FAS: Nearly Impossible To Trade

Summary

- I don't really think the majority of investors and traders understand how leverage and volatility interact.

- A leveraged ETF is more than a directional bet on endpoint, but also a path bet on low volatility because of the daily reset nature of these products.

- Direxion Daily Financial Bull 3X Shares ETF is a high-risk, high-reward investment that provides leveraged exposure to the Financial Select Sector Index *if* you can time it right.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

wildpixel

If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem. - J. Paul Getty.

I don't really think the majority of investors and traders understand how leverage and volatility interact. A leveraged exchange-traded fund, or ETF, is more than a directional bet on endpoint, but also a path bet on low volatility because of the daily reset nature of these products.

Can they be traded? Certainly yes - particularly if you can, on average, identify volatility regime changes. But most people tend to think more about trendlines than sequencing. With that said, it's worth looking at the Direxion Daily Financial Bull 3X Shares (NYSEARCA:FAS) to illustrate this. This is a leveraged exchange-traded fund that seeks to provide investment results equivalent to 300% of the daily performance of the Financial Select Sector Index.

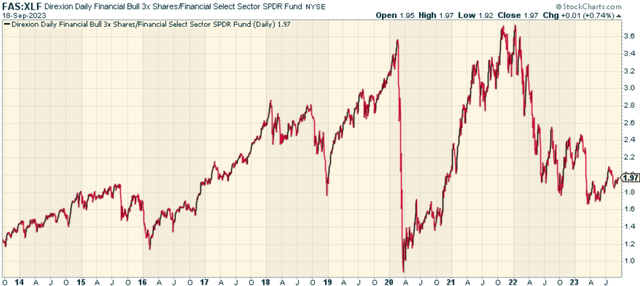

When we look at FAS relative to the unlevered Financial Select Sector SPDR® Fund ETF (XLF), it turns out that leveraged Financials have had the exact same performance as non-leveraged Financials going back to 2015, with a lot more volatility.

FAS: An Overview

FAS is a product of Direxion, a well-known provider of leveraged ETFs. Launched in 2008, FAS aims to provide daily investment results, before fees and expenses, of 300% of the performance of the Financial Select Sector Index. However, there's no guarantee that the fund will meet its stated investment objective.

The ETF achieves its investment objective by investing at least 80% of its net assets in financial instruments that provide daily leveraged exposure to the index and the remainder in money market instruments, cash, and cash equivalents. It charges a net expense ratio of 0.96%.

The Financial Select Sector Index

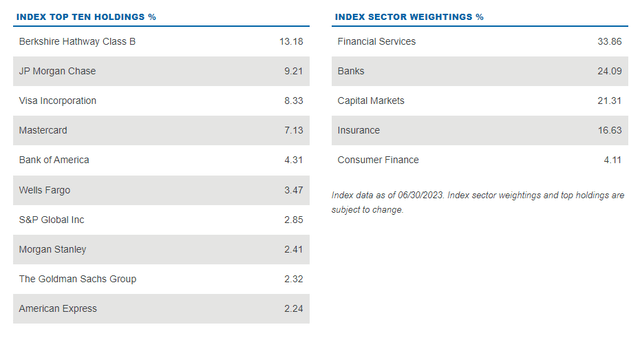

The Financial Select Sector Index includes securities from several financial industries, including banks, mortgage finance, diversified financial services, consumer finance, capital markets, insurance, and mortgage real estate investment trusts (REITs).

The index's top holdings include Berkshire Hathaway, JPMorgan Chase, Visa, Mastercard, Bank of America, Wells Fargo, S&P Global, Morgan Stanley, The Goldman Sachs Group, and American Express. However, it should be noted that one cannot directly invest in an index.

FAS Performance Review

Looking at the historical performance of FAS, the ETF has demonstrated high volatility due to its leveraged nature and the inherent risks of the financial sector. The performance of companies in the financial sector can be significantly impacted by various factors, including government regulations, economic conditions, credit rating downgrades, changes in interest rates, and decreased liquidity in credit markets.

The ETF's performance has also been influenced by the yield curve, a critical macroeconomic factor impacting financial services. Changes in the yield curve can significantly impact the profitability of banks and other financial institutions, which in turn affects the performance of FAS.

FAS vs. Peer ETFs

Compared to other ETFs that track the same or a similar underlying index but without any leverage, FAS's performance can be considerably more volatile. For instance, the Financial Select Sector SPDR Fund also tracks the Financial Select Sector Index but without leverage, and as noted has performed in-line since 2015. Its performance is considerably less volatile than FAS.

Moreover, other leveraged ETFs providing exposure to the financial sector, such as the Direxion Daily Regional Banks Bull 3X Shares (DPST), may also be considered as peers to FAS. However, their performance can differ due to variations in the specific indices they track and their leverage ratios.

Risks of Investing in FAS

Investing in FAS involves several risks. Firstly, the fund's leverage increases the risk of loss if the index's performance is negative. Secondly, the fund's daily rebalancing can result in compounding effects over periods longer than one day, potentially leading to returns that significantly differ from the index's returns over the same period.

Bottom line here? Direxion Daily Financial Bull 3X Shares ETF is a high-risk, high-reward investment that provides leveraged exposure to the Financial Select Sector Index *if* you can time it right and can identify volatility regime shifts. While it offers the potential for significant returns, it also comes with substantial risks due to its leverage and the volatility of the financial sector.

If I'm right about a credit event, this would be one to trade after a significant dislocation. Right here though this is a strong avoid for me.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.