in the latest reading. The expectation is that the strength of the Indian consumer will continue to lift the economy. These were themes covered in the Reserve Bank of India's latest "State of the Economy" update.

Dispelling this global gloom, the Indian economy is picking up steam and strength. Significantly, this was led by domestic drivers - private consumption and fixed investment - which offset the negative spill from net exports. A key lead indicator will be how inflation evolves, with expectations of a sharp decline in September, on top of the August ebbing, fanning optimism.

From a high-level perspective, the opportunity to invest in India starts with the massive population of 1.4 billion. According to data from WisdomTree, the Indian economy benefits from an exceptionally young median age of 28.1 years old, compared to 37.4 in China or even 38.1 in the United States.

The potential that metrics across literacy rates and even broadband internet penetration converge with developed markets, the setup here is a long runway for the working-age demographic to continue fuelling economic expansion. It is estimated that by 2027, India will become the 3rd largest consumer market in the world, behind only the U.S. and China.

As it relates to the EPI ETF, the setup here is that the leading companies continue to consolidate market share while expanding operations. Beyond consumer cyclical companies, Indian banks with a connection to the financial system along with utilities and industrials in the country on the ground to build infrastructure should perform well.

EPI Forecast

From the price chart, EPI has rallied sharply in recent months and is approaching its highest level since early 2022. We believe a new all-time high for EPI above $39.00 is simply a matter of time.

In terms of risks, keep in mind that EPI holds a basket of international stocks that may be influenced by changes in foreign exchange. The Indian Rupee has been volatile, and the possibility of a sharply stronger U.S. Dollar could also pressure sentiment toward the region.

Indian stocks and the EPI ETF could also face a deeper selloff in a scenario where global macro conditions deteriorate. A slowdown in major economies would likely pressure global trade activities and introduce some weakness into the Indian economy as another risk to consider.

Overall, we are bullish on India and believe EPI can work well in the context of a diversified portfolio for exposure to this important emerging market.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.