Prologis: Well Positioned For High Interest Rates

Summary

- CPI came in higher than expected, raising concerns about inflation and the possibility of higher interest rates.

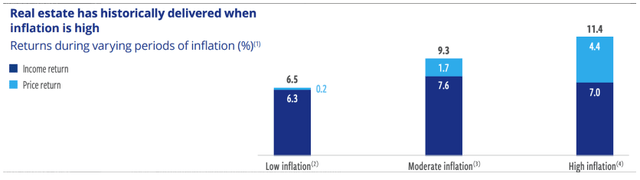

- Quality REITs, like Prologis, Inc., are a good investment in high inflation and have historically performed well in such conditions.

- Prologis is the world's largest industrial REIT, positioned to benefit from the growing e-commerce market and has strong operational performance.

- I present my bullish analysis on the stock.

Andrii Yalanskyi/iStock via Getty Images

Last week CPI came in hotter than expected as a result of energy heating up again, increasing by 5.6% month-over-month. The concern right now is that oil prices will continue climbing as a result of limited supply and increasing demand from China. This could reignite inflation, which would quite likely lead to the Federal Reserve keeping interest rates high for a longer period of time than currently expected.

As investors, we need to be ready for all possible future scenarios. That's why we should prepare for the possibility, that rates might indeed stay higher for longer, in which case we want to be invested in companies that will do well in high inflation.

Quality real estate investment trusts, or REITs, are an example of such an investment as highlighted by a study by Cohen & Steers which concluded that: (a) REITs tend to outperform once rates stabilize, regardless of the level of rates; and (b) real estate has historically done quite well in high inflation, returning double-digit returns.

The key is investing in high-quality REITs with low leverage and good growth prospects. One such REIT is Prologis, Inc. (NYSE:PLD), which I want to cover today.

Prologis

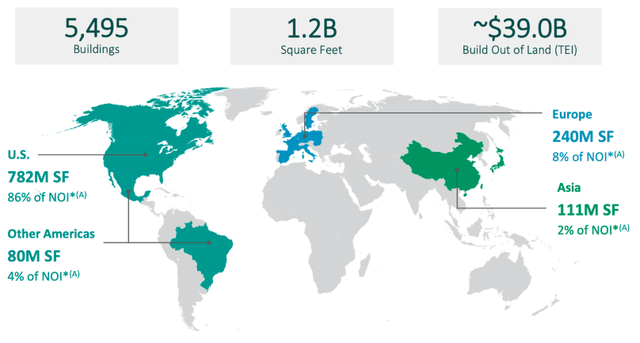

PLD is the world's largest industrial REIT with a market cap of over $100 billion. To put its size into perspective, it's more than triple of its 10 biggest competitors combined. This really puts Prologis in a league of its own when it comes to investment as well as financing opportunities.

The industrial market has seen a major boost during COVID and is expected to continue growing by 11% due to growing e-commerce, which according to PLD uses 3x more logistics space as brick-and-mortar stores. Additionally, as the average level of inventory as a proportion of sales recovers from low levels caused by supple constraints, logistics should be the logical beneficiaries. As a market leader, PLD is positioned to capture most of this growth going forward.

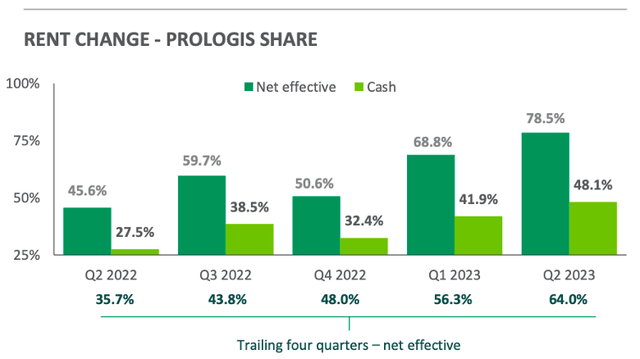

Q2 results were really good with the portfolio performing near all-time high levels. Currently, occupancy stands at 97.5%. I also want to point out that leasing has been very favorable with over 40 million square feet of space leased during the quarter, 70% of which came from existing tenants. Notably, the REIT has reached impressive rent spreads of almost 50% on a cash basis, which is a record result for the company. Strong leasing has contributed to a very solid 10.7% YoY increase in same-store cash NOI.

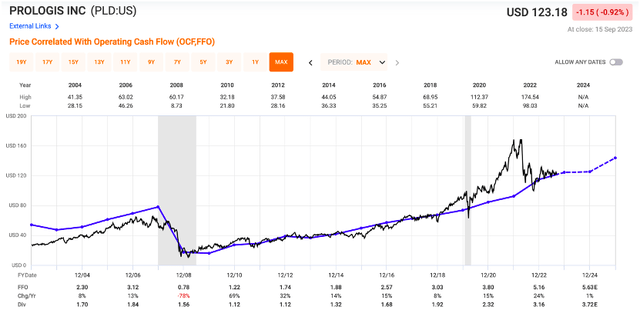

Strong operational performance of the portfolio has driven core funds from operations, or FFO, per share to $1.83 vs. $1.11 last year. To make these numbers comparable we have to mention that Q2 2023 included a one-off of $0.58 per share related to net income from PLD's strategic capital business, which wasn't there in Q2 2022. Absent this one-off, core FFO per share increased by 12.6% YoY.

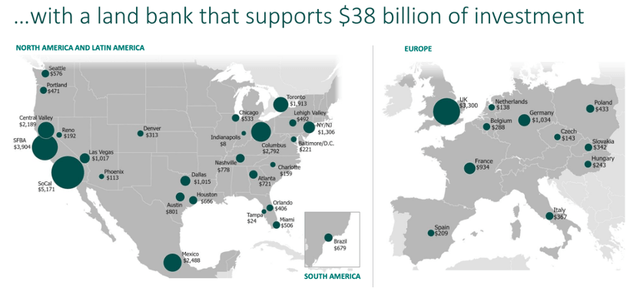

Going forward, PLD is likely to continue growing their FFO through rent increase, but also new development which has historically gone very well for the company, creating over $11 billion in value thanks to a 32% margin that the company has been able to generate on its development projects. With a $38 billion land bank, the company is very well positioned to continue growing externally if it chooses to.

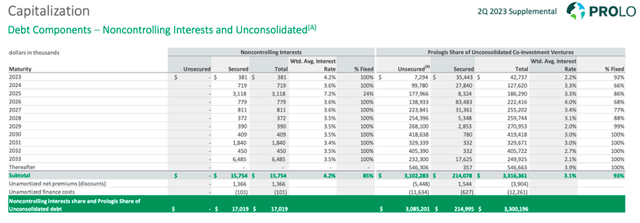

PLD maintains an A-rated balance sheet, which is extremely rare in the REIT sector. Their leverage is very reasonable at 4.2x EBITDA, 93% of their debt is fixed-rate, and they enjoy a very low cost of capital at 3.1%. Maturities are well staggered and while they are not zero in the upcoming years, with their A-rating PLD will have no problem refinancing.

All things considered, PLD is one of the largest and arguably safest REITs in the market today. Consequently, it's not cheap with a well-covered dividend yield of 2.8% and trading at 22.5x FFO which is around its historical average.

Growth consensus calls for forward FFO growth in the mid-single digits. My personal estimate is 6-7% annual growth for the next three years, based on rent increases and the new development pipeline.

I'm hesitant, however, to forecast multiple expansions from the current high level, especially if higher interest rates are now a real possibility. That's why my price target for 2025 assumes no multiple expansion and stands at $140-145 per share, or about 15% upside from today's level.

Combined with the dividend, I think it's realistic to expect a total 8% annual return from Prologis, Inc. Given the high level of safety, that may be enough for some investors, which is why I rate the stock a BUY here at $123 per share.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

It’s amazing how a few Reits have held or gained.

Still no dividend to speak of.

Pretty stiff price