Lululemon: A Textbook Case In Pricing Power

Summary

- Pricing power is crucial for long-term investments and Lululemon is a prime example of a company with strong pricing power.

- Lululemon's pricing power is indicative of its competitive advantages and is underscored by relative outperformance across a host of metrics.

- LULU has historically traded at a premium yet has outperformed. Compared to peers and 5-year average multiples, it looks attractive.

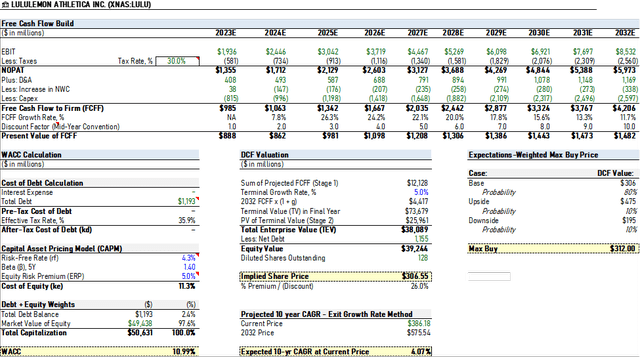

- Based on forecasted cash flows, I urge long-term investors to wait for pullbacks in the low $300's before resuming buying.

FinkAvenue

Investment Thesis

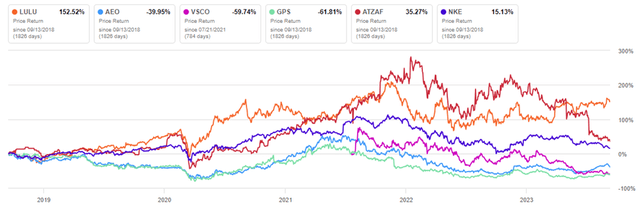

My last article on Lululemon (NASDAQ:LULU) was over a year and a half ago when the broader Apparel Retail sector was seeing post-pandemic demand tailwinds, inflation was on the rise, and LULU stock was trading in the $330s. Lululemon has continued to outperform peers fundamentally despite the challenging environment for its industry, driven in large part by the company’s demonstrated pricing power. Looking forward, I expect the company to remain atop the heap in its industry and reward patient long-term investors with market-beating returns.

The Economics of Pricing Power

In the context of uncovering attractive long-term investments, the impact of pricing power can’t be overlooked. Even the Oracle of Omaha himself, Warren Buffett, asserted that it is “the single most important decision in evaluating a business.” Pricing power is the capacity of a business to raise prices without incurring a meaningful loss in market demand. This capacity fortifies a company during times of market turbulence and economic uncertainties while helping secure long-term competitive outperformance.

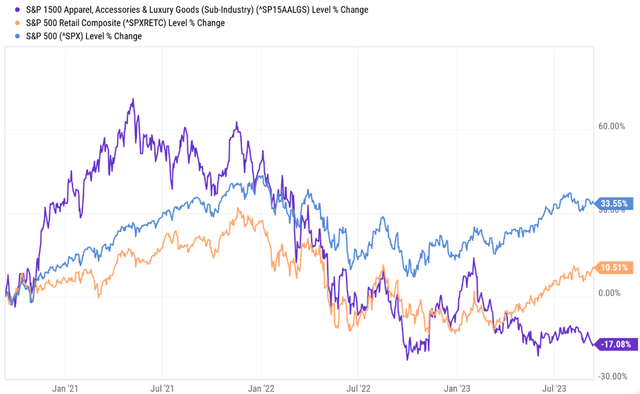

Apparel Retail falls under the Consumer Discretionary sector which tends to be heavily impacted by both Macro and Microeconomics. Higher inflation and cost of borrowing dampen consumer spending, while supply crunches and shifting demand trends benefit some firms but hurt others. Broadly speaking, Apparel Retail performance has been lackluster since the post-pandemic peak as this story plays out.

YCharts

Retailers have also faced challenges with consumer demand pulling out of goods and into experiences, in addition to a rising wave of inventory ‘shrink’. On the bright side, recent economic conditions provide a useful barometer by which we can test the pricing power of individual firms to find winners. And within Apparel Retail, Lululemon is the gold standard.

Demonstrated Pricing Power

The ability to pass rising costs to customers and retain demand is usually indicative of an underlying competitive moat. This is even more the case in industries more closely knit to consumer discretion like Apparel. Apparel is one of the first areas the average consumer tends to cut as their budgets tighten. Buyers also have leverage as the clothing industry is about as fragmented as industries get. Thus, firms demonstrating an inelasticity of demand in the Apparel industry tend to carry underlying advantages such as superior market positioning, product differentiation, or brand affinity. Lululemon exhibits all three.

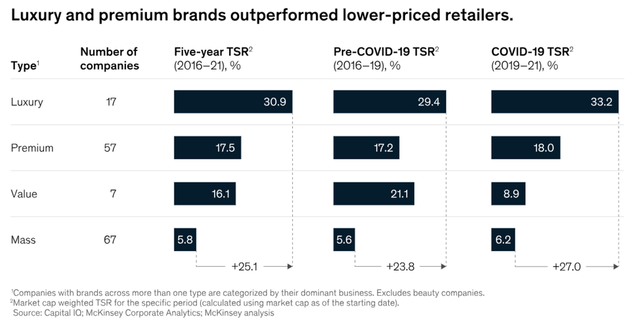

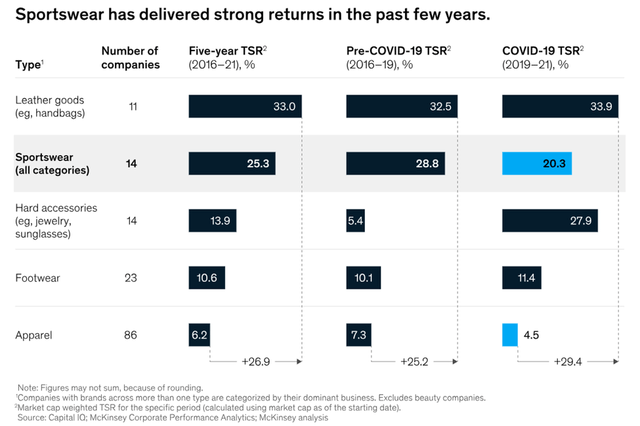

The combination of Lululemon’s already elevated price point, strategic focus on activewear, and ability to periodically increase prices without tamping growth highlights this fact. Lululemon would be considered a premium-priced company with many of its products exceeding $100. They were also a pioneer in the ‘Athleisure’ trend which exploded during the pandemic. The company’s strategic market position has been a major tailwind with McKinsey finding that Premium/Luxury and Sportswear brands were preferred by shoppers the past five years.

McKinsey

McKinsey

In addition to premium pricing, Lululemon has increased prices several times over the past half-decade. Yet, they’ve expanded their top-line at a 5-year annual clip of nearly 25% vs the sector average of 2% according to Seeking Alpha data. Their most recent price increase last summer amounted to 10% with the goal of absorbing higher input costs. Lululemon then proceeded to grow revenue 24% over the year. Something about Lululemon keeps customers coming back even with higher prices, namely, product differentiation and a strong brand. This is further underscored by their comparative outperformance across a variety of metrics.

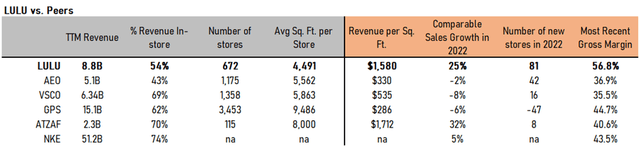

Author, data from company filings

The company’s sales per square foot and comparable sales growth wildly exceeds competitors, with the exception of Aritzia (OTCPK:ATZAF). Comparable sales are also known as ‘same store sales’, measuring the growth of existing stores and excluding new ones. Lululemon also continues to press on the gas in opening new stores. Doing so further leverages their impressive sales per square foot which has averaged about $1,500 the last five years. Lastly, the company’s gross margin exceeds peers by at least 10% and has a 5-year average of just over 56%. Margin superiority and stability are indicative of pricing power and competitive advantage. Both of which generated tremendous value for shareholders.

Seeking Alpha

Looking Forward

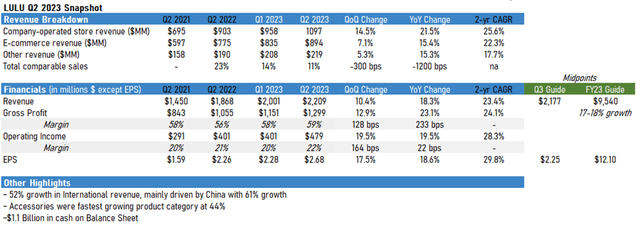

Lululemon’s inherent pricing power helped bolster its relative outperformance through the inflationary environment of 2022. But recently, the broader U.S. economy has experienced cooling inflation with tightening monetary policy. Disinflation and a tighter money supply often has an adverse effect on corporate profits overall, which fell 9.4% YoY in the second quarter of this year, according to the U.S. Commerce Department. Nonetheless, the company’s recent quarterly print has plenty of positive signs for investors, including an increase in profits. Here is a breakdown of their results:

Company Filings

Lululemon continues to meaningfully grow its topline, led by in-store revenue as traffic has trended upwards. Though growth has slowed in some areas relative to the company’s 2-year averages, newer categories and geographies appear to be picking up the slack, with accessories growing 44% and 52% sales growth internationally. China in particular was highlighted as an area of focus for Lululemon. Revenues there grew 61% YoY and the company has planned 35 new international stores for 2023 with a majority in China. Lululemon’s market runway is significant in the country, with only $527M of revenue so far in 2023 out of a Chinese Apparel market of nearly $318B (0.2% penetration). China is not without its risks though, including weakening consumer demand, falling exports, and sluggish growth. Overall, the company expects 17-18% growth for full FY24.

Effective capital allocation will be a major driver of success as we see a slowdown of growth in sales and earnings vs historicals. LULU has maintained and even expanded their gross and operating margins. In tandem with over $1B in cash on their balance sheet, the company looks poised to tackle persistent economic uncertainty. Additionally, Lululemon has slowly deployed cash to reduce outstanding shares through its repurchase program. With a 5-yr average ROIC of 25.6%, I expect shareholders are not complaining.

In addition to potentially slowing growth, macro and consumer uncertainty, and challenges in international markets, Lululemon faces increasing competitive pressure from established firms and newcomers. Continued operational excellence and product innovation will be the key differentiator moving forward as consumers’ appetites evolve.

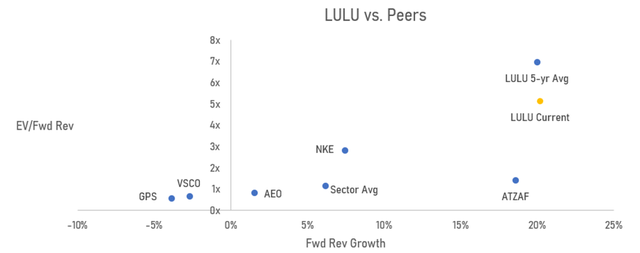

Valuation

Lululemon’s pricing power has pinned a premium on the stock historically. LULU’s 5-year average PS and PE are 7.1 and 55.8 respectively, well above its industry and the broader market. Yet, investors have been rewarded with market-beating returns. Currently, the stock sits below its 5-year average sales multiple but with similar forward topline growth, presenting a potentially bullish case in purely relative terms.

Author, data from Seeking Alpha

Nonetheless, the stock is pricing in too high of expectations in my view. In my base case, I see revenues growing at a 10-year CAGR of 13.9% as North American markets saturate, partially offset by a growing portion of revenues in Asia and Europe. I expect gross and operating margins to expand to the high 50’s and low-to-mid 20’s as the company continues to leverage its pricing power and realize economies of scale. Depreciation, change in net working capital, and capital expenditures are all expected to stay fairly constant as a & of revenue. My final assumptions are a WACC of 11% given LULU’s higher beta and a terminal cash flow growth rate of 5% to estimate terminal value. This results in a base case intrinsic value of $306.55 per share and an expected 10-year annual return of 4.07% at the current price. Upside and downside scenarios, which add variation to the DCF’s assumptions, had intrinsic values of $475 and $195. My expectations are an 80% probability of the base case coming to fruition and 10% for upside and downside cases, resulting in a probability-weighted fair value of $312 per share.

Author

Lululemon has been able to effectively navigate a difficult few years for Apparel Retail, driven in large part by clear pricing power and brand affinity. The company’s operating performance, competitive moat, and overall business quality have historically justified its premium pricing. Current relative valuation multiples and expected growth, especially given recent success in international markets, support a bullish view on shares. Nevertheless, I urge long-term investors to be patient for pullbacks and resume buying in the low 300’s.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.