Let's Build A Bond Portfolio Together: Charles Schwab Bonds Yield 5.7%

Summary

- Investment-grade bonds offer yields of 6.0% to 7.5% or more, making them a generational opportunity for investors.

- Charles Schwab is a leading financial trading platform that generates revenue primarily from interest and asset management fees.

- Schwab's recent acquisition of TD Ameritrade positions them well in the retail brokerage and registered investment advisor spaces.

- We like the high coupon, recently issued 5.875% bonds that mature in 2026. I have paired it with the 2029 and 2032, which are low coupon, discounted bonds.

Viktor Aheiev

***This report is a recommendation to purchase the Charles Schwab 2027 Bonds

We believe individual bonds are situated today as one of the best risks/rewards in the market. We can achieve 6%+ returns for investment-grade rated company debt. Two years ago, those issues yielded 2.5% or less.

We think this is a generational opportunity in individual bonds with the aggressive hiking campaign to kill the inflation bug. Investment grade bonds are boring but will provide you the best returns for the risk over the medium term.

- Individual Investment Grade Bonds: A Generational Opportunity To Lock In 6%+ Yields.

- Why A Lower Yield May Be A Better Long-Term Investment

The opportunity today should not, and cannot, be understated. Investment grade bonds offer up yields of 6.0% to 7.5% or more in some cases. Investors can lock these in as they are likely to be a fleeting figment of history.

We are encouraging our members to lock in these yields for as long as you can to cement these ~6.5% yields for many years. Individual bonds are the best (and really only way) to lock these in as open-end bond funds will be subject to cash flows that will correlate with current yields. Thus, as interest rates come down in the coming years, the yield on the bond fund will decline as well.

In the first part of this series, we looked at Main Street Capital 2026 bonds that yield upwards of 7.0% (at the time 7.5%).

- Let's Build A Bond Portfolio Together: Main Street Capital 2026 Bonds, 56035LAE4, YTW: 7.5%

- Let's Build A Bond Portfolio Together: Athene Holding Ltd. 6.5% 2033 (04686JAF8), YTW: 6.2%

- Let's Build A Bond Portfolio Together: Hercules Capital 3.375% (427096AH5), YTW: 7.4%

Why Charles Schwab?

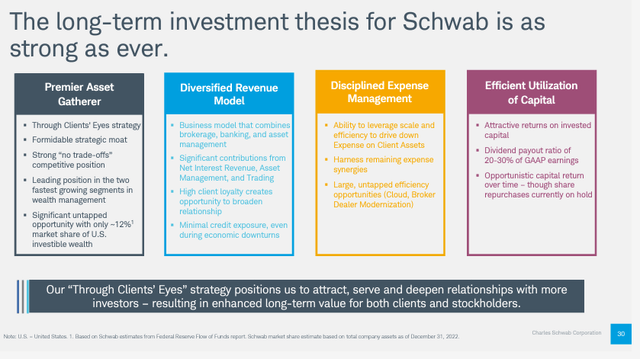

Charles Schwab (NYSE:SCHW) is the leading financial trading platform in the world (acting as a clearing mechanism between buyers and sellers over a large array of exchanges).

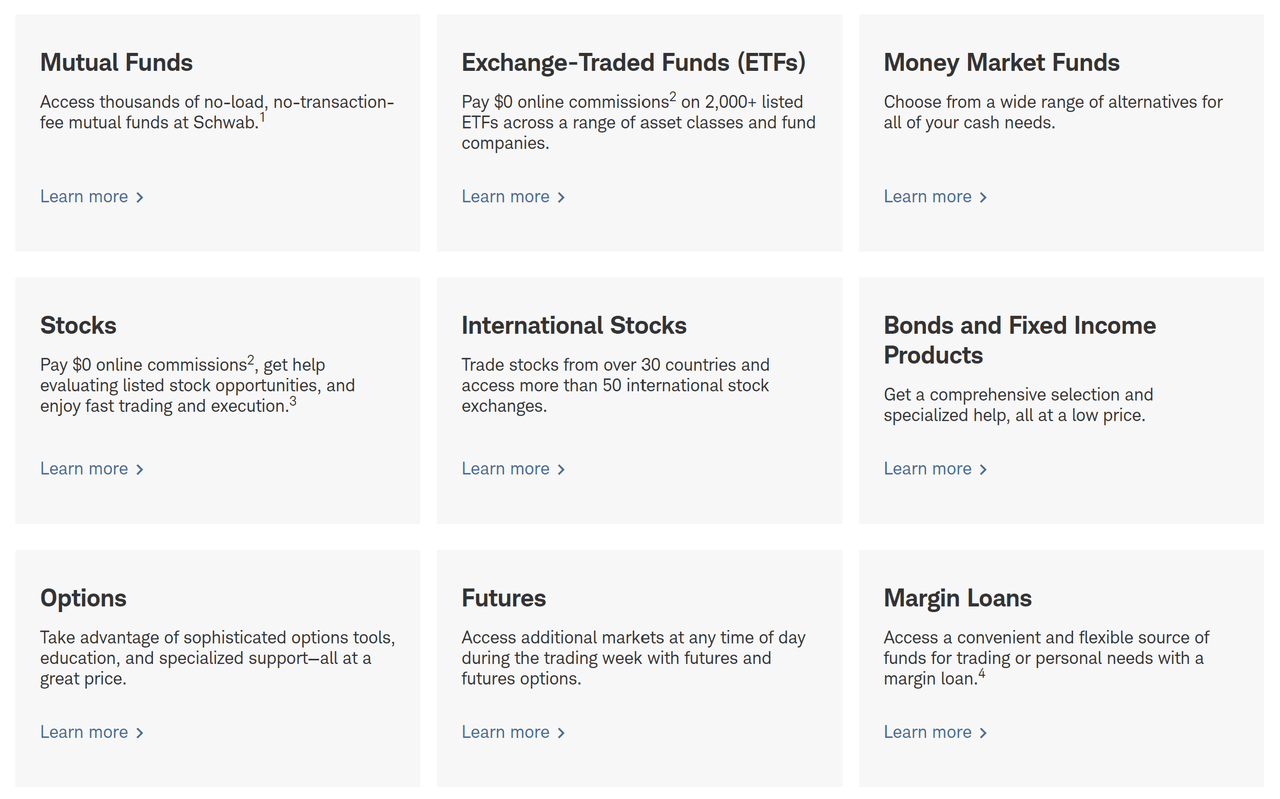

The biggest misnomer on Schwab is how do they make money? Most believe that they make money charging commissions for trades. However, having recently eliminating trading fees on stocks and exchange traded funds, that should tell you that this was only a minor player in their revenue generation. They still charge fees on many mutual fund transactions, options transactions, and $1 per bond on secondary bond trades.

Schwab generates revenue primarily from two places: 1) interest on deposits, loans, and securities, and 2) in asset management, mostly by charging fund companies a fee for being on the Schwab platforms. Additionally, they have their own funds with billions in assets under management generating substantial revenue.

You can think of Schwab as two different companies, one a bank and the other a trading platform.

Schwab

Schwab recently converted over TD Ameritrade combining the number 1 and number 2 players in the retail brokerage space. They also are the two largest players in the fast-growing registered investment advisor space, which should help solidify a significant amount of recurring, stable revenue.

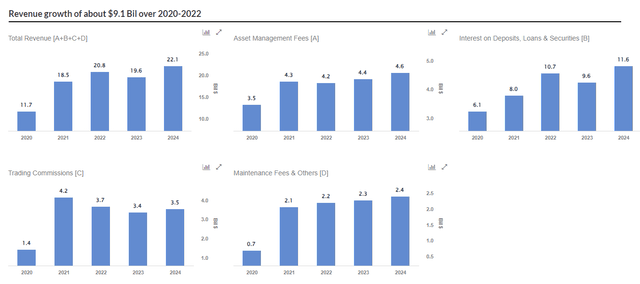

Below is the breakdown of the revenue and the change plus forecast for next year. The largest piece, and the most volatile, is interest on deposits, loans, and securities (top right chart).

In March, the company suffered along with other banks thanks to Silicon Valley Bank's failure. Remember, Schwab is half commercial bank and half brokerage platform. The bank side was experiencing the same dynamics that small and regional banks experienced, namely deposit flight.

Investors were pulling out cash (any pure cash in the brokerage is sitting in the Schwab bank as well as other types of typical cash accounts) and buying money market funds or other short-term assets. That is because the deposit rate on pure cash was around 1% while money markets were yielding more than 4.75%.

That is money going out of the "bank" and into a brokerage account, essentially going against the bank assets. Assets in the bank that pay 1% generate, for the bank, around 3%. A quasi-float, also called net interest margin. This is one of the largest drivers of the firm's revenue.

As money flows out of bank accounts at Schwab and into money markets, it drains that revenue driver and also, all else equal, increases the leverage of the bank. However, Schwab is NOT a traditional bank that takes in deposits, pays short-term rates, and invests long-term via originating 30-year mortgages.

Thus, the same risks that applied to Silicon Valley Bank do not apply here. Instead, the risk is that their largest revenue driver declines substantially, choking off cash to other areas of the company. Still a major risk but not nearly the same thing as a leverage/deposit flight issue. The bank only exists to support the brokerage business.

The question is A) when deposit growth will resume and B) when will net interest margins expand to support overall firm earnings.

Recent Results:

The key highlight in the quarter was management improving the outlook for expenses with an additional $500m in annual cost savings on top of the already $500m of Ameritrade cost savings already anticipated for this year. Schwab is now forecasting +6% in expense growth this year (mostly to digesting Ameritrade) and expenses to be flat or down slightly next year.

Cash "sorting", essentially the movement of deposits to money market, has slowed dramatically, which is good for the bank side of the business. By the end of June, just $29m per day was being moved. Average earning assets decreased by 2.7% (-$13.1B) to $466B. Of that $13.1B, $9.6B went into purchased money market funds at Schwab brokerage. This is unlikely to slow in the near term as the rate differential remains.

The real disappointment in their year has been their OneSource platform, their fund Supermarket, including their own Schwab-branded funds. Assets under management grew to $255B in the second quarter. While it is growing, it is the slowest part of their business.

Unfortunately for Schwab, the big winner in their acquisition of TD Ameritrade is Fidelity who will likely capture the bulk of the assets- both retail and institutional- fleeing Schwab for one reason or another. And as a percentage of AUM, their advice business is declining. No shock here as many probably won't want a 23-year-old journalism major building their portfolio.

Over the long-term, they are well positioned to reap the benefits of their massive scale and the shift away from broker-dealers and warehouses and towards registered investment advisors.

Most of the sell-side is bullish on the stock here. JP Morgan recently reiterated a $95 price target (upside of 61%). Goldman wasn't quite as bullish but is bullish, nonetheless.

From Goldman Sach's research:

We reiterate a Buy rating on SCHW with 21% upside to our updated $80 12-month price target. We continue to see SCHW as one of the few companies in our coverage that is still meaningfully under-earning, with EPS inflection set to accelerate over the coming quarters amid A) peaking headwinds from cash sorting / wholesale funding utilization that should drive material reduction in funding costs and upside to cash revenues over the next two year (we est. NII + BDA fees will be up 50%+ in 2025 from 2023 levels while the rest of the capital markets space is facing flat to down cash revenue trajectory as interest rates peak), B) better-than-expected expense trajectory (+6% in 2023 vs prior +7%, and flat to down in 2024 vs. +4%-5% Street expectations), C) a path to improving capital position (including unrealized AOCI losses), opening a window to share repurchases down the road (though likely not until 2025, in our view).

How To Play It

While I think the common is undervalued (and have a long position in it), I think the best way to play it is on the bond side. The debt that was recently issued is 3-year investment grade corporate notes maturing in August 2026. The coupon is far higher than any other issues Schwab has at 5.875% with the first semi-annual coupon at the end of February next year. The yield on that debt is 5.79%.

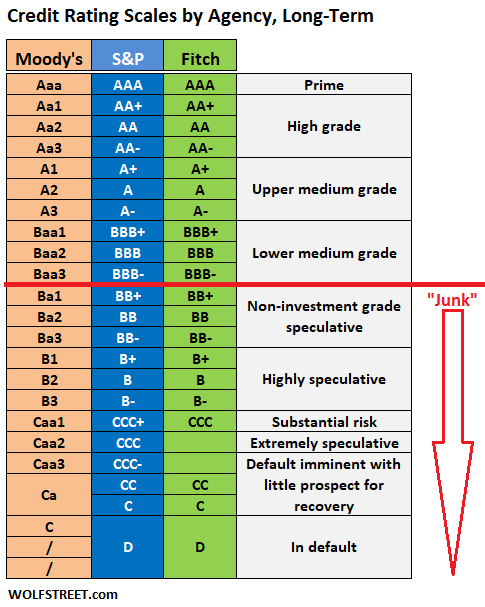

The credit rating of the debt is very strong at A- from S&P and A2 from Moody's. The problem for retail investors is there's a large minimum for the best quote- 250 bonds or $250,000.

wolfstreet

De-selecting best quote would open up your options to lower purchase quantities. With just a 2 bond minimum, you are sacrificing a mere 3 bps with a yield-to-worst of just 5.76%.

That is going to be your best bet for income given the high coupon (and trading right around par) but you can buy some lower coupon discount bonds and lock in that yield-to-maturity for longer.

For example, they have a 2029 issue (808513BA2) and a 2032 issue (808513CA1) that yield 5.72% and 5.70%, respectively.

I personally own all three issues, 2026, 2029, and 2032, as I attempt to push out my maturities and overall portfolio duration to lock in these yields as I expect yields to be lower a year from now.

Outside of the bonds and a smaller position in the common, I have some call options as well going out about 10 months. This is to 'leverage' my common position while defining my risk. They are out of the money by about 7% at the moment.

Concluding Thoughts

Schwab has been caught up in the banking contagion of the last six months and has lost a significant amount of shareholder value. While they have headwinds at the moment, they are not exposed to the same duration mismatch of many of the banks that are currently running into trouble.

Schwab Bank, a large revenue driver of the firm, is likely going to continue to see deposit outflow but most of that is shifting towards their own money markets over to the brokerage.

When building a bond portfolio, we are looking for liquid bonds (in case we do have to liquidate), with strong credit ratings and a solid yield. The Schwab bonds fit that criteria well. While they aren't the highest yielding bonds, they are high quality and very liquid allowing investors to build a solid base yield at 5.7%+ while adding satellite small issues that yield 6.5%+.

-----------------

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

This article was written by

- YH Core Income Portfolio: yield ~8%

- YH Flexible Income Portfolio: yield 7.53%

- YH Taxable Core Portfolio: yield 5.24% (some tax free)

- YH Financial Advisor Model

Plus: Muni CEF Shopping List.

Our team includes:

1) Alpha Gen Capital - I am a former financial advisor and investor. Not someone from another career doing this on the side. My analysis is meant to provide safe and actionable insight without the fluff or risky ideas of most other letters. My goal is to provide a relatively safer income stream with CEFs and mutual funds. We also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies:1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.3) Landlord Investor- spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.

www.YieldHunting.com

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SCHW BONDS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)