Stick A Fork In The Fed

Summary

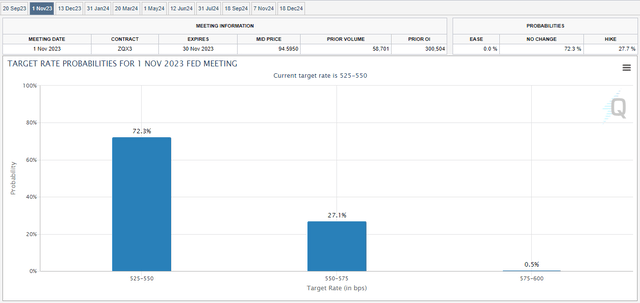

- There are low implied odds of a hike at September or December FOMC meetings. The highest chances for a hike in November but I think the Fed is done.

- Recent market weakness was not caused by CPI but by quad-witching derivatives expiration, UAW strike, and seasonal factors.

- Fed unlikely to hike in 2023, as rising energy prices may decline and inflation expectations hit a 2-year low.

- Monetary policy is a crude tool that is ineffective at reducing certain kinds of price pressure. This will be key to the Fed's decision.

bfk92/iStock via Getty Images

There are three FOMC meetings left in 2023. The market currently prices very low odds of a hike at the September or December meeting and instead places the highest chances for a hike at the meeting after next in November. Many bears are hoping for a hike or two after inflation data came in hot. However, I think they will be disappointed. You can stick a fork in the Fed. They are done hiking in 2023.

BLS

Identifying the cause of market weakness is always tricky. The immediate impulse of human beings is to look at the catalyst the news is focusing on and to assume it moved the market. However, this is often a faulty assumption. We were in a seasonally weak period that has likely just ended, so I think the rest of September will be very positive for markets. A great article by Ben Turcan outlined this dynamic here. So when you see people saying weakness was due to a hot CPI, bring a healthy dose of skepticism.

TradingView, Ben Turcan

You might have thought that the recent market weakness following the CPI report indicates a changing direction at the Fed. However, I think this would be a significant mistake. The price weakness after Wednesday's report this week had little to do with CPI, in my opinion, and was primarily caused by the following:

- Quad-Witching derivatives expiration on Friday

- Unprecedented UAW strike

- Standard seasonal factors for September

EToro

This has been the second most aggressive Fed hiking cycle in history. However, if you're sitting in an FOMC chair, I don't care how much of a Milton Friedman enthusiast you are; if you're a decent human being, you want to avoid needless economic carnage. And while there is an essential separation between the Fed and fiscal authorities that remains intact, that doesn't mean FOMC officials want to needlessly jeopardize the financial integrity of Uncle Sam within the context of fulfilling its mandate (whose borrowing costs are soaring).

Economics Help

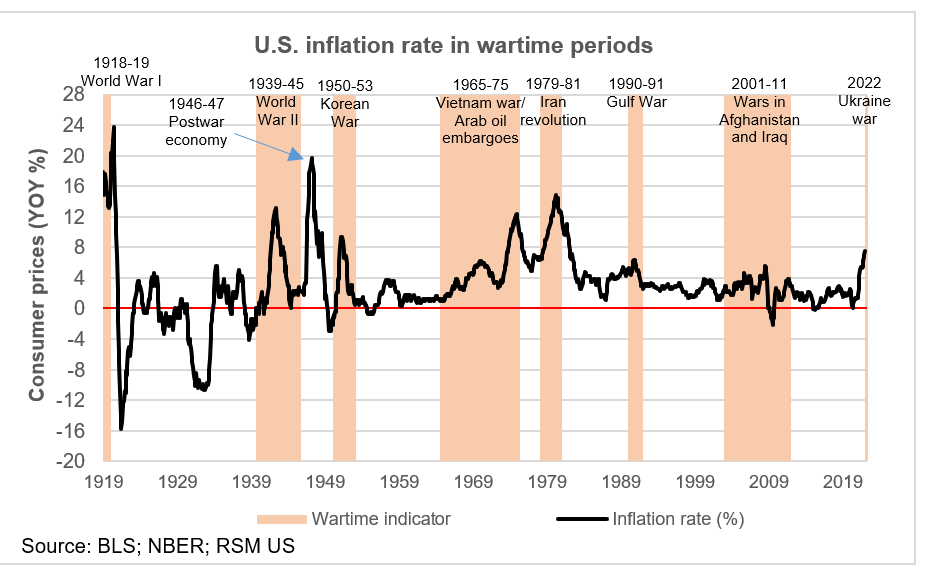

While rising Energy prices are a concern, and it certainly would have been better to have three Soft CPIs in a row, there is reason to believe they could decline in the coming months. An important thing to remember is that it is neither the Fed's intention nor within its capability to play whack-a-mole with specific items in the CPI. Instead, the Fed tries to prevent a behavioral inflationary spiral that creates a self-sustaining feedback loop. Most evidence suggests that the danger of such an outcome has all but diminished.

Bloomberg

Yesterday, inflation expectations hit a 2-year low. This development is far more critical in the Fed's thinking than one month of high gas and airline ticket prices. If the Fed wanted to control short-term price volatility, heading to an OPEC Plus meeting and convincing them to up production would be more effective than the broad and crude tool of hiking the Federal Funds Rate. Maybe we could drop Powell off in the desert like T.E. Lawrence and see what he can drum up.

As a reminder, I have covered this Fed hiking cycle extensively:

- Before Silicon Valley Bank's collapse, I postulated that the Fed was calling the bond market's bluff that it would "break something" and that they had a better grip on financial stability than consensus afforded.

- After the last Fed meeting, I stated that I believed the Fed would hike zero times or only one more time (one and done). That's now the consensus view, but it was not then.

- I predicted there was potential for diminished volatility following the last jobs report after the sell-off caused by the ADP report. I got people into the Dow before its recent 13-day streak.

- Positive economic data are increasingly validating the possibility of a soft landing. Inflation is coming down convincingly and potentially persistently.

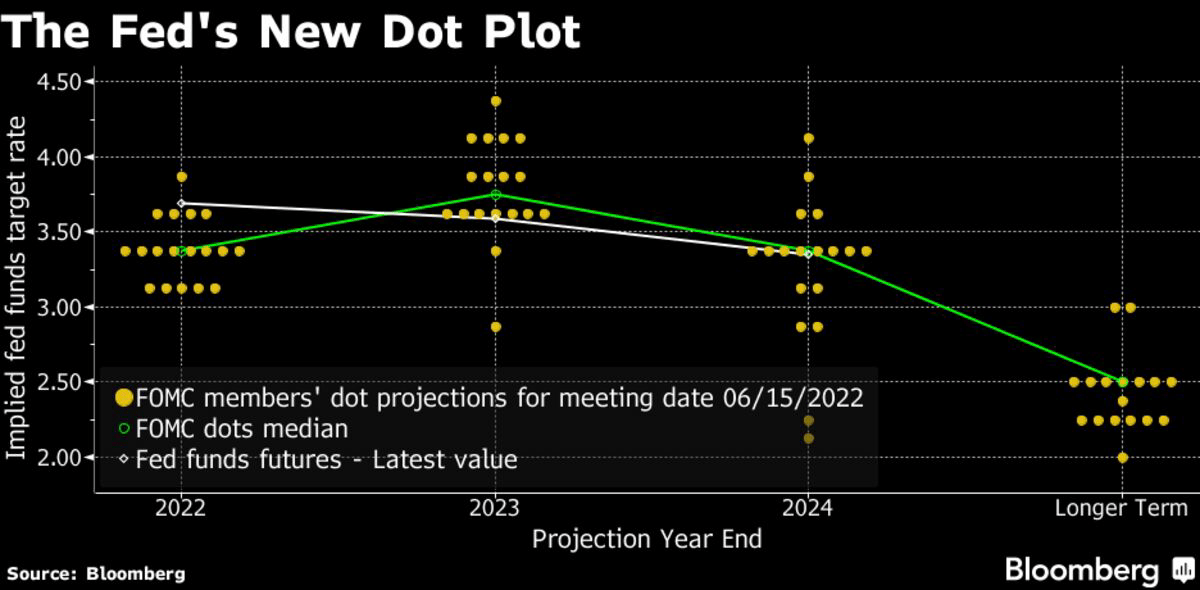

Overall, the Fed sees far better data than it imagined in June. I think the dot plot will be relatively more dovish this week than the one in June, and it will likely suggest that there will be no further hikes in 2023. However, like much of the Fed events, I suspect Powell will be talking from both sides of his essential mouth. The hot CPI will ensure that Powell sticks to the hardline rhetoric of the past two Jackson Hole meetings, despite the likely development that the Doves are gaining more relative control on the FOMC given the positive data.

To Hike, Or Not to Hike, That Is The Question

The market assigned the most significant hike probability to the November meeting. However, since the ECB provided some dovish language earlier this week, even the odds for a hike in November fell considerably. The odds were below 40% a few days ago and have materially dropped since.

CME Fed Watch Tool

After the last CPI print, which came in a tad hot, many in the inflationista crowd have declared victory prematurely. High for longer. The Fed has to raise now, and maybe clients won't want my head at the end of the year. But it's confirmation bias. Wishful thinking. A trap. However, the human mind is particularly receptive to narratives confirming our established thinking.

Bloomberg

The Fed's September meeting is usually a tricky one in some respects. Jackson Hole is the big summer event for real Fed nerds, and September falls in the year when normal cyclical fluctuations can cause noisy data. The Fed's last Summary of Economic Projections from June (dot plot) suggested that a further hike was necessary in November. Still, since then, there has been a lot of favorable data:

- June and July CPI were downside surprises.

- Labor market softness has shown persistence over the past three months.

- August CPI was hot, but Energy and airplane tickets primarily drove the upside surprise.

- The Fed is unlikely to hike in November unless evidence of a "behavioral inflationary spiral" occurs.

- If there is idiosyncratic pressure on the headline number from items like Used Cars and other anomalous drivers, this will not provoke a hike.

The weight of this data and the continuing decline of Consumer Inflation expectations lead me to believe the September Fed meeting will consist of dovish actions (by way of the Dot Plot) and continued hawkish rhetoric in response to the strength in the recent report. One way to assess Powell's dovishness in my mind would be whether or not he brings up the fact that higher Energy prices likely make stickier inflationary divers in the Core and Services less sticky.

Risks And Where I Could Be Wrong

Inflation is one of the most pernicious risks to investors for several reasons. It can erode returns, and it can also lead to economic stagnation in the right circumstances. Many current risks facing the market could easily result in inflation reigniting and forcing the Fed to conduct more rate hikes to bash inflation back under control. The current risks facing markets could lead to the Fed committing a policy error that worsens our collective economic prospects.

- Escalation in Ukraine or Taiwan.

- Fed Policy Error.

- Banking Issues Worsen.

- Return of Inflation.

- CRE meltdown.

- Write-downs of Private Assets.

The most significant risk toward continuing inflationary pressure, in my mind, is that the biggest War in Europe since 1945 is raging on its Eastern flank. Wars have historically been critical drivers of inflation, and the longer this one continues, the greater the chance that the outcome repeats itself.

The Real Economy Blog

Overall, the Hawks may be able to gain more sway than they've previously had because of the Energy strength, but I doubt it. However, I think the folks on the FOMC spend a lot of time assessing inflationary drivers and how effective monetary policy will be at vanquishing them. This is a vital part of the equation people are missing. The Fed doesn't just care about inflation; it also cares about whether its tools will affect it all.

Conclusion

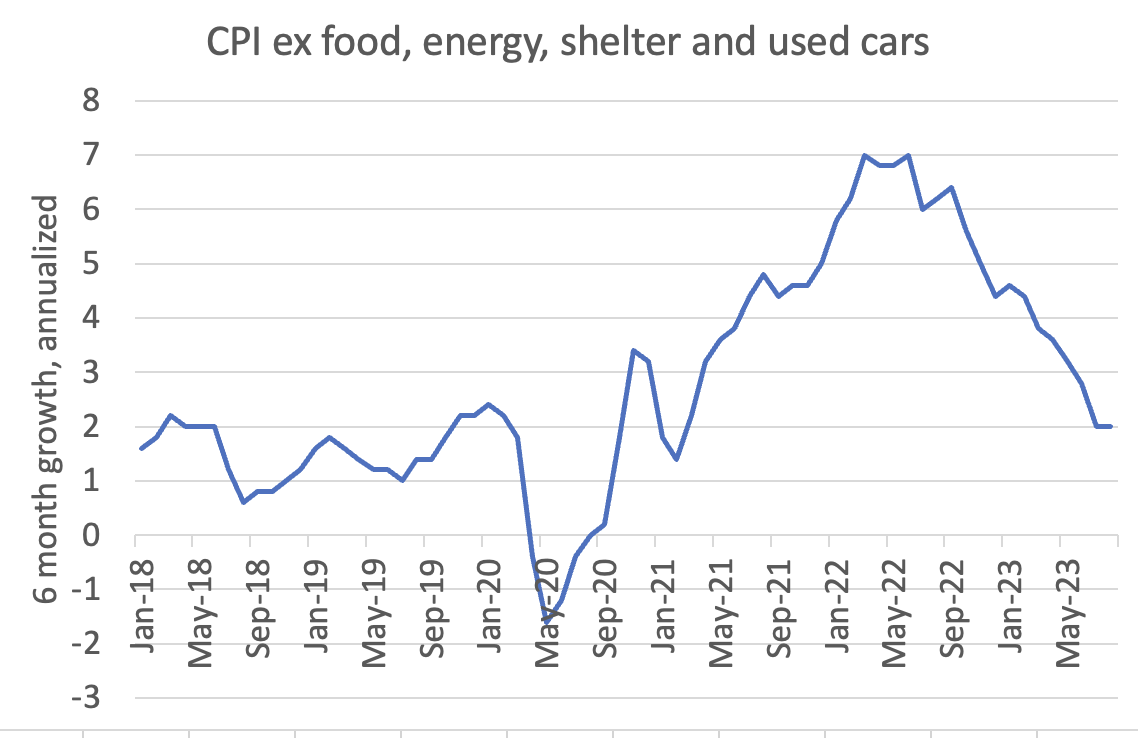

I saw something on Social Media that cracked me up this week. A bunch of angry bears who likely lost a lot of money in markets this year were pillorying famed Economist Paul Krugman for basically coming up with a modified core measure that excludes used cars. Of course, we have no inflation if we remove the rising items; I can't believe what an idiot Krugman is! I've been amazed at some of the people who seemed to endorse this position.

Paul Krugman

Well, folks who think that way have missed the point of Krugman's modified core measure. This is just a modified core inflation measure with a mind of focusing on areas of the economy that monetary policy will help.

The Shelter component lags and inserts artificial strength into the headline number even though concurrent data points suggest major weakness from high rates. So, it's useful for some engaged in monetary policy to look at the number without this. Used Cars have had a prolific run over the past years, but supply chain issues drove these, and there's likely little the Fed can do like in the case of oil. There is evidence that rate hikes have had a cooling effect on car loans.

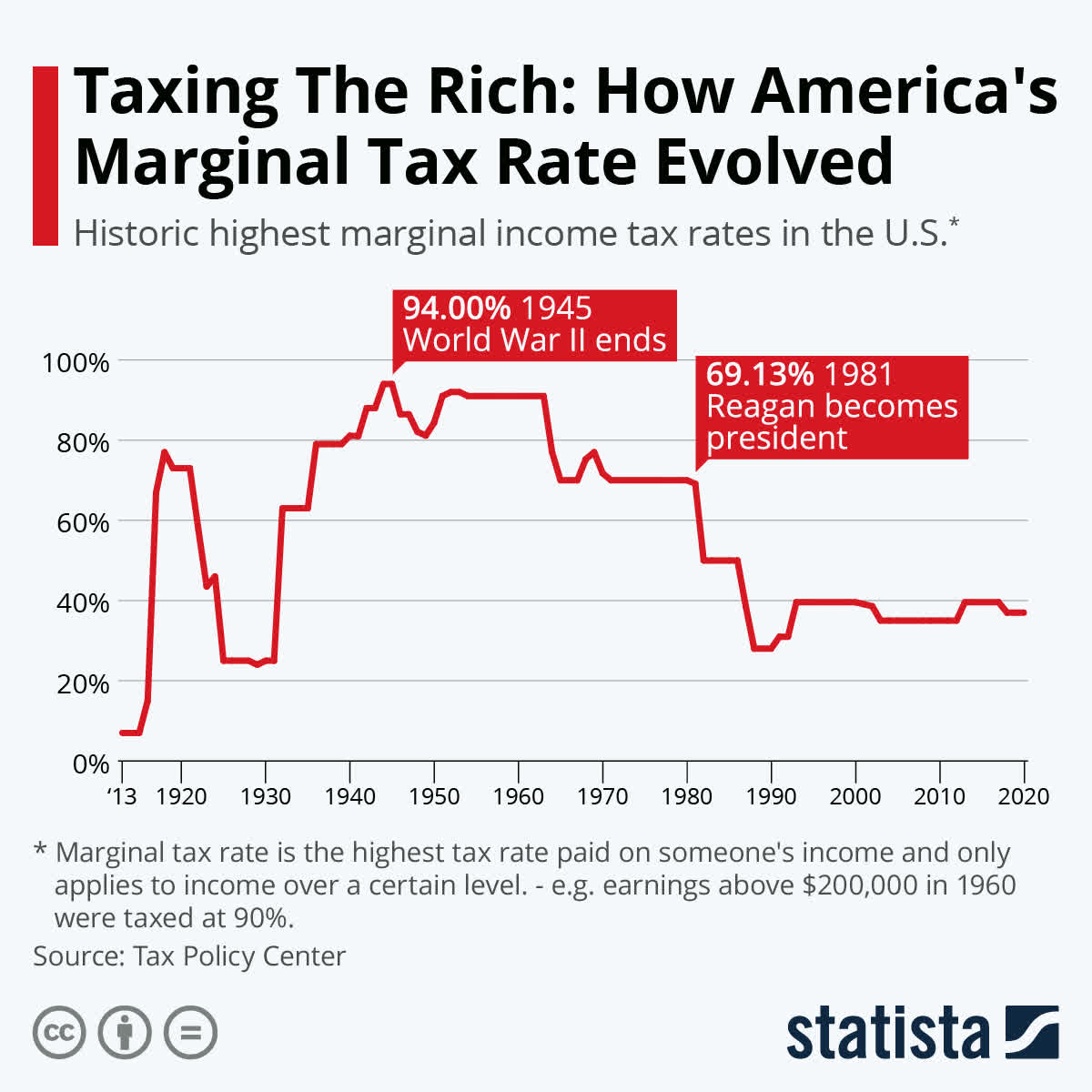

Inflation is undoubtedly a problem most Americans are feeling, and I'm not discounting that. But another side of that financial strain is that the tax burden has been shifted from the rich to the poor, and unions have been gutted, so wages haven't kept up with inflation. But inflation itself is coming down convincingly despite these facts.

Statista

However, the thrust of Krugman's graph is not meant for a US consumer shopping at the grocery store; it is meant for FOMC members who need to assess whether a further hike will even have the desired effect. Krugman's graph and much other evidence from around the economy suggest that it will not. This, to me, is the core reason why the Fed will not engage in a further hike. The downsides simply are beginning to outweigh the upsides, given the preponderance of data.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.