Sunrun: Debt Remains A Concern, Reiterating Sell

Summary

- Sunrun Inc.'s share price has decreased nearly 15% since our last coverage due to high debt levels and a lack of net income growth.

- Sunrun is a growing company offering residential solar energy solutions with a focus on clean and economical alternatives.

- Despite some growth in revenues, the increase in costs for obtaining new customers is a concern and may lead to a further decline in share price.

yangna/E+ via Getty Images

Investment Rundown

Investing in the solar industry may be exciting and potentially full of some very promising plays, but one has to realize some of the risks and poor tactics some of these companies are deploying. I think that Sunrun Inc. (NASDAQ:RUN) is a very good example of a company that gained way too much in share price during the hype and once the actual earnings potential of the company was visible the market woke up and realized the price was far too expensive.

Since my last article on the company where I rated them a sell, it has decreased a further nearly 15%. In hindsight, it's very easy to say that the decision was very good, but I think what made me conclude was the large amount of debt levels that are weighing heavily on the bottom line. With nearly 3x as much debt as the market cap RUN will remain to be very expensive for a long time until debt levels decrease drastically. I still don’t like the business and think the poor capitalizing of taking on that much debt and having no net income growth to show for it makes RUN still a sell.

Company Segments

RUN. is a quickly growing U.S.-based company focusing on homeowners by offering sustainable residential solar energy solutions. With a core mission centered on providing clean and economical solar energy alternatives, RUN offers a holistic suite of services. These services encompass every aspect of solar panel adoption, from flexible financing options to ongoing maintenance and support. RUN's commitment to streamlining the transition to solar power makes it a trusted partner for homeowners seeking eco-friendly and cost-effective energy solutions.

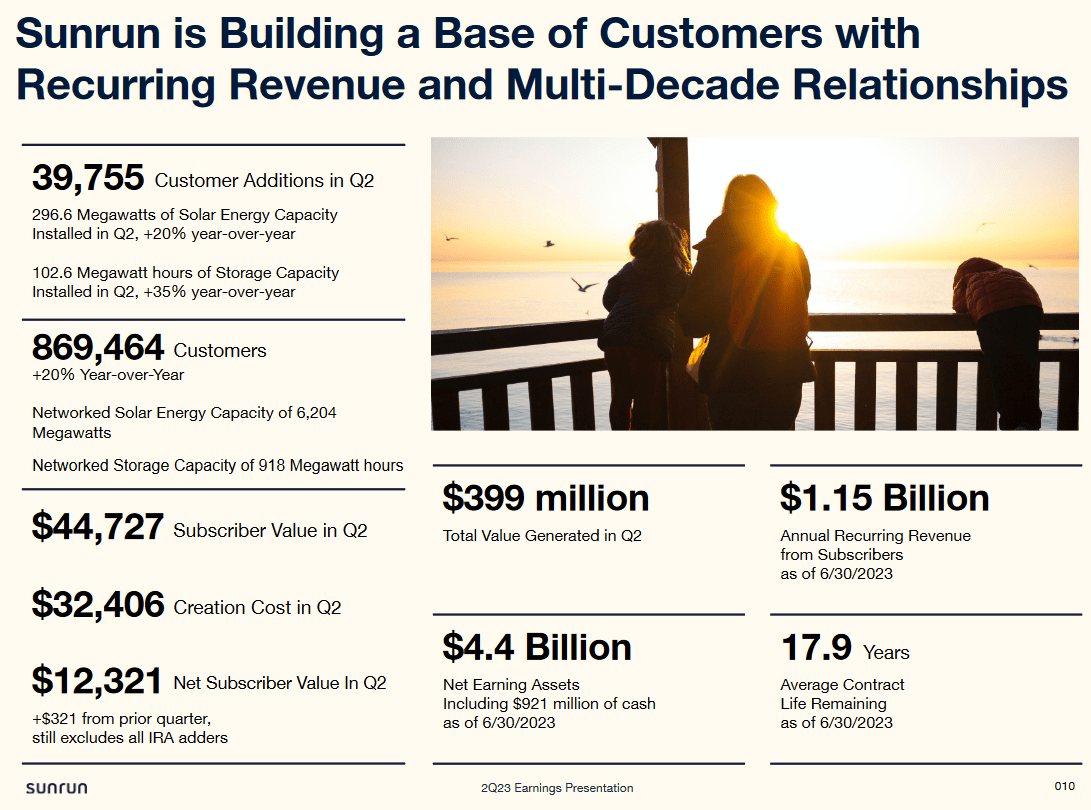

Company Overview (Investor Presentation)

The company has been able to grow the asset base very efficiently over the years and it right now sits at $4.4 billion and has gathered up an average contract life remaining of 17.9 years. That should help ensure a lot more recurring revenues for the business, but it will take time until it actually can trickle down to affect and pay down the debt in my opinion. The solar market has seen some headwinds as the rise of interest rates is softening the spending volumes of Americans, but RUN has still been able to grow the customers by 20% YoY.

Earnings Highlights

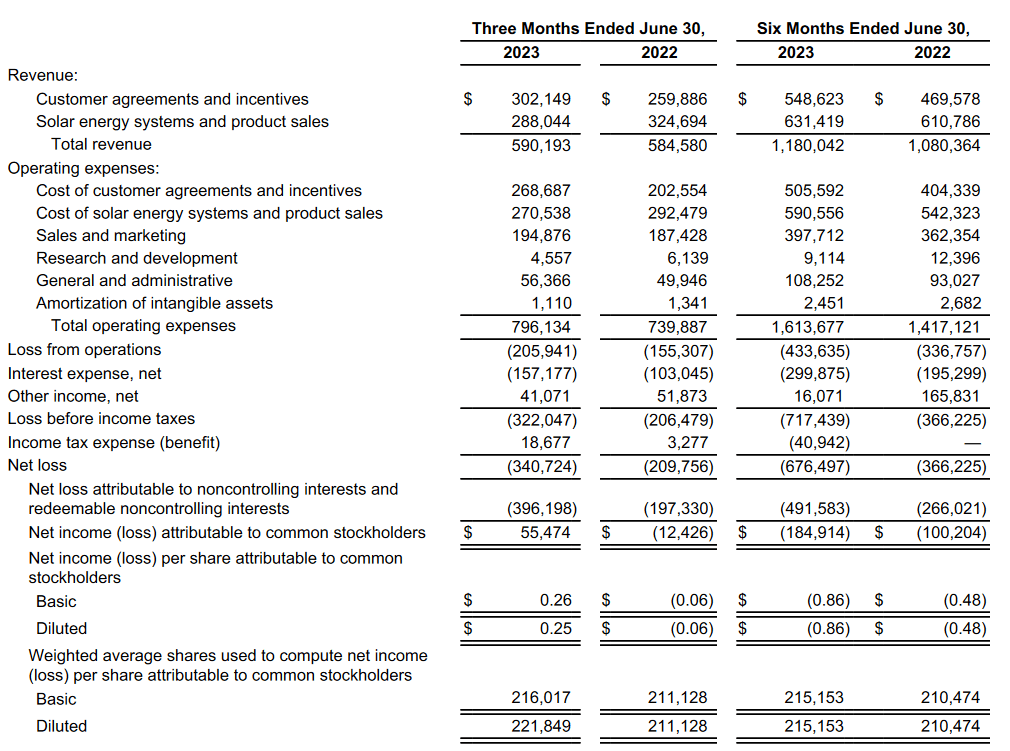

Income Statement (Earnings Report)

The revenues for RUN have had a slight increase on a YoY basis for the last quarter, coming in at $590 million, up $6 million. What has me worried when looking at the income statement is the large increase in costs for obtaining new customers. It has grown by over $60 million on just a yearly basis. That has not been translated into higher revenues by a vast amount. If this continues then RUN may face issues funding new customer acquisitions and be forced to hold back. This would likely result in sending the share price even lower.

Risks

RUN remains vulnerable to potential demand fluctuations, especially if the Federal Reserve continues its aggressive stance on combating inflation. The central bank's efforts to suppress inflation may have unintended consequences, including dampening consumer sentiment and spending. In such a scenario, if the Fed further raises interest rates or maintains them at these elevated levels for an extended duration, it could exacerbate RUN's existing substantial debt burden. This heightened financial risk underscores the importance of closely monitoring the Fed's actions and their potential impact on RUN's debt management strategy.

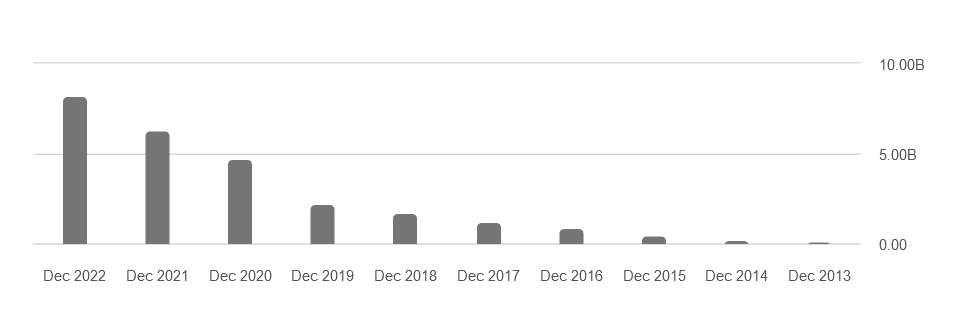

Debt Levels (Seeking Alpha)

With the debt levels quickly approaching the $10 billion mark, RUN is right now having nearly 3x as much debt as the market cap. This has created a in my opinion unsustainable situation where something might very well break, and the most prominent thing to me is defaulting on debt. RUN has had to rely on diluting shareholders to raise capital to pay down current debts and keep operations online. The rise of interest rates has also increased the interest expenses for RUN exponentially and are nearly $500 million in the last 12 months. I think that rates will remain elevated for quite some time and that will put an immense amount of downward pressure on the stock price and earnings potential.

Final Words

The valuation of RUN appears to be unreasonably high, even when considering its substantial potential growth trajectory from secular demand for renewables. When evaluating an investment, it's crucial to maintain a realistic perspective. When a company's stock price is not aligned with its underlying fundamentals, investors are exposed to a heightened level of risk. It's important to tread carefully in such situations to make informed investment decisions.

The p/e for RUN is negative as the company is focusing instead on growing unit cash generation. The earnings for RUN right now I think are quite difficult to assess. Expectations are that by 2025 RUN will be able to generate an EPS of $0.12 and the year after $1.67. I think that the potential of RUN is appealing, but if they can maintain solid earnings for several years and also grow that, then eventually the debt levels will be too large for dilution not to be the only solution to pay it down. I do have to admit that RUN still makes good progress on the top line in the business as it has by over 30% annually in the last 5 years. The p/s right now does offer a nearly 5% discount to the sector but once again, for solar companies, positive earnings are incredibly important as otherwise it's just a money drain. Given all that, I am going to reiterate my sell rating for the company as the debt levels are too high and earnings too volatile.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.