Ambev SA: Banking On New Combinations And Innovation To Raise Revenue

Summary

- Ambev has been operating profitably for the past two decades with an annual gross profit margin (TTM) of 49.95%.

- Ambev's BEES digital marketplace entered the COVID-19 pandemic with only 750,000 customers and left the pandemic with more than 1 million subscribers.

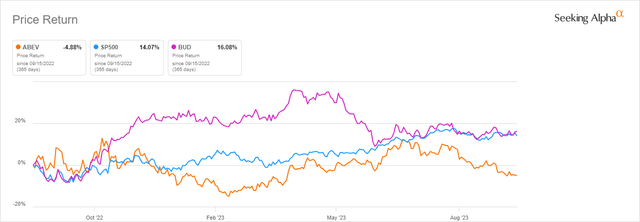

- Over the past year, Ambev's price return was down 4.88% against the SP500 which rose 14.07% (YoY) while AB InBev surged 16.08%.

Ranimiro Lotufo Neto/iStock via Getty Images

Global brewer, Ambev SA (NYSE:ABEV) reported Q2 2023 EPS of R$0.16 ($0.03) beating analysts’ forecast by R$0.13 ($0.027) The quarter’s revenue came in at R$18.9 billion ($3.95 billion) representing a 14.8% (YoY) increase. I believe the company is working to win its way in the beer world with astute marketing/combination tactics that make it stand out to the general population, having been around since 1999.

Thesis

Ambev SA is looking to attract consumers by adding new styled beer combinations while maintaining innovation and improving sequential coverage. The company has also invested in digital innovation to spur growth and raise revenue while growing out of its Brazilian market zone. In essence, Ambev has had consistent net revenue growth over the years that has driven margin expansion while moderating costs.

Firstly, ABEV stands out as an attractive stock with a market capitalization of $43.30 billion alongside a share price slightly under $3. The forward dividend yield stands at 5.30% against the industry average of 2.74% indicating a significant difference of 93.63%. It has been operating profitably for the past two decades, with an annual gross profit margin (TTM) of 49.95%.

Quarterly review

Q2 2023 saw Ambev's net revenue grow 20% (YoY), EBITDA at +34% (YoY) with the top-line commercial momentum boosted by Brazilian beer at +10.1% (YoY). Premium beer brands such as Brahma, Budweiser, and Stella Artois saw their sales volumes surge to their mid-30s despite an overall volume drop of 2.5% (YoY).

While overall sale volumes of non-alcoholic beverages (NAB) declined 2.2% (YoY) it grew its revenue by 7.5% (YoY) in Brazil. There was a 13.1% (YoY) decline in normalized profit due to the adverse effects of the removal of tax credits one-off. However, EBITDA grew 37% (YoY) at a margin expansion of 310 basis points with the company’s management sure of a well-positioned outlook in H2 2023.

International operations posted a 0.6% (YoY) growth to support the Brazilian context with countries such as Chile, Paraguay, Bolivia, and Argentine beer driving topline performance. Ambev has $2.6 billion in cash with total assets at $27.84 billion indicating a 6.6% (YoY). As of Q2 2023, Ambev's total debt stood at $855.4 million which is way less than the available cash position.

Sequential Improvement Outside Brazil

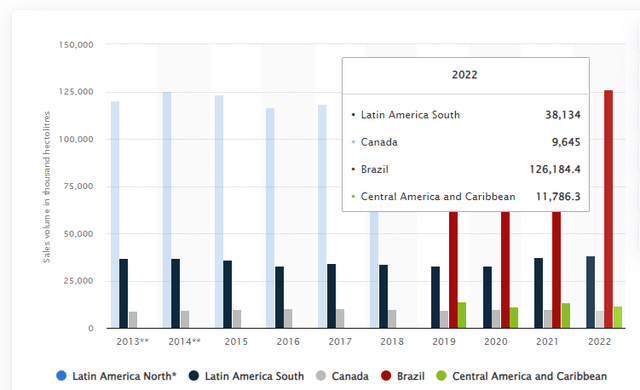

Despite a 2.8% (YoY) volume decline driven by Panama and the Dominican revenue (that adversely affected operating performance), Ambev saw a 0.6% (YoY) volume growth outside Brazil. In 2022, ABEV’s sales volume in South Latin America reached 38.13 million hectoliters, with Brazil at 126 million hectoliters.

There has been an improvement in topline performance in countries such as Paraguay, Chile, and Bolivia post-Covid19.

Budweiser brand led in driving a low-single-digit commercial growth in Argentina. Corona and Stella Artois added a high-single-digit volume growth in Chile. The Pacena brand in Bolivia was responsible for a high-single-digit beer volume growth. Statistics indicate that the Bolivian alcoholic drink market has netted €1.483 billion ($1.5 billion) in revenue in 2023. It is expected to grow at a CAGR of 8.36% by 2027. Ambev also attributed the continued rise in out-of-home alcoholic consumption in the Americas region as a key driver to increased intake into 2024.

New Combinations and Digital Growth

In its Q2 2023 transcript, Ambev explained that it had added 3 “new malt combinations to its Brahma Duplo Malte - Wheat, Toasted and Black.” The company had great success in 2022 after it launched the Dark Brahma Duplo Malt and the new options seek to widen the product reach. The toasted brand appeals as an appetizer and best accompanies meals, while the wheat and black brands are meant to raise the flavor possibilities. Still, it is vital to note that Ambev is also offering draft beer, mixed/ soft drinks, water, energy drinks, and Isotonic. With the added offerings, company estimates revealed that it had added 4 million fans since the pre-Covid19 period.

Then there's the digital sales platform, BEES which was founded in 2019 (co-created by both AB InBeV and Ambev) whose pilot program at the time was conducted in the Dominican Republic. The platform operates through an app that allows Ab InBev partners/retailers to place orders, manage inventories, and understand market trends to boost sales. BEES entered the COVID-19 pandemic with only 750,000 customers and left the pandemic with more than 1 million subscribers.

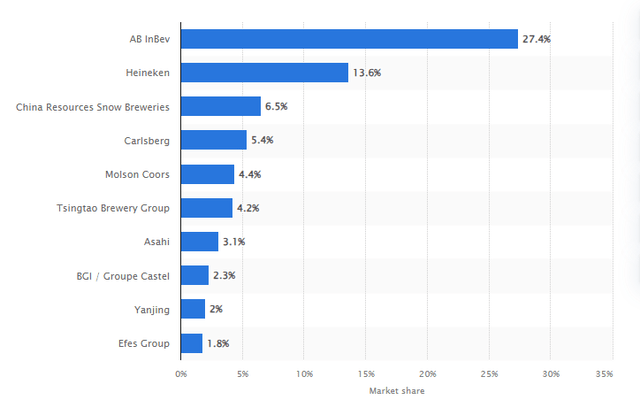

In its Q2 2023 earnings release, Ambev stated that Brazil’s BEES marketplace delivered up to R$1.7 billion worth of annualized volume sales. It represented a growth of 64% (YoY) with Paraguay indicating an all-time high Net Promoter Score (NPS) on BEES. I believe BEES will continue evolving above simple business connections within Ambev's circle. It controls at least 500 iconic brands in 20 markets globally. In the Q2 2023 earnings, parent company Anheuser-Busch InBev SA/NV (BUD) explained that BEES’ expansion in the quarter had seen the company reach over 700,000 customers, a 29% (YoY) increase. In the fiscal year 2022, AB InBev accounted for 27.4% of the global market share in terms of beer volume sales.

Heineken and China Resources Snow Breweries (which have heavily digitized operations) took up 13.6% and 6.5% of the market share respectively. There is room for growth to include product design/engineering, supply logistics, and customer experience among others into 2024 as far as the advancement of digital operations in the beverage industry is concerned.

Risk and valuation

Q2 2023 saw Ambev’s profit decline as higher operating costs/ expenses continued to outweigh the company’s higher sales. ABEV’s profit decreased $117.8 million on quarterly analysis, while net income was down 28.4% (QoQ). There was an underperformance in the net sales segment despite the EPS falling in line with market expectations.

Ambev’s B2B digital platform BEES has not yet been fully integrated with the company’s strategy to increase revenue generation in the market. In its Q2 2023 earnings, Ambev explained that over 76% of BEES clients in the Dominican Republic and more than 70% in Panama were using the platform to purchase non-Ambev product offerings. In my view, the company is yet to unlock its innovation capabilities within its supply chain especially since most of the volume growth is on alcoholic drinks as opposed to non-alcoholic beverages.

Additionally, Ambev’s cash position declined 13.8% (YoY) even as its cost of goods sold increased by R$0.2 billion.

Over the past year, ABEV's price return was down 4.88% against the SP500 which rose 14.07% (YoY) while BUD surged 16.08%. The share price has also delayed below the $3 mark, having hit a 52-week high of $3.24 despite rocking a market cap of $43.74 billion. In my view, ABEV has concentrated on the Brazilian market at the expense of a global expansion plan that will boost the stock’s momentum. ABEV’s 5-year gross profit margin (TTM) is at 54.85% which is about 8.94% below the industry average.

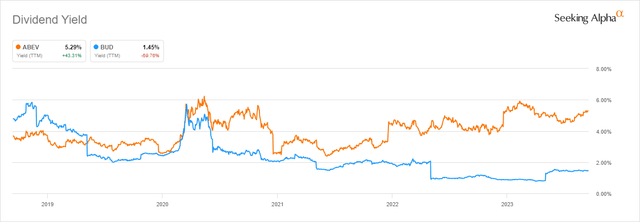

In regard to the dividend yield, ABEV's annual yield stands at 5.29% which is a 43.31% (YoY) increase. It contrasts BUD which stands at 1.45% which is a drop of 69.76% (YoY).

While BUD’s price return is at 16.08% (YoY), ABEV’s dividend yield is stronger at 5%. Still, I feel ABEV's annual payout ratio is below expectations at $0.14 with a 5-year growth rate of 5.57%. The low dividend payout ratio likely means that Ambev is retaining more earnings that should be repaid to shareholders. Further, as of Q2 2023, Ambev's retained earnings stood at $9.531 billion representing a 26.87% (YoY) increase from $7.52 billion retained in Q2 2022. The company’s financial strength is clear, as indicated by continued profitability over the years. However, Ambev should increase its dividend payout rate to shareholders boosted by buybacks to grow the share price.

In terms of the valuation, ABEV’s P/E ratio (FWD) stands at 15.66 against the industry average of 19.14 indicating a difference of -18.19%. The enterprise value (EV)/ EBITDA (FWD) stands at 8.15 against the industry average of 11.48. It shows a difference of -29.06%. I believe these metrics indicate that ABEV is slightly undervalued by the market and has the potential to rise above the $3 threshold.

Bottom Line

Global Brazilian brewer, Ambev posted volume and EBITDA growth in Q2 2023 despite the sector's volatility and growing costs. I believe the company needs to grow its BEES B2B digital platform to increase revenue generation into 2024. ABEV is also keen to raise its retained earnings, possibly to reinvest in its business portfolio at the expense of boosting shareholder returns. Other aspects such as stronger buybacks will see the share price grow over time. However, I will recommend a hold rating for the stock as we await the management actions that will grow the share price alongside increased revenues over time.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.