SoFi: Road To Top 10

Summary

- SoFi's high-margin Lending business is set to take off as the student loan moratorium expires.

- SoFi's balance sheet continues to expand as the company added a record number of Members.

- Expects GAAP profitability by the end of the year.

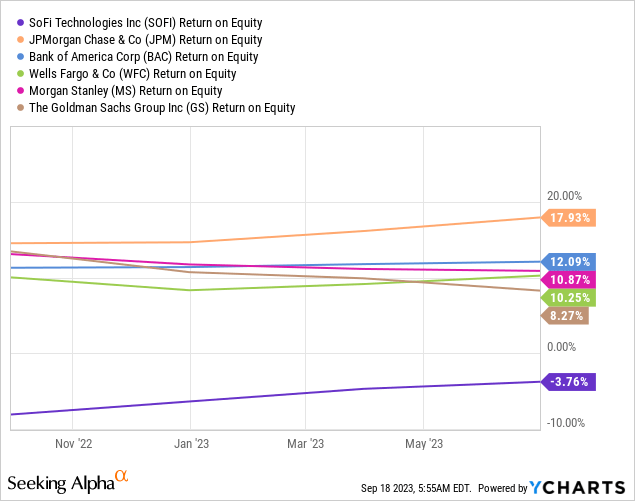

- Management targets an ROE of 30%+, well above industry levels.

- SoFi is taking market share from the top banks.

Brian Ach/Getty Images Entertainment

Introduction

Right off the bat, SoFi (NASDAQ:SOFI) stock gained popularity following its much-hyped merger with one of Chamath Palihapitiya's SPACs.

It's one of the most volatile stocks out there, and being the avid fintech follower that I am, I got curious with all the buzz with SoFi.

I've followed SoFi for a couple of years now but was reluctant to publish an article as I find SoFi one of the more difficult stocks to analyze.

Well, the day has come when I finally muster the courage to share my thoughts and findings on the company.

Any feedback or criticisms? Fire away.

That being said, I hope you enjoy this deep dive.

Here's the main takeaway to warm you up:

- SoFi is disrupting the banking industry through its all-in-one financial platform.

- The company is in hypergrowth mode and is set to continue to expand as the student loan moratorium expires.

- Profitability is also improving and management is targeting a long-term ROE of 30%+, which is well above those of major legacy banks.

- Most notably, SoFi is taking market share from the top banks, a clear indication that the road to becoming a top 10 financial institution is well underway.

Company

Social Finance, or SoFi, was founded in 2011 by four Stanford Graduate School of Business students, namely Mike Cagney, James Finnigan, Dan Macklin, and Ian Brady. In essence, they wanted to build a platform that provided more affordability in terms of student loan financing.

Funded by 40 Stanford Alumni, the four students went on to launch their pilot loan program to approximately 100 Stanford students, for a total of $2M.

This experiment proved to be successful and SoFi went on to raise more capital from banks and outside investors, which allowed the startup to expand to other schools across the country.

Over the years, the company also introduced other products such as student loan refinancing in 2012 (the first company to ever do so), mortgages in 2014, and personal loans in 2015.

Everything was going great for the company until September 2017 when former CEO Mike Cagney stepped down from the big job due to allegations of sexual harassment, which pretty much damaged SoFi's brand reputation.

Fortunately though, just four months later, SoFi hired the man that made SoFi today.

Anthony Noto joined SoFi as the new CEO and he is probably the perfect candidate to lead the fintech company. Previously, he was the

- Former COO and CFO of Twitter

- Former Managing Director and Partner at Goldman Sachs

- Former CFO of the NFL

Put simply, Noto has very strong leadership skills and he has excellent business and financial acumen to lead SoFi out of the dark.

And so he did...

Since Noto became CEO, SoFi launched its Financial Services and Technology Platform to complement its core Lending business, as well as went public through a SPAC merger in 2021.

In a nutshell, SoFi helps members get their money right by building a platform that serves as a one-stop shop for all things finance, allowing members to borrow, save, spend, invest, and protect their money.

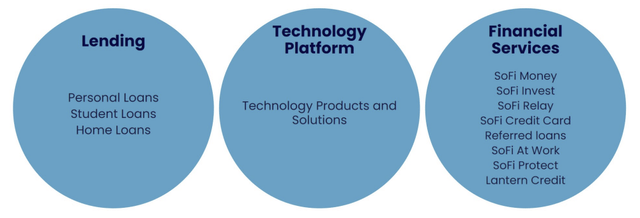

At a high level, SoFi operates three business units.

The first is its flagship Lending business, which offers personal, student, and home loans through an in-app, digital borrowing experience, which also supports the entire transaction cycle including credit application, underwriting, approval, funding, and servicing.

For example, students can apply for a student loan with varying loan sizes and repayment options at competitive rates, with no application or origination fees.

Next, SoFi's Technology Platform offers enterprises technology products and solutions such as digital banking, card issuing, payment processing, and more.

This is made possible through Galileo, which SoFi acquired back in May 2020 for $1.2B. Basically, Galileo is a banking-as-a-service that provides the technology platform for financial and non-financial institutions to power their fintech ambitions. Some of Galileo's clients include Dave (DAVE), Chime, Robinhood (HOOD), Toast (TOST), and of course, SoFi.

Galileo's value proposition is also amplified by its recent acquisition of Technisys, which is a cloud-native digital and core banking platform.

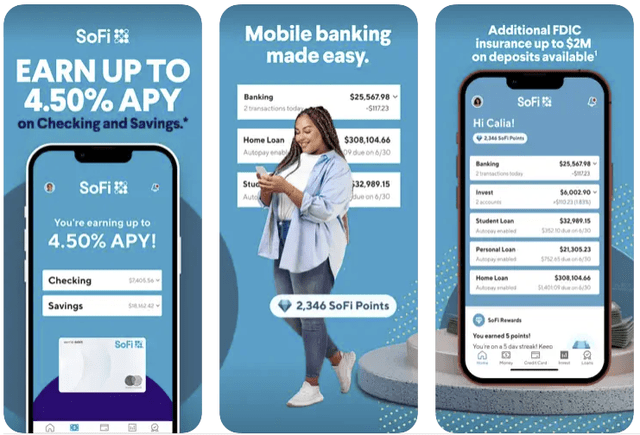

Finally, SoFi offers Financial Services through its mobile app and website.

This includes SoFi Checking and Savings which provides up to 4.5% APY, which is over 10x the national average, as well as up to $2M of FDIC insurance. This makes it one of the most attractive high-yield savings accounts in the US.

Then there's also SoFi Invest which is a mobile-first investment platform, SoFi Credit Card which allows members to earn rewards, and SoFi Protect which offers insurance products from third-party providers such as Lemonade (LMND). I won't go through all of them but these are just some of the financial services that SoFi offers.

Ultimately, through its three business units, SoFi aims to be the one-and-done platform for people to manage their finances, helping them to reach financial independence to realize their goals and ambitions.

Moats

I see three competitive moats for SoFi: technology, cost advantages, and switching costs.

Technology

SoFi offers one of the most vertically integrated offerings in the fintech space today.

Members can manage all their finances in a single app, including their loans, deposits, and investments.

SoFi also has Galileo which offers the back-end financial and banking infrastructure for other institutions, which some claim to be the AWS of Fintech.

SoFi also has a bank charter which enables SoFi to act as a bank for both its members and partnering businesses.

As far as I know, the only competing platform that comes close to SoFi is probably Block (SQ). However, Block doesn't have the banking-as-a-service component that Galileo offers.

So technology-wise, SoFi has a more complete stack among competitors which offers a stronger value proposition for everyone, and having a vertically integrated technology stack means that SoFi is able to collect more data at each stage of the product or service, which allows the company to create a better overall customer experience.

Cost Advantages

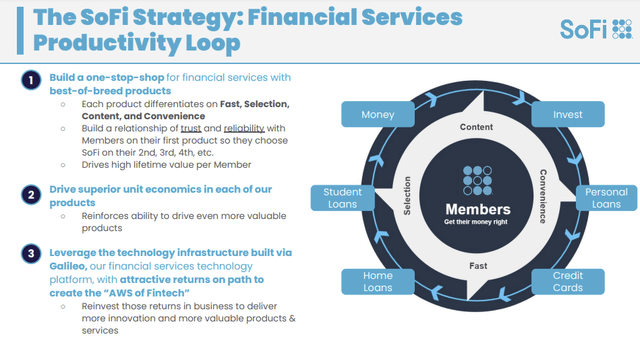

Because of that data advantage and through offering better products, SoFi is able to gain cost advantage moats - SoFi calls this the Financial Services Productivity Loop (FSPL).

Sofi's Acquisition of Technisys Presentation

Basically, by offering best-of-breed products, more members will eventually join the platform, and slowly but surely, they will start to use more products within the platform, which drive superior unit economics. As CEO Anthony Noto mentioned in the company's Q1 earnings call, cross-buying allows SoFi to bring in that second product with no customer acquisition cost, which has a huge impact on unit economics.

In addition, the banking charter, which it achieved in February last year, allows SoFi to lower its cost of asset-backed financing by utilizing customer deposits at SoFi Bank to fund its loans.

Furthermore, being a neobank with no physical branches, SoFi also has significantly lower overhead costs than traditional banks.

Put together, the FSPL, banking charter, and neobank business model grant SoFi superior unit economics.

With better unit economics, SoFi passes on the savings to customers, which further amplifies its value proposition. For example, SoFi can offer lower interest rates on loans and offer higher interest rates on deposit accounts, which is why customers are flocking to SoFi.

Switching Costs

Finally, SoFi has high switching cost moats.

Again, SoFi is the one-stop shop for all things finance, which makes it incredibly easy for consumers to manage and track their finances. It will be difficult for members to switch to another provider if let's say they are using SoFi Loans, SoFi Checking, and SoFi Invest, as leaving the platform would mean finding a provider that could do everything that SoFi offers, which I think is non-existent today.

Plus, that 4.5% APY is hard to beat.

I think it's just better to have one platform to manage all your finances, rather than having multiple accounts from different providers.

That said, as members use more SoFi products, the harder it is for them to leave the platform.

In addition, Galileo's banking-as-a-service offering provides the critical infrastructure for enterprise customers, which is essential to their operations and ultimately their success. At the same time, through SoFi bank, SoFi can also act as the sponsoring bank on behalf of these enterprises which makes it even more convenient for them to do business with Sofi.

Growth

Let's now take a look at its financials.

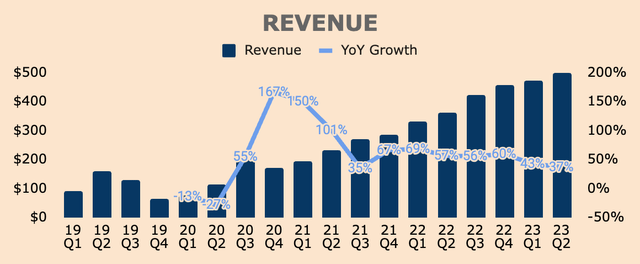

Q2 GAAP Revenue was $498M, which was up 37% YoY, while Adjusted Revenue was $489M, also up by 37% YoY. The difference between the two metrics is that Adjusted Revenue excludes the fair value changes in SoFi's lending segment as they are non-cash charges.

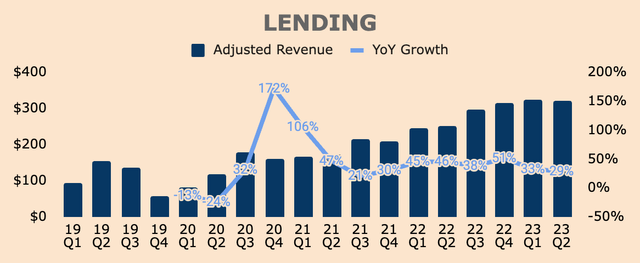

As you can see, SoFi experienced extreme growth in the early days of the pandemic with several quarters of triple-digit growth. However, growth has decelerated meaningfully over the last few quarters - considering that SoFi is growing over a much larger base, a 30%+ growth is still very impressive.

Nonetheless, strong growth was primarily due to strength in all three of SoFi's business segments.

The Lending segment is SoFi's bread and butter, generating 67% of Revenue in Q2. As of Q2, Lending Revenue was $331M, which was up 29% YoY.

As you can see, the Lending segment has been posting 30%+ growth over the last few quarters despite the student loan business experiencing a major slowdown due to the CARES Act pausing all federal student loan payments since March 2020.

Nevertheless, growth in the Lending business was due to higher loan balances and net interest margins, as well as strong demand for Personal Loans, offset by lower Student Loan and Home Loan originations.

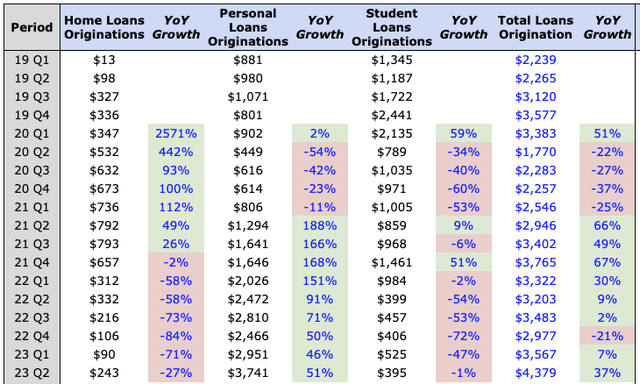

The star of the show in the last two years has been Personal Loans, which has been growing so rapidly that it is essentially carrying the entire Lending segment with a record $3.7B of Personal Loan originations in Q2, up a whopping 51% YoY.

On the other hand, the other two categories are not doing particularly well.

As you can see below, Home Loan originations took off in 2020 and early 2021 as ultra-low interest rates increased demand for home mortgage applications and mortgage refinancing. However, ever since the Fed started hiking interest rates, demand for Home Loans decreased significantly as home affordability became too unbearable for many.

In Q2, Home Loan volume was down 27% YoY to $243M. While it is still far below 2020/2021 levels, notice that Home Loans nearly tripled sequentially from Q1 to Q2. This is due to increased capacity and capabilities as SoFi fully integrates Wyndham Capital Mortgage, which it acquired back in April this year.

As such, Q1 should be the trough for Home Loans and we should see Home Loan volumes improve in subsequent quarters.

As for Student Loans, volumes fell from $2.1B in Q1 of 2020 to just $395M in Q2 this year, due to the student loan moratorium being extended multiple times.

However, the moratorium came to an end recently, with student loan payments expected to resume this coming October. As such, Student Loan originations should pick up once again as borrowers would want to refinance at a lower rate or extend the loan term. CEO Anthony Noto confirmed this in a recent conference:

I think we will see the demand for student loan refinancing continue to sort of move back to where it was in 2019. It may take several quarters for that to happen. We said, we would see a small increase in Q3 and a bigger increase in Q4. We are not looking for returning Q4 to 2019 levels. It's probably half of that or less than half of that.

(CEO Anthony Noto - Goldman Sachs Communacopia + Technology Conference)

In other words, with Student Loan volumes peaking at $2.4B in Q4 of 2019, SoFi should do more or less $1B in Student Loan volumes per quarter in the second half of 2023 - not as high as pre-Covid levels, but still a nice reacceleration from recent quarters.

That said, Lending Revenue could accelerate in the next few quarters as:

- Personal Loans continue to gain traction

- SoFi increases capacity for Home Loans

- The student loan moratorium expires

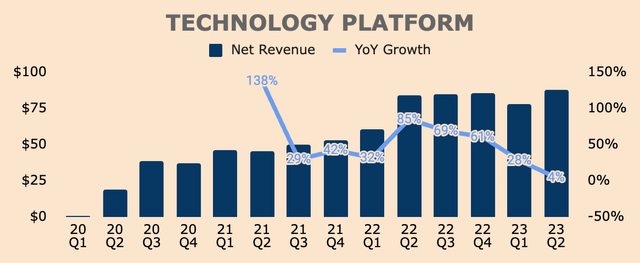

Moving on to the next business unit, Q2 Revenue from SoFi's Technology Platform was $88M, up only 4% YoY.

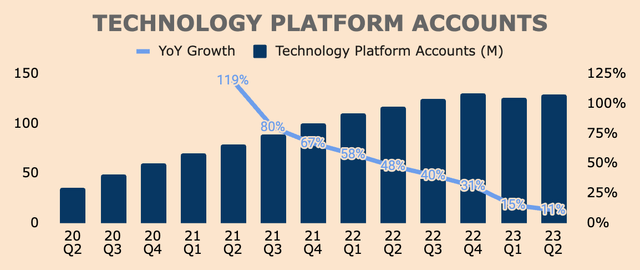

Growth was due to the additions of new clients and growth at existing clients, but as you can see, there's a sharp deceleration in the last few quarters, and this is in large part due to slowing Account growth, as you can see below.

As you may have noticed, Q1 Accounts actually dropped QoQ due to a partner moving out of the platform. However, Q2 Accounts recovered as Galileo and Technisys signed five and four new clients, respectively. As of Q2, total Accounts were 129M, which is up 11% YoY.

While growth in the segment may look discouraging at the moment, management mentioned that Technology Platform Revenue should reaccelerate, which is great to hear.

Importantly, we expect a year-over-year growth rate in Technology Platform revenue to accelerate by Q4, with increased contribution from new partners to the platform along with greater product adoption among existing partners.

(CEO Anthony Noto - SoFi FY2023 Q2 Earnings Call)

Moreover, SoFi maintains a robust deal pipeline, which should support strong growth within the segment moving forward.

Additionally, we have a robust pipeline of ongoing discussions with potential partners with large existing customer bases across both the U.S. and Latin America spanning both the financial services and non-financial services segments.

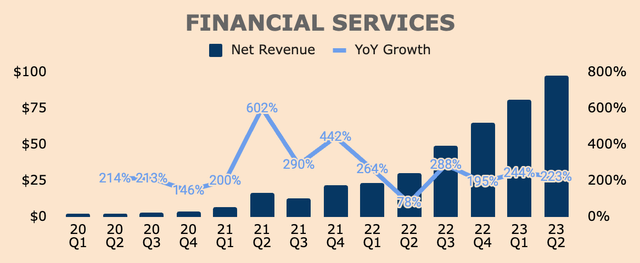

Turning to Financial Services, Q2 Revenue for the segment was $98M, up a staggering 223% YoY.

The hypergrowth that you see here is due to three reasons.

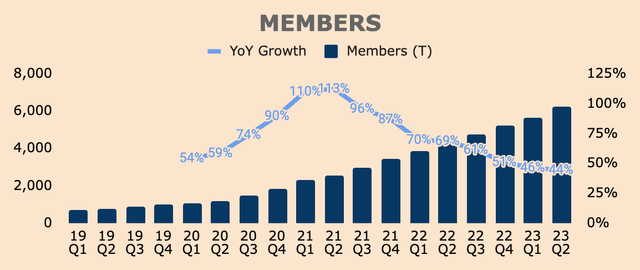

The first reason is strong member growth across SoFi Money, Invest, Credit Card, and Protect. As you can see, Q2 Members grew 44% YoY to 6.2M, adding a record 584K Members QoQ - the only other time SoFi added more than 500K Members was back in Q4 of 2021. In other words, this is an absolute home run of a quarter in terms of new Member adds.

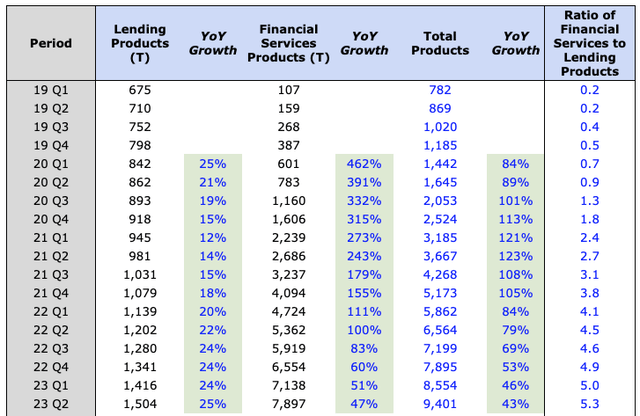

The second reason is cross-buy. In Q2:

- Total Products grew 43% YoY to 9.4M, adding 847K Products QoQ.

- Financial Services Products grew 47% YoY to 7.9M, adding 759K Products QoQ.

As you may have noticed, new Product additions QoQ is significantly higher compared to new Member additions QoQ, which means that Members, in general, are using more products on SoFi's platform.

In addition, the Ratio of Financial Services to Lending Products continues to grow with each passing quarter, which shows high engagement within the platform and more Members using multiple SoFi products.

The third reason is improved monetization, with Revenue per Financial Services Product doubling YoY to $50.

All in all, SoFi is showing really strong growth across all its business segments, especially in its Financial Services segment. And SoFi is not even firing on all cylinders due to struggles in the Student Loan and Home Loan categories.

While growth is slowing down, growth will likely continue to remain robust in the next few quarters due to reasons such as the end of the moratorium, the increased capacity following the Wyndham integration, as well as a strong pipeline within the Technology Platform segment.

That said, the fact that SoFi can grow at such a high pace despite the different challenges that it is facing currently, says a lot about the execution and quality of the management team.

More importantly, SoFi is taking market share, as mentioned by CEO Anthony Noto at a recent conference. Not just any market share, but market share from the top five banks.

The share we are taking is from the top five banks in the country. We are -- they probably don't even know that we are taking share because they are so big and we are so small. But we see where the ACH is coming from.

(CEO Anthony Noto - Goldman Sachs Communacopia + Technology Conference)

This is a critical remark from the CEO, which in essence, is a confirmation of SoFi's superior value proposition as well as the shifting consumer preference from traditional banking to digital banking.

The beauty of it is that the big banks don't even realize that SoFi is stealing market share from them - when they do finally realize it, it will already be too late.

Profitability

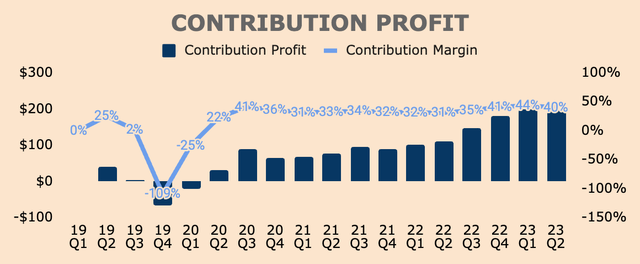

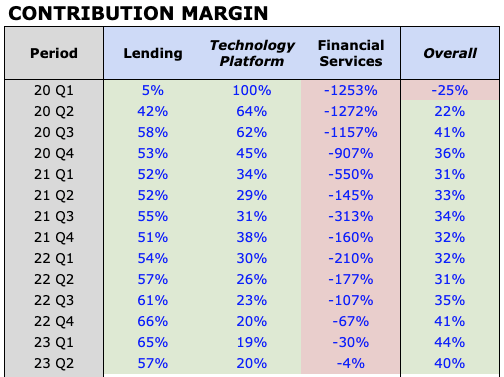

Turning to profitability, overall Contribution Profit, which is Net Revenue minus Direct Expenses, was $196M in Q2, representing a 40% Margin to Adjusted Revenue.

As you can see, Contribution Margin has been improving over the last few quarters, showing economies of scale within the SoFi platform.

Here, we can see Contribution Margins by segment.

Author's Analysis

For the Lending segment, Contribution Margin was 57% in Q2. Despite being flat YoY and lower QoQ, the Lending segment could one day sport a Contribution Margin as high as 70%, as mentioned by the CEO:

Some people may not realize this, our loans have a 70% Contribution Profit Margin, and that steady state I wouldn't expect it to go higher. If it did, I would reinvest to keep it at that level.

(CEO Anthony Noto - Goldman Sachs Communacopia + Technology Conference)

It's not there yet, but perhaps, some of its loans are generating that high of a Contribution Margin, which is probably why CEO Anthony Noto mentioned that 70% figure.

Next, Technology Platform Contribution Margin was 20% in Q2, which was a decline from last year's 26% Margin, due to the acquisition of Technisys, which has a lower margin profile. That said, it is a slight improvement from the prior quarter - hopefully, that trend will continue as Galieo and Technisys land and expand more clients.

And finally, the Financial Services segment is still operating at a loss, with a Contribution Margin of (4)%. However, it is a major improvement from the prior-year quarter's and last quarter's (177)% and (30)% Contribution Margin, respectively. This improvement was due to better monetization, lower customer acquisition costs, and economies of scale. Judging by its trajectory, it wouldn't be surprising to see the Financial Services segment achieve positive Contribution Profit in Q3.

Also of important note, SoFi is gaining operating leverage as all expense lines as a percentage of Revenue continue to fall:

- Technology and Product Development Expenses: down 200 bps

- Sales and Marketing: down 300 bps

- Cost of Operations: down 300 bps

- General and Administration: down 900 bps

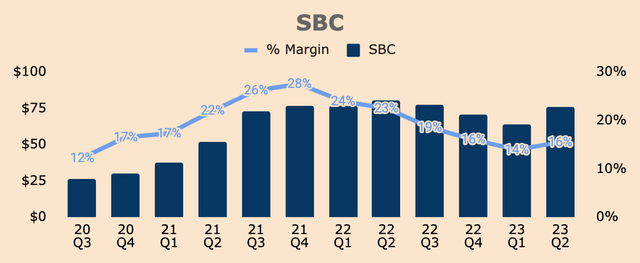

The only downside is that Stock-Based Compensation ticked up slightly in Q2, with SBC as a percentage of Revenue increasing 200 bps sequentially to 16%. Furthermore, management expects SBC to increase slightly in the back half of the year, which is not great from a profitability standpoint.

As we move toward expected GAAP net income profitability in the fourth quarter, we expect stock-based compensation and depreciation and amortization expenses to be slightly higher than reported Q2 levels in both the third quarter and fourth quarter of the year.

(CFO Chris Lapointe - SoFi FY2023 Q2 Earnings Call)

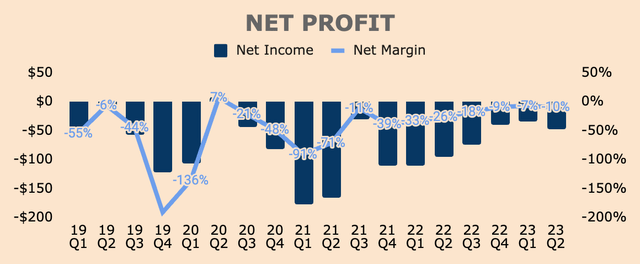

In Q2, SoFi recorded a GAAP Net Loss of $48M. As a result of the uptick in SBC, Net Margins dipped slightly QoQ, from (7)% to (10)%. Even so, it is a material improvement from last year's Q2 Net Margin of (26)%.

Whatever it is, profitability metrics are all trending in the right direction, which shows economies of scale as well as the Financial Services Productivity Loop gaining momentum.

SoFi's overall bottom line should improve significantly over the next few quarters as the company continues to gain operating leverage as well as benefit from the recovery of the high-margin Student Loans business following the end of the moratorium.

With that said, SoFi is on track to be GAAP Net Income profitable by the end of the year - a long-awaited milestone for the company.

Financial Health

Turning to the balance sheet, SoFi has Cash in hand of about $3.0B with $6.6B of Total Debt, which puts its Net Debt position at about $3.6B.

As of Q2, SoFi also has a Tier 1 Capital Ratio of 16.4%. This shows how leveraged SoFi is in relation to its total assets - a higher ratio means that SoFi is in a better position to deal with unexpected losses.

For context, JPMorgan (JPM) has a Tier 1 Capital Ratio of 13.8% and Bank of America (BAC) has a ratio of 11.6%, which means SoFi is more liquid and less leveraged than these institutions.

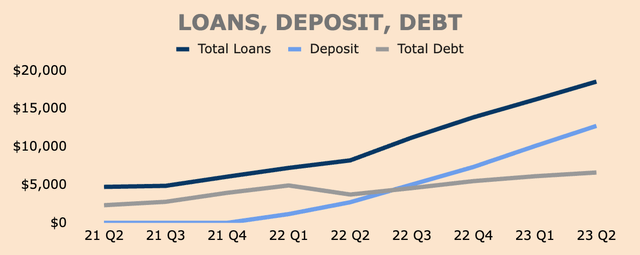

Below, you can see how SoFi's Loans, Deposits, and Debt balance have trended over time.

As you may or may not know, SoFi received its bank charter back in Q1 of 2022, which is when SoFi began accepting customer deposits. Consequently, SoFi can use those deposits to fund its loans at a lower cost of capital, which is why the growth of Total Debt has slowed down in pace, which is great to see.

As of Q2, SoFi has $18.6B of Loans on its balance sheet with $12.7B of Deposits. CEO Anthony Noto also mentioned adding $2B of deposits each quarter and feels "super confident" about reaching that target.

As deposits grow, so should its loan portfolio - this will boost Financial Services and Lending Revenues as SoFi's balance sheet expands.

It is also worth noting that despite growing its loan portfolio so rapidly, SoFi maintained stringent credit standards and a disciplined focus on quality borrowers.

During the earnings call, the CFO mentioned that its personal loan borrower's weighted average income is $164K with a FICO score of 745 and its student loan borrower's weighted average income is $163K with a FICO score of 768, which means SoFi's borrowers have high incomes and credit scores that are less likely to default.

The CFO also mentioned that delinquency rates and charge-off rates remain below pre-Covid levels, which is great to hear.

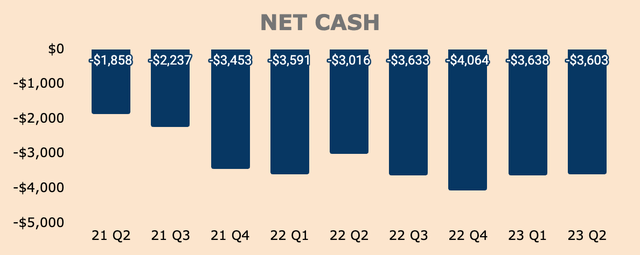

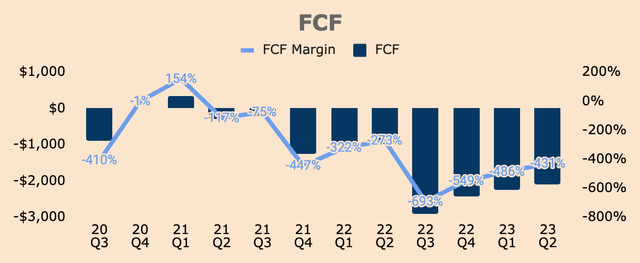

In terms of cash flow, it wouldn't be useful to look at SoFi's Free Cash Flow because SoFi is essentially a bank, and banks grow by holding more loans on their balance sheets, which will negatively affect Cash Flow from Operations under changes in Net Working Capital.

Since getting the bank charter, SoFi has been growing its loan portfolio as more and more customers deposit into SoFi Bank - remember that SoFi uses customer deposits to fund its loans.

As such, it wouldn't be appropriate to look at FCF as it only takes into account the growth of loans held in its balance sheet without taking into account the growth of customer deposits in its balance sheet.

That is why FCF is very negative as you can see below, even though Net Cash balance is actually improving quarter over quarter.

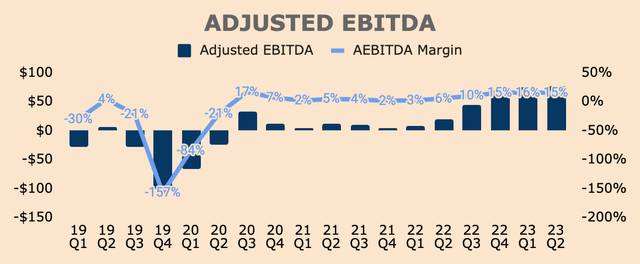

The better metric to look at is Adjusted EBITDA which is a good enough proxy for cash flow, and as you can see, Adjusted EBITDA is positive and is improving over the last few quarters.

In Q2, Adjusted EBITDA was $77M at a 15% Margin, which is a good indication that SoFi is actually cash flow positive.

So from a balance sheet and cash flow perspective, SoFi looks financially healthy.

Outlook

Turning to the outlook, management provided the following guidance. Keep in mind that I've only included the high-end of its guidance since SoFi seems to always beat its own guidance:

- H2 Adjusted Net Revenue: $1.085B, up 26% YoY.

- H2 Adjusted EBITDA: $190M at an 18% Margin.

Management also raised their full-year guidance, as they always seem to do:

- FY2023 Adjusted Net Revenue: $2.034B (raised by $14M), up 32% YoY.

- FY2023 Adjusted EBITDA: $343M (raised by $55M) at a 17% Margin.

All in all, strong guidance by management as SoFi posted another beat-and-raise quarter, which is a testament to the company's value proposition and execution.

In addition, for Adjusted EBITDA, management also expects an Incremental Adjusted EBITDA Margin of about 44%. For those who are unaware Incremental Adjusted EBITDA Margin is equal to the change in Adjusted EBITDA divided by the change in Revenue.

What this means is that for every extra $100M of Revenue that SoFi generates, the company subsequently produces $44M of Adjusted EBITDA. This is an important metric because it could potentially tell us about the long-term margin profile of the business.

Here's CEO Anthony Noto to elaborate:

If the Incremental EBITDA Margin was 30% and it was consistent over time, add some topically, you get to 30% Margin. Well, this year, we have driven over a 40% Incremental EBITDA Margin while growing over 40% as a company. So I am very confident our long-term margins can be 30%.

(CEO Anthony Noto - Goldman Sachs Communacopia + Technology Conference)

Oh, by the way, that was Mr. Noto's response to a question about how SoFi plans to achieve an ROE of 20-30%. He continued:

So I feel really confident in our long-term margin on an EBITDA basis. I know our equity base and where our Revenue will be in the next several years and so getting to $1 billion of Net Operating Profit After Tax is something that will take us a while to get there, but when we do, we would be at that 30% ROE.

The other way to look at it is we are already hitting a 40% ROE in our loans. Our bank has been over 20% and our tech platform's ROE really uses very little equity at all and so the ROE in that is well in excess of 35%.

(CEO Anthony Noto - Goldman Sachs Communacopia + Technology Conference)

What the CEO said is not 100% true as SoFi's current ROE is nowhere near 35%, but I assume he removed SBC from the equation which jacks up SoFi's ROE.

That said, if what the CEO said is true - that SoFi could reach an ROE of 30% - then SoFi could become the most profitable bank in the US (or the world for that matter) with far superior ROE figures than legacy banks.

Now that's something to be excited about.

Valuation

Here comes the most difficult part of this analysis, which is: how do we value SoFi?

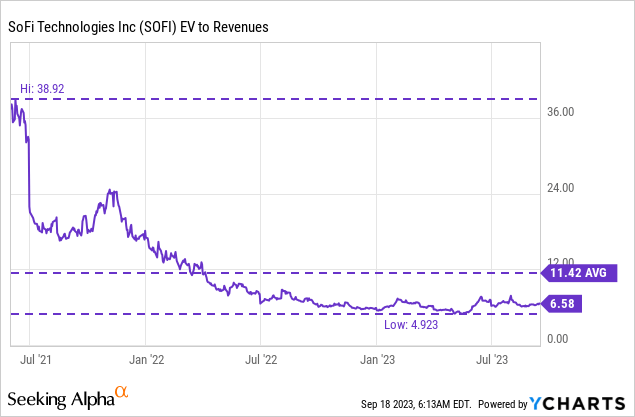

If we look at its valuation multiples, we can see that SoFi has traded as high as 38.9x its Revenue. However, valuation has now collapsed to just 6.6x its Revenue, which is a significant discount based on historical standards.

Now that's the easy part.

Here's the more complicated part: should we value SoFi as a fintech company or a bank?

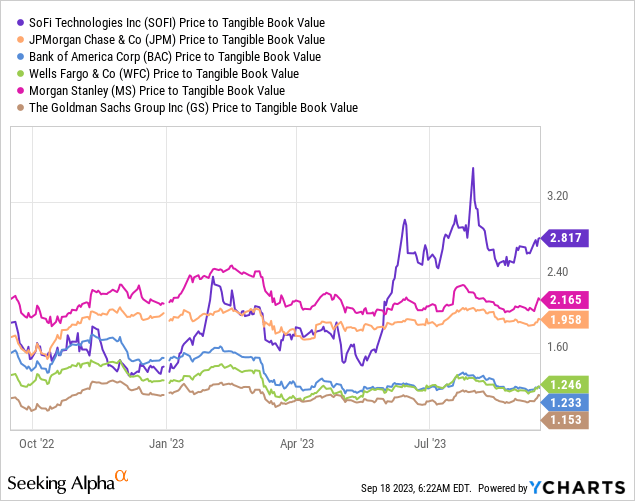

If we value the company as a bank, we can use Price to Tangible Book Value ratios - a popular valuation metric for banks - and compare that with other banks, in this case, the five largest banks in the US.

As you can see, SoFi is trading at a large premium.

But SoFi is trading at a premium for a reason, which is that the company is growing much faster than all of these banks, so it is unfair to compare it to legacy financial institutions.

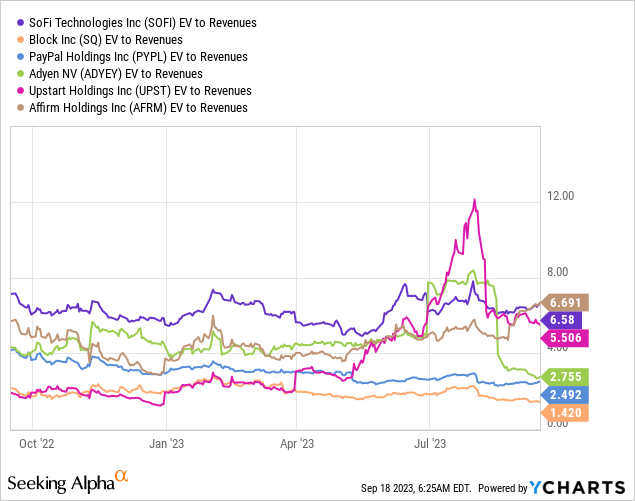

On the other hand, if we compare SoFi with fintech peers based on an EV to Revenue multiple, we can also see that SoFi is trading at the upper end of the range.

But comparing SoFi's valuation to fintech peers is useless too because their business models, margin structures, and growth profiles are not the same.

At the same time, we can't do a DCF analysis as well since SoFi has a negative FCF.

So that is the challenge with valuing SoFi - we can't do a DCF analysis, we can't do a comparable company analysis, and the company is not even profitable yet so we can't use PE ratios as well.

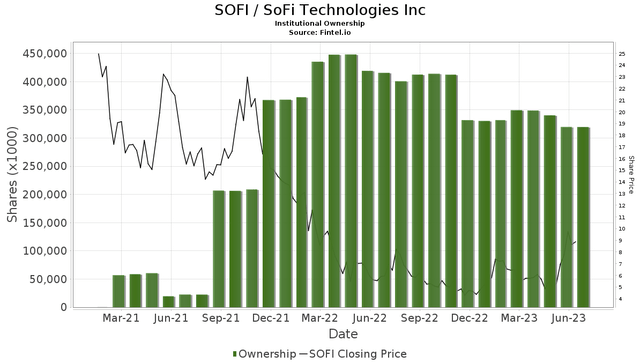

On a side note, institutions have been selling shares of SoFi over the last few quarters, which doesn't really give investors the confidence that they need.

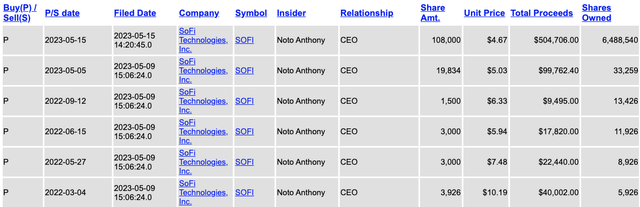

But one sure thing that shows SoFi is undervalued is that CEO Anthony Noto heavily bought the stock for the better part of 2022 and early 2023.

You know insiders could sell for a variety of reasons, but there are only two reasons why insiders buy stock in their company:

- They think the stock is undervalued

- They think the stock will go up

That said, the CEO buying shares - and not selling a single share - shows that he has skin in the game and high conviction in the long-term prospect of the business.

In fact, he strongly believes that SoFi will be a top 10 bank (by market cap) one day. We're seeing this coming to fruition with each passing quarter, with every single metric showing that SoFi is well on track to achieve this ambitious target - it bears repeating that SoFi is taking market share away from the top five banks.

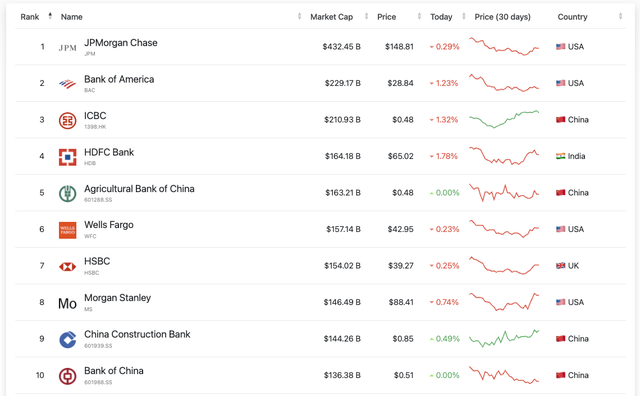

With that in mind, the 10th largest bank by market cap is Bank of China, which is valued at ~$136B. Based on SoFi's current market cap of ~$9B, taking position number 10 would mean a 15x increase in SoFi's market cap.

That alone is the ultimate bull thesis for SoFi.

Risks

Jack of All Trades, Master of None

While SoFi has a compelling value proposition of being the one-stop shop for all things finance, SoFi may fall victim to being the jack of all trades, master of none.

By spreading its resources among many different products, SoFi faces tough competition from specialized providers.

For example, some people might prefer using Coinbase (COIN) to buy crypto, Robinhood (HOOD) to buy stocks, or Affirm (AFRM) for buy now pay later loans.

These companies offer more features and unique experiences, which some customers would prefer, which consequently limits SoFi's product growth and adoption.

Regulation

As you can tell, SoFi's stock is very volatile with lots of spikes and drops.

That's because SoFi's stock is politically driven, not necessarily fundamentally driven. And the best example of this is the three-year-long student loan moratorium.

The stock drops every time there's an extension to the moratorium, and if we see another extension, the stock could drop again.

That said, the political and regulatory landscape are very unpredictable which makes this the biggest risk of all.

Thesis

SoFi has an amazing value proposition as the one-stop shop for consumers to manage their finances in a single app.

The investment case for SoFi is very compelling:

- Robust growth across all three business segments

- Turning profitable

- Strong technology, cost advantages, and switching costs moats

- SoFi has strong management

- Disrupting the entire banking industry

In addition, the end of the student loan moratorium could be the catalyst that turns around the stock for good.

Despite all the positives, I'm not buying the stock due to several reasons:

First, I find it hard to understand the business, particularly the Lending segment. It is also operating in an industry that I have little knowledge about - the banking industry - and I'm not afraid to admit that.

Secondly, the stock is politically driven and its performance depends on monetary policy and federal regulations, which is unpredictable.

Lastly, I'm not sure how to value SoFi.

For these reasons, I don't have the conviction to invest in SoFi just yet, which is why I'm staying on the sidelines.

I'm not completely dismissing the idea of investing in SoFi - I just need a little more time and research to fully understand the business.

Nevertheless, SoFi is still in its early innings as the one-and-done financial platform. More importantly, the company is taking market share from the big banks, a crystal clear indication that the road to being a top 10 financial institution is well underway.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.