BST: Get A High Yield From Tech

Summary

- BlackRock Science and Technology Trust is great for a hybrid portfolio focusing on income and growth opportunities in the technology sector.

- BST utilizes a covered call strategy and has a distribution yield exceeding 9%.

- The fund has outperformed the S&P 500 and has seen increasing income over time, but distributions may fluctuate due to the volatile nature of the tech sector.

Seiya Tabuchi

I've always been a believer that adding income to your portfolio is crucial. This applies no matter what age you are. By traditional standards, I am a "younger" investor that's created a hybrid portfolio between income and growth. Finding the perfect blend of holdings that have the potential for appreciation as well as high distributions that grow, can be a difficult thing to achieve if you don't know how to spot quality.

The cool factor was always there for me: Get dividends from companies you are a customer of, and then you can use that money to continue enjoying those companies' products and services. That concept was always challenging when trying to apply it to the tech sector. With this tech CEF (Closed End Fund), you get exposure to some of the big tech players as well get a nice upfront starting yield larger than 9%. I think that BST is a great addition to any portfolio looking to boost its total income.

Overview

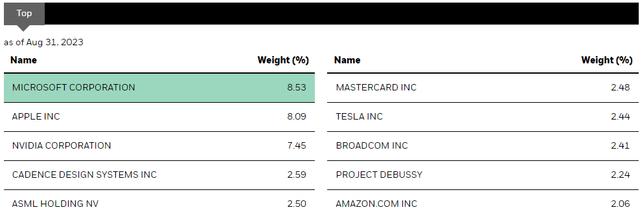

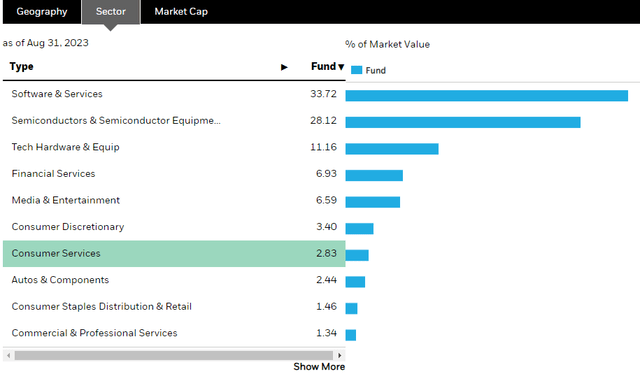

BlackRock Science and Technology Trust (NYSE:BST) is an investment fund that primarily focuses on the technology sector, with the goal of identifying opportunities for rapid and sustainable growth. BST's holdings encompasses not only tech giants like Tesla (TSLA) and Nvidia (NVDA) but also companies that utilize technology as an integral part of their core business operations. Think about companies like Mastercard (MA) or Broadcom (AVGO).

One of the distinguishing features of BST's strategy is its utilization of covered calls on individual stocks within its portfolio. This sets it apart from many other funds that apply covered call strategies to broad market indices. BST's approach allows for more targeted investments in high-conviction ideas, resulting in the potential for consistent and attractive income generation. Presently, the fund offers a distribution yield exceeding 9%, making it an appealing choice for income-oriented investors.

BlackRock

We can see that the top holdings are Microsoft (MSFT), Apple (AAPL), and Nvidia (NVDA). 34% of the fund is made up of software & service companies, followed by 28% made up of semiconductors. 73% of their portfolio is only invested into large cap companies with a market cap over $10B. It isn't that hard to understand why BST as managed to capture some upside movement. The majority of their positions are rooted in the United States, then the two smaller majorities made up of Netherlands and China.

BlackRock

Distribution

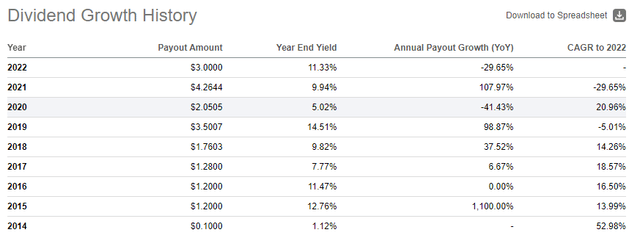

BST's distribution policy is designed to provide investors with a dependable and steady monthly income stream. That's right, this CEF pays a monthly distribution. The covered call strategy being utilized in combination with the majority of holdings being volatile tech companies, the payouts are going to vary depending on what the market is doing in a given year.

For example, we can see that the payout dropped big time in 2020 because of the covid crash. If you don't prefer variable distributions, this isn't the CEF for you.

Seeking Alpha

It's worth noting that BST has managed to maintain a sustainable payout ratio, which is crucial for the long-term stability of its distributions. This combination of a high yield and responsible financial management further bolsters BST's appeal among income-seeking investors. Although the distributions may be variable, it's reassuring to know that the distributions has never been entirely cut.

Something that seems to confuse people is the classification of ROC (Return of Capital). Investors seem to believe this means you are essentially getting your own money back as a distribution. This assumption would be incorrect but I fully understand the confusion as I too, also thought this is what ROC meant. I often see that it's a topic that's breezed over a lot here. Notice I use the word distribution and not dividend.

Return Of Capital

Return Of Capital is merely a tax classification for the distribution when coming from a Closed End Fund. You are not getting a paid of distribution of your own money back with BST. To generate income, a fund like BST engages in call option writing, receiving upfront income that is later realized through closing transactions. Think of this concept similar to unrealized capital gains.

For funds using a covered call strategy, the projected future gains, which may or may not become actuals, will be reclassified as realized gains. However, if they do not materialize, this income distribution effectively gets labeled as a return of capital, potentially exceeding the fund's earnings.

The confusion comes in when we lump in covered call funds with other types of funds. This is because with funds that are not using covered calls as part of the strategy, Return of Capital may refer to either "unrealized gains," as discussed earlier, or simply a return of the initial investment capital, essentially returning the principal. I tried to break it down and make it more understandable but if you still need more insight on ROC, I recommend reading the linked article.

Once again though, we need to realize that a fund like BST hasn't used ROC for every year. As mentioned, distributions may be variable based on market conditions and if you aren't comfortable with fluctuating income, BST may not be for you. Taking a step back and remember that most of the fund is comprised of tech. When tech takes a beating, your distributions may vary.

Performance

The holdings that have the ability to provide high amounts of income belong in everyone's portfolio. This applies true even if you are a younger investor. You will commonly hear the advice that if you are younger, you should focus on growthier assets and that there's little reason to focus on cash flow as a young adult.

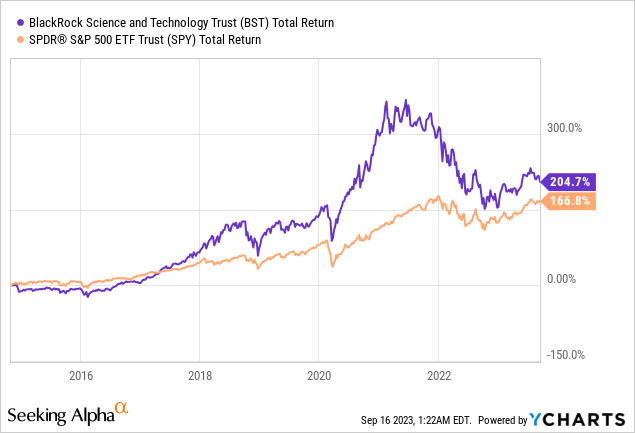

I disagree with this sentiment because there are plenty of funds out there like BST that has established a commendable track record of delivering strong total returns to its investors. When measured against the (SPY) we can see that BST actually outperforms in total return over the last ten year period. This success can be attributed to its exposure to high-growth technology stocks and its adept use of the covered call strategy.

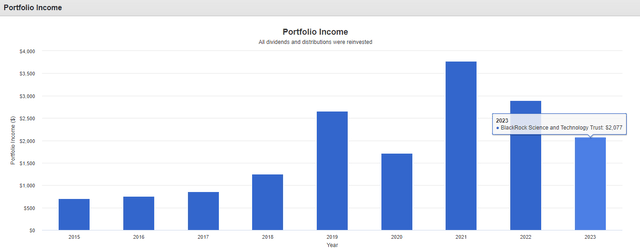

Not only would you have outperformed the S&P over the last decade, but you would have also seen the income produced from BST increased dramatically. If you were to invest $10k into BST a decade ago, your income produced would have been roughly $700. This would represent a 7% yield. If you only reinvested distributions back into BST and never made any additional contributions, your income would have grown to $2,077 a year off of your original $10k investment.

Portfolio Visualizer

Discount To NAV

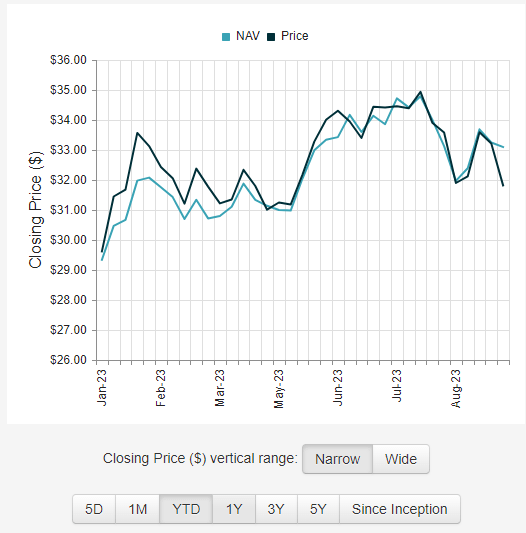

Since this is a CEF, valuation is not measured by normal metrics. Instead, we can determine what the spread is between the funds NAV (Net Asset Value) and the price. A different between traditional ETFs and of Closed End Funds is that a CEF's price can trade at a discount or premium of the value of the underlying assets they own. In the case of BST, it currently trades a discount which may prove a buying opportunity.

The current share price is $31.82, slightly below the net asset value of $33.10, representing a discount of 4%. Over the past 52 weeks, the share price traded at an average 0.45% premium against the fund's NAV. So if the price has previously averaged above the NAV, that means that currently BST offers a buy opportunity since it is currently trading at a discount to NAV.

CEF Connect

Risk

Investing in BST, like any investment, comes with inherent risks. A significant risk associated with BST is its exposure to the often volatile technology sector. Technology stocks are known for their price volatility, and as such, BST's performance can be notably influenced by fluctuations in the technology market. As such, when tech stocks are getting crushed, it's safe to assume that your distribution will be lowered. If you are already retired and would like steady, consistent, and tax-friendly distributions then BST may not be for you. Lastly, if you believe that the tech sector as a whole is trending downwards, it would probably be best to wait this one out.

Conclusion

BlackRock Science and Technology Trust offers an attractive addition to portfolios, providing a blend of income and growth opportunities. With a focus on tech giants, BST employs a covered call strategy, offering consistent income with a distribution yield exceeding 9%.

While Return of Capital (ROC) is unique to Closed End Funds (CEFs) like BST, it's essential to understand that it signifies income from covered call strategies and doesn't necessarily imply a return of principal. This may only be important sometimes as historically, the fund hasn't always relied on ROC.

BST's strong performance, outperforming the S&P 500 and increasing income over time, is compelling. However, its exposure to the volatile tech sector means distributions may fluctuate, making it essential for investors to assess their risk tolerance, particularly during periods of tech sector turbulence.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

I'll add under 30.