The Manitowoc Company, Inc: Product Innovation Resulting In Compounding Growth

Summary

- The Manitowoc Company specializes in custom-engineered lifting solutions, manufacturing various crane types for industries such as petrochemical, industrial, and infrastructure projects.

- Manitowoc demonstrated outstanding performance in earnings, surpassing expectations in revenue and earnings per share.

- Analysts rate Manitowoc as a "hold" with a potential 30.45% return, and the company's balance sheet shows solid financial strength and potential for future growth.

- Assuming my DCF figures, Manitowoc is currently undervalued, resulting in a buy rating.

- Constant product innovations will result in outperformance and improved cash flows, leading to compounding growth.

goncharovaia

Over the past year, Manitowoc (NYSE:MTW) price has declined significantly due to past earnings misses resulting in reduced FCF. However, I believe that the firm is currently a buy due to high backlog, undervaluation, and innovations resulting in improved FCF and compounding growth.

Business Overview

Custom-engineered lifting solutions are provided by The Manitowoc Company, Inc. in the Americas, Europe, Africa, the Middle East, and the Asia Pacific. Their area of specialization is the development, manufacture, and marketing of various crane kinds.

This comprises mobile hydraulic cranes sold under the Grove, Shuttlelift, and National Crane brands, top-slewing and self-erecting tower cranes sold under the Potain name, and crawler-mounted lattice-boom cranes sold under the Manitowoc and Manitowoc labels. They also produce hydraulic boom trucks under the National Crane name. The company offers aftermarket support in addition to crane production. This entails the sale of crane accessories and parts, field service work, routine upkeep, technical support, erection and decommissioning help, crane refurbishing, and training initiatives.

The cranes made by Manitowoc are used in a variety of industries, including petrochemical endeavors, industrial projects, and different infrastructure projects including highways, bridges, and airports. They are also used in the production and distribution of energy. Additionally, the use of their cranes in high-rise residential and commercial construction projects is essential. Dealers, rental companies, contractors, and governmental entities are just a few of the many clients Manitowoc serves. The petrochemical, industrial, commercial, power generating, utility, infrastructure development, and residential construction sectors are among the end markets they serve.

Manitowoc Company

Financials

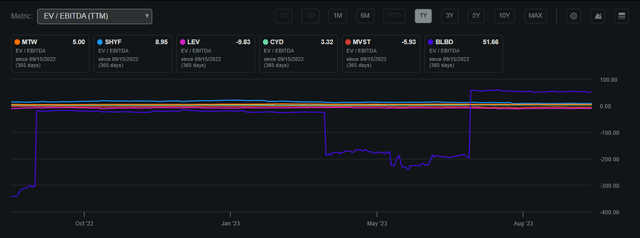

Manitowoc presently possesses a market capitalization of approximately $517.27 million and demonstrates a commendable Return on Invested Capital of 8%. The current stock price stands at $14.91, which falls below its 52-week high of $20.20 and is in proximity to its 200-day moving average of $15.26. It's worth noting that the company's P/E ratio is at 9.38, suggesting a potential undervaluation, a point discussed in detail in the valuation segment of this analysis. Furthermore, Manitowoc exhibits an EV/EBITDA ratio of 5, indicating a relatively favorable multiple compared to a majority of its industry peers as shown below.

Manitowoc EV/EBITDA Compared to Peers (Seeking Alpha)

While the company currently refrains from issuing dividends, my perspective aligns with its dedication to enhancing the fundamental business model and reinvesting cash flows, ultimately fostering robust growth demonstrated by an 8% Return on Invested Capital. I hold the view that issuing dividends might not be prudent given the fluctuations in the firm's FCF. Instead, Manitowoc should persist in share repurchases whenever viable, thereby establishing long-term value for shareholders. I anticipate a potential shift in the irregular FCF pattern in the future as the company diversifies further, leading to more consistent cash flows that can ultimately translate into steady income for shareholders.

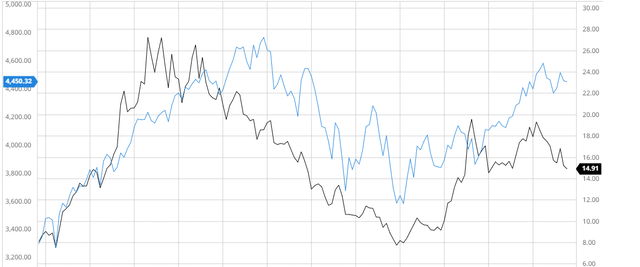

Manitowoc Annual FCF (TradingView) Share Price Performance (Seeking Alpha)

Earnings

Manitowoc showcased outstanding performance in Q2 2023, surpassing expectations both in revenue and earnings. The earnings per share outperformed predictions by an impressive $0.44, reaching $0.75. Additionally, the revenues exceeded estimated figures by a substantial $78.69 million, totaling $602.8 million and illustrating a remarkable 21.2% year-over-year growth. This notable earnings beat underscores the company's resilience in the face of challenges like elevated interest rates and inflation. Moreover, Manitowoc's robust backlog of $1.024 billion underscores its capability to generate substantial cash flow, providing a solid foundation for potential future growth through essential operational enhancements.

Performance Compared to the Broader Market

Over the past 3 years, Manitowoc has underperformed the broader market. This is due to the firm's weak performance in 2022 in regards to earnings resulting in significant share price declines. I believe that the recent recovery in share price exemplifies Manitowoc's ability to hedge against headwinds in the long term and demonstrates the firm's potential to outperform in the upcoming years.

Manitowoc Performance Compared to the S&P 500 3Y (Created by author using Bar Charts)

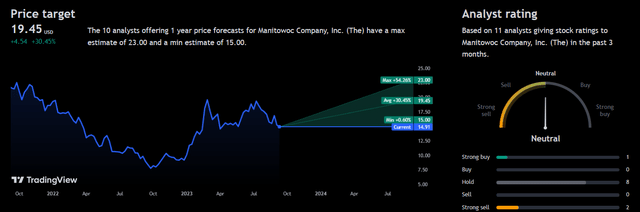

Analyst Consensus

Over the past 3 months, analysts currently rate Manitowoc as a "hold" with the most pessimistic of ratings being below the current share price and an average 1Y price target of $19.45 demonstrating a potential 30.45% return. This demonstrates the firm's medium-term ability to achieve solid returns due to the current strong FCF to stimulate growth.

Analyst Consensus (TradingView)

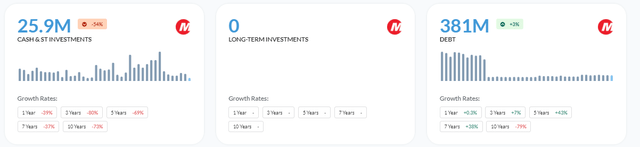

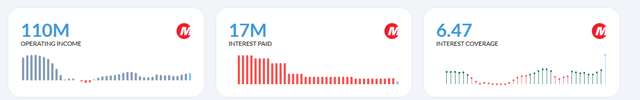

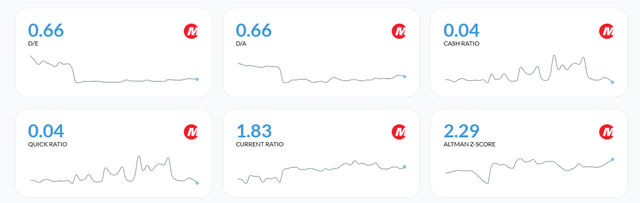

Balance Sheet

Manitowoc's balance sheet demonstrates solid financial strength in economic headwinds through the firm's deleveraged strategy moving into a high-rate environment. Although this may limit potential returns due to not maximizing growth opportunities through debt, the firm has recognized that unstable FCF and sudden rate increases will lead to potential downturns in the business and hurt long-term cash flows. With a strong and increasing interest coverage of 6.47, a current ratio of 1.83, and an Altman-Z-Score of 2.29, Manitowoc is able to leverage once the macro environment seems more stable enabling them to capture future cash flow opportunities while also maintaining a defensive position currently.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

Valuation

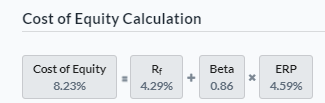

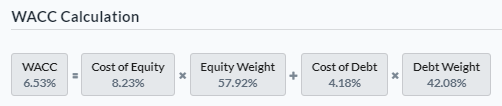

Prior to finding Manitowoc's fair value using a DCF approach, I calculated the firm's Cost of Equity and WACC in order to utilize an appropriate discount rate. Assuming a risk-free rate of 4.29% based on the 10-year-treasury yield, I was able to calculate a Cost of Equity of 8.23%.

Cost of Equity Calculation (Created by author using Seeking Alpha)

Based on the previously calculated Cost of Equity, I was able to calculate a WACC of 6.53%. This WACC is very advantageous as it is below the industry average of 9.94%.

WACC Calculation (Created by author using Seeking Alpha)

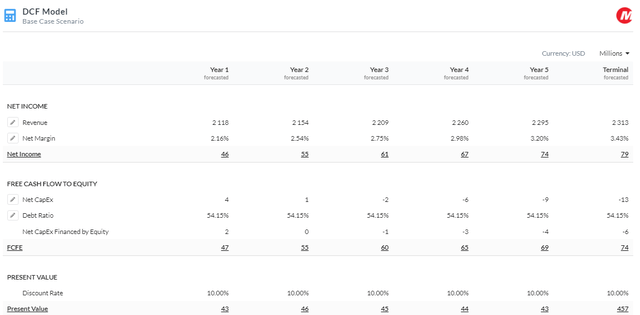

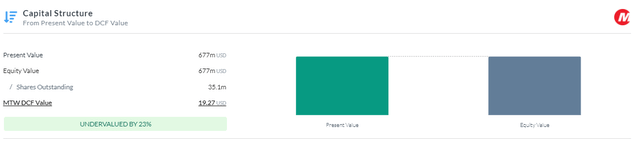

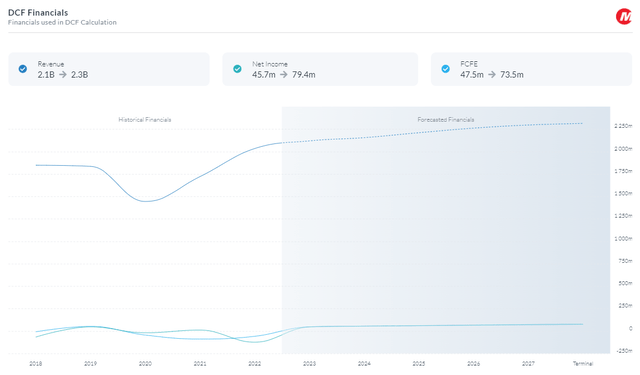

Based on the previous calculations, I was able to utilize a discount rate of 10% as the current rate of 8.23% does not fully account for macroeconomic headwinds and this risk premium of 1.77% creates a further margin of safety when calculating the firm's fair value. After estimating revenue growth and margins in line with analyst expectations, I used a 5Y Equity Model DCF using FCFE to calculate a fair value of $19.27 which presents a 23% upside.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Product Innovation Resulting in Long-Term Growth

To maintain its position as a top global producer of cranes and food service equipment, The Manitowoc Company, Inc. has strategically focused on product innovation and diversification. This strategy strives to improve the items' quality, effectiveness, and safety in addition to broadening the range of what it offers.

Manitowoc has put a lot of effort into diversifying its product line to include a variety of crane types that are suited to various market demands. For instance, Manitowoc manufactures a variety of crane types, such as mobile cranes, tower cranes, and crawler cranes, within the crane industry. Wheeled vehicles with mobile cranes placed on them offer flexibility and adaptability for use at various job sites. Construction of towering buildings and other structures is impossible without tower cranes, which are fixed to concrete slabs. On the other hand, crawler cranes that have tracks are excellent at doing big lifting duties in difficult terrain. Manitowoc can serve a wide range of sectors and applications because of this diverse product offering, which expands its client base and expands its market reach.

Manitowoc's strategy has placed a strong emphasis on innovation, which has fueled the creation of ground-breaking technology and the expansion of its product line. The Potain MRH 175 tower crane is an outstanding illustration of this dedication to innovation. This topless tower crane is made to be portable and simple to assemble while still being versatile in use. The Potain MRH 175 demonstrates Manitowoc's commitment to developing cutting-edge solutions that meet the changing needs of the industry by incorporating cutting-edge features like remote monitoring, greater energy economy, and improved operator ergonomics. Manitowoc has effectively positioned itself as an industry leader, attracting a wider client base, and preserving a competitive edge via technological superiority and product adaptability by consistently broadening its product line and inventing to answer certain market demands.

The enhancement of the company's product range underscores Manitowoc's dedication to augmenting cash flows while achieving a competitive edge, ultimately contributing to cumulative growth. I am of the belief that as the company further broadens its existing product portfolio, we can anticipate heightened usefulness in the offered products, consequently driving a higher price point and expanding profit margins. As highlighted earlier in this article, the effective utilization of the firm's Free Cash Flow is pivotal for its success. Successful innovations are poised to generate increased cash flows and enhance shareholder value, ultimately enabling the company to attain a larger scale and greater pricing influence.

Risks

Supply Chain Risks: Manufacturing, production schedules, and product delivery can all be negatively impacted by supply chain disruptions, such as a lack of raw materials, components, or personnel.

Safety and Liability Risks: The company faces major safety and liability concerns given the nature of its activities and goods. Accidents, product flaws, or failures may give rise to lawsuits, product recalls reputational harm, and financial obligations.

Conclusion

To summarize, I believe that Manitowoc is currently a buy due to its attractive valuation, coupled with the firm's strong recent performance and competitive product innovation strategy which will strengthen FCF and lead to solid performance in the long-term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.