Robinhood: Now Different Than Before

Summary

- Robinhood's business model initially relied on zero-commission trading and payment for order flow, but the company is undergoing a transformation from a brokerage business to more of a financial services firm.

- The company's revenue mix reflects more revenue from interest-related business than trading, which is very different from how it used to look a year or two ago.

- Robinhood has recognized the need for change and is adapting its business strategy to attract positive sentiment and regain its popularity.

filadendron/E+ via Getty Images

Robinhood (NASDAQ:HOOD) the stock trading platform has seen its fair share of ups and downs ever since it launched. It was loved by many for its ease of use and no-commission trading. Then came its downfall during the meme stock mania and a lot of bad press followed with questions about its revenue model and the sentiment was bad overall. While many traders still remember Robinhood of the past, the company has been making transformative changes that make the company look very different now compared to its past. I believe these changes are transforming the company for the better and the positive sentiment will follow the company once again. The stock has been responding accordingly. The stock fell more than 80% from its all-time highs but has been up more than 30% YTD.

Before V Now

Business Model

The company started off by providing zero-commission stock trading and eventually expanded to provide zero-commission options trading. The app was colorful, simple to use, and pushed users towards more trading which helped its business model that was primarily based on payment for order flow. It even started a premium version of its offering that offered margin among other features for a monthly fee.

Looking ahead to the most recent quarters and considering its product lineup, the company appears to be broadening its range of offerings. Due to the availability of low-risk, high-yield investments, there has been a decrease in users engaging in stock trading, resulting in a decline in revenue from this side. Consequently, the company acknowledges the necessity for adaptation. It is transitioning its business towards becoming more of a financial services firm.

Its biggest foray is into the retirement investing sector, traditionally dominated by established brokerage firms. Since introducing traditional and Roth investment retirement accounts in January, the platform has attracted over 325,000 IRAs with assets surpassing $1B. Robinhood's focus is on appealing to gig workers and freelancers without access to corporate 401(k) plans. They offer a 1% match on eligible IRA deposits kept for at least five years, including new contributions and transfers from other retirement accounts. Premium subscribers to Robinhood Gold, who pay $5 monthly, receive a 3% match. This offering is unique as it provides an IRA with a match without requiring an employer.

Its next foray is going to be a credit card offering. It bought the startup X1 and sees further opportunities for expansion in this area. With a sizeable cash hoard of $6B and $3B in lines of credit, it certainly would not be a problem for the company. Below is a quick list of implemented things and what is in the pipeline that is transforming the company.

1. Retirement accounts and Credit Cards

2. 24-hour Market for liquid stocks

3. Expansion into UK market

4. Stock screeners, Robinhood Wallet and Robinhood Connect

5. High Interest Account

Revenue Mix

The majority of the revenues were based on transactions and this has drastically changed for the company. Transaction revenues are based on trading volumes and can be inconsistent. Diversifying the revenue mix makes their earnings more stable. This becomes especially attractive when most banks are not offering high interest on customers' accounts. From being less than 20% of the revenues in 2020 to being more than 50% of the revenue mix, interest-related business is definitely transformative on the company's top and bottom lines.

Monthly active users are far from their peak but the company was able to report its first-ever profitable quarter as a public company and this is mainly attributed to its interest-related business. I believe its foray into retirement accounts and credit cards will further diversify its revenue mix and make it more resilient.

Efficiency

The company has been aggressive in its costs and has been focusing on making its operations leaner with a focus on efficiency. This has resulted in multiple benefits.

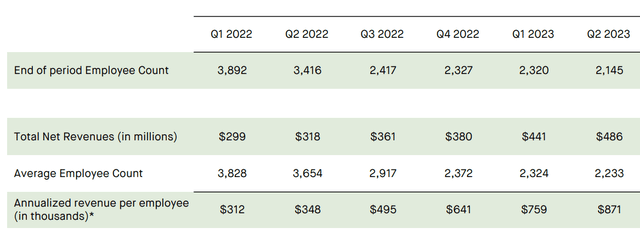

1. Revenue per employee has seen a 150% improvement YoY and the average employee count has fallen 39%

Revenue per Employee (Q2 Earnings)

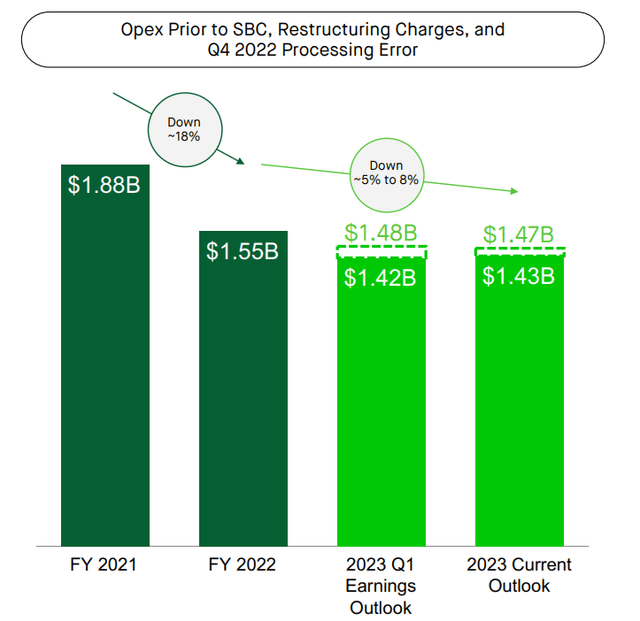

2. Operating expenses prior to SBC only saw a marginal increase of 1%. Prior full-year 2023 outlook for Opex prior to SBC was $1.42 - $1.48B. Even with costs related to their X1 acquisition, this remains unchanged mainly due to the company making its operations more efficient.

3. Another criticism of the company was its high SBC. Due to the company being more efficient with its resources, it has been able to drive this lower than its initial outlook. The initial outlook projected SBC at $955M - $1.035B and this has been lowered to $900 - $940M.

Valuation

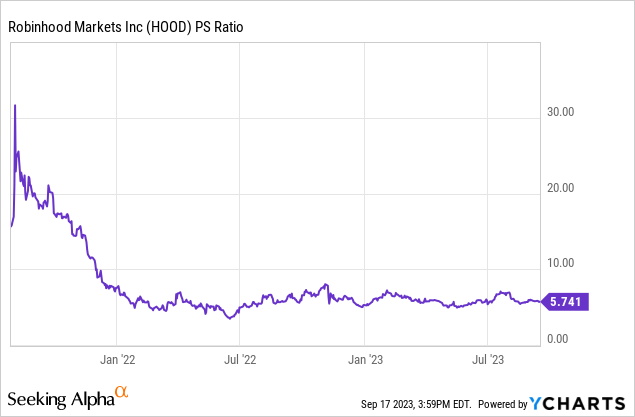

Valuation has definitely improved in the last two years. The company entered public markets at sky-high valuations but the market justified it due to its growth projections and when this did not materialize there was a big reality check. I still would not call the valuations fair at this point but what we have seen so far is a step in the right direction.

The takeaway here is that valuations have improved now from what was observed before and has also helped it get more in line with its peers. Right now as a brokerage group, its peer group is still small but as the company expands into more of a financial services firm this group should definitely expand in the coming years.

| Company | P/S |

| Robinhood (HOOD) | 5.7x |

| Futu Holdings (FUTU) | 7.1x |

| Charles Schwab (SCHW) | 5.2x |

| Interactive Brokers (IBKR) | 1.9x |

Final Takeaway

This company is on my radar and I rate this as a Hold. What I have seen this year warms me up to the stock but I need to see evidence for a longer duration before pulling the trigger on the stock. I expect to see their results for a few more quarters before fully committing to the stock and will be posting an update here in the next 3 - 12 months.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.