The Price Of The Procter & Gamble Company Is Simply Too High

Summary

- Procter & Gamble is seen as a haven during economic hardships and recessions due to its position as a leader in the consumer staples sector.

- The company has shown consistent revenue and EPS growth, and has a strong track record of increasing dividends for over 67 years.

- While Procter & Gamble offers promising growth opportunities and a commitment to shareholders, its current valuation is high and leaves no margin of safety in uncertain business conditions.

jetcityimage

Introduction

As a dividend growth investor for almost a decade, I always seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them to be attractively valued, and I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The consumer staples sector is attractive, particularly for Procter & Gamble (NYSE:PG). The industry tends to outperform during hardships, economic slowdowns, and recessions. While consumers limit spending during these periods, they still consume daily products. Therefore, Procter & Gamble, as a leader in the category, may be a haven during times of uncertainty, significantly if the business environment deteriorates even more.

I will analyze Procter & Gamble using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company's fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it's a good investment.

Seeking Alpha's company overview shows that:

The Procter & Gamble Company provides branded consumer packaged goods worldwide. It operates through five segments: Beauty, Grooming, Health Care, Fabric and Home Care, and Baby, Feminine and Family Care. The company sells its products primarily through mass merchandisers, e-commerce, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, specialty beauty stores, high-frequency stores, pharmacies, electronics stores, and professional channels, and directly to consumers. The Procter & Gamble Company was founded in 1837 and is headquartered in Cincinnati, Ohio.

Fundamentals

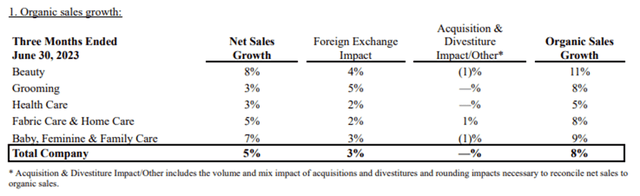

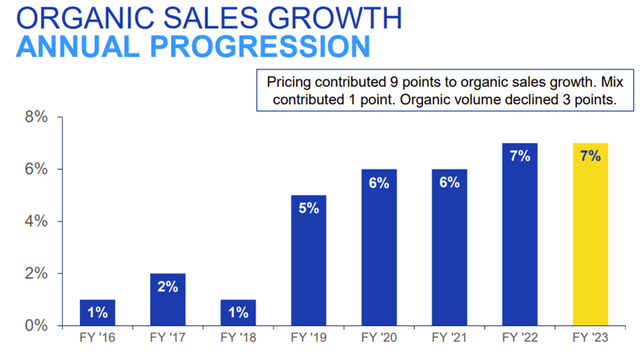

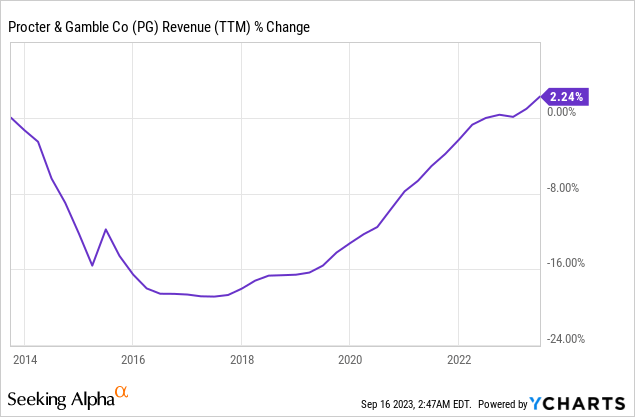

The revenues of Procter & Gamble have remained almost flat over the last decade. One reason for that is the strengthening of the U.S., but the main reason is the company has transformed over the previous decade. The company has shifted its portfolio position, acquiring and selling new products to achieve growth according to consumers' tastes. In the future, as seen on Seeking Alpha, the analyst consensus expects Procter & Gamble to keep growing sales at an annual rate of ~4% in the medium term.

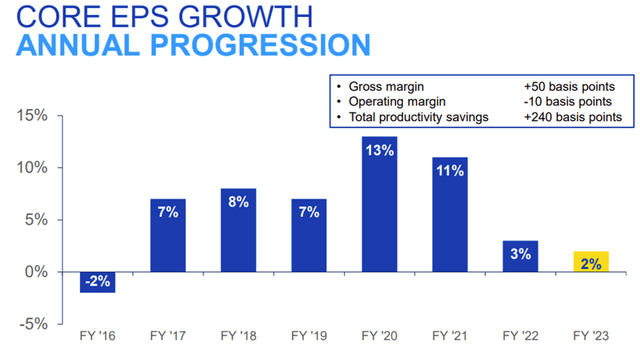

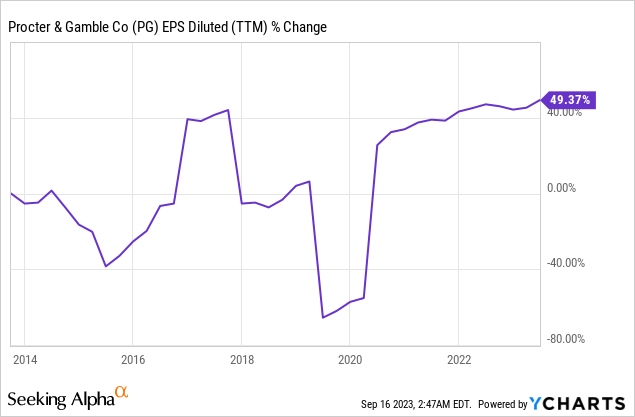

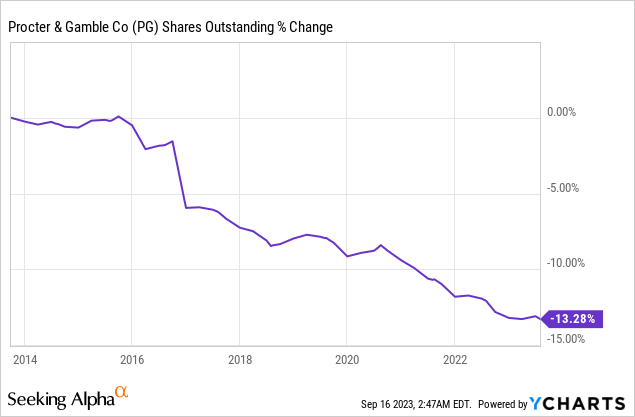

The EPS (earnings per share) has grown faster during the company's repositioning. The reasons for that are that while the company's sales were flat, it reduced its expenses to improve the operating margins, which grew from 19% to 23%. In addition, the company has also repurchased shares, supporting EPS growth. In the future, as seen on Seeking Alpha, the analyst consensus expects Procter & Gamble to keep growing EPS at an annual rate of ~8% in the medium term.

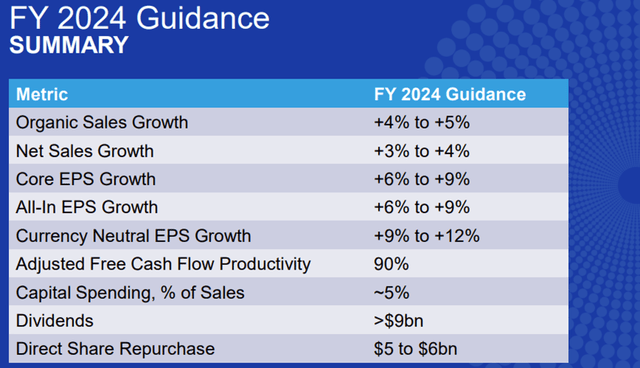

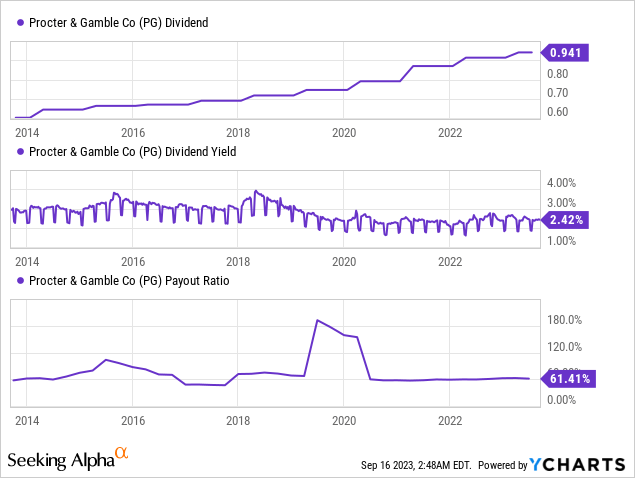

The company's dividend is probably one of its crown jewels. Procter & Gamble has not reduced the dividend payment for over a century. Moreover, it has increased the payment annually for the last 67 years, including a 3% increase in April. The company's payout ratio stands at 61%, improving as EPS grows faster following the repositioning. I expect the company to offer low to mid-single-digit increases in the medium term until it stabilizes its payout ratio to around 55%, its historical average. In the meantime, investors can enjoy a decent 2.4% yield.

In addition to the dividend, the company returns capital to shareholders via buybacks. Buybacks are an excellent tool for capital returns as they support EPS growth by lowering the number of shares. Over the last decade, the company has bought 12% of its shares. Buybacks are an integral part of the company's capital allocation and should be executed more aggressively when the share price is attractive, as every dollar has more impact.

Valuation

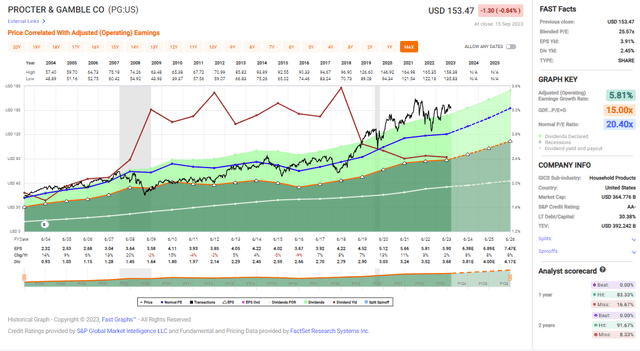

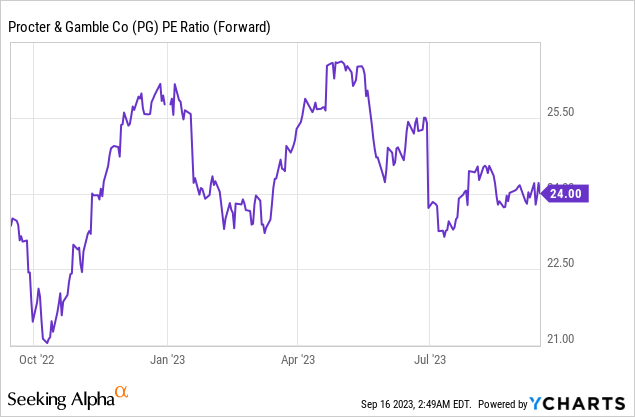

The P/E (price to earnings) ratio of Procter & Gamble when using the 2024 forecasted EPS (the company has just started FY 2024) is 24. It implies that the valuation is not attractive, as a solid consumer staples company growing at 8% annually is trading for a high valuation. While the current valuation aligns with the average valuation over the last twelve months, I still feel uncomfortable paying 24 times earnings when the risk-free interest rate is 4%-5%.

The graph below from Fast Graphs also implies that Procter & Gamble is overvalued. The average P/E ratio of the company over the last two decades was 20, and the current one is 24, 20% higher than average. The forecasted EPS growth rate stands at 8%, which is also higher than the average growth rate of 6%. Still, with the current environment and the higher interest rates, I find it hard to justify the current valuation.

Opportunities

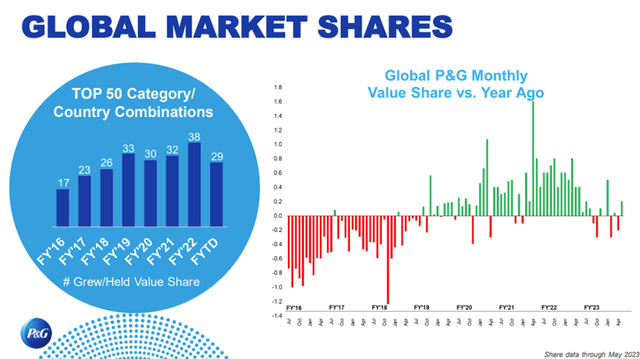

Procter & Gamble is a promising investment opportunity due to its remarkable market share growth. Following the strategic transformation, the company has experienced a resurgence since 2019. Notably, the number of leading brands within its portfolio enjoying market share growth or maintaining a solid position surged from 17 to an impressive 38 in 2022. This resurgence reflects the company's ability to adapt and thrive in dynamic markets, as the management is listening to the demands of its clients and acting accordingly.

The company is also showing a solid commitment to its shareholders, which is a compelling reason to consider investing in the company, especially for dividend growth investors. With a legacy of over a century of dividend payments and an impressive streak of 67 consecutive years of dividend increases, it stands out as a reliable income generator. Furthermore, the company plans to return over $15 billion to shareholders through buybacks and dividends, demonstrating its dedication to enhancing shareholder value. As its outlook for the coming twelve months remains bright, it offers income and capital appreciation potential.

Diversification is another key growth opportunity. The company is diversified across global markets and product segments, making it a more resilient investment option. The company operates in five distinct segments, reducing its exposure to any market or industry. While some segments, like healthcare in the last quarter, may experience slower growth, the overall portfolio remains balanced.

Risks

Recession is a risk despite the lower sensitivity. Investing in Procter & Gamble carries the risk of economic downturns, as the company offers premium brands that may face pressure during recessions. For instance, during the 2008 financial crisis, P&G saw a significant drop in sales, with a 9% decline. During the current slowdown, sales have increased by 7%, but it's important to note that pricing strategies primarily drive this growth, as the volume has declined by 3 points, and it may be hard to replicate annually. In a recession, consumers may shift towards more affordable private-label alternatives.

Price and expense management is also challenging due to inflation and competition. There is a risk associated with the ability to increase prices while effectively managing expenses. While the company has seen sales growth, its EPS growth has been sluggish due to the struggle to control costs, resulting in a decline in operating margins. Intense competition and inflationary pressures can constrain its ability to maintain healthy profit margins, especially if competition remains harsh during inflationary times.

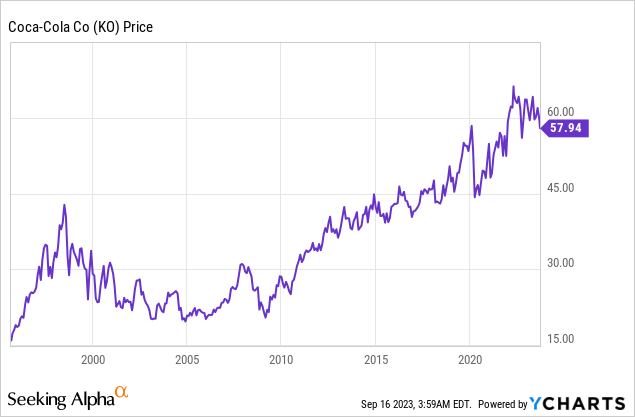

The most prominent long-term risk is the lack of margin of safety. Investors should be cautious of the company's current valuation, as it is priced for near-perfection in executing its growth plans. However, this situation is risky because changes in market conditions or consumer spending patterns could negatively affect the company's sales and profitability. When we look at the example of Coca-Cola in the late 1990s, we see how risky overvaluation can be even when the company performs well. It faced a high valuation (much higher than the current P&G premium) and took over a decade to recover its previous levels.

Conclusions

It doesn't get more blue chip than Procter & Gamble. Over a century of sales and EPS growth led to solid dividends that have increased for almost 70 years. In addition, the company is shareholder-friendly and rewards investors with buybacks. The company has several growth opportunities, which are extremely promising as the company completed a successful portfolio transformation to return to the path of growth.

However, while the business risks are not extraordinary, in my opinion, there are investment risks. The company's current valuation is significantly higher than its average valuation. The current situation leaves Procter & Gamble with no margin of safety in case the business environment deteriorates. Therefore, with no margin of safety and a business environment full of uncertainty, I believe shares are a HOLD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

JC