Royal Caribbean: Sailing Far Away From Fundamental Value

Summary

- Royal Caribbean's stock has doubled this year as cruise ticket sales have risen to and above pre-COVID levels.

- While RCL is below its pre-COVID level, its enterprise value is significantly higher due to equity dilutions and debt growth since 2020.

- Royal Caribbean's recovery may be temporary, as consumer spending levels are expected to decline and external factors could negatively impact the company's performance.

- Even if demand remains strong, RCL still appears overvalued as interest costs consume most of its potential income for common shareholders.

- RCL may be a decent short opportunity due to its overvaluation and significant exposure to negative cyclical catalysts.

ALEXIUZ

The hotel and leisure sector has performed generally well throughout 2023 as traveling rates rise back to, and often above, pre-COVID levels. After years of delaying vacation, many have pursued much larger traveling opportunities this year. Most stocks in the industry have taken note of this trend and have risen accordingly. Royal Caribbean (NYSE:RCL) shocked the market by doubling in value this year to nearly $100 per share. RCL performed very poorly in 2022, losing almost half its value that year as higher interest rates increased its financial risk exposures and lowered its growth outlook. However, it has outperformed expectations significantly.

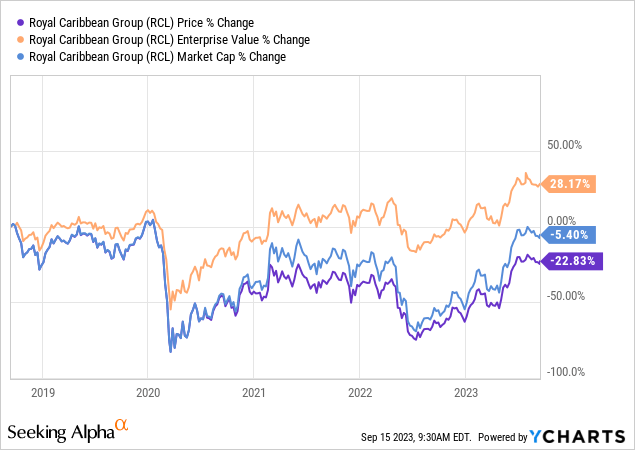

Royal Caribbean's equity stock price is currently around 20% below its pre-COVID level. However, a company's financial value is not its stock price but its market capitalization and, more accurately, its "enterprise value," which also accounts for net debt. Royal Caribbean's market capitalization equals its pre-COVID level, while its enterprise value is nearly 30% higher. See below:

During the COVID period, RCL suffered huge losses, causing the company to sell equity and raise debt to maintain its liquidity, considering Royal Caribbean is technically more valuable today than ever. Thus, no investors should buy RCL solely because it appears discounted to its pre-COVID level, given that it is due to financial dilution - it is at an all-time high.

Short interest on RCL is relatively high at 8.8%, implying a fair amount of speculators see more downside risk than upside potential for the company. Indeed, it is a much more expensive company with no further "recovery" potential. For its valuation to make sense today, we must expect the company to expand its sales and income well above pre-COVID levels. Furthermore, we must expect it to be immune to the cyclical risk factors facing other consumer discretionary stocks.

Has Royal Caribbean Truly Recovered?

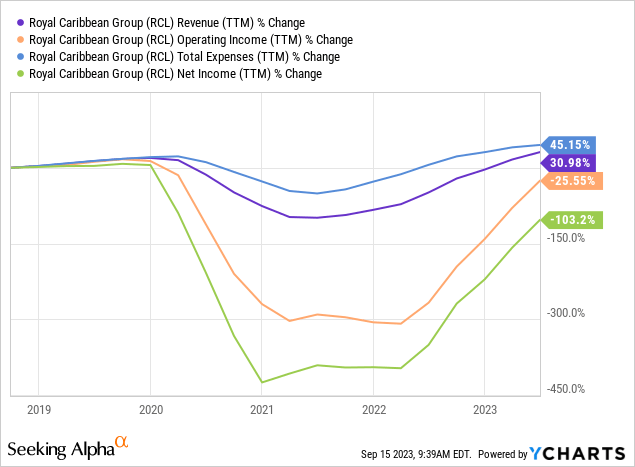

Over the past twelve months, Royal Caribbean has seen its total sales rise firmly above its pre-COVID level. Its annual sales are around 30% higher than before 2020, indicating it has recovered well. That said, there has also been around that much inflation since then, so its revenue growth is not a great indicator of its actual growth. Further, its total expenses have risen much faster at 45% over the past five years, so its operating income is around 25% lower. Due to its increased debt and the sharp increase in interest rates, its net income is still negative over the past twelve months. See below:

For the most part, Royal Caribbean has not seen material COVID-related impacts over the past 12 months. Its sales have been normal since 2022, or perhaps in the summer of 2022 if we account for inflation-adjusted sales. Thus, I believe the past 12 months are a good indicator of what we can expect from Royal Caribbean in the long term, depending on consumer trends. Air travel has also completely recovered and has typically been above 2019 levels, so, likely, the market is back at a peak economic cycle.

There are numerous trends causing strains on its profit margins. For one, fuel costs were sharply higher from the end of 2021, creating negative headwinds for the company as it was already challenged with pushing higher costs onto customers. Over the past year, its fuel costs have been flat, while the price of fuel commodities has declined dramatically. Its operating margins were around 21% last quarter, roughly the seasonally normal level before 2020. Aside from interest costs, a substantial negative factor for equity investors, Royal Caribbean is about as profitable operationally as it usually is. Of course, oil and petroleum product prices have started rising sharply again in recent months, so the company may soon see that primary headwind return.

Most Operating Income Will Go To Interest

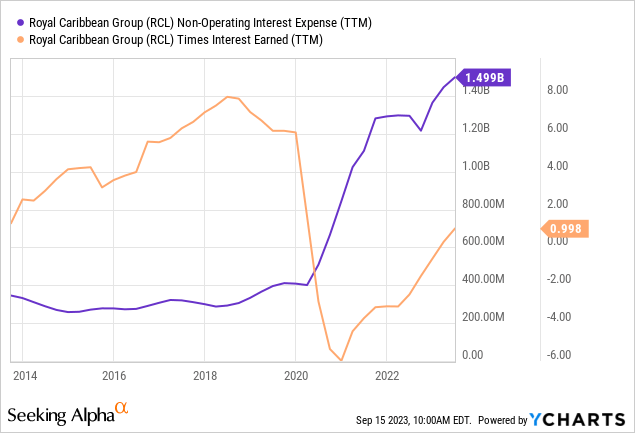

In my view, the most significant issue with Royal Caribbean is its immense debt growth since 2020. As its liabilities soar, its tangible book value has crumbled by over 75%, bringing its price-to-book to over 7X. While that figure is not too relevant, it has some importance, considering it is a very capital-intensive company. This trend also illustrates the extreme increase in liabilities facing the firm. Its interest expenses have risen by around 4-5X, bringing its times-interest-earned down to about 1X. See below:

Over the past 12 months, Royal Caribbean's EBIT has gone to interest costs. Even if we assume its EBIT rises slightly as its recovery finalizes (which I believe it already has), we can take most of its income to interest costs. This is a permanent issue because it is unlikely the company will earn enough money to raise sufficient cash to pay off its debt. Equity dilutions are a likelier means of reducing debt in the long run. Its financial debt-to-EBITDA is a staggering 7.7X, making it extremely difficult for the company to get out of this debt hole. Currently, its net income is not high enough that it should be able to raise sufficient cash to pay down its debt. It can refinance this debt, but likely at even higher interest rates due to the rise in borrowing costs since 2021. Most likely, the firm can (and, I believe, eventually will) issue equity to reduce debt, potentially diluting equity investors significantly.

Royal Caribbean's credit rating is B1 (B+) after its most recent upgrade. This is objectively a meager credit rating, particularly for a company of its size. Most of its debt is fixed-rate senior unsecured, with maturities peaking around 2025-2027 but occurring from 2023 to 2035. Crucially, much of this debt was created during the 2020-2021 period when interest rates were meager compared to today; thus, if rates remain high over the coming years, then Royal Caribbean's interest costs will continue to rise as it refinances at much higher interest rates.

Cyclical Recovery May Become Downturn Soon

From a purely operational standpoint, not accounting for debt concerns, Royal Caribbean's current standing is equal to, or even slightly better than, its pre-COVID level. Bookings are higher than in 2019, and the company has pushed most increased operating costs into its ticket prices without losing customers. A rebound in fuel costs could easily upset that trend, considering much of Royal's margin recovery in 2023 is likely due to the compression in fuel prices, which is currently reversing. Still, I believe it is safe to say that most major demand-side headwinds are behind the company, at least on a TTM basis.

Subjectively, I believe that Royal Caribbean's economic pattern is similar to that of Texas Roadhouse (TXRH). If we're looking broadly, US and global consumer activity is not strong. People are actively reducing discretionary spending as their real spending capacity declines, and many people's ability to borrow money reaches a limit. Over the most recent months, there has been a notable uptick in credit card defaults, slowdowns in credit card debt growth, and another sharp decline in personal savings rates. Put simply, many people want to spend like they have not been impacted by inflation but do not have the excess financial capacity to do so. For example, steakhouses are seeing stellar demand because people missed them, even though they're not much more expensive, and most people cannot afford them so quickly.

For the same reason, I believe many may be booking cruises because they missed the opportunity over the 2020-2022 period. Of course, cruises are more expensive, and people do not have more money to spend. Increased credit card debt has offset that issue, but the recent declines in credit card metrics indicate that people will need to reduce spending in the future. Statistical recession odds remain extremely high by historical standards, so an increase in unemployment could accelerate that trend significantly.

The Bottom Line

It is difficult to confidently say where consumer spending trends will go over the next year. Based on a great deal of data and trends, it seems most likely that consumer spending levels peaked around Q2 in the US (seasonally adjusted) and are now heading lower as more people tighten budgets. Obviously, this will not deter many from going on Royal Caribbean cruises; however, given its higher costs, even a 5-15% decline in ticket sales would be enough to hold Royal's net income below water for a prolonged period. The ongoing rebound in fuel prices or an actual cyclical recession (that causes some unemployment) would accelerate this trend. However, even if those negative catalysts do not occur, it seems very unlikely that consumer demand for Royal will continue to rise into abnormally high territory, given today's low savings and high consumer debt levels.

Overall, I am very bearish on RCL and believe it is significantly overvalued and likely a decent short opportunity at its current price. In my opinion, the stock is considerably overbought because it is a recovery trade. While that was true in early 2021, the company has been operating in a "new" normal environment over the past twelve months. Indeed, I believe the most recent quarter, and potentially Q3, are abnormally above its long-term potential because it's generating excess sales due to pent-up demand (people who delayed travel, etc.). I believe that Royal's ability to generate a consistently positive net income is questionable, considering both rising costs and, most importantly, colossal interest cost increases.

RCL's downside is challenging to estimate because it depends considerably on external trends. If we assume that consumer demand remains abnormally strong while cost pressures do not mount, then perhaps RCL overvalued by just 20-30%, adjusting its net income potential for increased interest. However, if any negative headwinds occur, such as a recession, prolonged high interest rates, increased fuel costs, wage pressures, environmental regulatory issues, or declines in consumer spending, then Royal's downside appears to be relatively significant because its ability to earn an income would become questionable. Most companies with debt-to-EBITDA and times interest earned at Royal's level could not obtain any external financing; however, its situation is unique because lenders have assumed it is recovering.

Although RCL's short interest level is elevated, its borrowing cost is still near zero. RCL's implied volatility is 32%, higher than most stocks but nearly one of the lowest levels RCL has seen in recent years. Since RCL's implied volatility is so low, speculators may find added potential in put options that may be a cheaper way to bet against it with defined risk. Of course, bearish speculators must be mindful of RCL's upside risks. To me, there is very little fundamental reason why RCL's income should outperform over the coming twelve months, but Q3 may still be better than expected, giving it some short-term upside potential. Further, it is a volatile stock historically popular among retail investors and can push stocks well outside of their fundamental value. Still, at its current elevated enterprise value and in light of economic trends, I firmly believe RCL's downside is much more significant than its upside.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in RCL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Looking at the estimated EPS of $8 (2023) $10 (2024) $12 (2025), and revenue of $13B (2023) $15B (2024) $17B (2025), RCL is about fairly priced.

It's a hold for me, but gun-to-the-head "long or short" I would short it because I see the high-interest rates are starting to cause some trouble in the economy.